Mexico Industrial Heat Recovery Market Size, Share, Trends and Forecast by Technology, Application, End Use Sector, and Region, 2025-2033

Mexico Industrial Heat Recovery Market Overview:

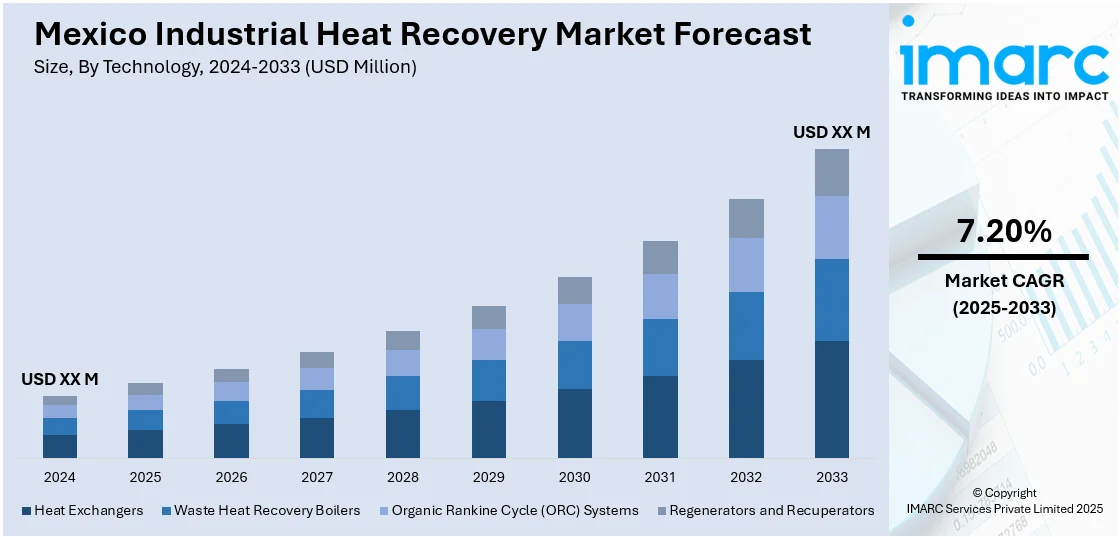

The Mexico industrial heat recovery market size is projected to exhibit a growth rate (CAGR) of 7.20% during 2025-2033. The market is majorly driven by the high industrial energy costs and the need for efficiency. Also, regulatory emissions targets and compliance requirements are fueling the product adoption. Additionally, growing integration with automation and modernization strategies is expanding its use. Decarbonization mandates, rising fuel expenses, and digital industrial upgrades are some of the other factors positively impacting the Mexico industrial heat recovery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Industrial Heat Recovery Market Trends:

Escalating Industrial Energy Costs and Efficiency Demands

Mexico’s industrial sector faces consistent pressure from rising electricity and fuel prices, particularly in energy-intensive operations such as cement, steel, food processing, and chemical manufacturing. With energy costs accounting for a significant portion of total production expenses, companies are turning to waste heat recovery systems as a practical solution for cost containment. These systems capture and reuse thermal energy from industrial processes, such as exhaust gases, kiln operations, or boiler stacks, reducing the need for additional fuel input. In doing so, manufacturers lower their operational expenses while improving energy efficiency ratings. Facilities using combined heat and power (CHP) systems are integrating waste heat recovery as part of broader decarbonization and modernization strategies. This is a major factor driving Mexico industrial heat recovery market growth, particularly in northern and central industrial corridors where energy demand is high and utility prices are volatile. With regulatory pressure to reduce energy waste and emissions, energy recovery investments are increasingly being justified by long-term savings, making them a priority in retrofit and plant upgrade plans. As companies pursue both environmental and cost performance, the role of heat recovery technology becomes more critical.

Environmental Regulations and Emissions Compliance

Mexico’s environmental policy landscape is increasingly aligned with global sustainability targets, pressuring industrial operators to adopt cleaner, more efficient technologies. The General Law on Climate Change and related regulations require industries to measure, report, and mitigate greenhouse gas emissions. This regulatory push is particularly pronounced for facilities exceeding energy consumption thresholds or participating in national emissions registries. Waste heat recovery technologies help companies comply by lowering fuel use and associated emissions, contributing directly to CO₂ reduction targets. These systems are also eligible under several clean technology and energy transition incentives, including fiscal deductions for efficiency upgrades and access to green financing instruments. International companies operating in Mexico must often meet environmental standards that exceed local laws, making heat recovery a critical compliance tool. This has increased demand for scalable, low-maintenance recovery units across sectors, especially in multinational-owned facilities with ISO 14001 or ESG reporting requirements. As enforcement tightens and pressure from supply chains and investors grows, adoption of heat recovery is accelerating, supported by a growing local ecosystem of technology providers and industrial energy consultants.

Industrial Modernization and Technological Integration

Mexico’s manufacturing sector is undergoing digital transformation, with Industry 4.0 technologies such as sensors, automation, and real-time data systems reshaping production processes. Waste heat recovery systems are increasingly integrated into this modernization trend, offering not just energy savings but also data insights and system control through digital platforms. These systems can now be linked with factory automation software, allowing plant operators to monitor performance, adjust recovery rates, and optimize operations in real time. This is particularly attractive in sectors with continuous or high-temperature processes, where recovery systems must respond dynamically to changing load profiles. Smart factories are embedding waste heat capture into broader energy management strategies, treating thermal energy as a measurable asset rather than waste. Industrial clusters and export-focused zones such as those in Querétaro, Guanajuato, and Nuevo León are investing in such technologies as part of competitiveness strategies. Equipment manufacturers are also developing modular, scalable systems suited to Mexico’s SME-heavy industrial base. The overlap between digitalization, cost control, and sustainability is solidifying waste heat recovery’s place in long-term industrial planning.

Mexico Industrial Heat Recovery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, and end use sector.

Technology Insights:

- Heat Exchangers

- Waste Heat Recovery Boilers

- Organic Rankine Cycle (ORC) Systems

- Regenerators and Recuperators

The report has provided a detailed breakup and analysis of the market based on the technology. This includes heat exchangers, waste heat recovery boilers, organic Rankine cycle (ORC) systems, and regenerators and recuperators.

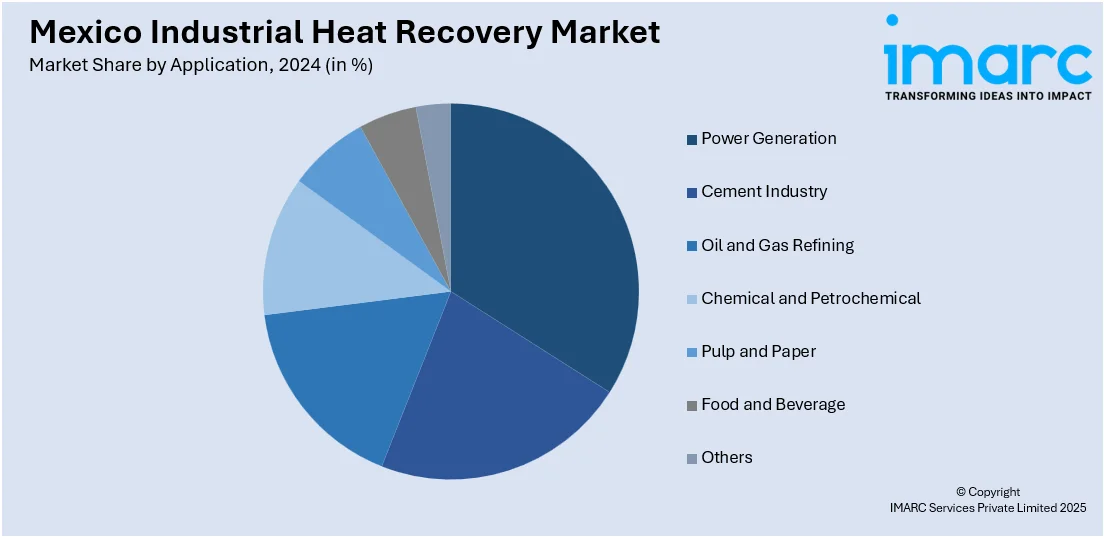

Application Insights:

- Power Generation

- Cement Industry

- Oil and Gas Refining

- Chemical and Petrochemical

- Pulp and Paper

- Food and Beverage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes power generation, cement industry, oil and gas refining, chemical and petrochemical, pulp and paper, food and beverage, and others.

End Use Sector Insights:

- Heavy Industries

- Manufacturing and Processing

- Utilities

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes heavy industries, manufacturing and processing, and utilities.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Heat Recovery Market News:

- On July 22, 2024, Danfoss inaugurated new production facilities in Monterrey, Mexico, expanding its site by 40,000 m² to meet rising demand for energy-efficient cooling and heating solutions. The expansion boosts annual output to 100,000 compressor units, 1.6 million pressure and leak detection sensors, and doubles capacity for microchannel heat exchangers, supporting electrification and refrigerant transition trends. This strengthens Mexico’s role in regional manufacturing of industrial heat recovery and HVAC components.

Mexico Industrial Heat Recovery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Heat Exchangers, Waste Heat Recovery Boilers, Organic Rankine Cycle (ORC) Systems, Regenerators and Recuperators |

| Applications Covered | Power Generation, Cement Industry, Oil and Gas Refining, Chemical and Petrochemical, Pulp and Paper, Food and Beverage, Others |

| End Use Sectors Covered | Heavy Industries, Manufacturing and Processing, Utilities |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial heat recovery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial heat recovery market on the basis of technology?

- What is the breakup of the Mexico industrial heat recovery market on the basis of application?

- What is the breakup of the Mexico industrial heat recovery market on the basis of end use sector?

- What is the breakup of the Mexico industrial heat recovery market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial heat recovery market?

- What are the key driving factors and challenges in the Mexico industrial heat recovery market?

- What is the structure of the Mexico industrial heat recovery market and who are the key players?

- What is the degree of competition in the Mexico industrial heat recovery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial heat recovery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial heat recovery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial heat recovery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)