Mexico Industrial Heaters Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

Mexico Industrial Heaters Market Overview:

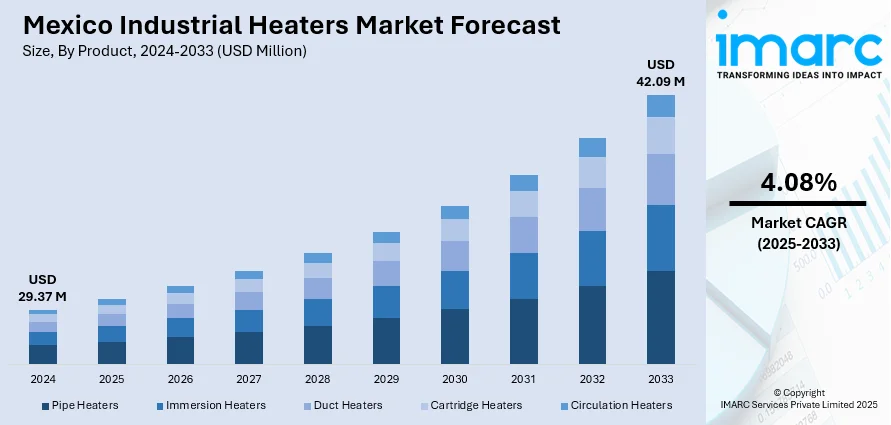

The Mexico industrial heaters market size reached USD 29.37 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 42.09 Million by 2033, exhibiting a growth rate (CAGR) of 4.08% during 2025-2033. The growth of the manufacturing sector, expansion in oil and gas industries, adoption of industrial automation, and increasing demand for energy-efficient solutions are supporting the market growth. Moreover, advancements in heating technologies, government focus on industrialization, growth in the construction sector, and rising renewable energy use are stimulating the market growth. Furthermore, food and beverage industry expansion, increasing focus on process optimization, and need for precise temperature control in electronics and automotive sectors are boosting the Mexico industrial heaters market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.37 Million |

| Market Forecast in 2033 | USD 42.09 Million |

| Market Growth Rate 2025-2033 | 4.08% |

Mexico Industrial Heaters Market Trends:

Increase in Manufacturing Industry

The growth of Mexico's manufacturing sector is one of the key drivers for the rising demand for industrial heaters. Mexico has become a prime manufacturing hub due to its strategic location, access to international markets, and the low cost of labor. Industries like the automobile, electronics, and chemicals sectors are driving the growth. Industrial heaters are crucial in such sectors since they are applied in curing, drying, and where equipment is maintained at the best temperature levels. For example, in the manufacturing of automobiles, industrial heaters are applied to vaporize paint coats or maintain temperature levels constant during material and equipment treatments. In the electronics sector as well, precise temperature control is required when manufacturing components without compromise on delicate materials. Increasing usage of these heaters is a direct result of increased production capacities and technologies that require enhanced temperature control in production processes, which is subsequently driving the Mexico industrial heaters market growth. In support of this trend, a 2024 report by the Mexican Ministry of Economy highlighted that foreign direct investment (FDI) in Mexico's manufacturing sector rose by 8.5% in the first half of the year, with automotive and electronics industries accounting for the majority of new capital inflows.

To get more information of this market, Request Sample

Expansion of the Oil and Gas Sector

Mexico's oil and gas sector has seen renewed growth in the recent years as a result of foreign as well as indigenous investment. As one of the biggest oil-producing nations in Latin America, Mexico's petrochemical and refinery industries rely on industrial heaters for various purposes such as distillation, cracking, and refining processes. Industrial heaters are used to attain certain temperatures that are required in refinery operations to ensure proper separation of different components of crude oil. For instance, during oil refining, heaters are used to obtain desired temperature for distillation without overheating or underheating, which would compromise the quality of the product. Industrial heaters also help chemical reactions in the petrochemical industry where temperature plays a crucial role. Increased oil and gas production in Mexico, fueled by recent changes and foreign investment, directly contributes to the need for industrial heating solutions that can withstand harsh environments and high temperatures. The industry's expansion is likely to continue contributing to demand for more specialized heating equipment optimized to operate in the harsh conditions of refineries and petrochemical complexes.

Industrial Automation Trend

Increasing application of industrial automation in Mexico is one of the major drivers of demand for advanced industrial equipment heaters. As manufacturing processes increasingly become automated, the need for precise, real-time temperature control has become more critical. Industrial factory systems now require integrated heat solutions that can be remotely easily controlled and monitored to ensure consistent and efficient operations. Industrial heaters, complemented with automation technologies, allow producers to automatically monitor and control temperatures, avoiding human mistakes and conserving energy. The technology also allows the producers to streamline their operations, enhancing productivity and minimizing time lost due to temperature issues. The creation of Internet of Things (IoT) technology for industrial applications is one of the drivers of this trend since it allows industrial heaters to be linked to and communicate with other machines and sensors, providing them with insightful information regarding temperature fluctuation and system performance. Automation-induced efficiency is a major drive that is fueling the application of energy-efficient and high-performance heating systems in Mexico's manufacturing sector.

Mexico Industrial Heaters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, and end user.

Product Insights:

- Pipe Heaters

- Immersion Heaters

- Duct Heaters

- Cartridge Heaters

- Circulation Heaters

The report has provided a detailed breakup and analysis of the market based on the product. This includes pipe heaters, immersion heaters, duct heaters, cartridge heaters, and circulation heaters.

Technology Insights:

- Electric Based

- Steam Based

- Hybrid Based

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electric-based, steam-based, and hybrid-based.

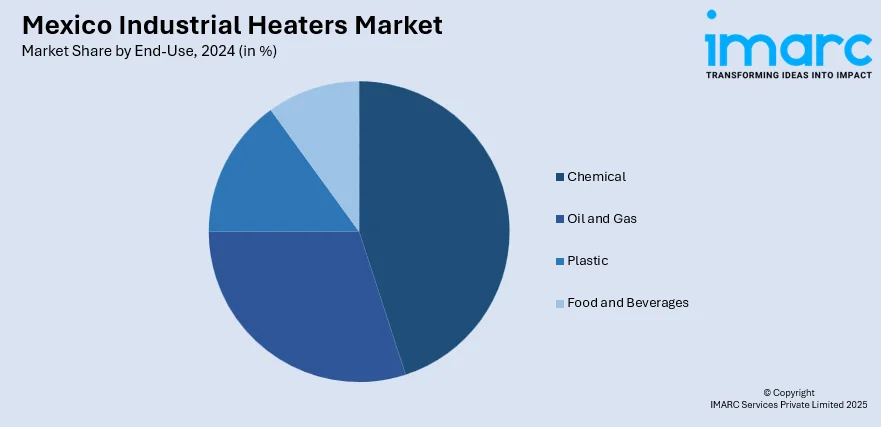

End-Use Insights:

- Chemical

- Oil and Gas

- Plastic

- Food and Beverages

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes chemical, oil and gas, plastic, and food and beverages.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Heaters Market News:

- In 2024, Mexico Infrastructure Partners (MIP) acquired 13 power generation assets from Iberdrola for USD 6.2 billion. This acquisition enhances Mexico's energy infrastructure, potentially impacting industries reliant on industrial heating solutions.

Mexico Industrial Heaters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Pipe Heaters, Immersion Heaters, Duct Heaters, Cartridge Heaters, Circulation Heaters |

| Technologies Covered | Electric Based, Steam Based, Hybrid Based |

| End-Uses Covered | Chemical, Oil and Gas, Plastic, Food and Beverages |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial heaters market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial heaters market on the basis of product?

- What is the breakup of the Mexico industrial heaters market on the basis of technology?

- What is the breakup of the Mexico industrial heaters market on the basis of end user?

- What is the breakup of the Mexico industrial heaters market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial heaters market?

- What are the key driving factors and challenges in the Mexico industrial heaters market?

- What is the structure of the Mexico industrial heaters market and who are the key players?

- What is the degree of competition in the Mexico industrial heaters market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial heaters market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial heaters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial heaters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)