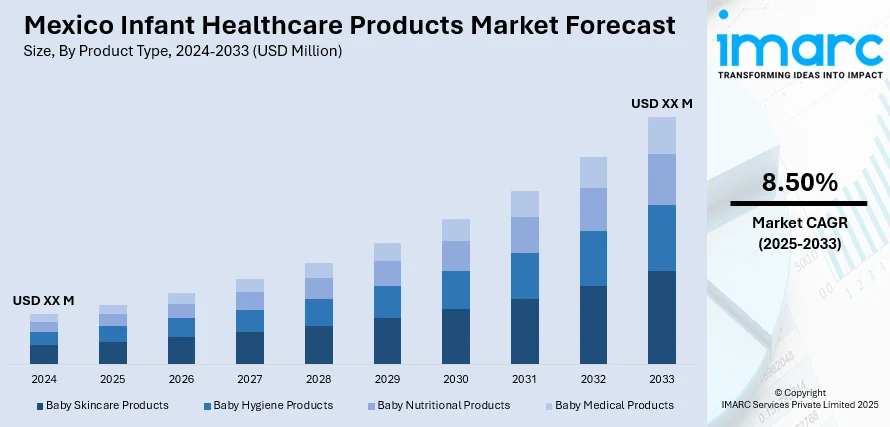

Mexico Infant Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2025-2033

Mexico Infant Healthcare Products Market Overview:

The Mexico infant healthcare products market size is projected to exhibit a growth rate (CAGR) of 8.50% during 2025-2033. The is fueled by growing demand for organic and natural baby care products, rising use of technology for monitoring the health of infants, and an emphasis on preventive nutrition and immune support. Safety, convenience, and wellness are valued by parents, promoting the use of plant-based items, intelligent health devices, and fortified nutrition. These changing consumer trends and innovations are driving strong growth and defining the future of infant care, driving the Mexico infant healthcare products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 8.50% |

Mexico Infant Healthcare Products Market Trends:

Growth in Demand for Natural and Organic Infant Healthcare Products

There is a growing desire for natural and organic infant healthcare products in Mexico as parents become more health-conscious about the products they apply to their children. This is a reflection of increased sensitization regarding the possible negative impacts of chemical synthetic additives that are most commonly used in traditional baby care products. Parents increasingly prefer products that contain plant-based, hypoallergenic components that reduce skin irritation and are paraben-, phthalate-, and artificial fragrance-free. Moreover, environmentally friendly and sustainable product packaging is most appealing to those with a ecofriendly consciousness. For instance, in November 2023, Soft N Dry™ collaborated with Mexico's ecoSuave Pañales to introduce eco-friendly diapers incorporating MicroFlex™ technology, shipping four million units in early 2024 to revolutionize the national baby care market. Moreover, the increased presence of certifications and labels guaranteeing organic and cruelty-free credentials only adds to the confidence of consumers. This trend towards natural items is bolstered by broader educational campaigns and online knowledge forums empowering parents to make informed decisions. Therefore, natural and organic baby care products are becoming an integral component of infant well-being in Mexico and truly impacting consumer demand and molding the future of infant healthcare goods.

To get more information of this market, Request Sample

Integration of Technology in Infant Health Monitoring

The advancement in technology is increasingly taking a central role in the healthcare of infants in Mexico, revolutionizing how parents monitor and take care of their infants' well-being. The use of smart health devices, for example, wearable monitors, electronic thermometers, and wireless baby monitors enables constant monitoring of vital signs such as temperature, breathing rates, and quality of sleep. These innovations allow parents to react quickly to health shifts and consult professionals when required. Additionally, cell phone applications complement the devices by providing individualized advice, vaccination reminders, and tracking of developmental milestones. Their complementarity is made possible by Mexico's increasing smartphone penetration and expanding internet connectivity, making it easier for people of all socioeconomic backgrounds to access them. Such adoption of technology is in line with contemporary parenting's heightened demand for convenience and proactive health management. This trend is the significant driver of the current Mexico infant healthcare products market growth, as it motivates the creation and adoption of advanced health monitoring solutions for infant care.

Focus on Preventive Nutrition and Immune Support

Preventative nutrition and immune support are now primary focus areas in the Mexican infant care market, echoing a more general cultural movement toward wellness-oriented parenting. Parents are more and more turning to products supplemented with essential nutrients like vitamins, minerals, probiotics, and prebiotics in order to facilitate healthy development and fortify the infant immune system from a young age. This development is supported by increasing scientific evidence that associates early diets with lower risks of infections and chronic diseases in later life. Fortified infant foods, supplements, and functional foods formulated to support immune function are highly being accepted. Additionally, public awareness campaigns and educational materials that emphasize preventive care are shaping parental decisions. Emphasis on improving immunity through diet leads healthcare professionals to prescribe such products as part of a complete infant care regimen. This prevention strategy is a leading driver of Mexico infant healthcare products growth, an indicator of changing consumer attitudes toward health-oriented, forward-thinking infant well-being solutions.

Mexico Infant Healthcare Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and age group.

Product Type Insights:

- Baby Skincare Products

- Lotions

- Oils

- Creams

- Baby Hygiene Products

- Diapers

- Wipes

- Sanitizers

- Baby Nutritional Products

- Infant Formula

- Vitamins

- Supplements

- Baby Medical Products

- Thermometers

- Nasal Aspirators

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby skincare products (lotions, oils, creams), baby hygiene products (diapers, wipes, sanitizers), baby nutritional products (infant formula, vitamins, supplements), and baby medical products (thermometers, nasal aspirators).

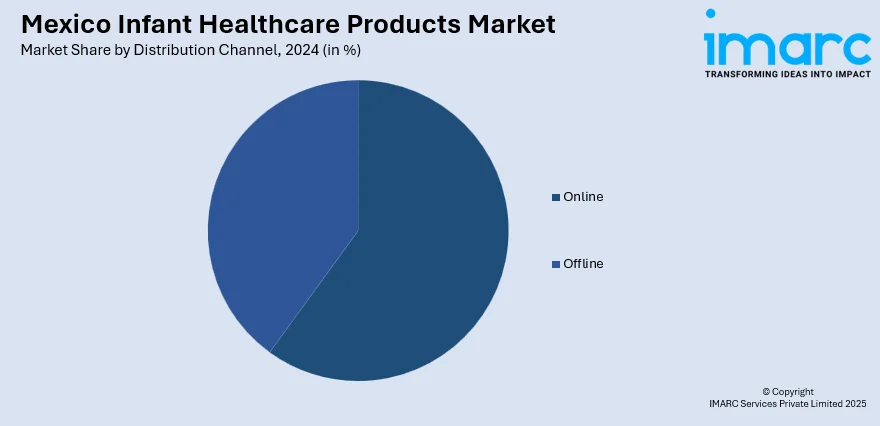

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on distribution channel have also been provided in the report. This includes online and offline.

Age Group Insights:

- 0-6 Months

- 6-12 Months

- 1-3 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-6 months, 6-12 months and 1-3 years.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Infant Healthcare Products Market News:

- In April 2024, Soft N Dry Diapers Corp. launched ecoFlexCore.com, a B2B portal promoting Mexican infant health by offering OEM manufacturers access to environmentally friendly, state-of-the-art ecoflex core materials, enhancing innovation and environmentally friendly baby diaper manufacture in Mexico's expanding infant care industry.

Mexico Infant Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online, Ofline |

| Age Groups Covered | 0-6 Months, 6-12 Months, 1-3 Years |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico infant healthcare products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico infant healthcare products market on the basis of product type?

- What is the breakup of the Mexico infant healthcare products market on the basis of distribution channel?

- What is the breakup of the Mexico infant healthcare products market on the basis of age group?

- What is the breakup of the Mexico infant healthcare products market on the basis of region?

- What are the various stages in the value chain of the Mexico infant healthcare products market?

- What are the key driving factors and challenges in the Mexico infant healthcare products?

- What is the structure of the Mexico infant healthcare products market and who are the key players?

- What is the degree of competition in the Mexico infant healthcare products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico infant healthcare products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico infant healthcare products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico infant healthcare products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)