Mexico Industrial Mixers and Agitators Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Industrial Mixers and Agitators Market Overview:

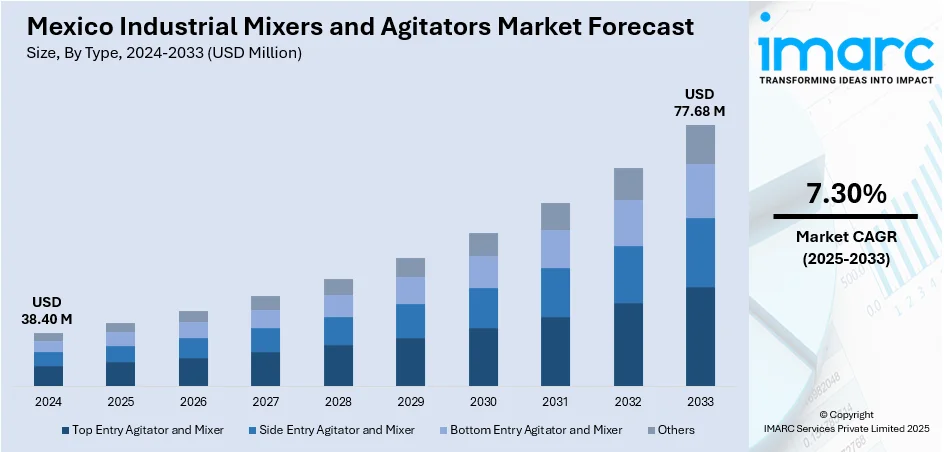

The Mexico industrial mixers and agitators market size reached USD 38.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 77.68 Million by 2033, exhibiting a growth rate (CAGR) of 7.30% during 2025-2033. The market is fueled by rising demand within the food and beverage, pharmaceutical, and chemicals sectors. Technological developments, pressure for automation, as well as the requirement for effective production processes further drive it. Such drivers are central in increasing the Mexico industrial mixers and agitators market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.40 Million |

| Market Forecast in 2033 | USD 77.68 Million |

| Market Growth Rate 2025-2033 | 7.30% |

Mexico Industrial Mixers and Agitators Market Trends:

Expansion of the Food and Beverage Industry

The high rate of growth in Mexico's food and beverages sector is a central factor in stimulating Mexico industrial mixers and agitators market growth. With the growing demand for packaged and processed food products, there is a requirement for effective mixing solutions that can provide quality and consistency. Industrial agitators and mixers are commonly employed in processes including emulsifying, blending, and homogenizing food components. Increased consumer demand for ready meals, nutritional supplements, and drinks has prompted manufacturers to explore sophisticated mixing solutions that can mix high-viscosity products and maintain food safety regulations. The industry is likely to see increased demand for mixing equipment in the nation due to this trend. For instance, in June 2024, Tetra Pak launched the Industrial Protein Mixer to address foaming issues in protein mixing. The mixer reduces product loss by eliminating foam and the need for de-foaming agents. It optimizes production, enhances product quality, and extends shelf life, making it ideal for a wide range of protein applications.

To get more information on this market, Request Sample

Growth in the Pharmaceutical and Chemical Sectors

The pharmaceutical and chemical sectors are significant contributors to the Mexico industrial mixers and agitators market growth. These industries require precise and efficient mixing processes for producing a wide range of products, such as drugs, paints, and coatings. As Mexico’s pharmaceutical market continues to expand due to both domestic demand and international exports, the need for specialized mixers and agitators is growing. Moreover, chemical manufacturers are adopting more sophisticated mixing technologies to improve product quality and streamline production. The rise of biologics, biopharmaceuticals, and specialty chemicals, along with stricter regulatory standards, further drives demand for high-performance mixers in the country. For instance, in January 2024, Marion Process Solutions introduced a new agitator design for horizontal mixers, reducing lead times by two weeks and offering up to 10% savings. The new plated paddle agitators, made from a single stainless steel piece, improve mixing efficiency and are ideal for shear-sensitive materials, benefiting industries such as food, pharmaceuticals, and chemicals.

Mexico Industrial Mixers and Agitators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Top Entry Agitator and Mixer

- Side Entry Agitator and Mixer

- Bottom Entry Agitator and Mixer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes top entry agitator and mixer, side entry agitator and mixer, bottom entry agitator and mixer, and others.

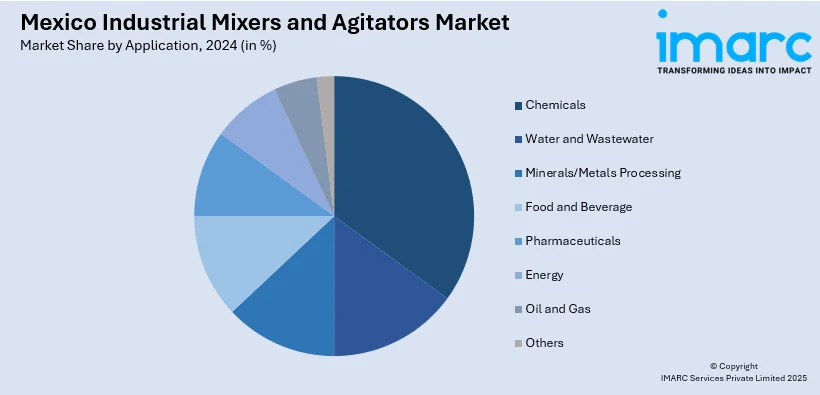

Application Insights:

- Chemicals

- Water and Wastewater

- Minerals/Metals Processing

- Food and Beverage

- Pharmaceuticals

- Energy

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemicals, water and wastewater, minerals/metals processing, food and beverage, pharmaceuticals, energy, oil and gas, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Mixers and Agitators Market News:

- In May 2025, Bühler broke ground on a new manufacturing facility in Torreón, Mexico, which will create 200 jobs and support its Grains & Food business. The facility, scheduled to begin operations in 2026, will enhance Bühler's proximity to customers and expand its manufacturing capacity, including providing industrial mixers and agitators.

- In March 2024, Ross announced the launch of fully rebuilt Double Planetary Mixers, designed for high-viscosity applications. These reconditioned models, including the DPM-4, feature patented HV blades and are ideal for thick, sticky semi-solids. With capabilities for vacuum and heating/cooling, the mixers are restored to as-new condition and come with a one-year warranty.

Mexico Industrial Mixers and Agitators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Top Entry Agitator and Mixer, Side Entry Agitator and Mixer, Bottom Entry Agitator and Mixer, Others |

| Applications Covered | Chemicals, Water and Wastewater, Minerals/Metals Processing, Food and Beverage, Pharmaceuticals, Energy, Oil and Gas, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial mixers and agitators market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial mixers and agitators market on the basis of type?

- What is the breakup of the Mexico industrial mixers and agitators market on the basis of application?

- What is the breakup of the Mexico industrial mixers and agitators market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial mixers and agitators market?

- =What are the key driving factors and challenges in the Mexico industrial mixers and agitators market?

- What is the structure of the Mexico industrial mixers and agitators market and who are the key players?

- What is the degree of competition in the Mexico industrial mixers and agitators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial mixers and agitators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial mixers and agitators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial mixers and agitators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)