Mexico Industrial Welding Machines Market Size, Share, Trends and Forecast by Welding Technology, Automation Level, Power Source Type, Sales Channel, End Use Industry, and Region, 2025-2033

Mexico Industrial Welding Machines Market Overview:

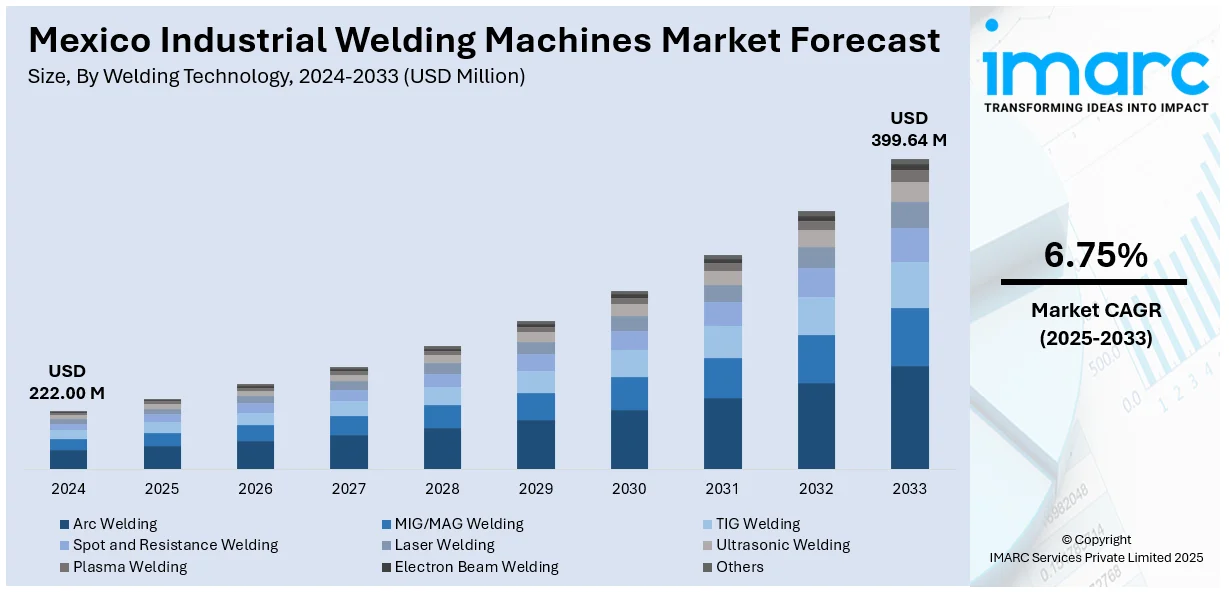

The Mexico industrial welding machines market size reached USD 222.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 399.64 Million by 2033, exhibiting a growth rate (CAGR) of 6.75% during 2025-2033. The market is propelled by strong infrastructure growth, a fast-growing auto industry, and increasing use of advanced welding technologies. Government policies and Mexico's low cost framework versus the surrounding regions also boost market growth. Furthermore, the increasing demand for skilled workforce and the incorporation of automation as well as robotics are major drivers fueling the Mexico industrial welding machines market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 222.00 Million |

| Market Forecast in 2033 | USD 399.64 Million |

| Market Growth Rate 2025-2033 | 6.75% |

Mexico Industrial Welding Machines Market Trends:

Government Initiatives and Infrastructure Development

The Mexican government's strategic focus on infrastructure development significantly influences the industrial welding machines market. Initiatives such as the National Infrastructure Plan and investments in sectors like transportation, energy, and construction have led to a surge in large-scale projects requiring advanced welding solutions. Moreover, according to industry reports, in 2024, the Mexican government is placing a strong emphasis on road construction, dedicating a budget of USD 12.53 Billion to the development and upgrade of 8,115 km of roads. Furthermore, investments are being made to expand rail networks, covering both passenger and freight lines, as well as enhancing water management through technology and training. The country’s construction sector is on the rise, with an anticipated annual growth rate of 5.5%, expected to reach MXN 2.04 trillion by 2025.These projects demand high-quality, durable welding equipment to ensure structural integrity and safety. Consequently, the market has witnessed increased demand for welding machines capable of meeting the rigorous standards set by these infrastructure endeavors. Furthermore, government incentives aimed at modernizing manufacturing processes have encouraged local and international companies to invest in state-of-the-art welding technologies, thereby fostering the Mexico industrial welding machines market growth.

Technological Advancements and Automation Integration

The application of emerging technologies in welding techniques is revolutionizing the industrial sector in Mexico. The use of automated welding technologies, such as robotic welding and laser technologies, improves accuracy, effectiveness, and safety in manufacturing practices. Sectors like automotive, aerospace, and heavy equipment industries are more using these technologies to improve production needs and quality requirements. The transformation to automation enhances productivity while, at the same time, solves labor shortage and skill deficiencies. Consequently, more welding machines are required to be compatible with automated systems, a demand that leads to competition and innovation among industry players. For instance, in February 2025, Hebei Rongkuai Machinery Manufacturing Co., Ltd., a brand under DAPU, showcased its premium welding machines at WIRE & TUBE MEXICO 2025. Highlighting their advanced Fence Panel Welding Machine and Chain Link Fence Machine, Rongkuai’s products feature high efficiency, precision, and customizable options.

Mexico Industrial Welding Machines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on welding technology, automation level, power source type, sales channel, and end use industry.

Welding Technology Insights:

- Arc Welding

- MIG/MAG Welding

- TIG Welding

- Spot and Resistance Welding

- Laser Welding

- Ultrasonic Welding

- Plasma Welding

- Electron Beam Welding

- Others

The report has provided a detailed breakup and analysis of the market based on the welding technology. This includes arc welding, MIG/MAG welding, TIG welding, spot and resistance welding, laser welding, ultrasonic welding, plasma welding, electron beam welding, and others.

Automation Level Insights:

- Manual Welding Machines

- Semi-Automatic Welding Machines

- Fully Automatic Welding Machines

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual welding machines, semi-automatic welding machines, and fully automatic welding machines.

Power Source Type Insights:

- Electric Welding Machines

- Gas Welding Machines

- Hybrid Welding Machines

A detailed breakup and analysis of the market based on the power source type have also been provided in the report. This includes electric welding machines, gas welding machines, and hybrid welding machines.

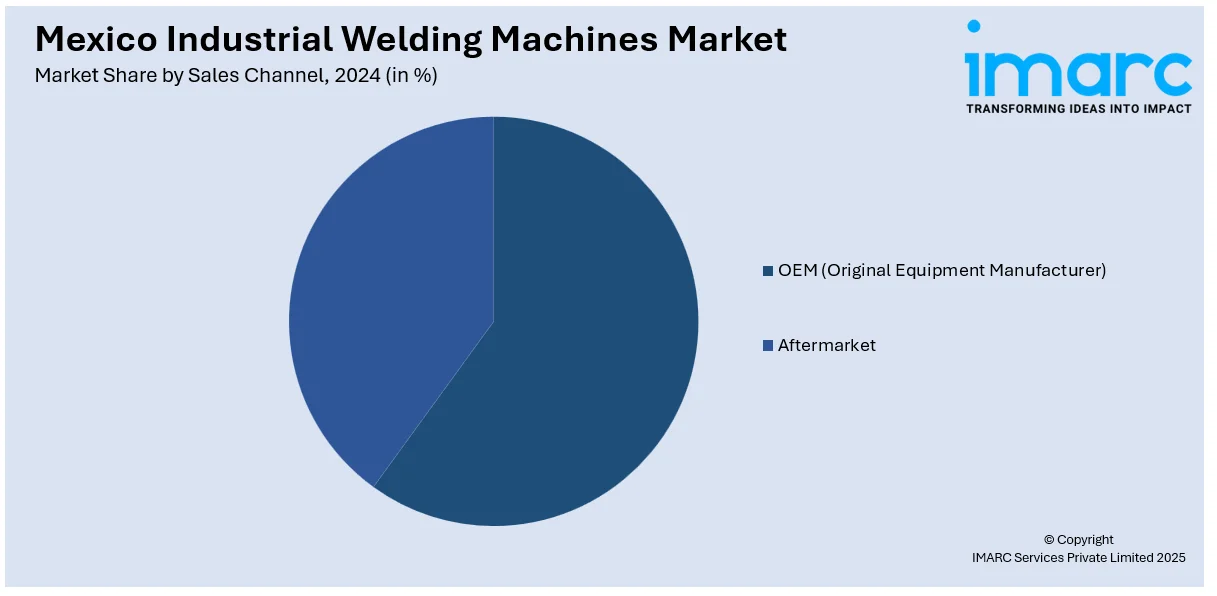

Sales Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (original equipment manufacturer) and aftermarket.

End Use Industry Insights:

- Automotive

- Transportation

- Construction and Infrastructure

- Shipbuilding

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Heavy Machinery and Equipment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, transportation, construction and infrastructure, shipbuilding, aerospace and defense, oil and gas, energy and power, heavy machinery and equipment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Welding Machines Market News:

- In May 2025, INTERMAQ showcased innovative welding, laser cutting, and bending machinery at FABTECH Mexico 2024, held in Monterrey, Mexico. The company presented advanced technologies, including 30,000-watt laser cutters, CNC benders, and multifunctional laser welders designed to enhance production efficiency and quality, particularly for the automotive industry.

- In July 2024, Heron Intelligent Equipment Ltd. Co. formed a strategic partnership with QUAT Industrial in Mexico, aiming to enhance customer service in the region. This collaboration will offer an expanded product portfolio, improved installation and maintenance services, and tailored engineering advice for Mexican manufacturers. With QUAT’s expertise in machinery installation and Heron’s leadership in resistance welding and riveting technologies, the partnership is set to boost market presence in central Mexico and facilitate further expansion into surrounding areas.

- In June 2024, ESAB Corporation announced a distribution agreement with Mexico’s INFRA Group to expand access to ESAB’s welding and gas control equipment across Mexico. The partnership aims to grow ESAB’s customer base and enhance service levels using INFRA’s extensive distribution network. INFRA will offer ESAB’s innovative products, including the Renegade VOLT™, Rogue™, Rustler™, and Arcair™ lines.

Mexico Industrial Welding Machines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Welding Technologies Covered | Arc Welding, MIG/MAG Welding, TIG Welding, Spot and Resistance Welding, Laser Welding, Ultrasonic Welding, Plasma Welding, Electron Beam Welding, Others |

| Automation Levels Covered | Manual Welding Machines, Semi-Automatic Welding Machines, Fully Automatic Welding Machines |

| Power Source Types Covered | Electric Welding Machines, Gas Welding Machines, Hybrid Welding Machines |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Automotive, Transportation, Construction and Infrastructure, Shipbuilding, Aerospace and Defense, Oil and Gas, Energy and Power, Heavy Machinery and Equipment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial welding machines market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial welding machines market on the basis of welding technology?

- What is the breakup of the Mexico industrial welding machines market on the basis of automation level?

- What is the breakup of the Mexico industrial welding machines market on the basis of power source type?

- What is the breakup of the Mexico industrial welding machines market on the basis of sales channel?

- What is the breakup of the Mexico industrial welding machines market on the basis of end use industry?

- What is the breakup of the Mexico industrial welding machines market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial welding machines market?

- What are the key driving factors and challenges in the Mexico industrial welding machines market?

- What is the structure of the Mexico industrial welding machines market and who are the key players?

- What is the degree of competition in the Mexico industrial welding machines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial welding machines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial welding machines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial welding machines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)