Mexico Industrial Packaging Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

Mexico Industrial Packaging Market Overview:

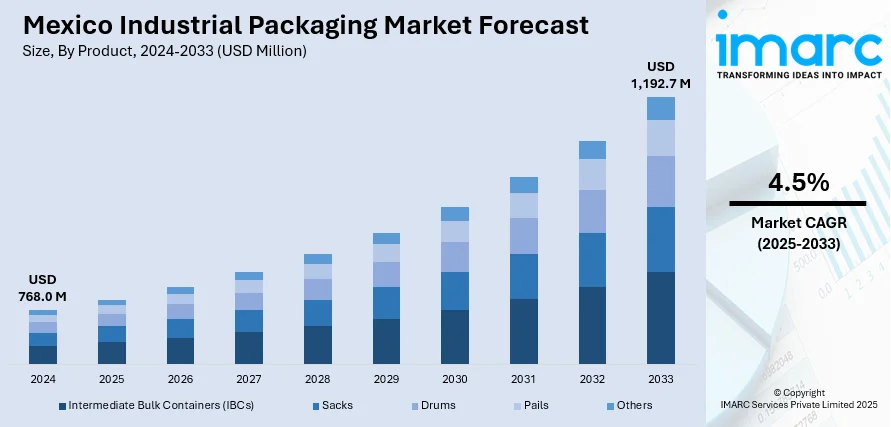

The Mexico industrial packaging market size reached USD 768.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,192.7 Million by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. Nearshoring-led manufacturing expansion, demand from automotive and electronics sectors, infrastructure development in logistics corridors, export compliance needs, growth of cold chain capacity, rise in perishable goods exports, increased demand for thermal-insulated packaging, integration of tracking technologies, and climate-resilient packaging innovations are some of the factors positively impacting the Mexico industrial packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 768.0 Million |

| Market Forecast in 2033 | USD 1,192.7 Million |

| Market Growth Rate 2025-2033 | 4.5% |

Mexico Industrial Packaging Market Trends:

Nearshoring Trends and Expansion of Automotive and Electronics Manufacturing

Mexico’s industrial packaging market is being significantly influenced by the widespread adoption of nearshoring strategies by multinational corporations. The industrial packaging sector has experienced heightened activity as a result, especially in supporting high-value, precision-driven industries such as automotive and electronics. These sectors demand a diverse array of packaging solutions, including anti-static containers, shock-absorbent packaging, and thermally insulated materials, and these requirements have increased competition among packaging manufacturers, resulting in innovation and customization that reflect positive Mexico industrial packaging market trends across packaging formats suited for high-tech applications. On November 7, 2024, ISE Labs, a semiconductor engineering services provider, announced the acquisition of land in the Axis 2 Industrial Park in Tonalá, near Guadalajara, Mexico, to build a semiconductor packaging and testing facility. This expansion is aimed at increasing ASE's global footprint and strengthening its presence in North America, with plans to create over 500 jobs in its first year of operation. The project will also foster collaboration with local educational institutions to develop a skilled workforce for the semiconductor industry in Jalisco, which currently holds 70% of Mexico’s semiconductor market. In addition, regional logistics hubs across northern Mexico are experiencing rapid infrastructure development to facilitate manufacturing exports. The emphasis on quality assurance and compliance with U.S. import regulations is driving upgrades in industrial packaging standards, creating strong traction among packaging providers capable of certifying and tailoring solutions for end-use compatibility. As a result, industry stakeholders are investing in equipment automation and quality control systems to keep pace with the technical requirements of international clients. This sectoral shift has laid the groundwork for sustained Mexico industrial packaging market growth through strategic collaborations between packaging manufacturers and industrial clients seeking integrated supply chain solutions that reduce waste, improve efficiency, and maintain performance integrity across transit and storage phases.

To get more information of this market, Request Sample

Development of Cold Chain Logistics and Perishable Goods Exports

The expansion of cold chain infrastructure across Mexico has emerged as a major driver of demand in the industrial packaging market. As the country strengthens its capabilities in temperature-sensitive logistics, particularly for exports of avocados, berries, seafood, and biopharmaceuticals, there is increasing need for specialized packaging that can maintain product integrity under controlled conditions. The complexity of handling perishable goods has led to close integration between packaging design and logistics planning. The heightened sensitivity of cold chain commodities to temperature excursions has stimulated investment in performance packaging solutions, reinforcing the positive Mexico industrial packaging market outlook for companies operating at the intersection of food, pharma, and industrial logistics. Another contributing factor is the increase in traceability requirements across supply chains, driven by both domestic regulators and foreign buyers. This shift is pushing demand for intelligent packaging formats equipped with sensors, RFID tags, and QR-based verification tools, especially for high-risk or compliance-heavy commodities. Consequently, a growing number of industrial packaging firms are working with logistics providers to develop smart packaging ecosystems that reduce spoilage, support automation, and meet sustainability thresholds. On March 24, 2025, Nefab Group announced the opening of a new 58,000-square-foot facility in Zapopan, Mexico, doubling its packaging production capacity. The plant will focus on sustainable plastic packaging for industries like automotive and electronics, producing recyclable trays and cushioning solutions. This expansion supports Nefab’s sustainability goals and enhances its ability to serve the growing Mexican market, improving supply chain efficiency. These converging requirements are contributing to a measurable rise in Mexico industrial packaging market demand for multifunctional, temperature-stable, and technology-enabled packaging systems across Mexico’s evolving cold chain and perishables economy.

Mexico Industrial Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, and application.

Product Insights:

- Intermediate Bulk Containers (IBCs)

- Sacks

- Drums

- Pails

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes intermediate bulk containers (IBCs), sacks, drums, pails, and others.

Material Insights:

- Paperboard

- Plastic

- Metal

- Wood

- Fiber

The report has provided a detailed breakup and analysis of the market based on the material. This includes paperboard, plastic, metal, wood, and fiber.

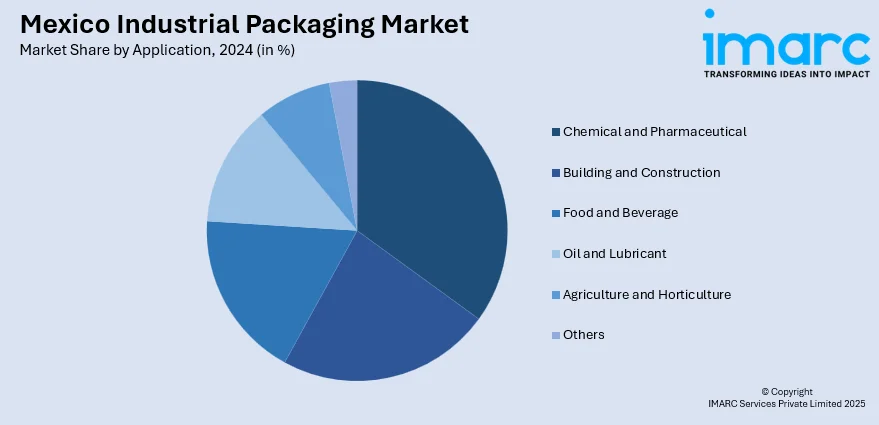

Application Insights:

- Chemical and Pharmaceutical

- Building and Construction

- Food and Beverage

- Oil and Lubricant

- Agriculture and Horticulture

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes chemical and pharmaceutical, building and construction, food and beverage, oil and lubricant, agriculture and horticulture, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Packaging Market News:

- On April 10, 2025, Paragon Films, a US-based stretch films maker, announced the expansion of its manufacturing operations into San Luis Potosí, Mexico, with the installation of Windmöller & Hölscher (W&H) equipment. The new facility will enhance Paragon's production capabilities and service Mexico, Central America, and South America, supporting its growth in the North American market. The facility, expected to be operational by December 2025, will also contribute to local employment and sustainability efforts.

Mexico Industrial Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Intermediate Bulk Containers (IBCs), Sacks, Drums, Pails, Others |

| Materials Covered | Paperboard, Plastic, Metal, Wood, Fiber |

| Applications Covered | Chemical and Pharmaceutical, Building and Construction, Food and Beverage, Oil and Lubricant, Agriculture and Horticulture, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial packaging market on the basis of product?

- What is the breakup of the Mexico industrial packaging market on the basis of material?

- What is the breakup of the Mexico industrial packaging market on the basis of application?

- What is the breakup of the Mexico industrial packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial packaging market?

- What are the key driving factors and challenges in the Mexico industrial packaging market?

- What is the structure of the Mexico industrial packaging market and who are the key players?

- What is the degree of competition in the Mexico industrial packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)