Mexico Industrial Sand Market Size, Share, Trends and Forecast by Product Type, Grade, Application, End Use, and Region, 2025-2033

Mexico Industrial Sand Market Overview:

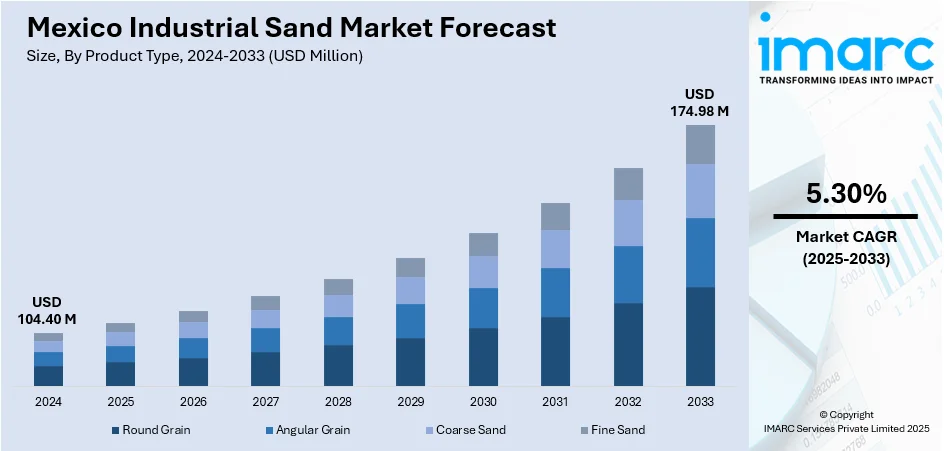

The Mexico industrial sand market size reached USD 104.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 174.98 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market is driven by extensive demand from Mexico’s infrastructure and construction sectors, supported by large-scale urban and industrial development. Strong activity in glass manufacturing and solar energy applications increases the need for high-purity silica sand, thereby fueling the market. Cross-border trade with the U.S. further strengthens the industry’s output potential, augmenting the Mexico industrial sand market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 104.40 Million |

| Market Forecast in 2033 | USD 174.98 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Industrial Sand Market Trends:

Growth in Domestic Construction and Infrastructure Projects

Mexico’s robust construction sector plays a central role in elevating the demand for industrial sand, particularly for concrete, mortar, asphalt, and other structural materials. Government-backed infrastructure programs, such as highway modernization, airport upgrades, and housing initiatives under the National Development Plan, are driving a consistent need for high-quality sand. Urban expansion in major cities like Mexico City, Guadalajara, and Monterrey increases year-round consumption of raw materials used in residential and commercial developments. Moreover, ongoing investments in industrial parks and logistics hubs have expanded the use of sand in foundation and paving works. Contractors increasingly prioritize clean, well-graded sand to meet both structural performance standards and sustainability requirements. Environmental regulations on aggregate quality have further incentivized the adoption of washed silica sand, which ensures consistency in construction applications. Additionally, with raw material costs under scrutiny, locally sourced sand reduces transport expenses and mitigates delays. These market dynamics are sustaining aggregate consumption across public and private projects. The widespread utility of this material across multiple construction layers directly supports Mexico industrial sand market growth through a blend of regulatory compliance, logistics efficiency, and urban planning trends.

To get more information on this market, Request Sample

Expansion of the Domestic Glass Manufacturing Sector

The rising demand for glass across packaging, construction, automotive, and solar applications is accelerating consumption of silica-rich industrial sand in Mexico. Flat and container glass production relies heavily on high-purity sand to ensure clarity, strength, and chemical resistance, making quality control a primary procurement driver for manufacturers. With Mexico serving as a regional hub for beverage bottling and food packaging, the demand for container glass remains strong, particularly from multinational firms operating in Jalisco, Nuevo León, and the State of Mexico. Furthermore, growth in the domestic solar energy sector has elevated the need for low-iron silica sand used in solar glass fabrication. The local automotive industry, which requires laminated and tempered glass, is another major consumer of specialty silica products. Producers are expanding their raw material sourcing networks to secure consistent, domestic supplies of silica sand that meet chemical purity standards. Ongoing investment in glass processing infrastructure has reinforced the position of sand suppliers as strategic partners. These structural factors, combined with export-oriented manufacturing policies, are creating a stable and growing consumption base for silica sand across Mexico’s industrial landscape.

Cross-Border Trade and Industrial Sand Exports to the U.S.

Mexico’s proximity to the United States and participation in regional trade agreements such as USMCA have enabled the country to emerge as a competitive exporter of industrial sand, particularly for foundry and hydraulic fracturing applications. U.S. energy producers and industrial manufacturers seek consistent supplies of processed silica sand to meet specific performance and safety standards. Northern Mexican states, especially Coahuila, Chihuahua, and Nuevo León, are capitalizing on their geological reserves and improving logistics infrastructure to serve these cross-border needs efficiently. The development of local beneficiation facilities has allowed Mexican firms to supply washed, graded, and dry-packed sand suitable for demanding U.S. applications. Competitive pricing and reduced transportation times further strengthen Mexico’s position against other international suppliers. Moreover, environmental restrictions in U.S. extraction zones have increased reliance on imports, reinforcing Mexico’s role in regional supply chains. Investment in rail and freight connectivity is expanding export capacity, while bilateral industrial ties continue to deepen. This export momentum, backed by robust trade logistics and regulatory harmonization, is adding a dynamic layer to the country’s sand economy.

Mexico Industrial Sand Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, application, and end use.

Product Type Insights:

- Round Grain

- Angular Grain

- Coarse Sand

- Fine Sand

The report has provided a detailed breakup and analysis of the market based on the product type. This includes round grain, angular grain, coarse sand, and fine sand.

Grade Insights:

- Industrial Grade

- Specialty Grade

- High Purity Grade

The report has provided a detailed breakup and analysis of the market based on the grade. This includes industrial grade, specialty grade, and high purity grade.

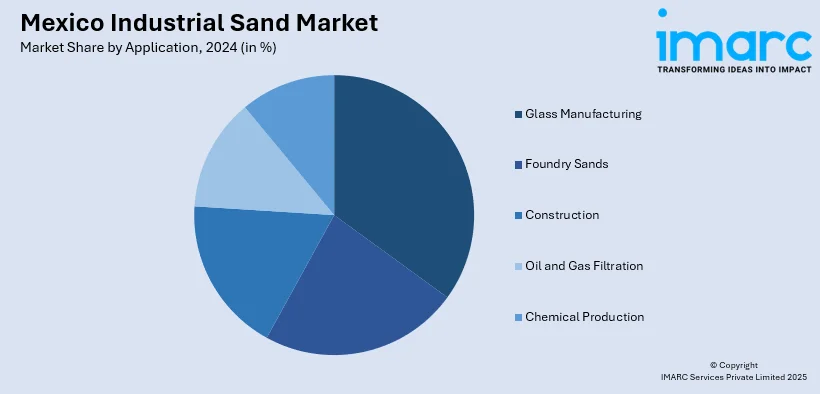

Application Insights:

- Glass Manufacturing

- Foundry Sands

- Construction

- Oil and Gas Filtration

- Chemical Production

The report has provided a detailed breakup and analysis of the market based on the application. This includes glass manufacturing, foundry sands, construction, oil and gas filtration, and chemical production.

End Use Insights:

- Construction

- Automotive

- Glass and Ceramics

- Oil and Gas

- Electronics

The report has provided a detailed breakup and analysis of the market based on the end use. This includes construction, automotive, glass and ceramics, oil and gas, and electronics.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Sand Market News:

- On 8 July 2024, Eni announced a new oil and gas discovery at the Yopaat-1 EXP well in Block 9, located 63 km offshore in the Cuenca Salina, Sureste Basin, Mexico, estimating 300–400 million barrels of oil equivalent (Mboe) in place. The well was drilled at a water depth of 525 meters, reaching 2,931 meters total depth, and encountered approximately 200 meters of hydrocarbon-bearing sands. With this and earlier finds in Blocks 7 and 10, Eni’s total estimated resources in the region now exceed 1.3 billion barrels of oil equivalent (Bboe), strengthening long-term energy investment activity in the region, which is tied to industrial sand demand in Mexico's upstream sector.

Mexico Industrial Sand Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Round Grain, Angular Grain, Coarse Sand, Fine Sand |

| Grades Covered | Industrial Grade, Specialty Grade, High Purity Grade |

| Applications Covered | Glass Manufacturing, Foundry Sands, Construction, Oil and Gas Filtration, Chemical Production |

| End Uses Covered | Construction, Automotive, Glass and Ceramics, Oil and Gas, Electronics |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial sand market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial sand market on the basis of product type?

- What is the breakup of the Mexico industrial sand market on the basis of grade?

- What is the breakup of the Mexico industrial sand market on the basis of application?

- What is the breakup of the Mexico industrial sand market on the basis of end use?

- What is the breakup of the Mexico industrial sand market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial sand market?

- What are the key driving factors and challenges in the Mexico industrial sand market?

- What is the structure of the Mexico industrial sand market and who are the key players?

- What is the degree of competition in the Mexico industrial sand market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial sand market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial sand market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial sand industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)