Mexico Industrial Pumps and Valves Market Size, Share, Trends and Forecast by Product Type, Position, Driving Force, End Use, and Region, 2025-2033

Mexico Industrial Pumps and Valves Market Overview:

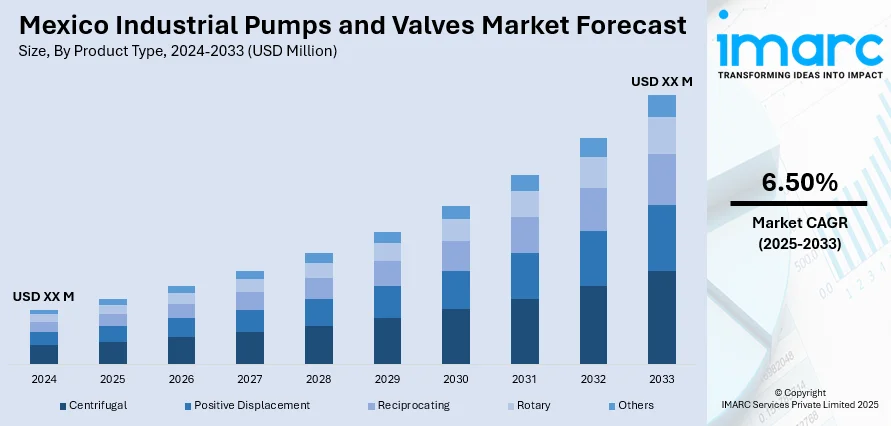

The Mexico industrial pumps and valves market size is projected to exhibit a growth rate (CAGR) of 6.50% during 2025-2033. The market is spurred by huge investments in oil, gas, and petrochemical infrastructure, as well as increasing demand for water treatment and distribution networks. The massive growth in the manufacturing and automotive sectors is also driving demand for next-generation industrial pumps and valves. These driving forces prompt the use of energy-efficient and smart fluid handling solutions to improve operational efficiency and sustainability. All these dynamics are major players in the growing Mexico industrial pumps and valves market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 6.50% |

Mexico Industrial Pumps and Valves Market Trends:

Growth of Oil, Gas and Petrochemical Infrastructure

Mexico's continued emphasis on developing and enhancing its oil, gas and petrochemical industries is fueling high demand for industrial pumps and valves. These products are essential in managing fluids during extraction, refining, and transport activities and they are responsible for ensuring operational efficiency and safety. Sophisticated pumps are employed in injection and pipeline transportation uses, while accurately engineered valves control pressure, temperature, and flow throughout facilities. The nation's energy policy, designed to enhance capacity for refining and enhance energy security, requires strong fluid controls able to function in severe environments, such as offshore platforms. High corrosion resistance and high-pressure endurance become more significant attributes. This infrastructure development enables the energy sector modernization and improves environmental regulation. All these considerations drive Mexico industrial pumps and valves growth, demonstrating the need for advanced fluid handling systems to strengthen the country's energy profile.

To get more information on this market, Request Sample

Increased Demand from Water Treatment and Distribution Projects

Water shortages and growth in urban populations have driven significant investments in Mexico's water treatment and distribution systems. Consequently, the industrial pumps and valves industry is witnessing growing demand to aid municipal and industrial water infrastructure. As per the reports, in June 2023, Bosch Rexroth inaugurated a $174 million factory in Querétaro, Mexico, increasing North America's mobile machinery and factory automation markets' production of hydraulic pumps, motors, valves, and linear motion technology. Furthermore, efficient pumps are utilized in desalination, purification, and sewage treatment plants for dependable movement of water and minimizing energy usage. At the same time, intelligent valve systems with actuators and sensors facilitate precise flow and pressure control, enhancing leak detection and system integrity. These technologies assist in maximizing water use and promoting sustainability in urban and agricultural industries. The use of automated control systems in water management projects is part of a wider movement toward digitalization and conservation of resources. Private and public collaborations for the modernization of water infrastructure are major drivers of Mexico industrial pumps and valves growth, highlighting the sector's strategic importance in meeting the country's water needs.

Industrialization of the Manufacturing and Automotive Industries

Mexico's manufacturing and automotive industries' growth is driving rising demand for advanced industrial pumps and valves. Foreign direct investment and nearshoring trends have spurred industrial production, requiring stable fluid handling solutions within factories and assembly plants. According to the sources, in February 2024, Ameriflo opened Ameriflo LATAM, dedicated to offering in-country sales and engineering support in Mexico for UL/FM fire protection and industrial pumps, further enhancing local market reach amidst increased demand. Moreover, industrial pumps find widespread application in cooling, lubrication, and hydraulic systems, whereas valves control the flow and pressure of fluids essential to the manufacturing process. Automated manufacturing lines are increasingly employing valve systems with onboard sensors for real-time feedback and greater operational effectiveness. Pressure to minimize downtime and refine precision has resulted in the implementation of high-performance pumps, including multi-stage centrifugal and rotary pumps, that facilitate continuous manufacturing operations. Upgrades to infrastructure supporting industrial expansion also create demand for rugged fluid control components. These forces are important drivers of Mexico industrial pumps and valves market growth, solidifying the nation's reputation as a top regional manufacturing center.

Mexico Industrial Pumps and Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, position, driving force, and end use.

Product Type Insights:

- Centrifugal

- Positive Displacement

- Reciprocating

- Rotary

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes centrifugal, positive displacement, reciprocating, rotary, others.

Position Insights:

- Submersible

- Non-Submersible

A detailed breakup and analysis of the market based on the position have also been provided in the report. This includes submersible and non-submersible.

Driving Force Insights:

- Engine Driven

- Electrical Driven

The report has provided a detailed breakup and analysis of the market based on the driving force. This includes engine driven and electrical driven.

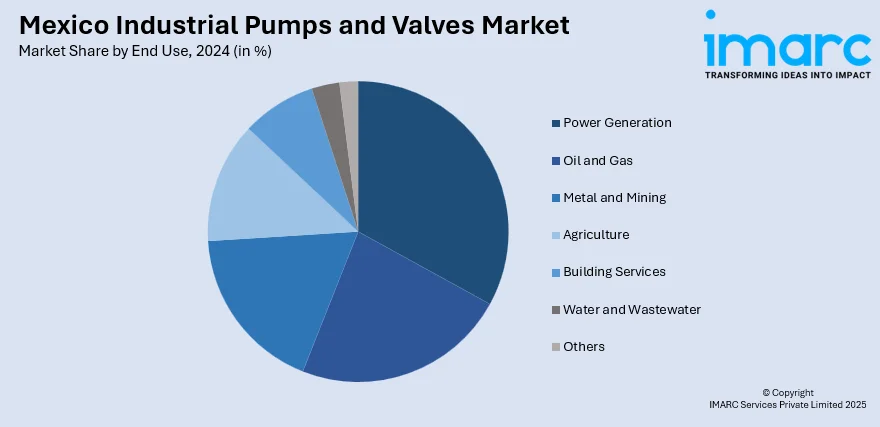

End Use Insights:

- Power Generation

- Oil and Gas

- Metal and Mining

- Agriculture

- Building Services

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes power generation, oil and gas, metal and mining, agriculture, building services, water and wastewater, others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Pumps and Valves Market News:

-

In March 2024, a new high-efficiency pump test and assembly facility in Mexico City was inaugurated by Sulzer, increasing production capacity with cutting-edge hydraulics testing to respond to increasing infrastructure demand across the Americas. The expansion reflects Sulzer's focus on innovation, efficiency and exceptional customer service.

Mexico Industrial Pumps and Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Centrifugal, Positive Displacement, Reciprocating, Rotary, Others |

| Positions Covered | Submersible, Non-Submersible |

| Driving Forces Covered | Engine Driven, Electrical Driven |

| End Uses Covered | Power Generation, Oil and Gas, Metal And Mining, Agriculture, Building Services, Water and Wastewater, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial pumps and valves market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial pumps and valves market on the basis of product type?

- What is the breakup of the Mexico industrial pumps and valves market on the basis of position?

- What is the breakup of the Mexico industrial pumps and valves market on the basis of driving force?

- What is the breakup of the Mexico industrial pumps and valves market on the basis of end use?

- What is the breakup of the Mexico industrial pumps and valves market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial pumps and valves market?

- What are the key driving factors and challenges in the Mexico industrial pumps and valves?

- What is the structure of the Mexico industrial pumps and valves market and who are the key players?

- What is the degree of competition in the Mexico industrial pumps and valves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial pumps and valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial pumps and valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial pumps and valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)