Mexico Intravenous Solution Market Size, Share, Trends and Forecast by Type, Nutrients, and Region, 2025-2033

Mexico Intravenous Solution Market Overview:

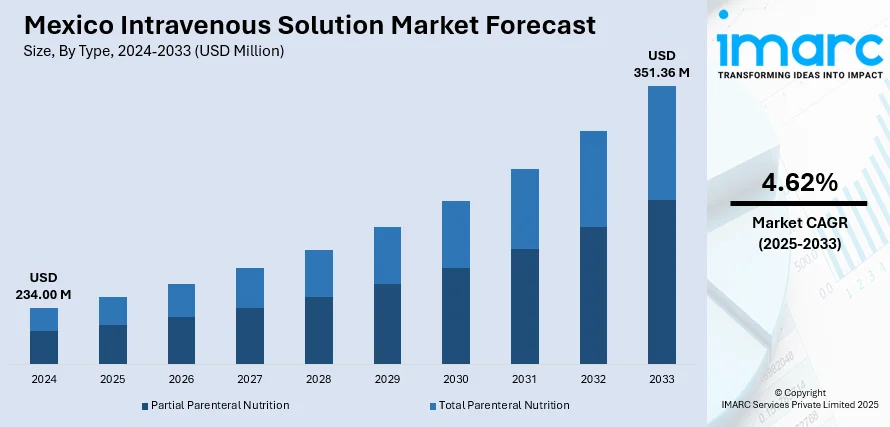

The Mexico intravenous solution market size reached USD 234.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 351.36 Million by 2033, exhibiting a growth rate (CAGR) of 4.62% during 2025-2033. The market is being driven by factors such as the increasing prevalence of chronic diseases, the aging population, advancements in IV therapy technology, growing healthcare infrastructure, government initiatives to improve healthcare access, and the rise of home healthcare services requiring efficient and safe IV fluid administration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 234.00 Million |

| Market Forecast in 2033 | USD 351.36 Million |

| Market Growth Rate 2025-2033 | 4.62% |

Mexico Intravenous Solution Market Trends:

Growing Prevalence of Chronic Diseases and Medical Conditions

The rising incidences of chronic diseases like diabetes, high blood pressure, and cancer in Mexico have contributed to the expansion of the intravenous (IV) solution market. Chronic diseases tend to continue for years, and patients with chronic diseases commonly require intravenous solutions for hydration, administration of nutrients, and medicines. For example, diabetes patients might need IV solutions to maintain electrolyte balance and regulate glucose levels, whereas cancer patients who are going through chemotherapy would need IV fluids to fight off dehydration and deal with side effects such as nausea. Moreover, the surging population of geriatrics in Mexico, which is also more prone to chronic diseases, further drives demand for intravenous solutions. This demographic change results in more hospital admissions and longer treatment periods, necessitating regular use of IV solutions. The growing prevalence of chronic diseases creates a demand for a steady supply of IV fluids, which fuels the market, with hospitals and healthcare providers having to maintain a sufficient inventory of different IV solutions for the treatment of their patients.

Technological Advancements in IV Therapy Delivery Systems

Improvements in medical technology have been key drivers of the development of the Mexican IV solution market. Improved and easier-to-use IV delivery systems, like infusion pumps and closed-loop delivery systems, have enabled more accurate and controlled delivery of intravenous solutions. The new delivery systems mitigate the potential for human error, improve patient safety, and overall treatment outcomes. For instance, today's infusion pumps come equipped with features such as rate control, monitoring, and alarms for any anomaly, which make IV therapy much more efficient. As Mexican healthcare institutions are widely embracing such technological advancements, the need for compatible IV solutions have increased. Clinics and hospitals are spending on advanced infusion devices to enhance patient care, which means more usage of IV fluids. In addition, these advances in technology address more therapeutic areas, such as pediatrics, oncology, and intensive care units, in which accurate IV delivery is imperative. The transition towards digital and automated IV delivery systems has fostered the latest surge in demand for intravenous solutions for Mexico's healthcare industry.

Mexico Intravenous Solution Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and nutrients.

Type Insights:

- Partial Parenteral Nutrition

- Total Parenteral Nutrition

The report has provided a detailed breakup and analysis of the market based on the type. This includes partial parenteral nutrition and total parenteral nutrition.

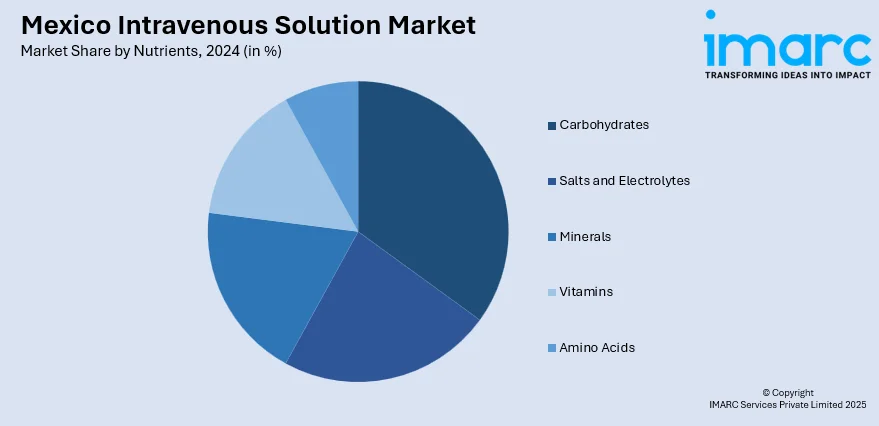

Nutrients Insights:

- Carbohydrates

- Salts and Electrolytes

- Minerals

- Vitamins

- Amino Acids

A detailed breakup and analysis of the market based on the nutrients have also been provided in the report. This includes carbohydrates, salts and electrolytes, minerals, vitamins, and amino acids.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Intravenous Solution Market News:

- December 2023: The Government of Mexico inaugurated a 40,000-square-meter centralized "super pharmacy" in Huehuetoca, Mexico, aiming to resolve nationwide medication shortages. This facility is designed to supply hospitals with essential medicines, including intravenous (IV) solutions, within 24 to 48 hours via the armed forces or the state-run pharmaceutical company Birmex.

- July 2023: General Atlantic invested up to USD 160 million in MAC Hospitals to expand affordable healthcare access across Mexico. This partnership enables MAC Hospitals to develop new facilities, enhance technology infrastructure, and improve service offerings. The expansion of healthcare services, including intravenous therapies, is driving demand for medical supplies and equipment, positively impacting the intravenous solution market in Mexico.

Mexico Intravenous Solution Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Partial Parenteral Nutrition, Total Parenteral Nutrition |

| Nutrients Covered | Carbohydrates, Salts and Electrolytes, Minerals, Vitamins, Amino Acids |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico intravenous solution market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico intravenous solution market on the basis of type?

- What is the breakup of the Mexico intravenous solution market on the basis of nutrients?

- What is the breakup of the Mexico intravenous solution market on the basis of region?

- What are the various stages in the value chain of the Mexico intravenous solution market?

- What are the key driving factors and challenges in the Mexico intravenous solution market?

- What is the structure of the Mexico intravenous solution market and who are the key players?

- What is the degree of competition in the Mexico intravenous solution market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico intravenous solution market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico intravenous solution market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico intravenous solution industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)