Mexico Industrial Bearings Market Size, Share, Trends and Forecast by Bearing Type, End Use Industry, and Region, 2025-2033

Mexico Industrial Bearings Market Overview:

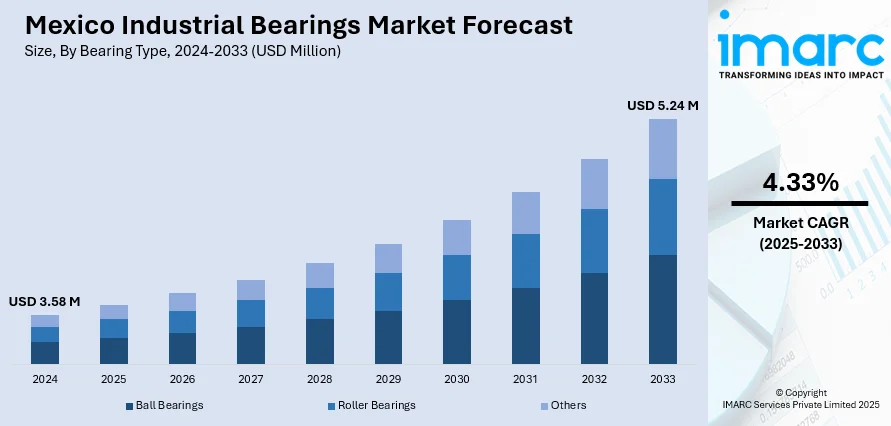

The Mexico industrial bearings market size reached USD 3.58 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5.24 Million by 2033, exhibiting a growth rate (CAGR) of 4.33% during 2025-2033. The market is progressing with mounting demand from automotive production, increased automation at factories, and growing renewable energy initiatives. Bearings are needed to maintain efficiency, durability, and performance in high-precision and heavy-duty applications. These trends mirror the country's industrial modernization and sustainability objectives, compelling demands for technologically sophisticated bearing solutions. As industries develop and make investments in longer-term reliability, these factors all merge to advance the Mexico industrial bearings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.58 Million |

| Market Forecast in 2033 | USD 5.24 Million |

| Market Growth Rate 2025-2033 | 4.33% |

Mexico Industrial Bearings Market Trends:

Expansion in Automotive Production and Assembly

Mexico's strong standing as a worldwide automotive manufacturing hub is largely impacting the industrial bearings industry. Ongoing growth in vehicle manufacturing and assembly facilities continues to generate significant demand for high-performance bearings employed in engines, transmissions, wheels, and drive systems. These parts are crucial for guaranteeing durability, low friction, and smooth operation of automotive machinery. As Mexico exports more automobiles to the United States and other countries, bearing precision and reliability become even more significant. Moreover, the increasing incorporation of hybrid and electric vehicles is also necessitating the adoption of new bearing technologies suited to high-speed and low-noise operations. These developments lead to more productive production lines and enhanced vehicle performance. The automotive industry is still a key driver of Mexico industrial bearings market growth, with new investment and technological advancements further securing the nation's role in the international supply chain for bearing products. According to the reports, in October 2023, SKF inaugurated a \\$70 million plant in Monterrey to manufacture 20 million bearings a year, adding to Mexico's industrial bearings sector cutting-edge solutions for EVs, agriculture and industry.

To get more information on this market, Request Sample

Rising Industrial Automation Across Manufacturing Sectors

The swift uptake of industrial automation technologies in Mexico is reconfiguring demand for precision mechanical components such as bearings. As production lines incorporate robotics, programmable logic controllers (PLCs), and sensor-based machines, bearings that can handle high-speed, repetitive motion with low wear are a necessity. The trend is strong in the electronics, food processing and packaging sectors where accuracy and uptime are paramount. Bearing in automated equipment must deliver consistent performance while allowing real-time condition monitoring and predictive maintenance. With factories becoming ever more digitized and data-based, bearing design is adapting to these new models of operation. This technological advancement complements Mexico's general industrial modernization and raises productivity and efficiency across the board. Mexico industrial bearings growth is thus tightly correlated with Mexico's path to automation, whereby reliability, smartness and extended service life are major buying factors in the manufacturing supply chain.

Growth in Renewable Energy Infrastructure

Mexico's increasing investment in renewable energy infrastructure is propelling demand for industrial bearings for applications in wind turbines, solar tracking systems, and hydroelectric power plants. Bearings that operate in these environments are subjected to high loads, changing speeds and harsh environments, so durability and efficiency are paramount. Wind power, in fact, demands proprietary bearing systems on rotor shafts, gearboxes, and generators to maintain smooth and uninterrupted power generation. As the nation diversifies its energy mix and aims to achieve environmental objectives, high-quality mechanical components are being highly relied upon to sustain long-term performance with reduced maintenance. The energy shift favors local manufacturing and importation of bearings optimized for clean energy uses. The growth of the renewable energy industry has been a crucial driver for Mexico industrial bearings expansion, supporting the role of technical robustness and flexibility in future bearing solutions aimed at sustainable development of infrastructure.

Mexico Industrial Bearings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on bearing type and end use industry.

Bearing Type Insights:

- Ball Bearings

- Roller Bearings

- Others

The report has provided a detailed breakup and analysis of the market based on the bearing type. This includes ball bearings, roller bearings, others.

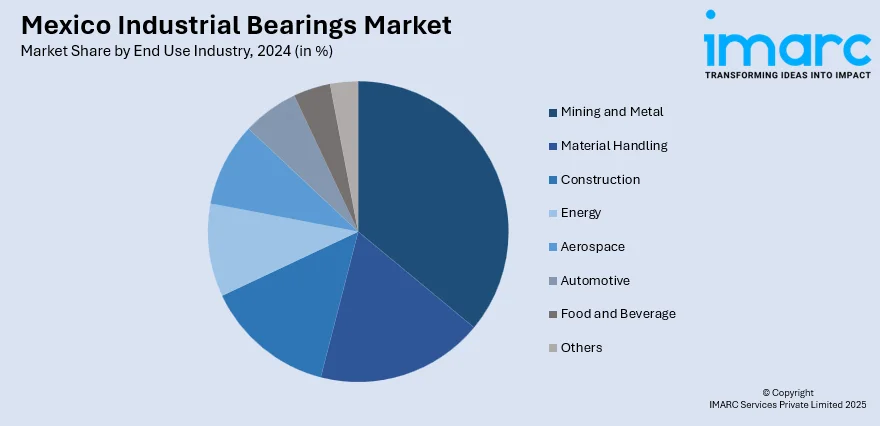

End Use Industry Insights:

- Mining and Metal

- Material Handling

- Construction

- Energy

- Aerospace

- Automotive

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes mining and metal, material handling, construction, energy, aerospace, automotive, food and beverage, others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also detailed profiles of all major companies have been provided.

Mexico Industrial Bearings Market News:

- In March 2024, Schaeffler introduced NJ23-ILR cylindrical roller bearings, delivering 24% greater dynamic load capacity and twice the lifespan. The development underlines Mexico's expanding industrial bearings business, particularly in heavy-duty gearboxes and machinery, in sync with local demand for resilient, compact and sustainable applications amidst increased manufacturing and construction activity.

Mexico Industrial Bearings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bearing Types Covered | Ball Bearings, Roller Bearings, Others |

| End Uses Indusries Covered | Mining and Metal, Material Handling, Construction, Energy, Aerospace, Automotive, Food and Beverage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial bearings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial bearings market on the basis of bearing type?

- What is the breakup of the Mexico industrial bearings market on the basis of end use industry?

- What is the breakup of the Mexico industrial bearings market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial bearings market?

- What are the key driving factors and challenges in the Mexico industrial bearings?

- What is the structure of the Mexico industrial bearings market and who are the key players?

- What is the degree of competition in the Mexico industrial bearings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial bearings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial bearings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial bearings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)