Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033

Mexico Inflight Catering Market Overview:

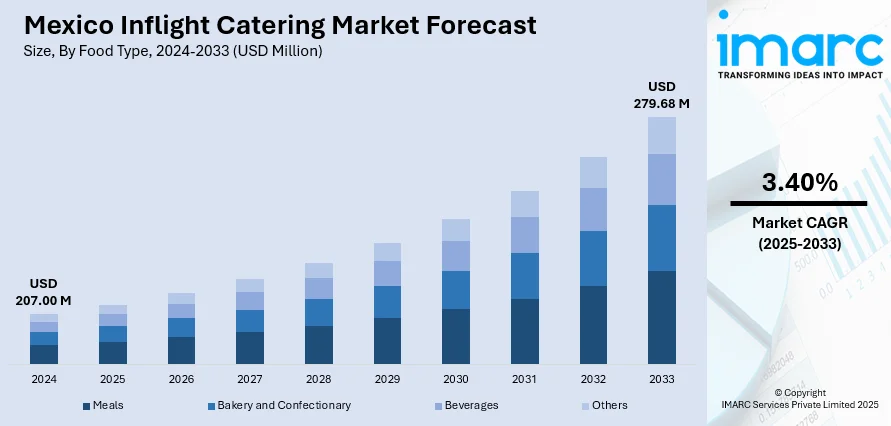

The Mexico inflight catering market size reached USD 207.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 279.68 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. Rising international tourism, increased frequency of long-haul flights, and growing demand for personalized inflight dining experiences are driving Mexico's inflight catering market, as airlines strive to enhance passenger satisfaction and differentiate their services amid intensifying competition and evolving consumer preferences in both premium and economy travel segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 207.00 Million |

| Market Forecast in 2033 | USD 279.68 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Mexico Inflight Catering Market Trends:

Growth in International Tourism and Air Passenger Traffic

One of the key factors driving the inflight catering industry in Mexico is the steady surge in international tourism and total air passenger traffic. Mexico is a global tourism destination, being among the top 10 nations by international tourist arrivals. Places such as Cancún, Mexico City, Los Cabos, and Guadalajara receive millions of foreign tourists every year, mostly from North America, Europe, and South America. This rising stream of visitors has created an upsurge in both national and international flights and, in direct proportion, the demand for inflight meal services. Carriers flying into and out of Mexico are under continuous pressure to drive passenger satisfaction, and one of the most keenly felt touchpoints on an airplane journey is food service. As flight lengths expand—particularly on transcontinental or extended-haul journeys—meal quality and options become paramount. Long-haul international passengers, including premium class travelers, demand differentiated, high-quality inflight meals that echo local fare and worldwide preferences. This drives airlines to invest in superior catering relationships and menu tailoring, resulting in industry expansion for inflight catering.

Increasing Focus on Differentiation and Brand Positioning by Airlines

Another driver fueling the inflight catering industry in Mexico is the increasing focus by airlines on brand positioning and differentiation in a more competitive air travel environment. With low-cost carriers (LCCs) and full-service carriers competing for passenger loyalty, inflight services, especially catering, have emerged as a potent branding instrument that can influence repeat business and shape traveler perception. In Mexico, large carriers such as Aeroméxico and Volaris are investing strategically in inflight products to differentiate themselves not only on price or routes, but on the character and novelty of the passenger experience. Catering is at the core of this effort, enabling airlines to express their brand personality through carefully curated menus, regional gourmet cuisine, eco-friendly packaging, and associations with popular chefs or food brands. These initiatives assist in communicating values of innovation, hospitality, and regional pride. Premium cabins, especially, are platforms for food experiential marketing. Airlines are using seasonal ingredients, traditional Mexican cuisine with a twist, and even providing multi-course meals for long-haul flights.

Mexico Inflight Catering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on food type, flight service type, and aircraft seating class.

Food Type Insights:

- Meals

- Bakery and Confectionary

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the food type. This includes meals, bakery and confectionary, beverages, and others.

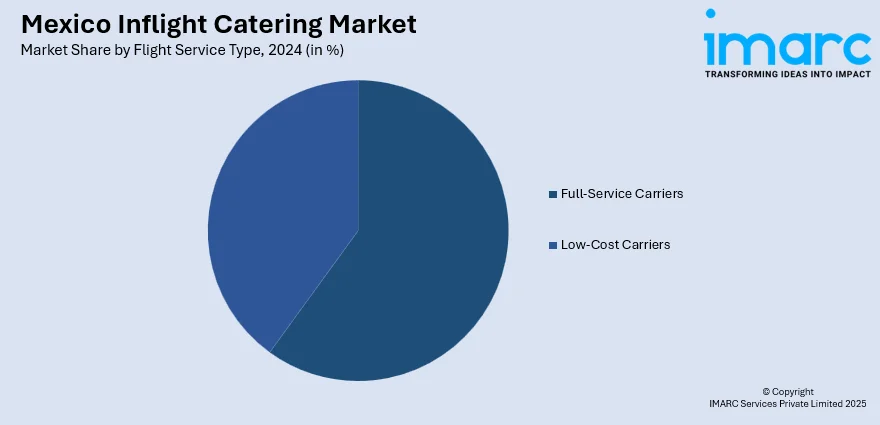

Flight Service Type Insights:

- Full-Service Carriers

- Low-Cost Carriers

A detailed breakup and analysis of the market based on the flight service type have also been provided in the report. This includes full-service carriers and low-cost carriers.

Aircraft Seating Class Insights:

- Economy Class

- Business Class

- First Class

The report has provided a detailed breakup and analysis of the market based on the aircraft seating class. This includes economy class, business class, and first class.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Inflight Catering Market News:

- September 2024: France-based catering company Newrest announced a strategic acquisition of Compass Group's operations in Mexico, Chile, and Colombia, marking a significant expansion in Latin America. The acquisition complements Newrest's existing inflight catering services in the region in addition to bolstering its catering and support services for other sectors.

- July 2024: Aeromexico reinstated its daily nonstop service between Washington Dulles International Airport and Mexico City. The Boeing 737 Max 8 aircraft features 150 economy and 16 premiere seats. Additionally, passengers enjoy complimentary snacks, meals, drinks, free messaging, and onboard entertainment.

Mexico Inflight Catering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Food Types Covered | Meals, Bakery and Confectionary, Beverages, Others |

| Flight Service Types Covered | Full-Service Carriers, Low-Cost Carriers |

| Aircraft Seating Classes Covered | Economy Class, Business Class, First Class |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico inflight catering market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico inflight catering market on the basis of food type?

- What is the breakup of the Mexico inflight catering market on the basis of flight service type?

- What is the breakup of the Mexico inflight catering market on the basis of aircraft seating class?

- What are the various stages in the value chain of the Mexico inflight catering market?

- What are the key driving factors and challenges in the Mexico inflight catering market?

- What is the structure of the Mexico inflight catering market and who are the key players?

- What is the degree of competition in the Mexico inflight catering market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico inflight catering market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico inflight catering market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico inflight catering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)