Mexico Iron Ore Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Mexico Iron Ore Market Overview:

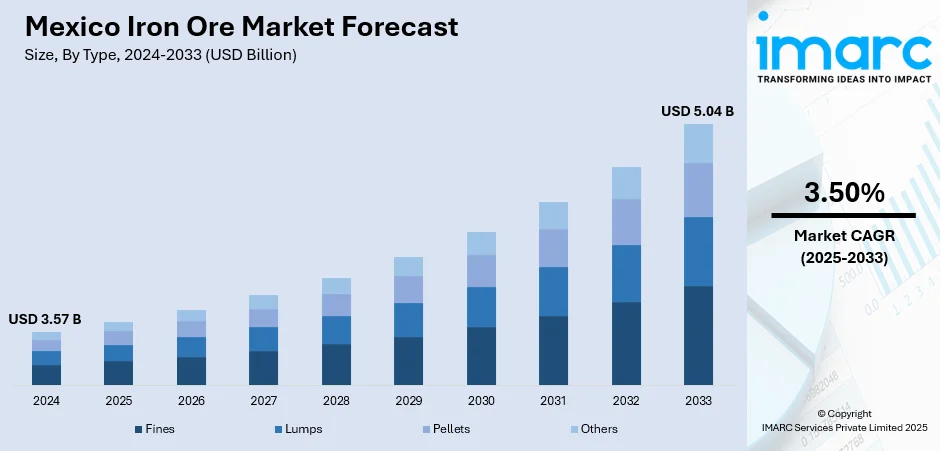

The Mexico iron ore market size reached USD 3.57 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.04 Billion by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The market is fueled by high domestic demand from the developing steel production industry. Additionally, a rise in investments for infrastructure growth and construction activities also drives demand for steel, which is contributing immensely towards consuming enormous amount of iron ore. Furthermore, the nation's proximity to significant trading partners such as the United States and the global transition to more efficient mining equipment further increases the Mexico iron ore market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.57 Billion |

| Market Forecast in 2033 | USD 5.04 Billion |

| Market Growth Rate 2025-2033 | 3.50% |

Mexico Iron Ore Market Trends:

Rising Domestic Steel Production Demand

The market is significantly influenced by the growing demand for steel, driven by expansion in sectors such as automotive manufacturing, construction, and infrastructure. Mexico's steel sector is among the largest in Latin America and depends heavily on iron ore as a major raw material. In April 2025, the Mexican government introduced an extensive infrastructure development plan, allocating over MXN 620 Billion (around USD 36.7 Billion) to enhance its energy and transportation networks. This large-scale public initiative underscores the country's commitment to accelerating infrastructure growth. These infrastructure upgrades are expected to drive increased demand for steel, which is crucial for the construction of transportation, energy, and public works projects. Apart from this, the automotive sector's robust growth is a notable contributor, with Mexico becoming a major hub for car manufacturing, particularly for major global automakers. This demand for steel, in turn, drives the need for iron ore, with domestic steel producers increasing production to meet both local and international market needs. As a result, iron ore supply chains are becoming increasingly integrated within the country, pushing the domestic market for iron ore to new heights. In addition, the move towards higher-value steel products that demand iron ore grades further propels the demand for local ore.

To get more information on this market, Request Sample

Increasing Export Potential to the United States

Mexico's geographical location has positioned it as a strategic market in the North American iron ore supply chain. According to industry reports, Mexico exported USD 36.7 Million of iron ore in 2023, and the country estimates that iron ore exports will be USD 44.7 Million in 2025. Other than this, the United States is a major importer of iron ore, mainly to supply its steel-producing factories, most of which are near the border or near Mexico. This is positively impacting the Mexico iron ore market growth. Moreover, the North American Free Trade Agreement (NAFTA) and the United States-Mexico-Canada Agreement (USMCA) facilitate trade between the two nations, promoting the export of iron ore from Mexico. Mexico has made itself a prominent exporter to the U.S. by utilizing its cost-effective manufacturing practices, such as upgrading mining operations and increasing efficiency in operations. This enhanced export potential results in the rising number of mining ventures in Mexico's northern regions with easy access to U.S. markets. In addition, iron ore producers in Mexico are intensifying efforts to expand capacity and enhance transport networks to provide a steady and consistent supply to satisfy U.S. demand.

Mexico Iron Ore Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Fines

- Lumps

- Pellets

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fines, lumps, pellets, and others.

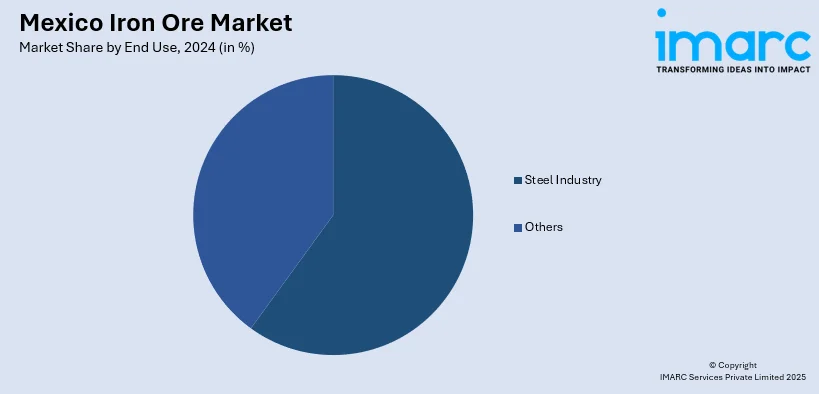

End Use Insights:

- Steel Industry

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes steel industry and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Iron Ore Market News:

- On September 24, 2024, the Mexican government announced stringent new regulations to verify the origin of iron ore exports, aiming to bolster the North American steel industry in collaboration with the United States. These measures mandate that export permits be directly linked to certified mineral reserves and production data, with a cap of 300,000 tonnes per calendar year, and require documentation from the Mexican Geological Service to confirm the ore's origin. The policy took effect 30 business days after publication in the Official Gazette, with certain provisions commencing on January 1, 2025.

Mexico Iron Ore Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fines, Lumps, Pellets, Others |

| End Uses Covered | Steel Industry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico iron ore market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico iron ore market on the basis of type?

- What is the breakup of the Mexico iron ore market on the basis of end use?

- What is the breakup of the Mexico iron ore market on the basis of region?

- What are the various stages in the value chain of the Mexico iron ore market?

- What are the key driving factors and challenges in the Mexico iron ore market?

- What is the structure of the Mexico iron ore market and who are the key players?

- What is the degree of competition in the Mexico iron ore market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico iron ore market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico iron ore market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico iron ore industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)