Mexico Industrial Air Blowers Market Size, Share, Trends and Forecast by Type, Business Type, End User, and Region, 2025-2033

Mexico Industrial Air Blowers Market Overview:

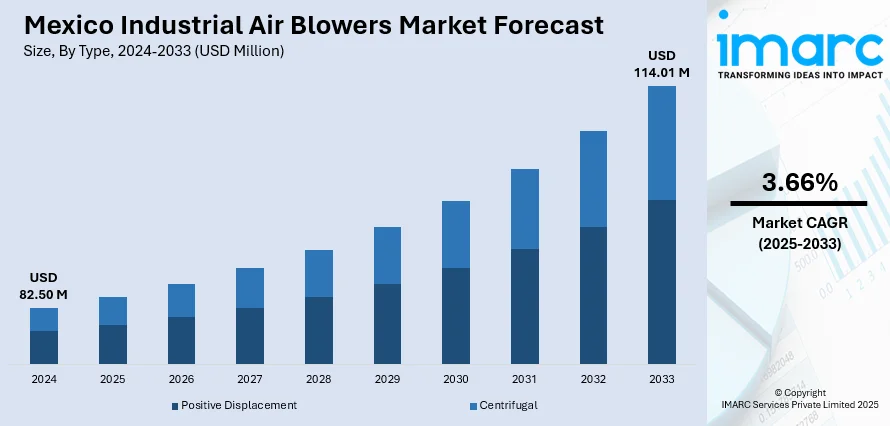

The Mexico industrial air blowers market size reached USD 82.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 114.01 Million by 2033, exhibiting a growth rate (CAGR) of 3.66% during 2025-2033. Industrial expansion, growing investments in water treatment, and demand for energy-efficient equipment are driving the market. Government regulations on emissions and increasing automation in manufacturing are also boosting Mexico industrial air blowers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 82.50 Million |

| Market Forecast in 2033 | USD 114.01 Million |

| Market Growth Rate 2025-2033 | 3.66% |

Mexico Industrial Air Blowers Market Trends:

Investment in Wastewater and Water Infrastructure Projects

Mexico’s continued investment in wastewater treatment and municipal infrastructure is creating sustained demand for air blowers. The Comisión Nacional del Agua (CONAGUA) and various local governments are allocating funds to expand treatment capacity and modernize aging systems. Air blowers play a key role in aeration processes within these facilities, especially as plants move toward stricter environmental discharge regulations. Blowers used in these applications must provide consistent airflow and energy efficiency, making high-performance models increasingly preferred. Public-private partnerships in the water sector are also encouraging upgrades in blower technologies to support long-term sustainability and cost savings. This sector alone is poised to significantly contribute to Mexico industrial air blowers market growth by increasing volume demand and encouraging technological upgrades. For instance, Alpha Blower, engineered by Aerzener Maschinenfabrik, is one of the world’s most powerful positive displacement blower that meets the demand of energy-intensive applications like wastewater treatment. Delivering up to 77,000 m³/h, it offers efficient, continuous operation. The blower features a lubrication system from HANSA‑FLEX subsidiary Willmann, ensuring reliable performance even in explosive or harsh environments. Designed to cut operational costs and energy use, it supports long-term use in facilities requiring round-the-clock airflow, such as municipal and industrial water treatment plants. Components from HANSA‑FLEX, including hose lines and pressure gauges, are supplied preassembled to reduce downtime.

To get more information of this market, Request Sample

Rise in Industrial Automation and Smart Manufacturing

Mexico is emerging as a nearshoring hub for industries like automotive, electronics, and consumer goods. With this shift, manufacturers are adopting smart technologies to improve operational efficiency and reduce downtime. Air blowers integrated with sensors and digital control systems are gaining favor, enabling predictive maintenance, remote diagnostics, and load-based performance adjustment. This transformation is supported by government initiatives to modernize production processes and improve energy use efficiency. The need for reliable, automated blower systems that can handle variable workloads aligns with the growing trend of Industry 4.0 adoption in Mexico. This digital shift is a significant driver behind Mexico industrial air blowers market growth, particularly in the private manufacturing sector. For instance, in 2024, at FABTECH Mexico 2024, Big Ass Fans showcased new ventilation technologies designed for Mexico’s metalworking sector. Featured products included the Powerfoil series, AirEye, and Sidekick fans, all equipped with Thread protocol-enabled smart connectivity to improve workplace safety and boost energy efficiency in industrial settings.

Mexico Industrial Air Blowers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on type, business type, and end user.

Type Insights:

- Positive Displacement

- Centrifugal

The report has provided a detailed breakup and analysis of the market based on the type. This includes positive displacement and centrifugal.

Business Type Insights:

- Equipment Sales

- Services

A detailed breakup and analysis of the market based on the business type have also been provided in the report. This includes equipment sales and services.

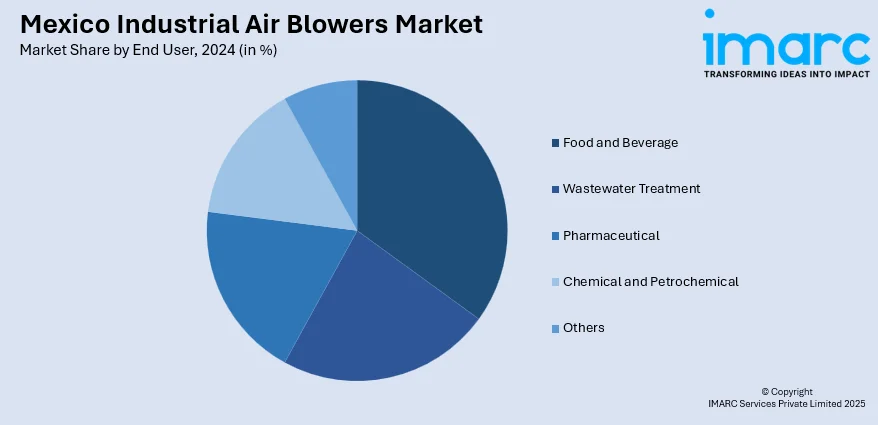

End User Insights:

- Food and Beverage

- Wastewater Treatment

- Pharmaceutical

- Chemical and Petrochemical

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage, wastewater treatment, pharmaceutical, chemical and petrochemical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Air Blowers Market News:

- In May 2025, Aerzen USA, which is operational in Mexico as Aerzen México S.A. de C.V., launched new Build America, Buy America (BABA) compliant blowers and controls to meet U.S. manufacturing standards and support domestic jobs. Designed for high performance and energy efficiency, the blowers cater to aeration applications in municipal wastewater systems.

- In March 2024, MAN Energy Solutions announced that they will supply two TURBAIR® vacuum blowers to Smurfit Kappa’s Cerro Gordo board mill in Mexico. These systems will support eco-friendly cardboard production by improving energy and water efficiency in the dewatering process. The high-altitude-adapted blowers reduce CO₂ emissions and energy use by up to 80%, aiding sustainability goals.

Mexico Industrial Air Blowers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Positive Displacement, Centrifugal |

| Business Types Covered | Equipment Sales, Services |

| End Users Covered | Food and Beverage, Wastewater Treatment, Pharmaceutical, Chemical and Petrochemical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial air blowers market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial air blowers market on the basis of type?

- What is the breakup of the Mexico industrial air blowers market on the basis of business type?

- What is the breakup of the Mexico industrial air blowers market on the basis of end user?

- What is the breakup of the Mexico industrial air blowers market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial air blowers market?

- What are the key driving factors and challenges in the Mexico industrial air blowers market?

- What is the structure of the Mexico industrial air blowers market and who are the key players?

- What is the degree of competition in the Mexico industrial air blowers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial air blowers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial air blowers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial air blowers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)