Mexico Industrial Conveyor Systems Market Size, Share, Trends and Forecast by Type, Load Capacity, Operation Type, End Use Industry, and Region, 2025-2033

Mexico Industrial Conveyor Systems Market Overview:

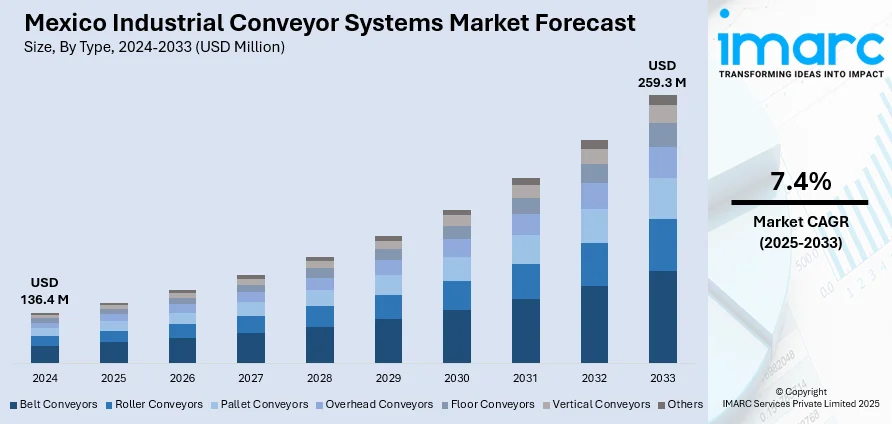

The Mexico industrial conveyor systems market size reached USD 136.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 259.3 Million by 2033, exhibiting a growth rate (CAGR) of 7.4% during 2025-2033. Expanding manufacturing and logistics sectors, growth in automotive and food processing industries, increased automation adoption, rising e-commerce activities, and infrastructure investments aimed at improving operational efficiency, material handling speed, and reducing labor dependency are some of the factors contributing to Mexico industrial conveyor systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 136.4 Million |

| Market Forecast in 2033 | USD 259.3 Million |

| Market Growth Rate 2025-2033 | 7.4% |

Mexico Industrial Conveyor Systems Market Trends:

Integrated Infrastructure Demand Driving Product Portfolio Expansion

Mexico’s automation and manufacturing ecosystem is witnessing increasing demand for interconnected electrical and mechanical infrastructure, with a particular focus on systems that enable efficient operations across industrial facilities. This includes the adoption of advanced cable tray systems designed to complement high-performance conveyor systems. Collaborative ventures aimed at delivering enhanced electrical support solutions are expanding the scope of available offerings for plant automation. These developments reflect a broader movement toward building fully integrated production environments where conveyors function alongside robust electrical support systems. Such coordination is becoming essential in sectors like automotive, electronics, and food processing, where uninterrupted power and precise control are key to maintaining output levels and reducing downtime in highly automated settings. These factors are intensifying the Mexico industrial conveyor systems market growth. For example, in November 2024, ABB and Niedax Group launched ABNEX Inc., a joint venture to offer advanced cable tray systems for automation and electrical infrastructure. The venture would enhance ABB’s product portfolio across industrial facilities. This move supports Mexico’s growing automation and manufacturing landscape, which relies on integrated systems like conveyors.

To get more information of this market, Request Sample

Emphasis on Safety Tech in Heavy-Duty Transport

Mexico’s cement industry is advancing toward cleaner production methods by integrating industrial byproduct processing into existing operations. Facilities handling materials like slag and fly ash require reliable bulk transport solutions to manage the continuous movement of these inputs. As manufacturers modernize infrastructure to meet sustainability goals, there is growing emphasis on conveyor systems capable of efficiently supporting complex, multi-stage material flows. This shift not only improves operational efficiency but also aligns with environmental regulations and circular economy goals. Upgrades in processing lines are prompting higher demand for conveyors that offer durability, adaptability, and automation compatibility, particularly in large-scale cement operations aiming to optimize handling of both virgin and recycled raw materials throughout their production cycles. For instance, in August 2024, Cemento Cruz Azul launched a new processing line for industrial byproducts at its Hidalgo plant, aiming to enhance sustainable cement production. The facility handles materials like slag and fly ash, requiring efficient bulk transport systems. This development is expected to boost demand for industrial conveyor systems in Mexico’s cement sector, as firms upgrade infrastructure to support eco-friendly operations and streamline the movement of raw and recycled inputs across production stages.

Mexico Industrial Conveyor Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, load capacity, operation type, and end use industry.

Type Insights:

- Belt Conveyors

- Roller Conveyors

- Pallet Conveyors

- Overhead Conveyors

- Floor Conveyors

- Vertical Conveyors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes belt conveyors, roller conveyors, pallet conveyors, overhead conveyors, floor conveyors, vertical conveyors, and others.

Load Capacity Insights:

- Light-Duty Conveyors

- Medium-Duty Conveyors

- Heavy-Duty Conveyors

A detailed breakup and analysis of the market based on the load capacity have also been provided in the report. This includes light-duty conveyors, medium-duty conveyors, and heavy-duty conveyors.

Operation Type Insights:

- Automated Conveyors

- Semi-Automated Conveyors

- Manual Conveyors

The report has provided a detailed breakup and analysis of the market based on the operation type. This includes automated conveyors, semi-automated conveyors, and manual conveyors.

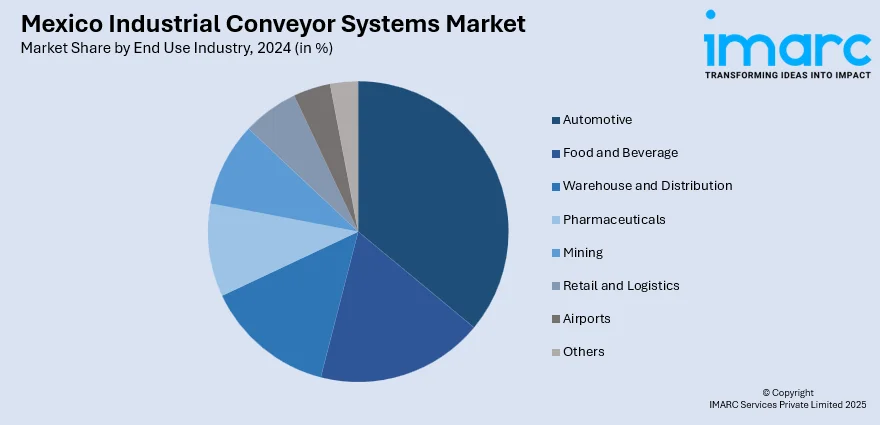

End Use Industry Insights:

- Automotive

- Food and Beverage

- Warehouse and Distribution

- Pharmaceuticals

- Mining

- Retail and Logistics

- Airports

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, food and beverage, warehouse and distribution, pharmaceuticals, mining, retail and logistics, airports, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Conveyor Systems Market News:

- In February 2025, Atlas Energy Solutions launched the Dune Express, a 42-mile conveyor belt transporting sand from Kermit, Texas, to New Mexico oil wells. Operational since early 2025, the USD 400 Million system replaces 400 truckloads per well, reducing logistics costs. This model signals growing interest in large-scale, fixed conveyor infrastructure, offering insight for Mexico’s mining and construction sectors seeking efficient, automated alternatives to traditional truck-based bulk material transport across remote or high-volume sites.

- In January 2025, Kodiak Robotics delivered autonomous RoboTrucks to Atlas Energy Solutions, completing 100 driverless hauls of proppant. This advancement highlights the growing role of automation in bulk material transport. As mining and energy sectors adopt autonomous solutions, demand may rise for efficient, fixed-site handling systems like industrial conveyors in Mexico, especially for loading and unloading processes in resource operations aiming to integrate with automated logistics networks.

Mexico Industrial Conveyor Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Belt Conveyors, Roller Conveyors, Pallet Conveyors, Overhead Conveyors, Floor Conveyors, Vertical Conveyors, Others |

| Load Capacities Covered | Light-Duty Conveyors, Medium-Duty Conveyors, Heavy-Duty Conveyors |

| Operation Types Covered | Automated Conveyors, Semi-Automated Conveyors, Manual Conveyors |

| End Use Industries Covered | Automotive, Food And Beverage, Warehouse And Distribution, Pharmaceuticals, Mining, Retail And Logistics, Airports, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial conveyor systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial conveyor systems market on the basis of type?

- What is the breakup of the Mexico industrial conveyor systems market on the basis of load capacity?

- What is the breakup of the Mexico industrial conveyor systems market on the basis of operation type?

- What is the breakup of the Mexico industrial conveyor systems market on the basis of end use industry?

- What is the breakup of the Mexico industrial conveyor systems market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial conveyor systems market?

- What are the key driving factors and challenges in the Mexico industrial conveyor systems market?

- What is the structure of the Mexico industrial conveyor systems market and who are the key players?

- What is the degree of competition in the Mexico industrial conveyor systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial conveyor systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial conveyor systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial conveyor systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)