Mexico Industrial Coatings Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

Mexico Industrial Coatings Market Overview:

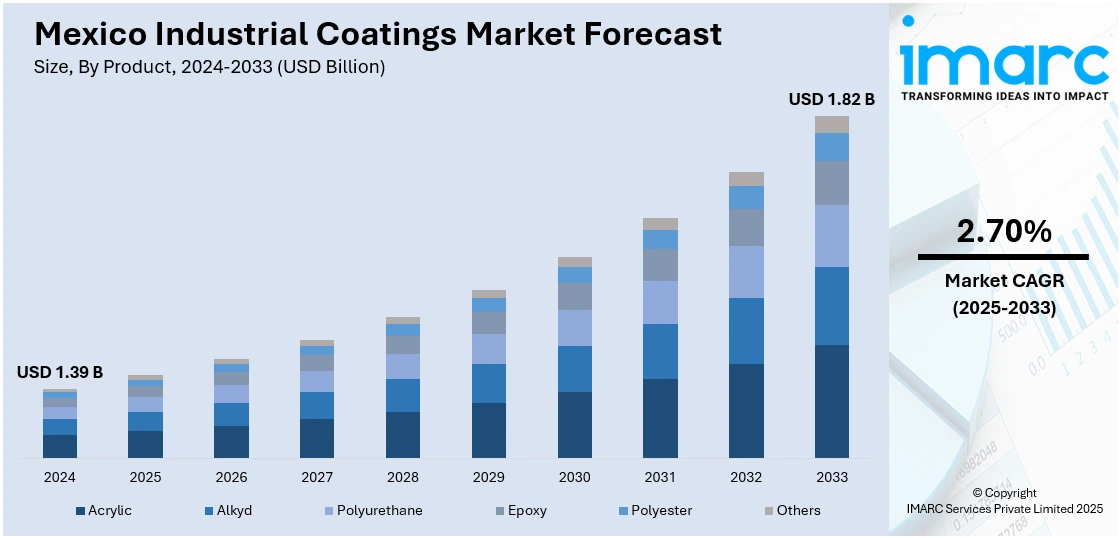

The Mexico industrial coatings market size reached USD 1.39 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.82 Billion by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The market is driven by factors such as the rapid growth of the automotive and construction sectors, increasing demand for eco-friendly and low- volatile organic compounds (VOCs) coatings, and technological advancements in coating materials further surging the Mexico industrial coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.39 Billion |

| Market Forecast in 2033 | USD 1.82 Billion |

| Market Growth Rate 2025-2033 | 2.70% |

Mexico Industrial Coatings Market Trends:

Shift Toward Sustainable and Eco-friendly Coatings

Mexico's industrial coatings sector is progressively embracing sustainable practices in response to heightened environmental concerns and increasingly stringent regulatory frameworks. There is a growing consumer preference for coatings with low or zero volatile organic compound (VOC) content, driven by the demand for environmentally responsible products and reinforced by government-imposed emissions targets. As a result, companies are increasingly adopting water-based and ultraviolet (UV)-cured coatings, which minimize environmental impact while delivering high levels of performance and durability. These eco-friendly solutions are witnessing rising demand across key industries such as automotive, construction, and manufacturing. In addition to their environmental advantages, these coatings offer rapid curing times, enhanced protective properties, and compliance with clean industry standards—aligning with Mexico’s broader shift toward more sustainable and responsible industrial operations.

Growth in the Automotive and Construction Sectors

Mexico’s industrial coatings market is experiencing robust growth, primarily fueled by the expanding automotive and construction sectors. The automotive industry increasingly demands high-performance coatings to meet rising vehicle production needs, driven by nearshoring trends and greater manufacturing capacity. Simultaneously, rapid expansion in the construction sector—spurred by urbanization and infrastructure development—is generating strong demand for coatings across residential, commercial, and public projects. These developments highlight the critical need for durable, weather-resistant, and visually appealing coatings that meet industry-specific performance standards. As of Q3 2024, the construction sector alone employed approximately 8.54 million people, emphasizing its vital role in the national economy. This combined momentum from both industries is significantly shaping the coatings market in Mexico, encouraging innovation and investment in advanced protective and decorative coating technologies.

Advancements in Coating Technologies

Technological advancements are revolutionizing Mexico's industrial coatings industry through the introduction of new solutions with improved performance and efficiency. The latest technologies such as nanotechnology, self-healing coatings, and UV-cured coatings are enhancing durability, shortening drying times, and improving resistance against wear, corrosion, and damage from the environment. Self-healing coatings, for instance, have the capability to heal superficial scratches on their own, enhancing the lifespan of coated materials while lowering maintenance expenses. UV-cured coatings facilitate quicker curing, which suits them for application in high-speed production lines of industries such as automotive, aerospace, and building. These advancements not only achieve the changing standards of quality and performance but are also in consonance with the principles of sustainability, as the majority of such technologies lower the consumption of energy and emissions thereby strengthening the Mexico industrial coatings market growth.

Mexico Industrial Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, and end user.

Product Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

Technology Insights:

- Solvent Borne

- Water Borne

- Powder Based

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent borne, water borne, powder based, and others.

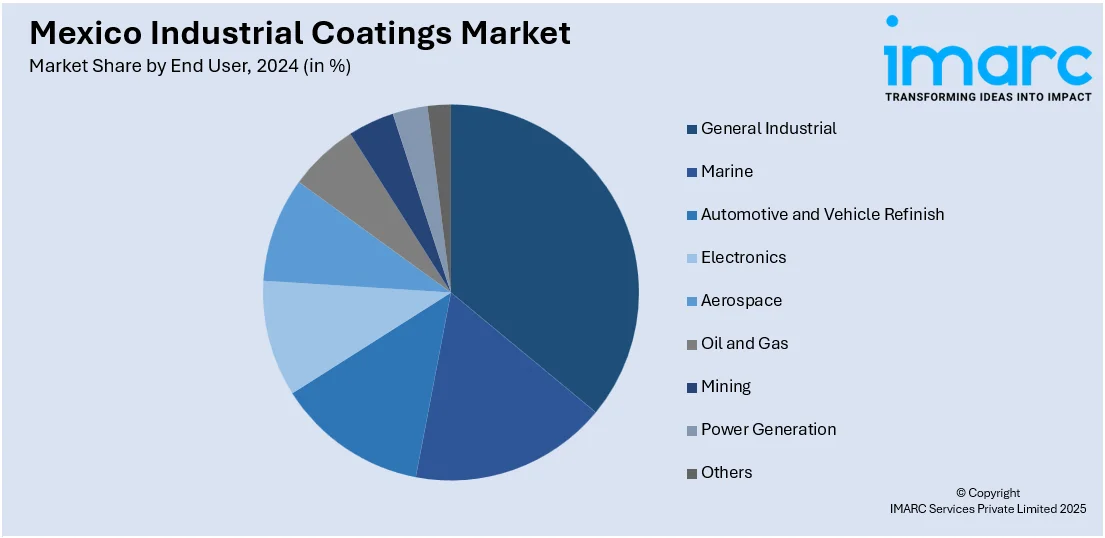

End User Insights:

- General Industrial

- Marine

- Automotive and Vehicle Refinish

- Electronics

- Aerospace

- Oil and Gas

- Mining

- Power Generation

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes general industrial, marine, automotive and vehicle refinish, electronics, aerospace, oil and gas, mining, power generation, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Coatings Market News:

- In March 2024, WEG invested $20 million in a new industrial liquid paints factory in Atotonilco de Tula, Mexico. The 5,300m² facility, set to begin operations in early 2026, will expand WEG Coatings' production capacity to meet growing demand in North and Central America. This move aims to strengthen the company’s international presence and support the demand for efficient, sustainable coating solutions in the region.

Mexico Industrial Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Technologies Covered | Solvent Borne, Water Borne, Powder Based, Others |

| End Users Covered | General Industrial, Marine, Automotive and Vehicle Refinish, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial coatings market on the basis of product?

- What is the breakup of the Mexico industrial coatings market on the basis of technology?

- What is the breakup of the Mexico industrial coatings market on the basis of end user?

- What is the breakup of the Mexico industrial coatings market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial coatings market?

- What are the key driving factors and challenges in the Mexico industrial coatings market?

- What is the structure of the Mexico industrial coatings market and who are the key players?

- What is the degree of competition in the Mexico industrial coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)