Mexico Industrial Automation Sensors Market Size, Share, Trends and Forecast by Sensor Type, Type, Mode of Automation, End User, and Region, 2025-2033

Mexico Industrial Automation Sensors Market Overview:

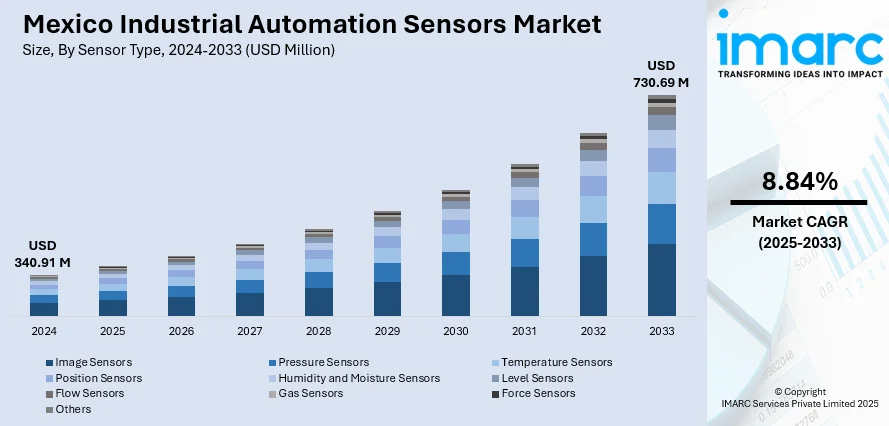

The Mexico industrial automation sensors market size reached USD 340.91 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 730.69 Million by 2033, exhibiting a growth rate (CAGR) of 8.84% during 2025-2033. The market is fueled by increased use of intelligent manufacturing solutions, heightened requirements for real-time observation, and growth of entirely automated systems across important industries. Support from varying sensor types, such as non-touch and multi-task sensors facilitates better operating efficiency, security, and scalability. Digitalization is affirming competitiveness and green practices throughout sectors, helping substantially in Mexico industrial automation sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 340.91 Million |

| Market Forecast in 2033 | USD 730.69 Million |

| Market Growth Rate 2025-2033 | 8.84% |

Mexico Industrial Automation Sensors Market Trends:

Growing Integration of Sensor Technologies with Non-Contact Nature

Within Mexico's industrial automation environment, non-contact sensors are experiencing a dramatic increase in usage across industries like manufacturing, power, and mining. These sensors, such as ultrasonic, capacitive, inductive, and laser displacement types, are preferred due to their accuracy, longevity, and minimal maintenance needs in high-speed and dangerous environments. With industries evolving towards higher levels of automation, the potential for non-contact sensors to measure variables like distance, pressure, and motion without making contact boosts process reliability. Their integration allows for more intelligent machine interfaces and real-time monitoring, boosting production stability and reducing downtime. As per the sources, in January 2023, ABB inaugurated its Mexico Technology and Engineering Center (MXTEC) in Merida, Yucatan, with an investment of \$1 million, adding 25% engineering capacity to drive improved project delivery in North America. Furthermore, the sensor technologies also allow predictive maintenance approaches through the provision of constant data input to centralized control systems. The trend is an extension of the expanding movement towards computerized manufacturing systems that supports national efforts towards technological upgradation. Mexico industrial automation sensors growth is largely driven by the rising demand for accurate, contactless measurements essential for enabling efficient and scalable industrial processes.

Growth of Fully Automated Systems based on Sensor-Driven Intelligence

One of the key trends defining Mexico's industrial landscape is the transition from semi-automatic to fully automated systems with intelligent sensors backing them. Sensors today are the cornerstone of computerized production environments, gathering and forwarding vital information that controls robotics, assembly lines, and quality control processes. For instance, in January 2023, German sensor and automation expert Balluff announced an expansion plan for a new Smart Factory in Aguascalientes, Mexico. The 15,000 m² plant will concentrate on manufacturing sensors, RFID solutions, and network systems. Moreover, industry 4.0 concepts have driven the rollout of fully automated systems at an unprecedented pace, with sensor technologies from temperature and flow sensors to gas and level sensors allowing for self-adjusting mechanisms and adaptive control. As more factories move towards autonomous production models, sensor networks provide the smooth operation of processes by enabling real-time responses to environmental and operational adjustments. This mass sensor integration not only provides increased productivity but also guarantees adherence to evolving performance and efficiency standards. The ensuing change helps provide a strong automation infrastructure, which forms the basis for smarter, networked industrial environments that require little human interaction and produce highly consistent output quality.

Cross-Sector Sensor Adoption in Varied Industrial Environments

Sensor adoption in Mexico's industrial automation market is rapidly diversifying, with increasing applications across sectors like chemicals, food and beverages, pharmaceuticals, and aerospace. The flexibility of automation sensors—e.g., force sensors for accurate loading, humidity sensors for quality monitoring, and position sensors for robotic guidance—is rendering them invaluable in legacy installations as well as new installations. This multi-sector trend reflects a larger movement toward standardized, sensor-based process control where data collection, monitoring, and adjustment happen in real time. Industries are using sensor data not only for process optimization but also to enable strategic initiatives such as resource maximization and compliance with sustainability mandates. Further, multi-sensor integration into in-place infrastructure is facilitating hybrid automation platforms that boost safety and scalability. The increasing sensor utilization by verticals depicts an industrial base that is maturing in Mexico, where digital transformation is no longer isolated but integrated into all aspects of operational strategy.

Mexico Industrial Automation Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sensor type, type, mode of automation, and end user.

Sensor Type Insights:

- Image Sensors

- Pressure Sensors

- Temperature Sensors

- Position Sensors

- Humidity and Moisture Sensors

- Level Sensors

- Flow Sensors

- Gas Sensors

- Force Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the sensor type. This includes image sensors, pressure sensors, temperature sensors, position sensors, humidity and moisture sensors, level sensors, flow sensors, gas sensors, force sensors, and others.

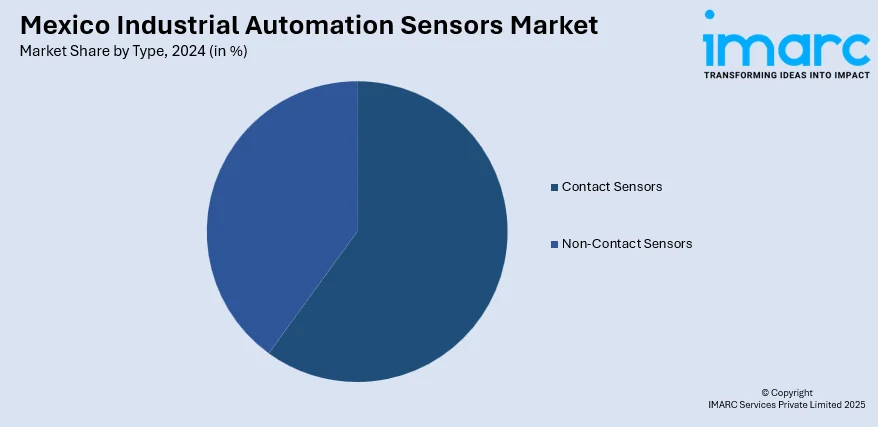

Type Insights:

- Contact Sensors

- Non-Contact Sensors

- Photonic Sensors

- Hall Effect Sensors

- Capacitive Sensors

- Ultrasonic Sensors

- Inductive Sensors

- Laser Displacement Sensor

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes contact sensors, and non-contact sensors (photonic sensors, hall effect sensors, capacitive sensors, ultrasonic sensors, inductive sensors, and laser displacement sensor).

Mode Of Automation Insights:

- Semi-Automatic Systems

- Fully Automatic Systems

The report has provided a detailed breakup and analysis of the market based on the mode of automation. This includes semi-automatic systems and fully automatic systems.

End User Insights:

- Oil and Gas

- Automotive

- Food and Beverage

- Semiconductor and Electronics

- Chemical and Material

- Consumer Goods

- Mining and Metals

- Pharmaceuticals and Biotech

- Power

- Machines and Tools

- Paper and Pulp

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, automotive, food and beverage, semiconductor and electronics, chemical and material, consumer goods, mining and metals, pharmaceuticals and biotech, power, machines and tools, paper and pulp, aerospace and defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Automation Sensors Market News:

- In January 2025, Allegro MicroSystems has launched two next-gen current sensor ICs—ACS37030MY and ACS37220MZ—to improve power density and accuracy. These small-form-factor, high-isolation sensors provide up to 40% reduced footprints and lower resistance, enabling next-generation automotive, industrial, and consumer applications in the dynamic sensors market landscape.

Mexico Industrial Automation Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sensor Types Covered | Image sensors, Pressure sensors, Temperature sensors, Position sensors, Humidity & Moisture sensors, Level sensors, Flow sensors, Gas sensors, Force sensors, Others |

| Types Covered |

|

| Modes of Automation Covered | Semi-Automatic Systems, Fully-Automatic Systems |

| End Users Covered | Oil and Gas, Automotive, Food and Beverage, Semiconductor and Electronics, Chemical and Material, Consumer Goods, Mining and Metals, Pharmaceuticals and Biotech, Power, Machines and Tools, Paper and Pulp, Aerospace and Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial automation sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial automation sensors market on the basis of sensor type?

- What is the breakup of the Mexico industrial automation sensors market on the basis of type?

- What is the breakup of the Mexico industrial automation sensors market on the basis of mode of automation?

- What is the breakup of the Mexico industrial automation sensors market on the basis of end user?

- What is the breakup of the Mexico industrial automation sensors market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial automation sensors market?

- What are the key driving factors and challenges in the Mexico industrial automation sensors?

- What is the structure of the Mexico industrial automation sensors market and who are the key players?

- What is the degree of competition in the Mexico industrial automation sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial automation sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial automation sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial automation sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)