Mexico Insulation Market Size, Share, Trends and Forecast by Material Type, Function, Form, End Use Industry, and Region, 2025-2033

Mexico Insulation Market Overview:

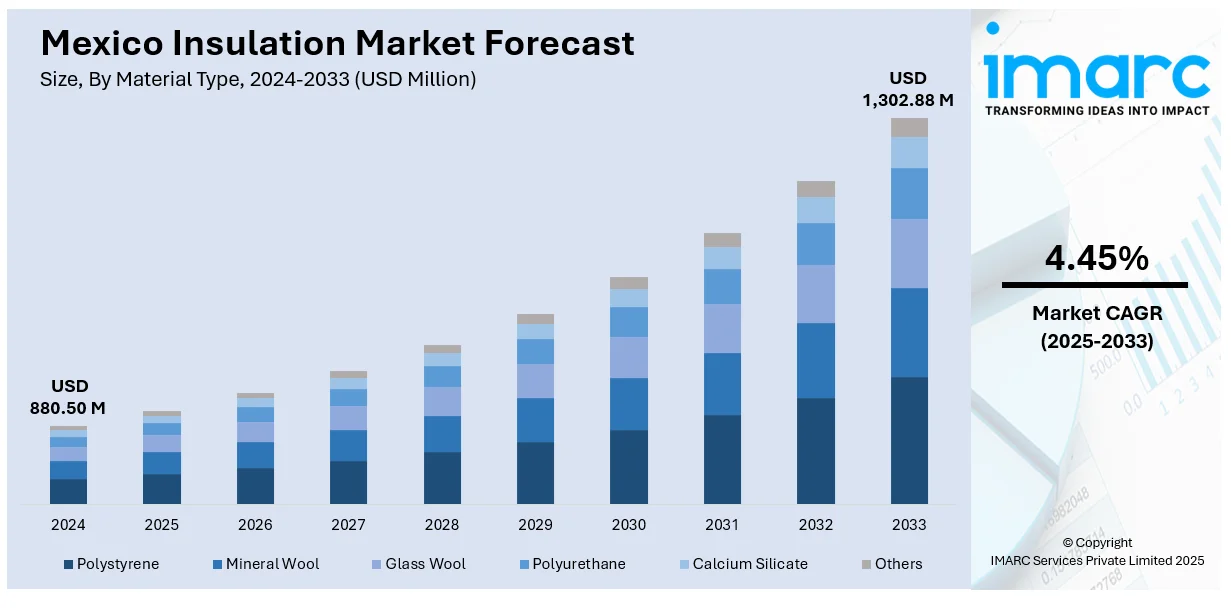

The Mexico insulation market size reached USD 880.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,302.88 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. Urban construction growth, stricter energy codes, rising electricity costs, rapid industrial development, cold chain expansion, surging eco-friendly material demand, burgeoning infrastructure investments, retrofitting activities, and increasing foreign direct investments (FDI) are some of the factors boosting the Mexico insulation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 880.50 Million |

| Market Forecast in 2033 | USD 1,302.88 Million |

| Market Growth Rate 2025-2033 | 4.45% |

Mexico Insulation Market Trends:

Expansion of the Construction Sector

The Mexican construction sector is a key driver of demand for insulation products. As urbanization continues and investments in residential, commercial, and mixed-use infrastructure continue to grow, developers are increasingly focusing on energy-efficient building solutions. Insulation is seen as an essential element for achieving performance standards in thermal control and energy saving. This is especially true in Mexico City, Monterrey, and Guadalajara, where urban density and climatic fluctuations require better building envelopes. Moreover, the increasing application of prefabricated construction methods has generated demand for insulation that is compatible with modular and panel-based systems. Additionally, the local and global construction companies are integrating high-tech insulation into their design requirements to increase occupant comfort and minimize long-term operational expenses, thus propelling the Mexico insulation market growth.

Energy Efficiency Regulations and Government Support

Mexico has been progressively tightening its building codes to align with global sustainability goals, and this has directly influenced the insulation market. Government bodies such as CONUEE (National Commission for the Efficient Use of Energy) have introduced energy efficiency standards that encourage the use of thermal insulation in new buildings as well as in retrofitting projects. These regulations are part of broader national efforts to reduce greenhouse gas emissions and lower electricity consumption in residential and commercial sectors. Developers and contractors are increasingly required to comply with Mexican official standards related to insulation performance, particularly in regions with extreme temperature variations. Additionally, some local governments offer incentives for energy-efficient construction practices, including tax benefits and expedited permitting for compliant projects. These policy instruments have helped mainstream insulation usage, making it a key specification in project design, which is further supporting the market growth.

Industrial Growth and Demand from Manufacturing

Mexico’s position as a major manufacturing hub, especially in sectors such as automotive, aerospace, food processing, and consumer electronics, has created steady demand for industrial insulation solutions. For instance, Chinese investments in Mexico's manufacturing sectors, including electric vehicles and electronics, have been substantial, with over US 7 billion invested since mid-2022. Insulation in industrial settings is critical for maintaining thermal stability, reducing energy loss in equipment and piping, and enhancing worker safety. As manufacturing facilities expand, particularly in northern states like Nuevo León and Chihuahua, demand for high-performance insulation materials is rising. In line with this, the growth of industrial clusters and the nearshoring trend, where companies relocate operations closer to the U.S. market, are further contributing to the insulation requirement in process-intensive industries. Additionally, factories are upgrading legacy systems to meet international energy efficiency standards, which includes the adoption of better insulation across production units, further facilitating the market growth.

Mexico Insulation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on material type, function, form, and end use industry.

Material Type Insights:

- Polystyrene

- Mineral Wool

- Glass Wool

- Polyurethane

- Calcium Silicate

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes polystyrene, mineral wool, glass wool, polyurethane, calcium silicate, and others.

Function Insights:

- Thermal

- Acoustic

- Electric

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes thermal, acoustic, electric, and others.

Form Insights:

- Blanket

- Foam

- Board

- Pipe

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes blanket, foam, board, pipe, and others.

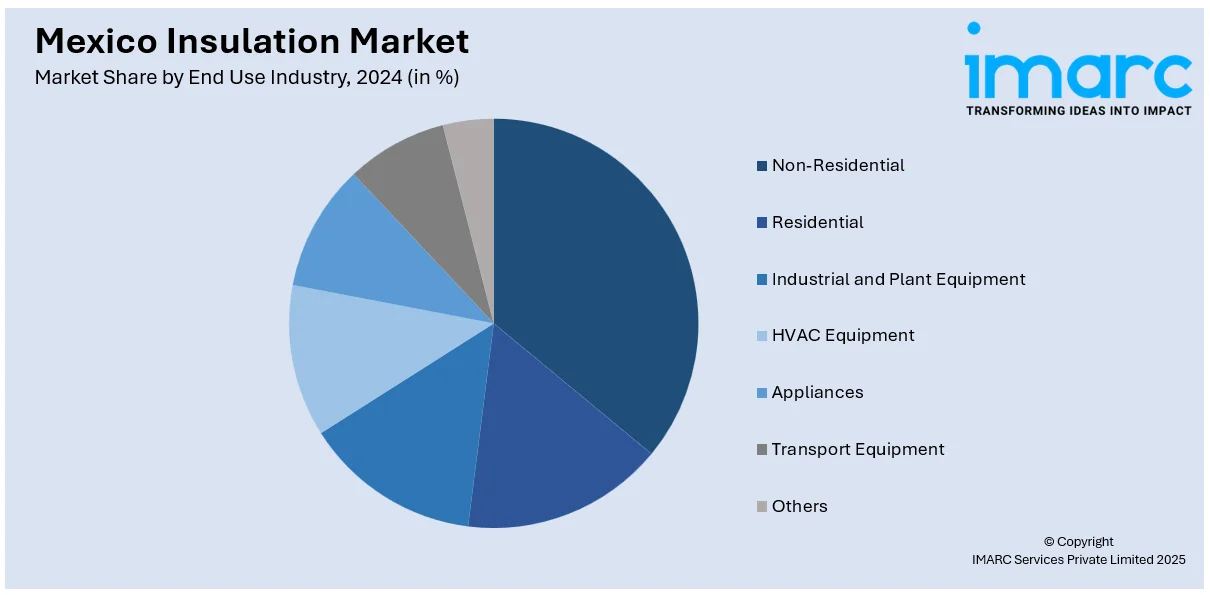

End Use Industry Insights:

- Non-Residential

- Residential

- Industrial and Plant Equipment

- HVAC Equipment

- Appliances

- Transport Equipment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes non-residential, residential, industrial and plant equipment, HVAC equipment, appliances, transport equipment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Insulation Market News:

- In 2024, Krempel acquired EIC Insulation Company to enhance its product offerings and strengthen its presence in the Mexican market. This acquisition aims to provide global customers in the energy sector with a comprehensive product lineup more efficiently.

Mexico Insulation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Polystyrene, Mineral Wool, Glass Wool, Polyurethane, Calcium Silicate, Others |

| Functions Covered | Thermal, Acoustic, Electric, Others |

| Forms Covered | Blanket, Foam, Board, Pipe, Others |

| End Use Industrys Covered | Non-Residential, Residential, Industrial and Plant Equipment, HVAC Equipment, Appliances, Transport Equipment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico insulation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico insulation market on the basis of material type?

- What is the breakup of the Mexico insulation market on the basis of function?

- What is the breakup of the Mexico insulation market on the basis of form?

- What is the breakup of the Mexico insulation market on the basis of end use industry?

- What is the breakup of the Mexico insulation market on the basis of region?

- What are the various stages in the value chain of the Mexico insulation market?

- What are the key driving factors and challenges in the Mexico insulation?

- What is the structure of the Mexico insulation market and who are the key players?

- What is the degree of competition in the Mexico insulation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico insulation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico insulation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)