Mexico Induction Cooktop Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

Mexico Induction Cooktop Market Overview:

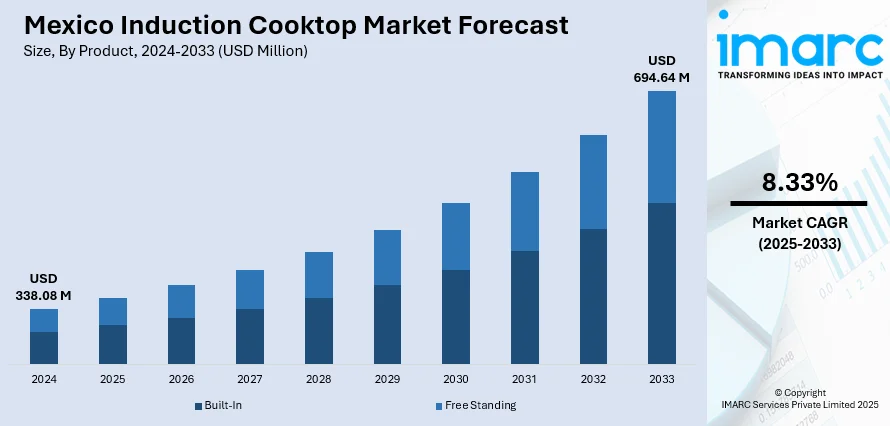

The Mexico induction cooktop market size reached USD 338.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 694.64 Million by 2033, exhibiting a growth rate (CAGR) of 8.33% during 2025-2033. The market is growing with increasing demand for energy-efficient appliances driven by consumer attention toward sustainability and cost optimization. Smart technology integration provides greater convenience and accuracy, attracting tech-conscious users who desire hassle-free smart home compatibility. Government policies facilitating electrification and environmental aspirations also favor the induction cooktops' broader uptake. Such factors cumulatively lead to constant growth in the Mexico induction cooktop market share, indicating changing consumer tastes and regulatory tendencies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 333.08 Million |

| Market Forecast in 2033 | USD 694.64 Million |

| Market Growth Rate 2025-2033 | 8.33% |

Mexico Induction Cooktop Market Trends:

Growing Demand for Energy-Efficient Cooking Equipment

Mexican demand for energy-efficient cooking equipment is growing at a fast pace, driving the Mexico induction cooktop market. For instance, in January 2023, Miele introduced the KM7000 induction cooktop line at KBIS Las Vegas, providing energy-savvy, smart, and safe cooking with advanced design and Wi-Fi connectivity for current homes. Moreover, induction cooking units are popular because they quickly and efficiently heat foods compared to conventional electric or gas stovetops. This energy-saving benefit draws green-conscious consumers and those seeking to save electricity bills in the face of volatile energy prices. The high level of precision temperature control provided by induction technology improves cooking performance while minimizing waste and energy usage. As urban homes upgrade kitchens to modern standards, energy efficiency becomes a fundamental aspect when choosing appliances. Additionally, the need for greener, cleaner cooking options that minimize indoor air pollution promotes switching from gas to induction. This trend is part of a wider consumer shift toward cost savings and sustainability, putting induction cooktops in the spotlight as an increasingly favored option in the Mexican home market.

To get more information of this market, Request Sample

Smart Technology Integration in Kitchen Appliances

The Mexico induction cooktop market is embracing smart technology integration with the incorporation of smart technologies aimed at enhancing the user experience. Contemporary induction cooktops feature app-control capabilities, programmable cooking modes, and integration with voice assistant devices, delivering more convenience and accuracy. These innovations appeal to technologically savvy consumers who seek frictionless interaction between their kitchen equipment and smart home platforms. Smart cooking capabilities provide precise temperature control, automated cooking sequences, and remote monitoring, all of which enhance meal preparation and cooking results. As smart home technologies become more embraced by urban and suburban Mexican consumers, induction cooktops with smart capabilities are gaining popularity. This increasing convergence of cooking equipment and digital connectivity is one of the key drivers in the Mexico induction cooktop growth, indicating a customer liking for innovation blended with efficiency in cooking utensils.

Government Policy Favoring Electrification and Sustainability

Mexico government policies aimed at curbing carbon emissions and encouraging electrification are hugely impacting consumer appliance demand, adding to the Mexico induction cooktop growth. Several policy initiatives promote the use of electric cooking devices as part of overall strategies to reduce gas and other fossil fuel reliance. Rebates, increased energy efficiency standards, and urban electrification schemes are incentives that offer concrete advantages to consumers shifting to induction technology. Such measures perform best in high-density urban markets where electric infrastructure is readily available and environmental controls are strictly enforced. By linking consumption habits with country-level sustainability objectives, these government measures are driving the transition toward more energy-efficient kitchen appliances. As a result, the induction cooktop sector gains from a regulatory framework that favors cleaner, safer, and more environmentally friendly cooking options, making induction technology the bedrock of Mexico's modernization of residential kitchens.

Mexico Induction Cooktop Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Built-In

- Free Standing

The report has provided a detailed breakup and analysis of the market based on the product. This includes built-in and free standing.

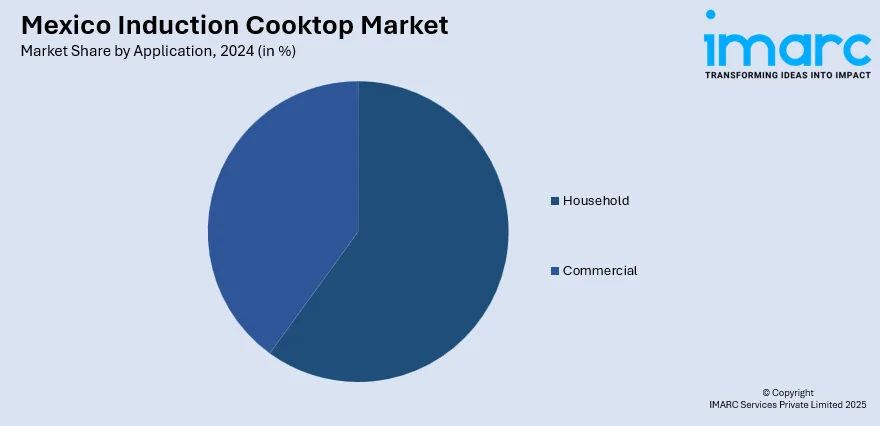

Application Insights:

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, specialty stores, and online.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Induction Cooktop Market News:

- In January 2024, Impulse Labs revealed a revolutionary battery-powered induction cooktop at CES. It is built to run on a common 120V outlet and has four burners with instant heating, as well as a 3 kWh lithium iron phosphate battery for reserve power, providing an eco-friendly and performance-driven solution for kitchens today.

Mexico Induction Cooktop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Built-In, Free Standing |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Online |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico induction cooktop market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico induction cooktop market on the basis of product?

- What is the breakup of the Mexico induction cooktop market on the basis of application?

- What is the breakup of the Mexico induction cooktop market on the basis of distribution channel?

- What is the breakup of the Mexico induction cooktop market on the basis of region?

- What are the various stages in the value chain of the Mexico induction cooktop market?

- What are the key driving factors and challenges in the Mexico induction cooktop?

- What is the structure of the Mexico induction cooktop market and who are the key players?

- What is the degree of competition in the Mexico induction cooktop market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico induction cooktop market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico induction cooktop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico induction cooktop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)