Mexico Industrial Robotics Software Market Size, Share, Trends and Forecast by Type of Software, Deployment Model, Functionality, Application, End User Industry, and Region, 2025-2033

Mexico Industrial Robotics Software Market Overview:

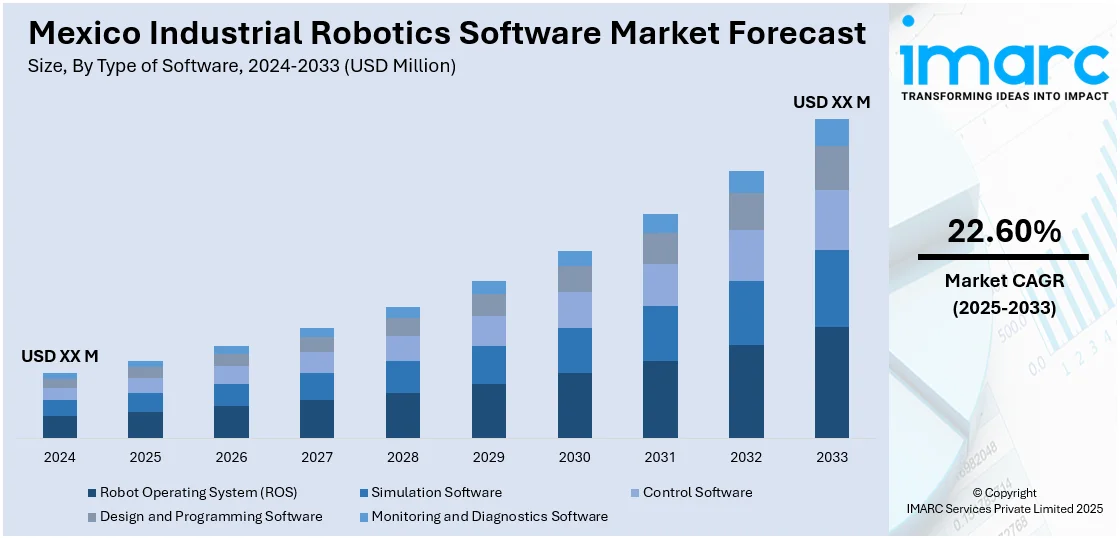

The Mexico industrial robotics software market size is projected to exhibit a growth rate (CAGR) of 22.60% during 2025-2033. The market is driven by increasing demand for automation in manufacturing. Also, government incentives and Industry 4.0 integration are fueling the product adoption. Additionally, the growing need for improved productivity and operational efficiency in sectors like automotive and electronics, the ongoing push towards digital transformation and the integration of smart manufacturing systems are positively impacting the market. Technological advancements, the drive for enhanced manufacturing capabilities, and government policies are expanding the Mexico industrial robotics software market share further.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 22.60% |

Mexico Industrial Robotics Software Market Trends:

Increasing Demand for Automation in Manufacturing

The increasing need for automation in Mexico's manufacturing industry is a key driver of the market. With increased global competition, Mexican manufacturers are increasingly turning to robotics systems to improve efficiency, accuracy, and production speed and lower operational costs. Nauticus Robotics, a leading provider of autonomous subsea robotics and software, successfully completed its first 2024 Gulf of Mexico survey for Shell on November 5, 2024, autonomously performing subsea work untethered at depths of up to 1,000 meters. This project covered both active and inactive assets off the Louisiana coast, and that marks a significant step in the company's transformation towards sustainable, commercial operations. Mexico's strategic position as a manufacturing hub for industries such as automotive, electronics, and aerospace further accelerates the need for automation. The demand for robots in Mexico is majorly propelled by the automotive sector, which accounts for 70% of the market: Robotics software is integral to streamlining operations, improving production workflows, and ensuring quality control across these industries. Additionally, automation helps to address labor shortages and skills gaps by automating repetitive tasks, thus allowing workers to focus on higher-value activities. As manufacturers aim to meet the rising demand for high-quality, cost-effective products, the role of industrial robotics software becomes essential. The need for reliable, scalable solutions that integrate with existing infrastructure is propelling the Mexico industrial robotics software market growth, as companies seek to stay competitive in the global marketplace.

Government Incentives and Industry 4.0 Integration

The Mexican government's support for Industry 4.0 technologies is another crucial factor fueling the industrial robotics software market. Through initiatives such as tax incentives, grants, and policy frameworks, Mexico is encouraging the adoption of advanced technologies like robotics, artificial intelligence, and automation in its industrial sectors. The government has also focused on aligning its manufacturing industry with global Industry 4.0 standards, which emphasize the integration of cyber-physical systems, IoT, and data analytics. This strategic approach is facilitating the transition of Mexico's manufacturing sector to smarter, more automated production processes. As Mexico looks to enhance its industrial competitiveness and diversify its economy, the adoption of robotics and automation technologies becomes increasingly important. Moreover, these advancements contribute to improving productivity, sustainability, and safety in industrial operations. With continued government support for these technologies, the industrial robotics software market in Mexico is positioned to expand significantly in the coming years. On October 10, 2024, Symbotic announced a commercial agreement with Walmart de México y Centroamérica (Walmex) to implement advanced warehouse automation systems at two distribution centers near Mexico City. The deployment, which includes Symbotic’s robotic case picking systems, is set to enhance productivity, capacity, and worker safety, significantly improving Walmex's supply chain operations. This agreement marks a key milestone in Symbotic’s strategic international expansion in Mexico.

Mexico Industrial Robotics Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of software, deployment model, functionality, application, and end user industry.

Type of Software Insights:

- Robot Operating System (ROS)

- Simulation Software

- Control Software

- Design and Programming Software

- Monitoring and Diagnostics Software

The report has provided a detailed breakup and analysis of the market based on the type of software. This includes Robot Operating System (ROS), simulation software, control software, design and programming software, and monitoring and diagnostics software.

Deployment Model Insights:

- On-Premises Solutions

- Cloud-Based Solutions

- Hybrid Solutions

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes on-premises solutions, cloud-based solutions, and hybrid solutions.

Functionality Insights:

- Robot Programming and Development

- Path Planning and Navigation

- Collaborative Robots (Cobots) Software

- Machine Learning and AI Integration

- Safety and Compliance Features

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes robot programming and development, path planning and navigation, collaborative robots (cobots) software, machine learning and AI integration, and safety and compliance features.

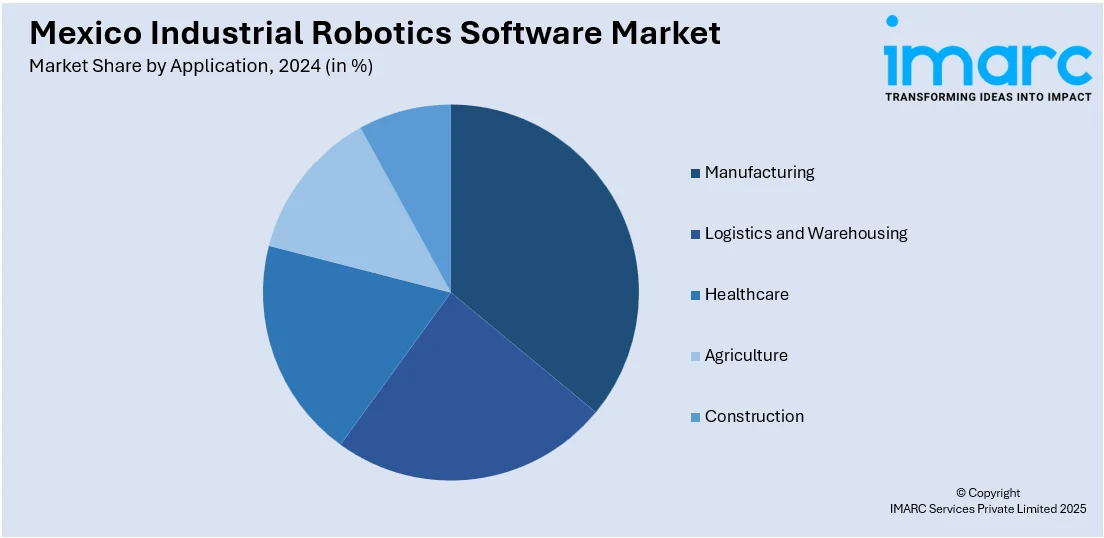

Application Insights:

- Manufacturing

- Logistics and Warehousing

- Healthcare

- Agriculture

- Construction

The report has provided a detailed breakup and analysis of the market based on the application. This includes manufacturing, logistics and warehousing, healthcare, agriculture, and construction.

End User Industry Insights:

- Aerospace and Defense

- Automotive

- Electronics

- Food and Beverage

- Pharmaceuticals

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes aerospace and defense, automotive, electronics, food and beverage, and pharmaceuticals.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Robotics Software Market News:

- On April 29, 2025, Huayan Robotics announced its official debut at FABTECH Mexico 2025, taking place from May 6–8 in Monterrey, Mexico. The company will showcase its innovative robotics solutions, including the Elfin and Elfin-Pro collaborative robots, as well as the S-Heavy Payload Robots, designed to enhance efficiency and flexibility in manufacturing environments.

Mexico Industrial Robotics Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Software Covered | Robot Operating System (ROS), Simulation Software, Control Software, Design and Programming Software, Monitoring and Diagnostics Software |

| Deployment Models Covered | On-Premises Solutions, Cloud-Based Solutions, Hybrid Solutions |

| Functionalities Covered | Robot Programming and Development, Path Planning and Navigation, Collaborative Robots (Cobots) Software, Machine Learning and AI Integration, Safety and Compliance Features |

| Applications Covered | Manufacturing, Logistics and Warehousing, Healthcare, Agriculture, Construction |

| End User Industries Covered | Aerospace and Defense, Automotive, Electronics, Food and Beverage, Pharmaceuticals |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial robotics software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial robotics software market on the basis of type of software?

- What is the breakup of the Mexico industrial robotics software market on the basis of deployment model?

- What is the breakup of the Mexico industrial robotics software market on the basis of functionality?

- What is the breakup of the Mexico industrial robotics software market on the basis of application?

- What is the breakup of the Mexico industrial robotics software market on the basis of end user industry?

- What is the breakup of the Mexico industrial robotics software market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial robotics software market?

- What are the key driving factors and challenges in the Mexico industrial robotics software market?

- What is the structure of the Mexico industrial robotics software market and who are the key players?

- What is the degree of competition in the Mexico industrial robotics software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial robotics software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial robotics software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial robotics software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)