Mexico Industrial Pumps Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2025-2033

Mexico Industrial Pumps Market Overview:

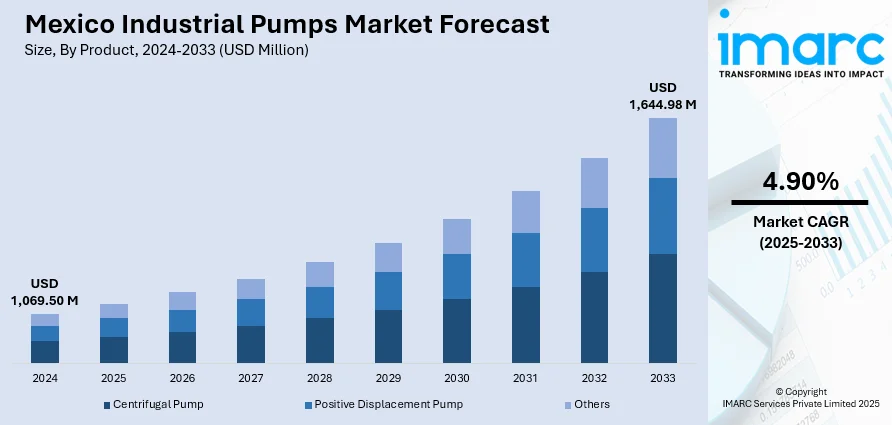

The Mexico industrial pumps market size reached USD 1,069.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,644.98 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. Rising manufacturing output, expansion in mining and oil and gas activities, and increased government spending on water and wastewater infrastructure are propelling the market growth. Additionally, industrial automation and process optimization, growth in the chemical and petrochemical industries, and expanding food and beverage (F&B) sector are supporting the market growth. Furthermore, energy efficiency regulations, rapid urban development, smart pump technology adoption, replacement of outdated equipment, surging private infrastructure investments, and stricter environmental compliance laws are factors boosting the Mexico industrial pumps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,069.50 Million |

| Market Forecast in 2033 | USD 1,644.98 Million |

| Market Growth Rate 2025-2033 | 4.90% |

Mexico Industrial Pumps Market Trends:

Growing Manufacturing Sector

Mexico’s growing manufacturing industry is a major factor boosting the demand for industrial pumps. The country has become a global manufacturing hub, especially in sectors like automotive, aerospace, electronics, and packaging. These industries rely on pumps for cooling systems, fluid transfer, hydraulic operations, and process control. Mexico is currently the seventh-largest car producer in the world and the fourth-largest exporter of auto parts, with manufacturing output contributing around 18% to its gross domestic product (GDP). Industrial pumps are essential to maintain productivity and ensure efficiency in assembly lines, chemical processing, and heat exchange systems. As companies continue to invest in new plants and expand existing ones, demand for durable and energy-efficient pumping systems is rising. Government efforts to attract foreign direct investment through trade agreements and incentives are also encouraging plant setup and upgrades, further driving the Mexico industrial pumps market growth.

Expansion of Mining and Oil & Gas Projects

Oil and gas and mining are Mexico's conventional stalwarts of industry, and the recent expansion in the two sectors is fueling the demand for high-performance pump. Mexico is among the globe's top ten silver, zinc, and copper producers. All of these minerals require high fluid handling for chemical processing, tailings management, and mining. Additionally, the government has approved umpteen mining ventures, indicating future strong activity, which is fostering the market growth. In the oil and gas sector, state-owned Pemex and private enterprises are investing in offshore and shale reserves, and industrial pumps for injection, refining, drilling, and transportation. Pemex plans to reopen over 10,000 closed wells to boost declining production, aiming to address low pressure and water intrusion issues that require specialized equipment. The pumps used in these applications must be corrosion-resistant and built to withstand abrasive material at high pressure and temperature, which is another growth-inducing factor.

Water and Wastewater Infrastructure Development

Rapid urbanization and growing industrial activity in Mexico are putting pressure on water supply and wastewater systems, creating a strong need for industrial pumps. Many municipalities are upgrading treatment plants and pipeline networks to meet rising consumption and environmental standards. Mexico's aging and underperforming wastewater pipes need urgent attention, with over 30% of treated water lost due to leaks and inefficiencies. According to Mexico Business News (2024), the country requires an estimated USD 2.5 billion (MX$ 42 billion) investment to modernize its water infrastructure and improve wastewater treatment coverage across key regions. This opens up opportunities for installing high-capacity sewage, submersible, and centrifugal pumps. Moreover, new projects under the National Water Program aim to improve access to clean water and upgrade existing systems across cities and rural areas. In industrial zones, factories are adopting closed-loop water systems and advanced treatment methods that depend on chemical dosing and precision pumps. Government regulations related to wastewater discharge are also pushing industries to invest in modern pump systems for compliance and environmental protection.

Mexico Industrial Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, distribution channel, and application.

Product Insights:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating

- Rotary

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes centrifugal pump (axial flow pump, radial flow pump, and mixed flow pump), positive displacement pump (reciprocating, rotary, and others), and others.

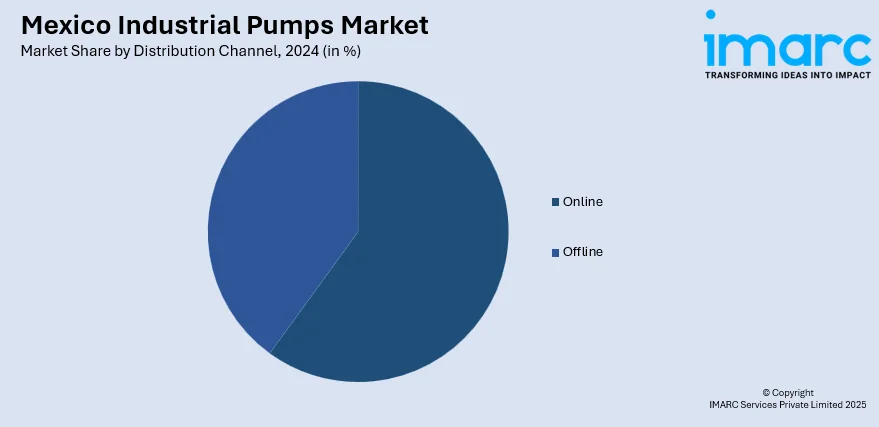

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Application Insights:

- Oil and Gas

- Chemicals

- Construction

- Power Generation

- Water and Wastewater

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas, chemicals, construction, power generation, water and wastewater, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Pumps Market News:

- In 2024, Odessa Pumps partnered with Boerger, LLC to distribute Boerger's rotary lobe pumps and macerating technology. The collaboration aims to expand Odessa Pumps’ product portfolio and enhance its market presence in Mexico’s industrial pump sector.

- In 2024, Ingersoll Rand acquired UT Pumps & Systems Private Limited, an Indian manufacturer of high-pressure pumps. The acquisition expands Ingersoll Rand’s product offerings across water, wastewater, food and beverage, pharmaceuticals, general industrial, and chemical sectors, supporting growth in markets including Mexico.

Mexico Industrial Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Oil and Gas, Chemicals, Construction, Power Generation, Water and Wastewater, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial pumps market on the basis of product?

- What is the breakup of the Mexico industrial pumps market on the basis of distribution channel?

- What is the breakup of the Mexico industrial pumps market on the basis of application?

- What is the breakup of the Mexico industrial pumps market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial pumps market?

- What are the key driving factors and challenges in the Mexico industrial pumps?

- What is the structure of the Mexico industrial pumps market and who are the key players?

- What is the degree of competition in the Mexico industrial pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)