Mexico Industrial Motors Market Size, Share, Trends and Forecast by Type of Motor, Voltage, End Use, and Region, 2025-2033

Mexico Industrial Motors Market Overview:

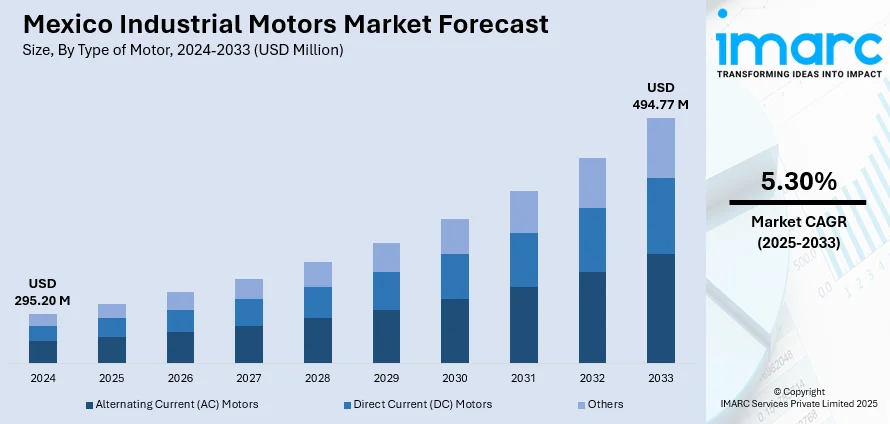

The Mexico industrial motors market size reached USD 295.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 494.77 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The increasing demand for manufacturing automation, an energy-saving trend, and industrial infrastructure development are the drivers of the market. Industrial growth policies promoted by the government, higher demand in renewable energy-based industries, technological innovation in motor design technology, and automotive and food processing industry development are driving the market. Further, the adoption of Industry 4.0 practices, supply chain logistics upgrades, foreign investment, growth in the manufacturing of consumer electronics, growth in the application of robotics, and recovery in the mining and construction sectors are propelling the Mexico industrial motors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 295.20 Million |

| Market Forecast in 2033 | USD 494.77 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Industrial Motors Market Trends:

Increasing Demand for Automation in Manufacturing Industries

The demand for automation in manufacturing industries has been growing steadily in Mexico. As businesses strive to improve productivity and reduce labor costs, automation has become a top priority. Motors play a crucial role in these systems, powering machinery that performs repetitive tasks like assembly, packaging, and material handling. This trend is particularly strong in sectors like automotive and food processing, where high-speed and consistent production is essential. The benefits of automation, such as increased efficiency, lower operational costs, and reduced human error, are compelling many manufacturers in Mexico to invest in industrial motors. Moreover, as companies look to modernize their operations to stay competitive, the need for advanced motor solutions that can support automated processes is rising. This growing reliance on automation is expected to continue driving the industrial motor market in Mexico for the foreseeable future.

To get more information of this market, Request Sample

Growing Emphasis on Energy Efficiency and Sustainability

Energy efficiency and sustainability have become major focal points for industries worldwide, and Mexico is no exception. Companies are under pressure to meet environmental regulations while reducing energy consumption, which makes the demand for energy-efficient motors stronger. Industrial motors, especially in energy-intensive sectors, account for a large portion of total energy use. As businesses face rising energy costs, adopting more efficient motor technologies has become a key strategy to optimize performance and cut down on power consumption. Furthermore, the increasing adoption of green and sustainable practices in manufacturing processes has led to the development of eco-friendly motor solutions that minimize energy waste. This growing emphasis on sustainability, driven by both government policies and global trends, has significantly impacted the industrial motors market in Mexico, where industries are looking for cost-effective ways to comply with energy regulations while reducing their environmental footprint. Notably, in 2024, Mexico’s Ministry of Energy launched a new initiative to promote the use of high-efficiency electric motors in industrial zones, offering tax incentives and technical support to companies that upgrade outdated systems.

Expansion of Industrial Infrastructure, Particularly in Manufacturing and Renewable Energy Sectors

Mexico’s industrial infrastructure is expanding rapidly, particularly in the manufacturing and renewable energy sectors. The country has long been a key manufacturing hub for North America, with numerous factories focused on automotive, electronics, and consumer goods production. The expansion of these industries requires more advanced equipment, including industrial motors that can handle the demands of modern production lines. In addition to manufacturing, Mexico is investing heavily in renewable energy projects, including wind and solar power. These sectors also require specialized industrial motors to convert energy efficiently and power various machinery. The expansion of both manufacturing and renewable energy infrastructure is directly contributing to the demand for industrial motors in Mexico, as businesses in these sectors continue to grow and adopt new technologies. As the country’s industrial base expands, the need for motors to power machinery, pumps, and turbines grows, which will continue to drive the Mexico industrial motors market growth.

Mexico Industrial Motors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of motor, voltage, and end use.

Type of Motor Insights:

- Alternating Current (AC) Motors

- Direct Current (DC) Motors

- Others

The report has provided a detailed breakup and analysis of the market based on the type of motor. This includes alternating current (AC) motors, direct current (DC) motors, and Others.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage.

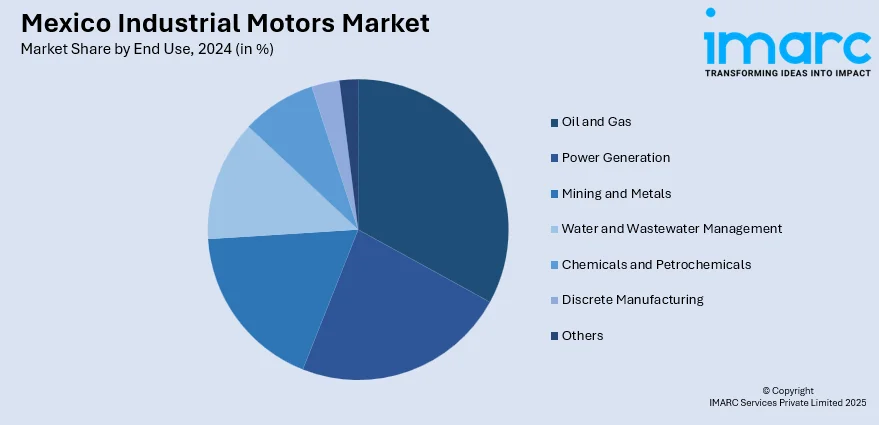

End Use Insights:

- Oil and Gas

- Power Generation

- Mining and Metals

- Water and Wastewater Management

- Chemicals and Petrochemicals

- Discrete Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes oil and gas, power generation, mining and metals, water and wastewater management, chemicals and petrochemicals, discrete manufacturing, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Motors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Motor Covered | Alternating Current (AC) Motors, Direct Current (DC) Motors, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Uses Covered | Oil and Gas, Power Generation, Mining and Metals, Water and Wastewater Management, Chemicals and Petrochemicals, Discrete Manufacturing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial motors market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial motors market on the basis of type of motor?

- What is the breakup of the Mexico industrial motors market on the basis of voltage?

- What is the breakup of the Mexico industrial motors market on the basis of end use?

- What is the breakup of the Mexico industrial motors market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial motors market?

- What are the key driving factors and challenges in the Mexico industrial motors market?

- What is the structure of the Mexico industrial motors market and who are the key players?

- What is the degree of competition in the Mexico industrial motors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial motors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial motors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)