Mexico Industrial Valves Market Size, Share, Trends and Forecast by Product Type, Functionality, Material, Size, End Use Industry, and Region, 2025-2033

Mexico Industrial Valves Market Overview:

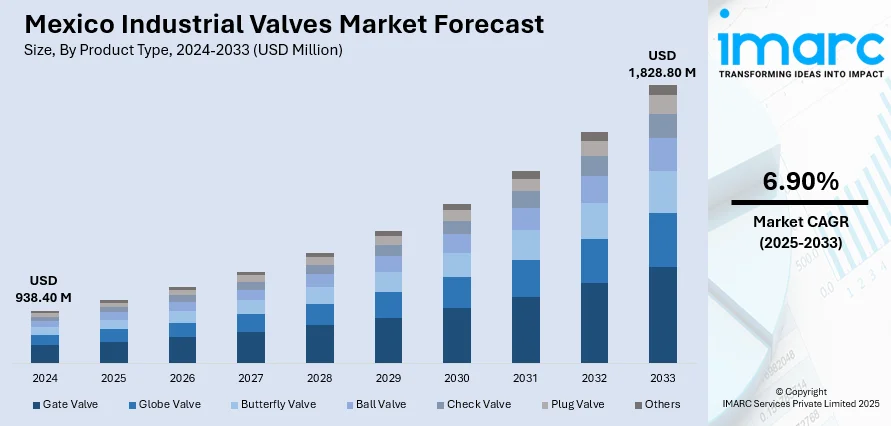

The Mexico industrial valves market size reached USD 938.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,828.80 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is being driven by increased investments in key sectors, such as oil and gas, water treatment, and manufacturing. Besides this, government initiatives focusing on infrastructure development and energy reforms, the adoption of smart valve technologies, and stringent environmental regulations are also acting as significant growth-inducing factors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 938.40 Million |

| Market Forecast in 2033 | USD 1,828.80 Million |

| Market Growth Rate 2025-2033 | 6.90% |

Mexico Industrial Valves Market Trends:

Adoption of Smart Valve Technologies

The integration of smart valve technologies, powered by IoT and automation, is revolutionizing the industrial valves market in Mexico. Real-time monitoring, predictive maintenance, and remote-control lead to increased operational efficiency and decreased costs. For example, the adoption of smart valves can boost energy efficiency in sectors like chemical manufacturing and power generation. Additionally, stricter environmental and safety regulations are driving companies to invest in high-quality, compliant valve solutions, encouraging product innovation and the use of advanced materials to meet these standards. Smart valves are especially popular in industries like oil and gas, water treatment, and manufacturing, where precise control and monitoring are required. Beyond boosting operational efficiency, these technologies help to achieve sustainability goals by reducing energy usage and increasing system resilience. As these solutions become more available and cost-effective, adoption is likely to rise, driving development in Mexico's industrial valves market.

Investments in Infrastructure Development

Mexico is experiencing significant investments in infrastructure development, which is driving the growth of its industrial valves market. As per the National Institute of Statistics and Geography (INEGI), the volume of construction production grew by 6.3% year-on-year (YoY) in the first nine months of 2024. This surge in infrastructure projects, such as the development of new pipelines, power plants, water treatment facilities, and industrial complexes, is creating strong demand for industrial valves. These projects necessitate a variety of valve types, including ball valves, check valves, and butterfly valves, which are vital for managing flow and pressure within critical systems. Furthermore, the growing popularity of cigar culture, as well as Mexico's expanding tourist industry, help to drive market growth. With a sustained focus on infrastructure development, demand for industrial valves is likely to stay strong, establishing the groundwork for continued market expansion.

Mexico Industrial Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, functionality, material, size, and end use industry.

Product Type Insights:

- Gate Valve

- Globe Valve

- Butterfly Valve

- Ball Valve

- Check Valve

- Plug Valve

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes gate valve, globe valve, butterfly valve, ball valve, check valve, plug valve, and others.

Functionality Insights:

- On-Off/Isolation Valves

- Control Valves

A detailed breakup and analysis of the market based on functionality have also been provided in the report. This includes on-off/isolation valves and control valves.

Material Insights:

- Steel

- Cast Iron

- Alloy Based

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, cast iron, alloy based, and others.

Size Insights:

- Upto 1”

- 1”-6”

- 7”-25”

- 26”-50”

- 51” and Above

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes upto 1”, 1”-6”, 7”-25”, 26”-50”, and 51” and above.

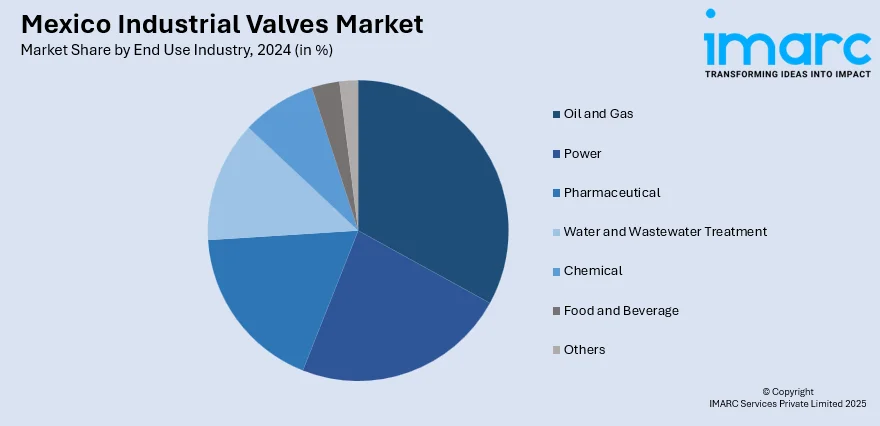

End Use Industry Insights:

- Oil and Gas

- Power

- Pharmaceutical

- Water and Wastewater Treatment

- Chemical

- Food and Beverage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, power, pharmaceutical, water and wastewater treatment, chemical, food and beverage, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Valves Market News:

- April 2025: Mexico's government announced that it would launch tenders for the "Polos de Desarrollo para el Bienestar" (Development Poles for Welfare) program in May 2025. The initiative involved constructing a series of industrial hubs with the aim to attract investment in sectors like petrochemicals, energy, and manufacturing. The focus on industrial development suggested potential opportunities for companies in the industrial valve sector.

- February 2024: Danfoss Power Solutions launched an expanded Integrated Circuit Solutions (ICS) portfolio, consolidating cartridge valves and hydraulic integrated circuits from multiple legacy brands into a unified offering. This portfolio included over 500 base valve models, such as solenoid, check, flow, pressure, directional, sequence, and shuttle valves, as well as logic elements, coils, and electronics. Danfoss manufactured these valves in Reynosa, Mexico, among other locations.

Mexico Industrial Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gate Valve, Globe Valve, Butterfly Valve, Ball Valve, Check Valve, Plug Valve, Others |

| Functionalities Covered | On-Off/Isolation Valves, Control Valves |

| Materials Covered | Steel, Cast Iron, Alloy Based, Others |

| Sizes Covered | Upto 1”, 1”-6”, 7”-25”, 26”-50”, 51” and Above |

| End Use Industries Covered | Oil and Gas, Power, Pharmaceutical, Water and Wastewater Treatment, Chemical, Food and Beverage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial valves market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial valves market on the basis of product type?

- What is the breakup of the Mexico industrial valves market on the basis of functionality?

- What is the breakup of the Mexico industrial valves market on the basis of material?

- What is the breakup of the Mexico industrial valves market on the basis of size?

- What is the breakup of the Mexico industrial valves market on the basis of end use industry?

- What are the various stages in the value chain of the Mexico industrial valves market?

- What are the key driving factors and challenges in the Mexico industrial valves?

- What is the structure of the Mexico industrial valves market and who are the key players?

- What is the degree of competition in the Mexico industrial valves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)