Mexico Industrial IoT Market Size, Share, Trends and Forecast by Component, End-User, and Region, 2025-2033

Mexico Industrial IoT Market Overview:

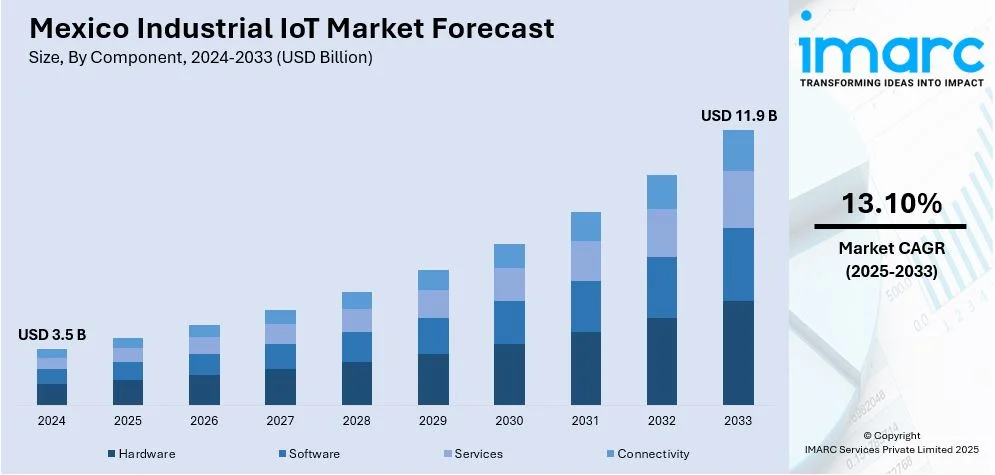

The Mexico industrial IoT market size reached USD 3.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.9 Billion by 2033, exhibiting a growth rate (CAGR) of 13.10% during 2025-2033. The growth of advanced connectivity technologies like 5G and the integration of digital twin technologies are contributing to the market by enabling real-time monitoring, proactive maintenance, enhanced manufacturing methods, and more complex industrial automation, thereby enhancing efficiency, innovation, and operational transparency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.9 Billion |

| Market Growth Rate 2025-2033 | 13.10% |

Mexico Industrial IoT Market Trends:

Integration of Advanced Connectivity Technologies

The growth of high-speed internet infrastructure and the rise of 5G networks are crucial factors propelling the industrial Internet of Things (IIoT) market in Mexico. Improved connectivity via 5G and other advanced communication technologies allows quicker, more dependable data transfer among devices, systems, and cloud platforms, which is vital for real-time monitoring, remote management, and the smooth functioning of industrial processes. The broad utilization of advanced connectivity technologies enables factories and industries to deploy more complex IIoT applications, such as autonomous systems, edge computing, and machine-to-machine communication. This transition is changing manufacturing settings, enhancing their intelligence and efficiency by boosting the capability to manage larger data quantities and facilitate intricate operations in real time. The significance of this infrastructure growth is clear in América Móvil's initiatives in 2024, as the telecom leader extended its 5G network to 125 cities in Mexico, achieving over 10 million 5G subscribers. Leveraging technology from Ericsson and Huawei, Telcel, Mexico's biggest mobile operator. Such high-speed 5G services enable the deployment of sophisticated IIoT applications in multiple sectors. This connectivity revolution is essential for facilitating the next phase of industrial automation and digital transformation in Mexico, accelerating the adoption of IIoT technologies and driving market expansion, as industries now possess the required digital infrastructure to sustain more intricate, data-centric, and real-time operations.

Expansion of Digital Twin Technologies

Digital twins, which include virtual models of physical assets, processes, or systems, allow manufacturers to simulate, oversee, and improve operations in real time without interrupting real production. This technology offers a means to visualize the behavior of machines and systems in different situations, enabling proactive decision-making to avert failures or inefficiencies. By combining IIoT and digital twins, industries in Mexico can execute predictive maintenance, optimize production processes, and experiment with new workflows in a safe virtual setting. This results in better efficiency minimized downtime, and increased product quality. A clear illustration of this in practice is Foxconn's implementation of NVIDIA Omniverse and Isaac platforms in 2024 to develop a digital twin of a factory in Guadalajara, Mexico. Using this virtual facility, Foxconn successfully trained robots, streamlined assembly lines, and enhanced the production efficiency of intricate NVIDIA Blackwell HGX systems. The combination of IIoT and digital twin technologies demonstrates how these advancements can optimize operations, improve productivity, and elevate overall manufacturing effectiveness. As businesses in Mexico keep integrating and advancing digital twin technologies, they are improving operational clarity, encouraging innovation, and propelling the expansion of the IIoT market within the nation.

Mexico Industrial IoT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component and end-user.

Component Insights:

- Hardware

- Software

- Services

- Connectivity

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, services, and connectivity.

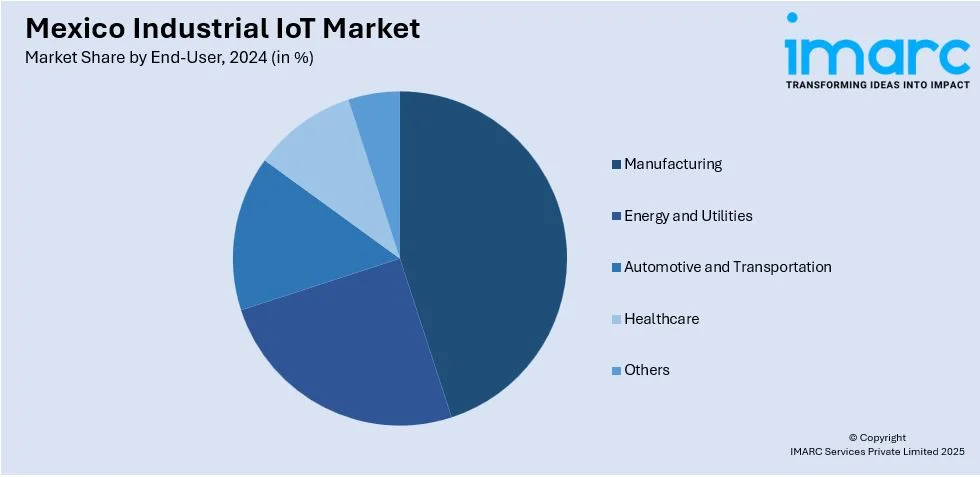

End-User Insights:

- Manufacturing

- Energy and Utilities

- Automotive and Transportation

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes manufacturing, energy and utilities, automotive and transportation, healthcare, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial IoT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| End-Users Covered | Manufacturing, Energy and Utilities, Automotive and Transportation, Healthcare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial IoT market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial IoT market on the basis of component?

- What is the breakup of the Mexico industrial IoT market on the basis of end-user?

- What is the breakup of the Mexico industrial IoT market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial IoT market?

- What are the key driving factors and challenges in the Mexico industrial IoT?

- What is the structure of the Mexico industrial IoT market and who are the key players?

- What is the degree of competition in the Mexico industrial IoT market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial IoT market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial IoT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial IoT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)