Mexico Industrial Air Compressors Market Size, Share, Trends and Forecast by Product, Lubrication, Operation, Capacity, End User, and Region, 2025-2033

Mexico Industrial Air Compressors Market Overview:

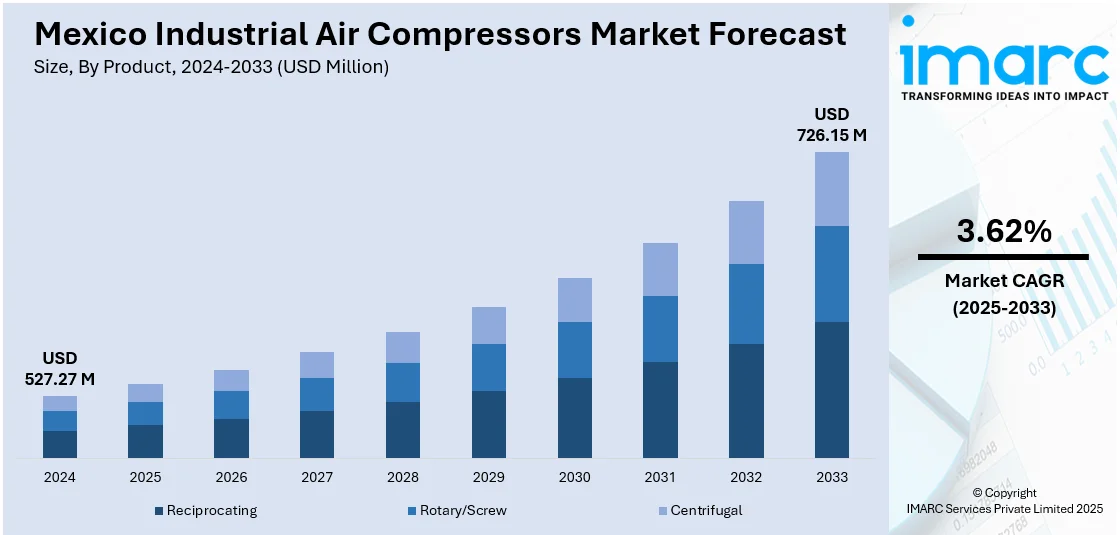

The Mexico Industrial Air Compressors Market size reached USD 527.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 726.15 Million by 2033, exhibiting a growth rate (CAGR) of 3.62% during 2025-2033. The market is driven by increasing demand for energy-efficient solutions, technological advancements, and the growth of manufacturing industries. Rising automation in sectors like automotive, food and beverage, and pharmaceuticals further fuels market expansion. Additionally, government initiatives promoting industrial development and sustainability contribute to the adoption of advanced air compressor systems. These factors collectively influence the rising Mexico industrial air compressors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 527.27 Million |

| Market Forecast in 2033 | USD 726.15 Million |

| Market Growth Rate 2025-2033 | 3.62% |

Mexico Industrial Air Compressors Market Trends:

Growth Through Nearshoring and Industrial Expansion

Mexico is rapidly becoming a major manufacturing hub, largely due to its proximity to the United States and the strategic relocation of production facilities from Asia. This shift is fueling demand for critical industrial equipment, particularly air compressors, which are essential across sectors like automotive, electronics, and aerospace for tasks such as assembly and quality control. As new factories are built and existing ones expand, industries increasingly require advanced, reliable compressors capable of operating continuously under varying workloads. Supporting this trend, Mexico's total trade exchange of pumps and compressors for air, vacuum, or gas reached approximately US$2.32 billion in 2023, reflecting robust industrial activity. This underscores how Mexico’s manufacturing growth is directly driving the expansion of its air compressor market, fueled by increasing Mexico industrial air compressors market growth for efficiency, productivity, and modern technological integration.

Adoption of IoT and Smart Technologies

Industrial operations in Mexico are embracing digital transformation, and air compressors are becoming a part of that. Smart air compressors with IoT technologies enable real-time monitoring of performance, automated alarm notifications, and data-driven maintenance. This enables businesses to avoid downtime, reduce energy consumption, and enhance productivity in general. With remote access and cloud-based analytics, users can monitor compressor status remotely from anywhere in the world. These smart systems minimize human supervision and downtime, and thus are appealing in industries with continuous operation and efficiency as a goal. As Mexican industries update their equipment, more interest is being given to compressors that provide connectivity and automation, a sign of a larger trend toward intelligent, responsive industrial equipment.

Focus on Energy Efficiency and Environmental Responsibility

Operational cost saving and environmental sustainability are key issues for businesses in Mexico. Compressors, which are energy-hungry, are being considered not only for their efficiency but also for how efficiently they consume power and how little they emit. Businesses are opting for lower-power and lower-emission models. They prefer compressors with variable speed drives and oil-free systems, which are more appropriate for delicate surroundings and save the environment. Maintenance factors are also driving decisions, with customers opting for machines that need less servicing and utilize environmentally friendly materials. This trend illustrates how companies are meeting global sustainability objectives while saving money through wiser equipment selection. As the demand for environmentally conscious solutions grows, the market is expected to further evolve with innovations that enhance operational efficiency and reduce environmental footprints. These developments are expected to solidify the Mexico industrial air compressors market share.

Mexico Industrial Air Compressors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, lubrication, operation, capacity, and end user.

Product Insights:

- Reciprocating

- Rotary/Screw

- Centrifugal

The report has provided a detailed breakup and analysis of the market based on the product. This includes reciprocating, rotary/screw, and centrifugal.

Lubrication Insights:

- Oil-free

- Oil-Filled

A detailed breakup and analysis of the market based on the lubrication have also been provided in the report. This includes oil-free and oil-filled.

Operation Insights:

- ICE

- Electric

The report has provided a detailed breakup and analysis of the market based on the operation. This includes ICE and electric.

Capacity Insights:

- Up to 100 kW

- 101-200 kW

- 201-300 kW

- 301-500 kW

- 501 kW and Above

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 100 kW, 101-200 kW, 201-300 kW, 301-500 kW, and 501 kW and above.

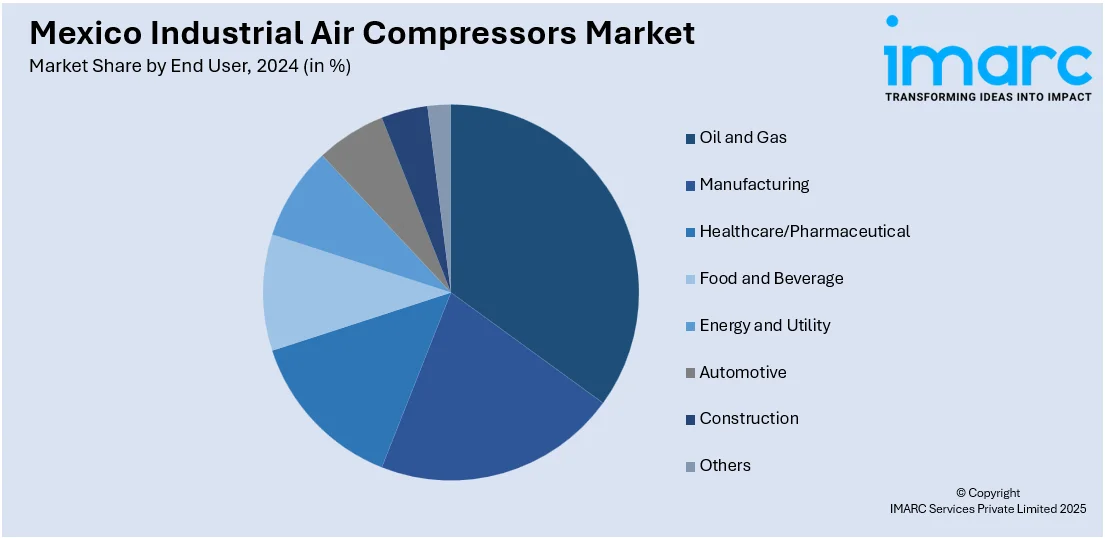

End User Insights:

- Oil and Gas

- Manufacturing

- Healthcare/Pharmaceutical

- Food and Beverage

- Energy and Utility

- Automotive

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes oil and gas, manufacturing, healthcare/pharmaceutical, food and beverage, energy and utility, automotive, construction, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Air Compressors Market News:

- In February 2024, The X-Air⁺ 750-25, a portable air compressor by Atlas Copco, has a 10% higher efficiency than its predecessor. Featuring a compact design with half the size and weight, it is powered by a 6.7-liter Cummins engine. The X-Air⁺ 750-25 utilizes AirXpert technology to optimize fuel and energy use, improving performance in medium-depth drilling. With dynamic flow boost, it enhances efficiency during demanding phases, accelerating borewell completion and reducing project timelines.

- In January 2024, LG Electronics expanded its manufacturing capacity to satisfy the rising demand in North America by establishing a new scroll compressor production line in Monterrey, Mexico. The facility will support LG's eco-friendly, energy-efficient Gen 3 Scroll Compressors, which use low Global Warming Potential refrigerants to comply with upcoming refrigerant regulations. This strategic move aims to strengthen LG's competitiveness, improve logistics, and address challenges in the HVAC industry, ensuring better service for North American customers.

Mexico Industrial Air Compressors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reciprocating, Rotary/Screw, Centrifugal |

| Lubrications Covered | Oil-Free, Oil-Filled |

| Operations Covered | ICE, Electric |

| Capacities Covered | Up to 100 kW, 101-200 kW, 201-300 kW, 301-500 kW, 501 kW and Above |

| End Users Covered | Oil and Gas, Manufacturing, Healthcare/Pharmaceutical, Food and Beverage, Energy and Utility, Automotive, Construction, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial air compressors market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial air compressors market on the basis of product?

- What is the breakup of the Mexico industrial air compressors market on the basis of lubrication?

- What is the breakup of the Mexico industrial air compressors market on the basis of operation?

- What is the breakup of the Mexico industrial air compressors market on the basis of capacity?

- What is the breakup of the Mexico industrial air compressors market on the basis of end user?

- What is the breakup of the Mexico industrial air compressors market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial air compressors market?

- What are the key driving factors and challenges in the Mexico industrial air compressors market?

- What is the structure of the Mexico industrial air compressors market and who are the key players?

- What is the degree of competition in the Mexico industrial air compressors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial air compressors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial air compressors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial air compressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)