Mexico Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2026-2034

Mexico Insurtech Market Summary:

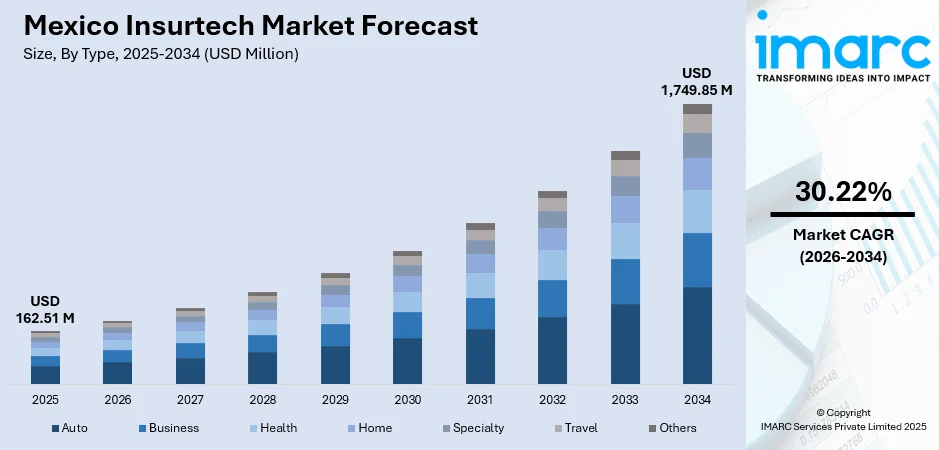

The Mexico insurtech market size was valued at USD 162.51 Million in 2025 and is projected to reach USD 1,749.85 Million by 2034, growing at a compound annual growth rate of 30.22% from 2026-2034.

The market is driven by increasing investor confidence, rising venture capital inflows, and the rapid expansion of e-commerce platforms that are reshaping digital user expectations and accelerating technology adoption across the insurance sector. Growing smartphone penetration, expanding internet connectivity, and the evolution of digital payment ecosystems are enabling insurtech providers to offer seamless, user-friendly, and accessible insurance solutions. The proliferation of embedded insurance models integrated into purchase flows, combined with data-driven personalization capabilities and real-time underwriting technologies, is positioning digital-first platforms to effectively address persistent market inefficiencies, enhancing the Mexico insurtech market share.

Key Takeaways and Insights:

- By Type: Health dominates the market with a share of 25.72% in 2025, supported by rising demand for end-to-end operational support, infrastructure management, and continuous monitoring that allows insurtech firms to prioritize core business functions.

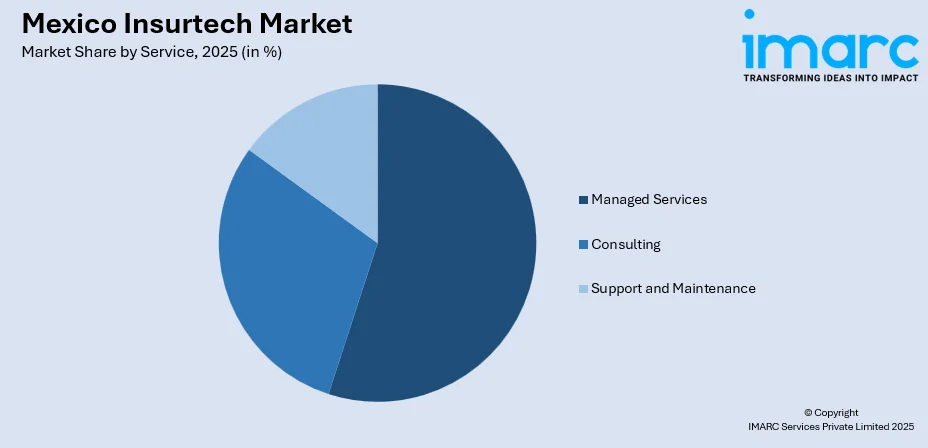

- By Service: Managed services lead the market with a share of 44.54% in 2025, driven by Mexico’s large uninsured population, increasing out-of-pocket medical spending, and growing demand for affordable digital health insurance with telemedicine and personalized wellness features.

- By Technology: Cloud computing represents the largest segment with a market share of 26.86% in 2025, due to its scalable infrastructure, real-time data processing, lower IT costs, and strong API integration capabilities that enable embedded insurance models and multi-channel engagement.

- Key Players: market shows moderate competitive intensity, characterized by digital-first startups, technology solution providers, and traditional insurers adopting advanced digital capabilities. Competition spans claim automation, distribution platforms, customer analytics, embedded insurance, and health-focused solutions, with firms prioritizing innovation, scalability, and user-centric service delivery.

To get more information on this market Request Sample

The Mexico insurtech market is experiencing accelerated growth fueled by technological innovation and evolving consumer preferences for digital-first insurance solutions. The country has emerged as one of Latin America's most attractive destinations for insurtech ventures, driven by regulatory stability and a robust digital infrastructure. Startups are focusing on specialized sectors including health, employee benefits, and wellness, reflecting a deep understanding of local needs and commitment to addressing coverage gaps through innovative distribution models. In September 2025, MetLife acquired a 20% stake in insurtech Klimber to advance digital insurance distribution in Mexico, strengthening embedded insurance capabilities and expanding access to mobile-first protection solutions across the region. Moreover, the integration of AI, ML, and advanced analytics is enabling insurers to automate underwriting processes, enhance claims management, and deliver personalized policy offerings that align with modern consumer expectations for convenience and accessibility.

Mexico Insurtech Market Trends:

Rising Integration of Embedded Insurance Solutions

The Mexican insurtech landscape is witnessing substantial growth in embedded insurance, where coverage is seamlessly integrated into the purchase flows of e-commerce platforms, mobility services, and digital marketplaces. In June 2025, Mexican insurtech Crabi raised US$13.6 million in a Series A round to enhance AI-driven underwriting and expand embedded insurance integrations across auto-financing and dealership channels. This approach allows consumers to acquire insurance protection at the point of transaction with minimal friction, enhancing relevance and reducing customer acquisition costs for providers. Insurtech platforms are developing proprietary technologies enabling any company to offer end-to-end embeddable insurance experiences across verticals including auto, mobile devices, home, and travel insurance, transforming traditional distribution paradigms.

Expansion of Usage-Based Insurance Models

Usage-based insurance is gaining traction across Mexico as insurtech providers leverage telematics and connected device technologies to offer personalized premium structures based on real-time behavioral data. Pay-per-kilometer auto insurance models and behavior-based health coverage are attracting digitally savvy consumers seeking flexibility and cost optimization. In November 2024, Mexican insurtech miituo launched pay-per-kilometer car insurance, letting drivers pay only for kilometers driven, offering flexible, cost-effective coverage and promoting usage-based insurance adoption in Mexico. Smart gamification software analyzing driving behavior and providing instant feedback is emerging as an innovative approach to reward safe practices while reducing overall claims costs for insurers.

Proliferation of Artificial Intelligence and Automation

Artificial intelligence (AI) and machine learning (ML) technologies are fundamentally transforming insurance operations across underwriting, claims processing, fraud detection, and customer service functions. Insurtech platforms are deploying AI-powered virtual assistants designed to handle routine client inquiries, automate quote generation, and streamline policy issuance processes. In May 2025, experts reported that 15–20% of Mexican insurance companies use artificial intelligence, with Mexico representing 18% of Latin America’s Insurtechs, highlighting growing AI adoption in the sector. Predictive analytics tools are enabling more accurate risk assessment and personalized pricing models, while natural language processing and computer vision technologies are accelerating claims evaluation and improving operational efficiency throughout the insurance value chain.

Market Outlook 2026-2034:

The Mexico insurtech market is projected to experience strong growth, supported by rapid digitalization within the insurance ecosystem and increasing consumer preference for seamless, technology-driven insurance solutions. Expanding smartphone usage, improved internet accessibility, and the rise of embedded insurance models will sustain revenue momentum. Continued investment in AI, cloud platforms, and data analytics is expected to strengthen operational efficiency and product personalization. Collaboration between insurtech startups and established insurers will accelerate modernization of legacy systems, while rising health awareness, a growing middle class, and supportive regulatory reforms will widen access to digital insurance services and drive long-term market expansion. The market generated a revenue of USD 162.51 Million in 2025 and is projected to reach a revenue of USD 1,749.85 Million by 2034, growing at a compound annual growth rate of 30.22% from 2026-2034.

Mexico Insurtech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Health | 25.72% |

| Service | Managed Services | 44.54% |

| Technology | Cloud Computing | 26.86% |

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The health dominates with a market share of 25.72% of the total Mexico insurtech market in 2025.

The health insurance segment represents a significant opportunity within Mexico's insurtech landscape, driven by substantial coverage gaps and high out-of-pocket healthcare expenditures among the population. Digital health insurance platforms are addressing underserved market segments by offering affordable, accessible coverage through mobile applications and telemedicine integration. In November 2025, Sofía, a Mexican digital health insurer, delivered 28,972 in-person consultations, 22,282 video consultations, and 11,219 chat consultations, with average video wait times of seven minutes. Additionally, insurtech providers are developing specialized products including micro-insurance, indemnity coverage, and major medical expense plans targeting previously overlooked demographics.

The digitalization of health insurance is enabling providers to streamline policy management, claims processing, and customer service through online platforms and mobile applications. Telemedicine integration within insurance offerings has accelerated significantly, allowing policyholders to access remote consultations, particularly benefiting populations in areas with limited healthcare infrastructure. The growing emphasis on preventive care and wellness programs is further enhancing the value proposition of digital health insurance solutions.

Service Insights:

Access the Comprehensive Market Breakdown Request Sample

- Consulting

- Support and Maintenance

- Managed Services

The managed services lead with a share of 44.54% of the total Mexico insurtech market in 2025.

Managed services have emerged as the dominant service category within Mexico's insurtech ecosystem, reflecting the growing demand for comprehensive operational support and infrastructure management solutions. Insurtech providers are increasingly partnering with managed service providers to access specialized technical expertise, ensure continuous platform monitoring, and maintain robust cybersecurity frameworks. This approach enables insurtech companies to reduce operational complexities, optimize resource allocation, and focus on core business activities including product development and customer acquisition strategies.

The expansion of managed services is driven by the need for scalable solutions that can accommodate rapid growth while ensuring regulatory compliance and data security. Cloud-based managed services offer insurtech platforms the flexibility to quickly adapt infrastructure based on demand fluctuations, implement automatic updates, and leverage advanced analytics capabilities without significant capital expenditure on in-house technology infrastructure and specialized personnel. In October 2025, AWS launched new local cloud‑availability zones in Mexico — boosting cloud infrastructure and increasing demand for managed‑service providers as insurers digitize operations and migrate to cloud environments.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

The cloud computing exhibits a clear dominance with a 26.86% share of the total Mexico insurtech market in 2025.

Cloud computing technology has established itself as the foundational infrastructure supporting Mexico's insurtech ecosystem, enabling platforms to achieve scalability, operational efficiency, and cost optimization. In June 2025, half of Mexican enterprises, including insurtech companies, were rapidly adopting cloud and AI solutions, driven by Microsoft Azure and its ecosystem partners, enhancing automation, efficiency, and digital transformation. Furthermore, cloud-based solutions facilitate real-time data processing, seamless API integrations with partner ecosystems, and enhanced security frameworks essential for handling sensitive customer information. The technology allows insurtech companies to rapidly deploy new products, scale operations based on demand and implement continuous updates without significant disruption.

The adoption of cloud infrastructure is enabling insurtech platforms to reduce IT operational costs while accessing advanced capabilities including artificial intelligence, machine learning algorithms, and big data analytics. Multi-cloud and hybrid cloud strategies are gaining traction as providers seek flexibility and risk mitigation through diversified infrastructure approaches, supporting both innovation initiatives and regulatory compliance requirements across the insurance value chain.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for insurtech adoption, driven by its proximity to the United States border, strong industrial base, and relatively higher income levels compared to other regions. The presence of manufacturing clusters and international trade activities creates demand for commercial insurance solutions while growing urban populations increasingly seek digital insurance options for health, auto, and property coverage.

Central Mexico, encompassing Mexico City and surrounding metropolitan areas, constitutes the largest regional market for insurtech services. The concentration of population, advanced digital infrastructure, and presence of major financial institutions creates favorable conditions for insurtech growth. High smartphone penetration and digital literacy among urban consumers accelerate adoption of mobile-first insurance platforms and embedded insurance solutions.

Southern Mexico presents emerging opportunities for insurtech expansion, particularly in addressing underserved populations through micro-insurance products and accessible digital solutions. The region's agricultural economy and tourism sector create demand for specialized coverage products while mobile-first approaches enable insurtech platforms to reach consumers in areas with limited traditional insurance infrastructure.

Other regions across Mexico contribute to insurtech market growth through localized adoption patterns influenced by regional economic activities, demographic characteristics, and infrastructure development. Coastal areas demonstrate demand for catastrophe and travel insurance while agricultural regions present opportunities for parametric insurance solutions leveraging weather data and satellite imagery.

Market Dynamics:

Growth Drivers:

Why is the Mexico Insurtech Market Growing?

Expanding Digital Infrastructure and Connectivity

The continuous expansion of internet penetration and smartphone adoption across Mexico is creating a robust foundation for insurtech growth. According to the sources, in 2025, Mexico had 110 million internet users, representing 83.3 percent of the population, and 127 million active mobile connections equivalent to 96.5 percent of residents, reflecting strong digital adoption and connectivity across the country. Enhanced connectivity enables insurance providers to reach previously underserved populations through mobile applications and digital platforms, democratizing access to coverage options. The proliferation of digital payment ecosystems facilitates seamless premium collection and claims disbursement, reducing friction in insurance transactions. Growing consumer comfort with digital financial services, accelerated by e-commerce adoption, is translating into increased willingness to purchase and manage insurance policies through online channels, creating substantial opportunities for insurtech platforms.

Rising Venture Capital Investment and Strategic Partnerships

The Mexican insurtech sector continues to attract significant venture capital investment and strategic interest from both domestic and international investors recognizing the market's growth potential. Funding enables startups to accelerate product development, enhance user acquisition strategies, and build essential infrastructure including automation systems, data analytics capabilities, and API integrations. Strategic partnerships between insurtech companies and traditional insurers are intensifying, creating collaborative ecosystems where innovative technologies complement established distribution networks and regulatory expertise, driving overall market expansion.

Growing Healthcare Coverage Gaps and Consumer Awareness

Significant gaps in healthcare coverage among Mexico's population, combined with rising out-of-pocket medical expenses, are driving demand for affordable digital health insurance solutions. As of October 2025, Mexico’s uninsured population reached 29.1% by 2023 following the dismantling of Seguro Popular and the launch of INSABI, highlighting the persistent coverage gaps. Increasing consumer awareness regarding financial protection and risk management is expanding the addressable market for insurtech providers offering accessible, transparent, and personalized coverage options. The insurtech sector specializes in developing products catering to middle- and lower-income segments previously overlooked by traditional insurers, utilizing technology to reach large volumes efficiently while pooling needs to create accessible products for millions.

Market Restraints:

What Challenges the Mexico Insurtech Market is Facing?

Limited Insurance Penetration and Cultural Barriers

Insurance penetration in Mexico remains relatively low compared to developed markets, reflecting cultural barriers and limited awareness regarding the importance of financial protection. Many consumers lack trust in insurance products and perceive insurance purchasing as complex and bureaucratic. Overcoming these cultural barriers requires significant investment in consumer education and simplified product offerings that resonate with local expectations and preferences.

Regulatory Complexity and Compliance Requirements

The regulatory landscape for insurtech companies involves navigating multiple oversight bodies and compliance frameworks that can create barriers to market entry and operational expansion. Stringent capital requirements, licensing procedures, and ongoing reporting obligations demand substantial resources from emerging insurtech companies. Regulatory uncertainty regarding emerging technologies including artificial intelligence applications and data usage further complicates strategic planning.

Cybersecurity Threats and Data Protection Concerns

The expansion of digital insurance services exposes platforms to increasing cybersecurity threats and data breach risks that can undermine consumer confidence and operational stability. Insurtech companies must continuously invest in security infrastructure, implement robust data protection measures, and maintain compliance with privacy regulations. The absence of comprehensive cybersecurity legislation creates uncertainty regarding liability and response protocols.

Competitive Landscape:

The Mexico insurtech market exhibits a dynamic competitive environment characterized by diverse participants across the insurance value chain including digital-first startups, technology enablers, and traditional insurers embracing digital transformation. Competition is intensifying as market participants seek to differentiate through innovative product offerings, superior user experiences, and efficient distribution models. Technology enablers providing solutions for digitizing traditional intermediation, claims management, and fraud detection are gaining prominence. Strategic partnerships between insurtech companies and established insurers are reshaping competitive dynamics, enabling collaborative approaches that combine technological innovation with regulatory expertise and distribution reach. International insurtech companies are increasingly attracted to the Mexican market, contributing additional competitive pressure while introducing best practices from developed markets. The competitive landscape rewards platforms demonstrating sustainable business models, strong customer retention, and effective risk management capabilities.

Recent Developments:

- In October 2025, HDI Seguros partnered with insurtech Zuru to expand Mexico’s cargo insurance market, leveraging AI for predictive risk monitoring, route tracking, and preventive risk management. The alliance aims to triple premium volumes amid growing e‑commerce demand, enhancing security, digitalization, and operational efficiency in logistics.

Mexico Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico insurtech market size was valued at USD 162.51 Million in 2025.

The Mexico insurtech market is expected to grow at a compound annual growth rate of 30.22% from 2026-2034 to reach USD 1,749.85 Million by 2034.

The health segment held the largest market share, supported by rising demand for affordable digital medical coverage, increased out-of-pocket healthcare spending, and growing adoption of telemedicine and wellness-based insurance solutions among underserved consumer groups.

Key factors driving the Mexico insurtech market include expanding digital infrastructure and connectivity, rising venture capital investment and strategic partnerships between startups and traditional insurers, growing healthcare coverage gaps driving demand for affordable digital solutions, and increasing consumer adoption of technology-enabled insurance services.

Major challenges include limited insurance penetration and cultural barriers, regulatory complexity and compliance requirements across multiple oversight bodies, cybersecurity threats and data protection concerns, high customer acquisition costs, legacy system integration difficulties, and ongoing need for consumer education regarding digital insurance benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)