Mexico Industry 4.0 Market Size, Share, Trends and Forecast by Component, Technology Type, End Use Industry, and Region, 2025-2033

Mexico Industry 4.0 Market Overview:

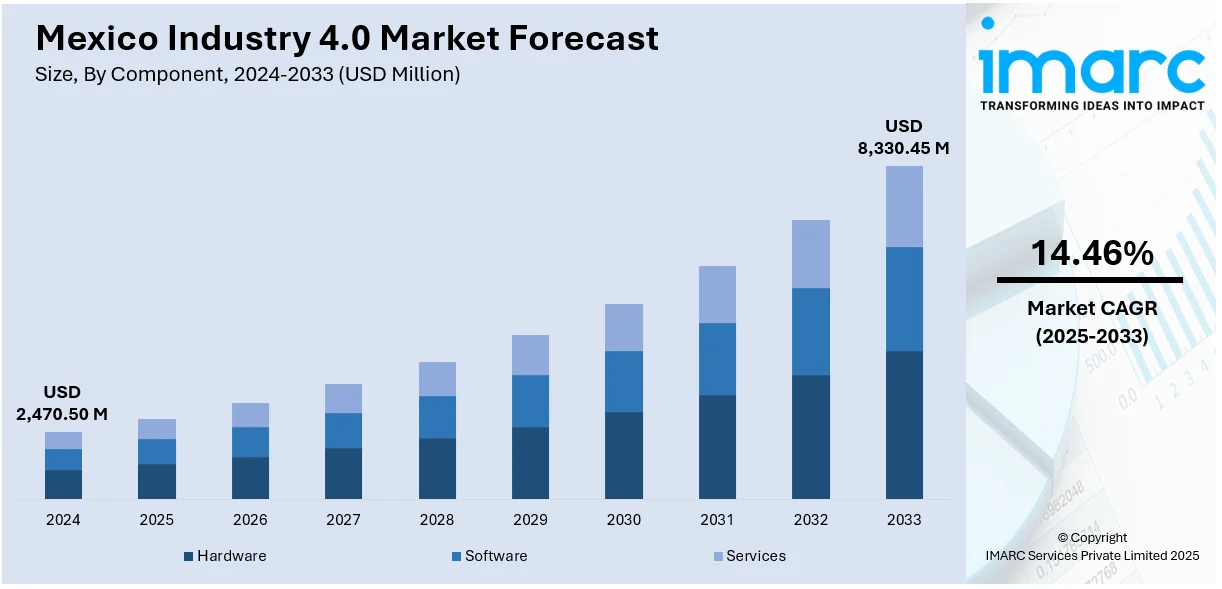

The Mexico Industry 4.0 market size reached USD 2,470.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,330.45 Million by 2033, exhibiting a growth rate (CAGR) of 14.46% during 2025-2033. The market in Mexico is driven by the rising use of automation and robotics in manufacturing processes. This trend, along with government initiatives and policies, is playing an important role in contributing to the market growth. Additionally, the increasing need for smart manufacturing technology is expanding the Mexico Industry 4.0 market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,470.50 Million |

| Market Forecast in 2033 | USD 8,330.45 Million |

| Market Growth Rate 2025-2033 | 14.46% |

Mexico Industry 4.0 Market Trends:

Increasing Adoption of Automation and Robotics

The market is driven by the rising use of automation and robotics in manufacturing processes. Businesses in Mexico are implementing automated systems to improve production efficiency and minimize operating costs. The continuous adoption of robotic systems is allowing manufacturers to streamline their operations, increase product quality, and ensure consistency. As more industries adopt smart factories, robots are being put to work in increasingly different capacities, such as assembly lines, material handling, and inspection. This movement is transforming production lines, enabling manufacturers to have higher throughput rates, fewer human errors, and more worker safety. Moreover, the growing complexity of robots is facilitating an even more agile production process, where businesses can rapidly change in response to shifting consumer needs and market conditions. To counter these trends, Mexican producers are making investments in state-of-the-art automation technologies to be competitive in the international market. For instance, Huayan Robotics, previously Han's Robot, will officially launch at FABTECH Mexico 2025, taking place from May 6-8 at Booth 1937. As the leading North American metalworking and manufacturing event, FABTECH provides the perfect stage for Huayan Robotics to showcase its newest developments in industrial automation.

Government Initiatives and Support

Government initiatives and policies are playing an important role in contributing to the Mexico Industry 4.0 market growth. Different government programs are being crafted to promote the use of digital technologies in production. The Mexican government is, at present, promoting industry modernization through subsidies, tax relief, and incentives for firms making investments in artificial intelligence (AI), data analytics, and automation. These support mechanisms are designed to strengthen the nation's industrial strengths and competitiveness globally. The government is also encouraging research and development (R&D) partnerships between academia, the private sector, and technology clusters. Under this approach, public-private partnerships are being formed to enhance the advancement and uptake of smart technologies in industries. This is creating a favorable climate for companies to adopt cutting-edge technologies like AI, Internet of Things (IoT), and machine learning (ML) in their operations, guaranteeing the ongoing development of Mexico's manufacturing industry. The IMARC Group predicts that the Mexico IoT market is expected to reach USD 46,079.0 Million by 2033.

Rising Demand for Smart Manufacturing Technologies

The increasing need for advanced manufacturing technology is bolstering the growth of the market in Mexico. Businesses are increasingly using IoT devices, cloud computing, and data analytics to streamline production processes, minimize downtime, and boost the overall efficiency of manufacturing facilities. By applying networked systems, companies are gaining real-time information on machine productivity, inventory status, and supply chain behavior, which allows them to make timely and informed decisions that drive performance improvements. As customers become increasingly interested in customized products and shorter lead times, manufacturers are turning to flexible production systems that can readily accommodate these requirements. These smarter technologies are making it possible for Mexican manufacturers to enhance quality monitoring, decrease losses, and consume less energy. The demand for these technologies is growing as businesses recognize the competitive advantages offered by smarter, more connected manufacturing systems.

Mexico Industry 4.0 Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, technology type, and end use industry.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Technology Type Insights:

- Industrial Robotics

- Industrial IoT

- AI and ML

- Blockchain

- Extended Reality

- Digital Twin

- 3D Printing

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes industrial robotics, industrial IoT, AI and ML, blockchain, extended reality, digital twin, 3D printing, and others.

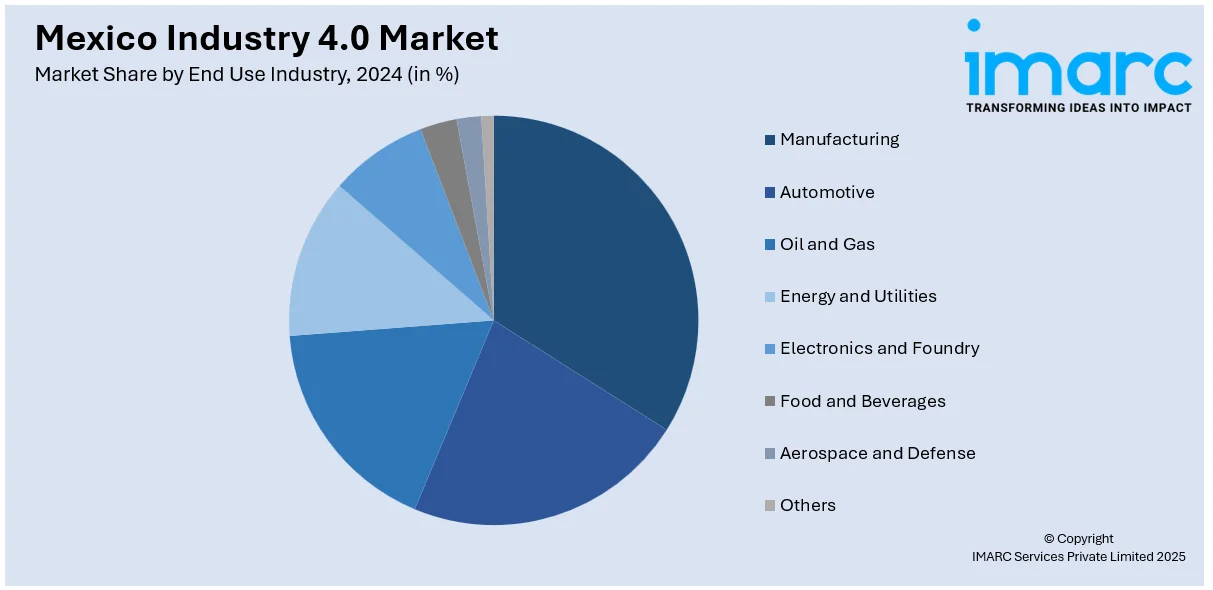

End Use Industry Insights:

- Manufacturing

- Automotive

- Oil and Gas

- Energy and Utilities

- Electronics and Foundry

- Food and Beverages

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes manufacturing, automotive, oil and gas, energy and utilities, electronics and foundry, food and beverages, aerospace and defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industry 4.0 Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Technology Types Covered | Industrial Robotics, Industrial IoT, AI and ML, Blockchain, Extended Reality, Digital Twin, 3D Printing, Others |

| End Use Industries Covered | Manufacturing, Automotive, Oil and Gas, Energy and Utilities, Electronics and Foundry, Food and Beverages, Aerospace and Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico Industry 4.0 market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico Industry 4.0 market on the basis of component?

- What is the breakup of the Mexico Industry 4.0 market on the basis of technology type?

- What is the breakup of the Mexico Industry 4.0 market on the basis of end use industry?

- What is the breakup of the Mexico Industry 4.0 market on the basis of region?

- What are the various stages in the value chain of the Mexico Industry 4.0 market?

- What are the key driving factors and challenges in the Mexico Industry 4.0 market?

- What is the structure of the Mexico Industry 4.0 market and who are the key players?

- What is the degree of competition in the Mexico Industry 4.0 market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico Industry 4.0 market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico Industry 4.0 market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico Industry 4.0 industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)