Mexico Industrial Paints & Coatings Market Size, Share, Trends and Forecast by Product Type, Type, Application, End User, and Region, 2025-2033

Mexico Industrial Paints & Coatings Market Overview:

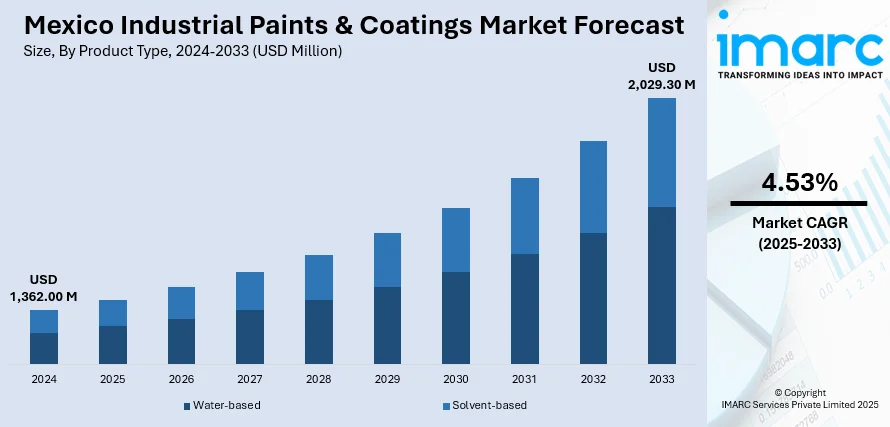

The Mexico industrial paints & coatings market size reached USD 1,362.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,029.30 Million by 2033, exhibiting a growth rate (CAGR) of 4.53% during 2025-2033. The market is fueled by the growing construction sector, owing to fast urbanization and rising public income levels. Automotive manufacturing growth, specifically in electrical vehicles, has necessitated highly specialized coatings with a view toward endurance and esthetic appeal. A focus on environmental sustainability, along with preference for environmentally friendly, low VOC, and aqueous coatings having lower environmental concerns, has also added another dimension of need. Modern advancements have allowed functional coatings based on insulation values as well as antimicrobial efficacy to gain popularity while increasing the Mexico industrial paints & coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,362.00 Million |

| Market Forecast in 2033 | USD 2,029.30 Million |

| Market Growth Rate 2025-2033 | 4.53% |

Mexico Industrial Paints & Coatings Market Trends:

Growth in Construction and Infrastructure Development

Mexico's rapid urbanization and rising public income levels have hugely increased construction activity throughout the nation. The construction industry, as a pillar of Mexico's economy, earned tremendous revenue in recent years, showcasing strong growth. According to the IMARC Group, the Mexico architectural, engineering, and construction (AEC) market size reached USD 124.8 Million in 2024, and is further expected to reach USD 284.8 Million by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. This upsurge is especially seen in the hospitality industry, with big global hotel groups actively increasing their footprint, underpinned by Mexico's status as a top tourist destination in Latin America. The arrival of foreign tourists has also boosted demand for construction paints and protective coatings across different uses. Moreover, the government's emphasis on urban renewal schemes and infrastructure development has resulted in higher investments in residential and commercial construction, further fueling the demand for industrial paints and coatings. These trends highlight the pivotal role of the construction sector in determining the Mexico industrial paints & coatings market growth and development.

Transition Toward Sustainable and Eco-Friendly Coatings

Environmental sustainability has emerged as an important priority in Mexico's industrial paint and coating industry. Companies are increasingly formulating bio-based industrial coatings with outstanding protective properties with reduced environmental footprint. The trend is most noticeable in the architectural coating sector, where waterborne paint and low-VOC products are becoming more prominent. Implementation of green building norms and other incentives has provided an important boost to the development of waterborne coatings in Mexico. Recently, In April 2025, Arkema, AkzoNobel, and Omya teamed up to create a series of low-carbon alternatives for more eco-friendly decorative paints with at least a 30% lower carbon footprint (1) aimed at mass market use while ensuring performance comparable to current products. This initiative seeks to enhance experiments and attain a carbon reduction of up to 50% for decorative paints. Hence, awareness in consumers and corporate entities regarding environmental concerns related to conventional coatings has resulted in increasing demand for environmental-friendly alternatives. These trends mark a wider push in the industry towards aligning with international standards of sustainability as well as changing consumer preferences regarding environmentally friendly goods.

Technological Developments in Coating Solutions

Technological advancements are contributing significantly to the growth of Mexico's industrial paint and coatings industry. The advancement of functional coatings, including insulative paints for keeping indoor temperatures stable and antimicrobial coatings that provide additional protection in healthcare applications, is emerging. These technological developments not only improve the functionality and longevity of coatings but also address particular industry requirements and uses. In addition, the sector's landscape is being redefined through strategic investments and capacity additions by leading market participants. Firms are enhancing their presence through capacity additions and technological improvements to respond to changing market needs. Examples include investments in manufacturing capacity and the extension of operations to service increasing demand across different end-user segments as reflecting the sector's focus on innovation and responsiveness to market needs.

Mexico Industrial Paints & Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, type, application, and end user.

Product Type Insights:

- Water-based

- Solvent-based

The report has provided a detailed breakup and analysis of the market based on the product type. This includes water-based and solvent-based.

Type Insights:

- Automotive and Refinish Coating

- Protective Coating

- Powder Coating

- General Industrial Coating

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes automotive and refinish coating, protective coating, powder coating, general industrial coating, and others.

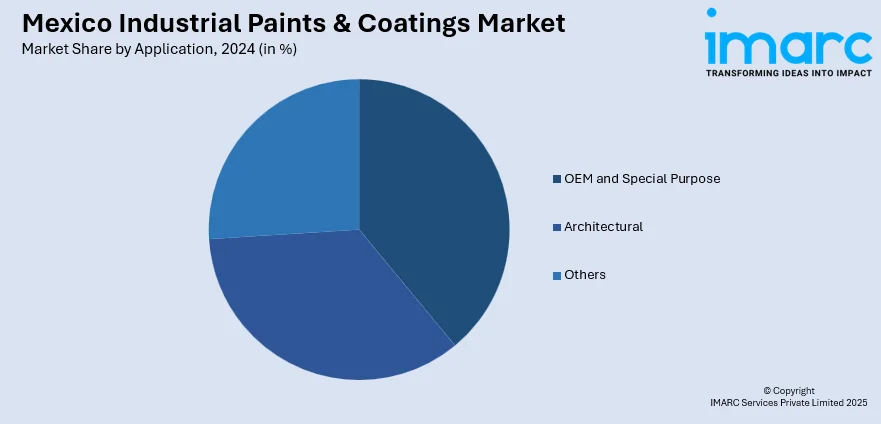

Application Insights:

- OEM and Special Purpose

- Architectural

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes OEM and special purpose, architectural, and others.

End User Insights:

- Automotive

- Marine

- General Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, marine, general industries, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Paints & Coatings Market News:

- In March 2024, WEG allocated R$100 million ($20 million) toward a new industrial liquid paint manufacturing plant in Mexico. The building of the new facility will increase WEG Coatings' existing production capabilities and will cater to the North and Central American market. The new facility will encompass around 5,300m² (57,000 ft²) of constructed space and is anticipated to commence operations in early 2026.

Mexico Industrial Paints & Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Water-based, Solvent-based |

| Types Covered | Automotive and Refinish Coating, Protective Coating, Powder Coating, General Industrial Coating, Others |

| Applications Covered | OEM and Special Purpose, Architectural, Others |

| End Users Covered | Automotive, Marine, General Industries, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial paints & coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial paints & coatings market on the basis of product type?

- What is the breakup of the Mexico industrial paints & coatings market on the basis of type?

- What is the breakup of the Mexico industrial paints & coatings market on the basis of application?

- What is the breakup of the Mexico industrial paints & coatings market on the basis of end user?

- What is the breakup of the Mexico industrial paints & coatings market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial paints & coatings market?

- What are the key driving factors and challenges in the Mexico industrial paints & coatings market?

- What is the structure of the Mexico industrial paints & coatings market and who are the key players?

- What is the degree of competition in the Mexico industrial paints & coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial paints & coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial paints & coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial paints & coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)