Mexico Industrial Ovens and Furnaces Market Size, Share, Trends and Forecast by Product, Power Type, Application, and Region, 2025-2033

Mexico Industrial Ovens and Furnaces Market Overview:

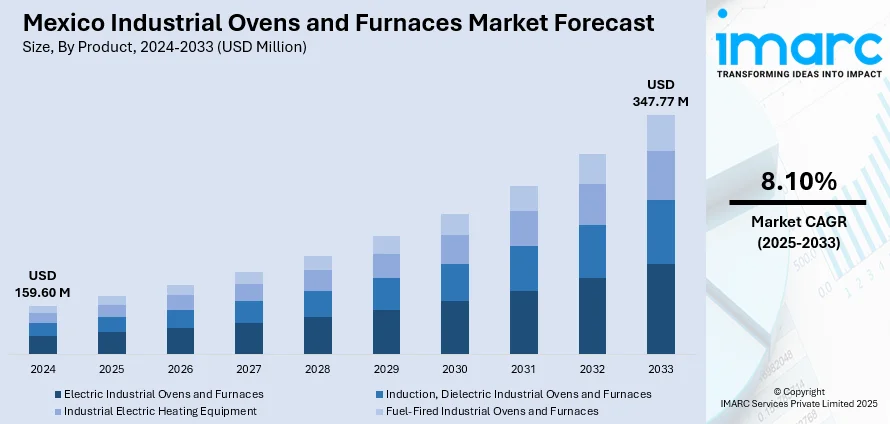

The Mexico industrial ovens and furnaces market size reached USD 159.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 347.77 Million by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. The market is expanding steadily, driven by the growth of manufacturing, automotive, and food processing industries. Increasing foreign investment and modernization of industrial infrastructure supporting advanced thermal processing needs, along with the rising demand for energy-efficient solutions are further contributing to the evolving landscape of the Mexico industrial ovens and furnaces market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 159.60 Million |

| Market Forecast in 2033 | USD 347.77 Million |

| Market Growth Rate 2025-2033 | 8.10% |

Mexico Industrial Ovens and Furnaces Market Trends:

Rising Demand for Energy-Efficient and Electrically Powered Equipment

Energy efficiency is becoming a top priority for Mexican industries due to rising energy costs and environmental regulations. This shift is driving the adoption of electric-powered industrial ovens and furnaces, which offer better energy control, lower emissions, and reduced operational costs compared to fossil-fuel-based systems. Manufacturers are increasingly replacing older, inefficient equipment with modern, eco-friendly alternatives that comply with international sustainability standards. Integrating advanced IoT technologies helps optimize energy and manage different processes. These innovations not only reduce carbon footprints but also improve productivity, making energy-efficient systems a strategic investment for companies aiming to stay competitive in a greener industrial landscape.

Expansion of the Metal and Steel Processing Industry

Mexico’s metal and steel industry is growing at a reliable rate due to increased construction, infrastructure projects and manufacturing needs. Processes such as forging, melting, sintering and heat treatment of metals rely on furnaces in industry. As domestic and export-oriented production increases, so does the need for high-capacity, reliable thermal processing equipment. The rise in demand for specialty steels and alloys in sectors like construction, automotive, and defense further fuels the need for advanced furnace technologies. Additionally, government-backed infrastructure projects and private sector investments are creating a favorable environment for the expansion of metal processing facilities, acting as a major factor driving the Mexico industrial ovens and furnaces market growth.

Technological Advancements and Automation Integration

Technological innovation is transforming the industrial ovens and furnaces market in Mexico. The integration of automation, AI, and smart control systems is enhancing operational efficiency, safety, and precision in thermal processing. These improvements enable immediate observation, foresight in maintenance, and decisions based on data, reducing downtime and improving product quality. As industries move toward Industry 4.0 standards, the demand for intelligent, interconnected equipment is rising. Additionally, innovations in materials and design, such as modular and compact furnace systems, are making installations more flexible and cost-effective. This technological evolution is not only modernizing existing facilities but also encouraging new investments in state-of-the-art thermal processing infrastructure.

Mexico Industrial Ovens and Furnaces Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, power type, and application.

Product Insights:

- Electric Industrial Ovens and Furnaces

- Induction, Dielectric Industrial Ovens and Furnaces

- Industrial Electric Heating Equipment

- Fuel-Fired Industrial Ovens and Furnaces

The report has provided a detailed breakup and analysis of the market based on the product. This includes electric industrial ovens and furnaces; induction, dielectric industrial ovens and furnaces; industrial electric heating equipment; and fuel-fired industrial ovens and furnaces.

Power Type Insights:

- Combustion Type

- Electric Type

The report has provided a detailed breakup and analysis of the market based on the power type. This includes combustion type and electric type.

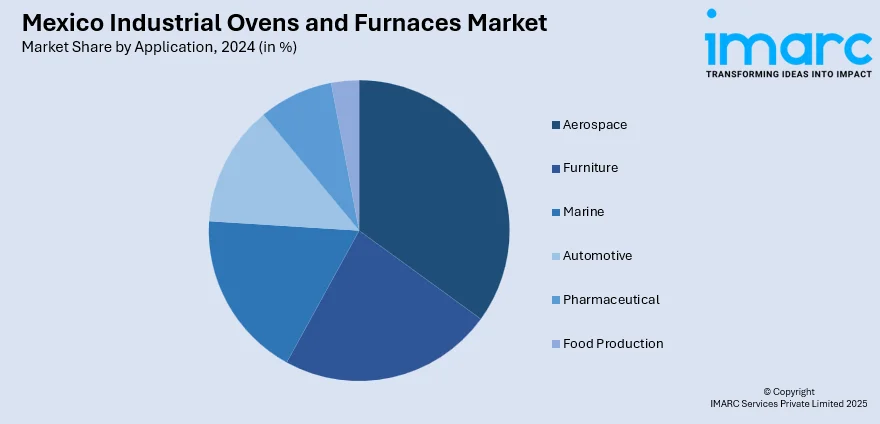

Application Insights:

- Aerospace

- Furniture

- Marine

- Automotive

- Pharmaceutical

- Food Production

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aerospace, furniture, marine, automotive, pharmaceutical, and food production.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Ovens and Furnaces Market News:

- In January 2023, Saverglass, a French container glass maker, opened its second furnace in Mexico. Furnace number thirteen was inaugurated last weekend at its Acatlan site in Jalisco state, Mexico. The ceremony, which was attended by Saverglass President Jean Marc Arrambourg, group CEO Loic de Gromard, and employees, marked the company's second furnace launch at the location.

Mexico Industrial Ovens and Furnaces Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electric Industrial Ovens and Furnaces, Induction, Dielectric Industrial Ovens and Furnaces, Industrial Electric Heating Equipment, Fuel-Fired Industrial Ovens and Furnaces |

| Power Types Covered | Combustion Type, Electric Type |

| Applications Covered | Aerospace, Furniture, Marine, Automotive, Pharmaceutical, Food Production |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial ovens and furnaces market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial ovens and furnaces market on the basis of product?

- What is the breakup of the Mexico industrial ovens and furnaces market on the basis of power type?

- What is the breakup of the Mexico industrial ovens and furnaces market on the basis of application?

- What is the breakup of the Mexico industrial ovens and furnaces market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial ovens and furnaces market?

- What are the key driving factors and challenges in the Mexico industrial ovens and furnaces market?

- What is the structure of the Mexico industrial ovens and furnaces market and who are the key players?

- What is the degree of competition in the Mexico industrial ovens and furnaces market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial ovens and furnaces market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial ovens and furnaces market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial ovens and furnaces industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)