Mexico Juvenile Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2025-2033

Mexico Juvenile Products Market Overview:

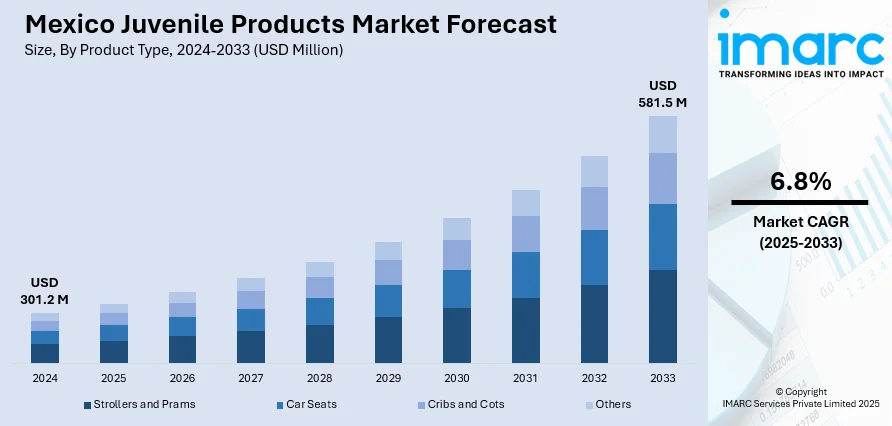

The Mexico juvenile products market size reached USD 301.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 581.5 Million by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. The market share is expanding, driven by the increasing birth rate, which is motivating companies to launch innovative items in the country, along with the rising need for high-quality and multifunctional products that offer safety and convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 301.2 Million |

| Market Forecast in 2033 | USD 581.5 Million |

| Market Growth Rate 2025-2033 | 6.8% |

Mexico Juvenile Products Market Trends:

Growing birth rate

The rising birth rate is fueling the Mexico juvenile products market growth. As per the World Population Review, in 2024, Mexico recorded 14.3 births for every 1000 women. As the newborn population increases each year, the demand for juvenile products is escalating. Parents and caregivers require several baby items, including diapers, food, clothing, toys, strollers, cribs, and car seats. This ongoing increase in demand is motivating companies to continue creating and delivering more styles and quality products. New parents often exhibit more willingness to spend on baby items that promote safety, comfort, and convenience to their children. As families grow, the market for products designed for infants and toddlers sees steady expansion. As a result of high birth rates, new baby product companies continue to enter the juvenile products industry, contributing to competition that enhances affordability and access to people. Healthcare providers and early education learning institutions also improve purchases related to juvenile products. Digital marketing platforms, as well as parenting webpages, continue to promote an assortment of juvenile items to new parents, collectively increasing sales.

Increasing number of working parents

The rising number of working parents is offering a favorable Mexico juvenile products market outlook. According to industry reports, in the third quarter of 2024, Mexico's economically active population reached 61.4 Million individuals. The labor force totaled 59.5 Million individuals (40.8% female and 59.2% male), with an average monthly wage of USD 6.26k MX. As more parents take up full-time jobs, they look for items that make childcare easier, more efficient, and time-saving. Products like baby monitors, bottle warmers, diaper bags, strollers, and automatic swings become essential for busy households. Working parents often seek high-quality and multifunctional products that offer safety and convenience, even if they cost more. This is driving the demand for premium and innovative items in the market. Daycare centers and babysitters also require reliable juvenile products, adding to overall usage. Time constraints lead parents to prefer ready-to-use baby food items, easy-to-clean gear, and digital tools to monitor their child’s health and activities. Online shopping also grows, as working parents prefer quick and easy ways to buy what they need. As dual-income families are becoming more common, the ability and willingness to spend on juvenile items is also increasing.

Mexico Juvenile Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and age group.

Product Type Insights:

- Strollers and Prams

- Car Seats

- Cribs and Cots

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes strollers and prams, car seats, cribs and cots, and others.

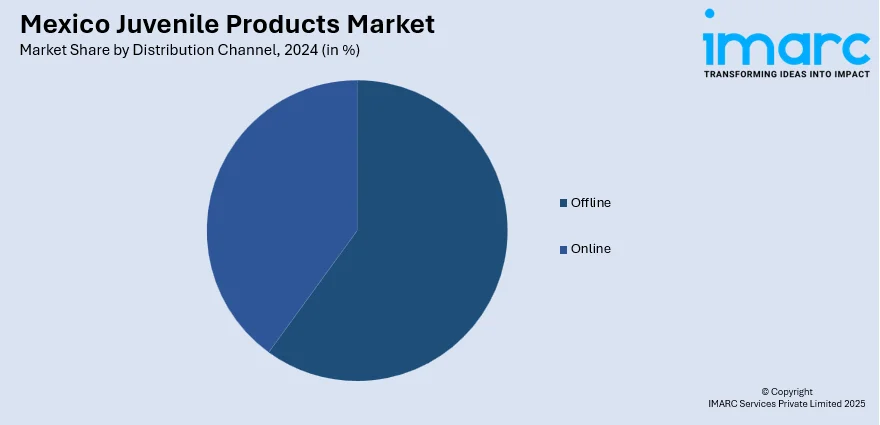

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Age Group Insights:

- 0-1 Year

- 2-4 Years

- 5-7 Years

- >8 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-1 year, 2-4 years, 5-7 years, and >8 years.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Juvenile Products Market News:

- In November 2024, Amazon Mexico announced two upcoming LEGO Star Wars sets, featuring another entry in the Starship Collection and a new Grogu that could be built. The items were 75403 Grogu with Hover Pram and 75404 Acclamator-class Assault Ship. At a price of £89.99, the customizable hover pram featured the well-known small blue alien frog character.

- In January 2024, WHP Global, a parent organization of Toys ‘R’ Us and Babies ‘R’ Us, teamed up with omnichannel retailer El Puerto de Liverpool to introduce Babies ‘R’ Us in Mexico. The upcoming brand’s locations and website in Mexico were set to offer a comprehensive selection of items, including baby necessities, nursery furnishings, toys, educational materials, and services tailored for new and expectant parents and families.

Mexico Juvenile Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Strollers and Prams, Car Seats, Cribs and Cots, Others |

| Distribution Channels Covered | Offline, Online |

| Age Groups Covered | 0-1 Year, 2-4 Years, 5-7 Years, >8 Years |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico juvenile products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico juvenile products market on the basis of product type?

- What is the breakup of the Mexico juvenile products market on the basis of distribution channel?

- What is the breakup of the Mexico juvenile products market on the basis of age group?

- What is the breakup of the Mexico juvenile products market on the basis of region?

- What are the various stages in the value chain of the Mexico juvenile products market?

- What are the key driving factors and challenges in the Mexico juvenile products market?

- What is the structure of the Mexico juvenile products market and who are the key players?

- What is the degree of competition in the Mexico juvenile products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico juvenile products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico juvenile products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico juvenile products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)