Mexico Industrial Automation Components Market Size, Share, Trends and Forecast by Component, Application, End Use Industry, and Region, 2025-2033

Mexico Industrial Automation Components Market Overview:

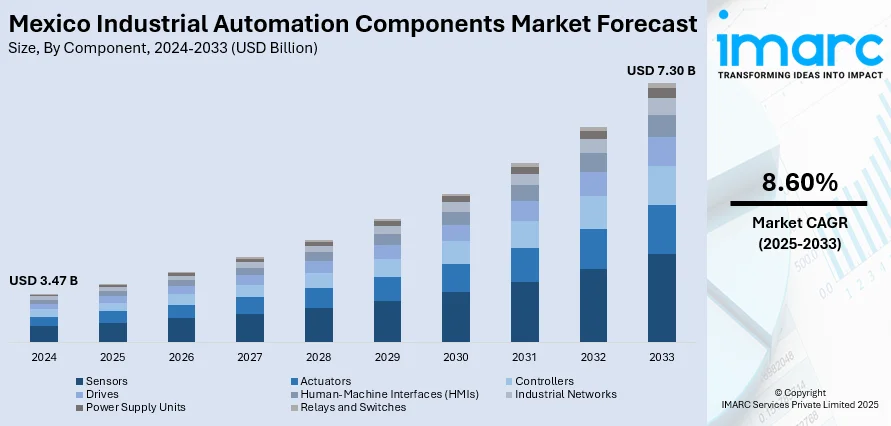

The Mexico industrial automation components market size reached USD 3.47 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.30 Billion by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. The market is fueled by rising industrialization, need for high-quality manufacturing, and automation technological advancements. The growth in demand for productivity and efficiency has increased adoption of industrial automation solutions. These factors are driving the Mexico industrial automation components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.47 Billion |

| Market Forecast in 2033 | USD 7.30 Billion |

| Market Growth Rate 2025-2033 | 8.60% |

Mexico Industrial Automation Components Market Trends:

Emphasis on Industry 4.0 and IoT Integration

The convergence of Industry 4.0 technologies and the Internet of Things (IoT) is rising as a key trend within the Mexico industrial automation components market. Firms are increasingly deploying IoT-integrated sensors, controllers, and monitoring systems to streamline operational efficiency, minimize downtime, and enhance maintenance processes. The data-driven nature of Industry 4.0 enables real-time decision-making, predictive maintenance, and more robust control of production. This change is resulting in more efficient operations, lower cost of operations, and the capacity to ramp up production lines more quickly. Smarter and networked components are anticipated to power future market growth as companies in Mexico look for automation systems that enhance productivity as well as responsiveness in their operations. Robotic automation is picking up tremendous momentum in Mexico's manufacturing sector, with numerous industries like automotive, electronics, and food processing embracing robotic systems for applications from material handling to assembly. For instance, in May 2024, Omron opened a new Proof of Concept Center (PoCC) in Guadalajara, Mexico, offering industry professionals a hands-on experience with cutting-edge automation technologies. The center showcases solutions in vision, robotics, and AI-powered inspection systems, enabling businesses to validate automation technologies and optimize operations with expert guidance.

To get more information on this market, Request Sample

Investment in Robotic Automation Solutions

The transition to robotic automation is being necessitated by the requirement for increased productivity, improved precision, and minimal human involvement in repetitive operations. As wages increase and producers want to become more flexible, robots with artificial intelligence and machine learning are becoming increasingly popular. The Mexico industrial automation components market growth is driven by the increasing demand for robotic arms, vision systems, and collaborative robots, which enable industries to make processes more efficient and increase output while maintaining workplace safety. For instance, in April 2025, FANUC America showcased its cutting-edge robotics and automation solutions at Automate 2025 in Detroit, including collaborative robots, autonomous mobile robots, and advanced vision technologies. Their innovations aim to enhance production efficiency, offering flexible, scalable solutions for industries such as automotive and manufacturing, maximizing productivity.

Mexico Industrial Automation Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, application, and end use industry.

Component Insights:

- Sensors

- Actuators

- Controllers

- PLC

- DCS

- Drives

- Servo Drives

- VFDs

- Human-Machine Interfaces (HMIs)

- Industrial Networks

- Power Supply Units

- Relays and Switches

The report has provided a detailed breakup and analysis of the market based on the component. This includes sensors, actuators, controllers (PLC and DCS), drives (servo drives and VFDs), human-machine interfaces (HMIs), industrial networks, power supply units, and relays and switches.

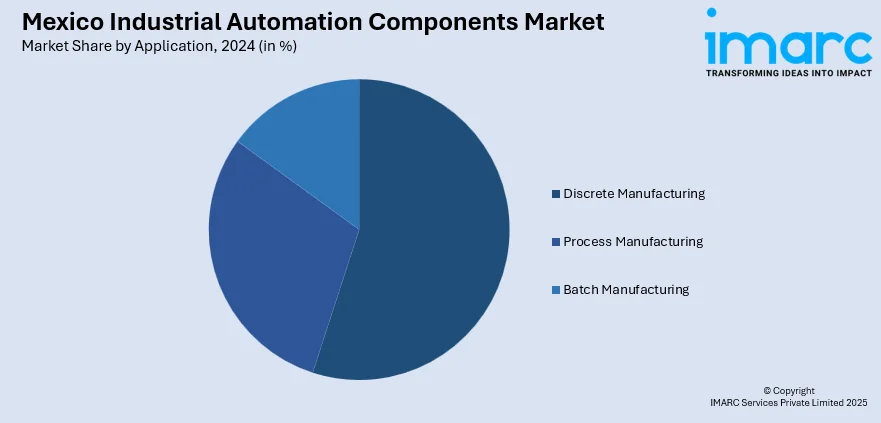

Application Insights:

- Discrete Manufacturing

- Process Manufacturing

- Batch Manufacturing

The report has provided a detailed breakup and analysis of the market based on the application. This includes discrete manufacturing, process manufacturing, and batch manufacturing.

End Use Industry Insights:

- Automotive

- Food and Beverage

- Pharmaceuticals

- Oil and Gas

- Chemicals

- Electronics and Semiconductors

- Metals and Mining

- Water and Wastewater

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes automotive, food and beverage, pharmaceuticals, oil and gas, chemicals, electronics and semiconductors, metals and mining, water and wastewater, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Automation Components Market News:

- In April 2025, Komaspec opened a new manufacturing facility in Juarez, Mexico, to meet growing demand for custom metal parts. This 20,000-square-foot facility will help streamline production and offer fast, cost-effective solutions for U.S. and Canadian customers. The facility specializes in precision manufacturing, including laser cutting, bending, and surface finishing.

- In August 2024, SCHUNK opened a new 5,000 square meter facility in Santiago de Querétaro, Mexico. The location features assembly and manufacturing capabilities, along with a CoLab application center for automation and depaneling technology. This expansion enhances SCHUNK's ability to serve North and South America, offering customized solutions with quicker delivery times.

- In June 2024, Lisconn, a global electronics design and manufacturing specialist, expanded to Mexico with a new facility in Rosarito, Baja California. This 68,000 square-foot plant offers customizable, low-to-medium-volume production and services for OEMs in regulated sectors like Medical, Automotive, and Industrial Automation, enhancing flexibility and scalability.

Mexico Industrial Automation Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Discrete Manufacturing, Process Manufacturing, Batch Manufacturing |

| End Use Industries Covered | Automotive, Food and Beverage, Pharmaceuticals, Oil and Gas, Chemicals, Electronics and Semiconductors, Metals and Mining, Water and Wastewater, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial automation components market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial automation components market on the basis of component?

- What is the breakup of the Mexico industrial automation components market on the basis of application?

- What is the breakup of the Mexico industrial automation components market on the basis of end use industry?

- What is the breakup of the Mexico industrial automation components market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial automation components market?

- What are the key driving factors and challenges in the Mexico industrial automation components market?

- What is the structure of the Mexico industrial automation components market and who are the key players?

- What is the degree of competition in the Mexico industrial automation components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial automation components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial automation components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial automation components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)