Mexico Kidswear Market Size, Share, Trends and Forecast by Gender, Category, Season, Sector, Sales Channel, and Region, 2026-2034

Mexico Kidswear Market Summary:

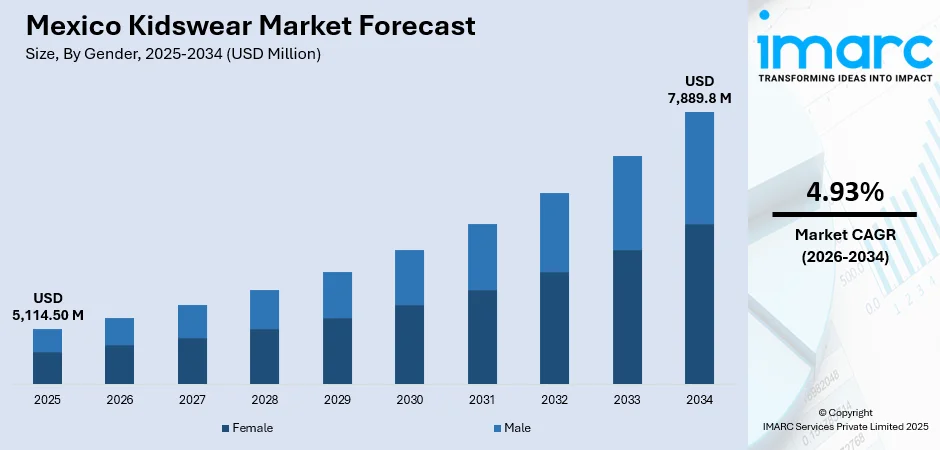

The Mexico kidswear market size was valued at USD 5,114.50 Million in 2025 and is projected to reach USD 7,889.8 Million by 2034, growing at a compound annual growth rate of 4.93% from 2026-2034.

The Mexico kidswear market is experiencing robust expansion driven by evolving consumer preferences, increasing urbanization, and the growing influence of global fashion trends on children's apparel. Parents across the country are increasingly prioritizing quality, comfort, and style when purchasing clothing for their children, while the proliferation of e-commerce platforms and organized retail channels has considerably improved product accessibility. The rising middle-class population, coupled with higher disposable incomes, continues to strengthen demand for diverse kidswear categories, contributing to the positive trajectory of the Mexico kidswear market share.

Key Takeaways and Insights:

-

By Gender: Female dominates the market with a share of 52% in 2025, owing to the extensive variety of fashion choices, greater emphasis on stylish designs for girls, and strong demand for dresses, skirts, and coordinated outfits. Cultural celebrations and school events further drive purchases in this segment.

-

By Category: T-Shirts/Shirts lead the market with a share of 22% in 2025, reflecting their versatility for everyday wear, affordability across income groups, and suitability for Mexico's predominantly warm climate. Easy maintenance and wide design variety enhance their appeal among parents.

-

By Season: Summer wear exhibits a clear dominance with a share of 46% in 2025, driven by Mexico's tropical and subtropical climate conditions requiring lightweight, breathable clothing throughout most of the year. Cotton-based fabrics dominate this segment due to comfort and skin-friendly properties.

-

By Sector: Organized sector represents the leading segment with 55% share in 2025, supported by the expansion of department stores, specialty retailers, and branded outlets offering consistent quality assurance, attractive store environments, and promotional campaigns that attract modern consumers.

-

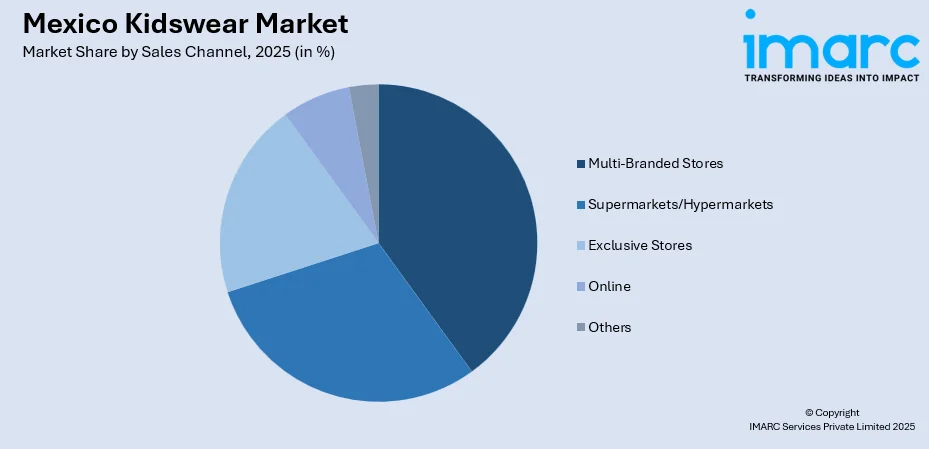

By Sales Channel: Multi-branded stores dominate the market with 30% share in 2025, benefiting from their ability to offer diverse brand selections under one roof, competitive pricing strategies, and convenient shopping experiences that appeal to time-conscious parents seeking variety.

-

By Region: Central Mexico is the biggest region with 42% share in 2025, driven by the concentration of Mexico's population in the metropolitan areas of Mexico City and surrounding states, higher purchasing power, and the presence of major retail infrastructure.

-

Key Players: Key players drive the Mexico kidswear market by expanding retail networks, enhancing product quality, and strengthening omnichannel distribution strategies. Their investments in sustainable materials, digital marketing, and partnerships with international brands boost consumer engagement and market penetration across diverse segments.

To get more information on this market Request Sample

The Mexico kidswear market continues to evolve alongside shifting demographic patterns and consumer behaviors that prioritize both functionality and fashion. Parents are increasingly influenced by social media platforms and digital content creators when making purchasing decisions for their children's wardrobes. The market benefits from Mexico's young population demographics, with families seeking age-appropriate, durable, and stylish clothing options. Retail sales in Mexico grew by 7.1% in 2024, with clothing and footwear representing 18.2% of total revenues among major retailers, reflecting the sector's significance within the broader retail landscape. The integration of e-commerce capabilities by traditional retailers has expanded market reach, while the entry of international fast-fashion brands has intensified competition and raised consumer expectations. Seasonal collections, character-licensed apparel, and school uniform requirements create consistent demand cycles throughout the year, supporting sustained market growth.

Mexico Kidswear Market Trends:

Digital Transformation and E-Commerce Expansion

The Mexico kidswear market is witnessing accelerated adoption of digital commerce platforms as parents increasingly prefer online shopping for convenience and variety. Major retailers have invested substantially in mobile applications and digital infrastructure to capture this growing segment. Leading department store chains have reported significant increases in active mobile-app users, with digital sales contributions rising consistently year-on-year. This digital shift enables parents to access extensive product catalogs, compare prices, and receive doorstep delivery, fundamentally transforming purchasing patterns in the children's apparel sector.

Growing Preference for Sustainable and Organic Clothing

Environmental consciousness among Mexican parents is driving demand for eco-friendly and sustainably produced children's clothing. Consumers are increasingly seeking garments made from organic cotton and non-toxic materials that are gentle on children's sensitive skin while minimizing environmental impact. The global organic kids clothes market continues experiencing robust expansion as awareness grows among health-conscious families. Major international brands operating in Mexico have responded by introducing organic cotton lines and implementing stricter chemical management policies to meet evolving consumer expectations.

Influencer Marketing and Social Media Engagement

Social media platforms have become instrumental in shaping purchasing decisions within the Mexico kidswear market. Influencer marketing emerged as essential for brands connecting with target audiences, representing a fundamental shift in how companies engage consumers in the digital age. Parents increasingly discover new brands, styles, and trends through digital content creators and family-focused social media accounts. This evolution has prompted retailers to allocate significant marketing budgets toward digital campaigns, collaborations with parenting influencers, and interactive content that resonates with modern Mexican families.

Market Outlook 2026-2034:

The Mexico kidswear market outlook remains positive as consumer spending power strengthens and retail infrastructure continues expanding across the country. The market generated a revenue of USD 5,114.50 Million in 2025 and is projected to reach a revenue of USD 7,889.8 Million by 2034, growing at a compound annual growth rate of 4.93% from 2026-2034. Innovation in fabric technologies, expansion of sustainable product lines, and enhanced omnichannel retail experiences will characterize market evolution. The organized retail sector's continued investment in store networks and digital capabilities positions the market for sustained growth, while international brand partnerships introduce fresh design perspectives.

Mexico Kidswear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Gender | Female | 52% |

| Category | T-Shirts/Shirts | 22% |

| Season | Summer Wear | 46% |

| Sector | Organized Sector | 55% |

| Sales Channel | Multi Branded Stores | 30% |

| Region | Central Mexico | 42% |

Gender Insights:

- Female

- Male

Female dominates with a market share of 52% of the total Mexico kidswear market in 2025.

The female segment's leadership in Mexico's kidswear market reflects the extensive variety of fashion options available for girls, ranging from everyday casual wear to occasion-specific dresses and coordinated outfits. Parents demonstrate heightened willingness to invest in stylish, trendy clothing for daughters, influenced by social media platforms showcasing children's fashion trends and celebrity-inspired styles. The segment benefits from broader design possibilities including dresses, skirts, leggings, blouses, and accessories that encourage multiple purchases and wardrobe coordination, driving higher average transaction values compared to boys' apparel.

Cultural celebrations, quinceañera preparations for older children, and school events create additional demand occasions within this segment throughout the year. Mexican families traditionally place significant emphasis on presenting daughters in fashionable attire during social gatherings, religious ceremonies, and family events. Department stores like Liverpool and Suburbia dedicate substantial floor space to girls' apparel sections, recognizing the segment's commercial importance and offering diverse collections from international fast-fashion chains and domestic brands catering to varying price points and style preferences.

Category Insights:

- Uniforms

- T-Shirts/Shirts

- Bottom Wear

- Ethnic Wear

- Dresses

- Denims

- Others

T-Shirts/Shirts lead with a share of 22% of the total Mexico kidswear market in 2025.

T-shirts/shirts maintain their position as the most purchased category due to their versatility, affordability, and suitability across various occasions from school to playtime and family outings. Mexico's predominantly warm climate creates year-round demand for comfortable, breathable tops that allow children freedom of movement during active play. Character-licensed t-shirts featuring popular animated characters, superheroes, and sports themes particularly resonate with young consumers and their parents, driving impulse purchases and brand loyalty from an early age.

The category benefits from accessible price points that encourage frequent replacement as children grow rapidly, along with easy care requirements that appeal to busy working parents managing household responsibilities. Retailers offer extensive selections ranging from basic cotton tees to premium branded options, catering to diverse budget considerations across income segments. Fast-fashion chains like Zara Kids and H&M regularly refresh their t-shirt collections with seasonal designs, introducing new prints and styles that maintain consumer interest and drive repeat purchases throughout the calendar year.

Season Insights:

- Summer Wear

- Winter Wear

- All Season Wear

Summer wear dominates the market with a 46% share of the total Mexico kidswear market in 2025.

Mexico's geographic location results in predominantly warm temperatures across most regions throughout the year, driving sustained demand for lightweight, breathable summer wear that keeps children comfortable during daily activities. Cotton fabrics remain the preferred choice among Mexican parents due to their exceptional comfort, hypoallergenic properties suitable for sensitive skin, and ease of washing after frequent use. The segment encompasses shorts, sleeveless tops, light dresses, rompers, and casual wear specifically designed for optimal comfort during extended warm seasons.

Summer vacation periods generate additional demand as families prepare children's wardrobes for travel destinations, beach visits, and outdoor recreational activities. Bright colors, playful prints, and traditional Mexican design elements featuring vibrant hues remain popular choices that reflect the country's rich cultural heritage and festive spirit. Retailers strategically time promotional campaigns around school break periods and holiday seasons, offering attractive discounts on summer collections to capitalize on heightened purchasing activity when parents refresh their children's seasonal wardrobes.

Sector Insights:

- Organized Sector

- Unorganized Sector

Organized sector exhibits a clear dominance with a 55% share of the total Mexico kidswear market in 2025.

The organized retail sector's prominence reflects Mexico's evolving retail landscape characterized by expanding department store networks, specialty children's retailers, and branded outlets offering curated shopping experiences. Major retail groups have invested significantly in infrastructure development, with leading industry associations driving substantial job creation and capital allocation primarily for store expansions, renovations, and new openings across urban and suburban markets. These substantial investments enhance shopping experiences through modern store formats, improved customer service standards, and technology-enabled conveniences that attract discerning consumers.

Organized retailers offer quality assurance, flexible return policies, and loyalty programs that build consumer confidence in purchasing children's apparel from trusted establishments. The sector's ability to maintain consistent inventory levels, provide accurate size guidance, and offer authenticated branded options distinguishes it from unorganized alternatives prevalent in traditional markets. International brands entering Mexico through organized retail partnerships have elevated product standards and consumer expectations regarding quality, design innovation, and shopping experience, further strengthening this sector's dominant market position.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Exclusive Stores

- Multi-Branded Stores

- Online

- Others

Multi-branded stores represent the leading segment with a 30% share of the total Mexico kidswear market in 2025.

Multi-branded stores dominate the sales channel landscape by offering diverse product selections from multiple brands under one roof, providing convenience-oriented shopping experiences that appeal to time-conscious parents seeking efficiency. Department stores like Liverpool, El Palacio de Hierro, and Suburbia exemplify this format, featuring extensive children's sections stocked with domestic and international brands across price categories. This channel allows consumers to compare products, styles, and prices efficiently within a single shopping trip, reducing time and transportation costs.

These retail formats benefit from established customer trust built over decades, accessible credit facilities enabling installment payments, and comprehensive after-sales services that enhance purchasing confidence among families. Promotional events, seasonal sales, and loyalty program benefits create additional value propositions attracting repeat customers throughout the year. The integration of e-commerce capabilities by major multi-branded retailers has significantly extended their market reach, enabling customers to browse online catalogs, check inventory availability, and collect purchases in-store, further strengthening this channel's competitive position.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico holds the largest share with 42% of the total Mexico kidswear market in 2025.

Central Mexico's market leadership stems from the concentration of Mexico's population in the metropolitan areas surrounding Mexico City, including the State of Mexico, Puebla, Querétaro, and Morelos. The region hosts the country's largest consumer base with higher average household incomes, greater urbanization rates, and increased exposure to international fashion trends through media and retail presence. Dense retail infrastructure ensures extensive product availability through department stores, modern shopping malls, specialty retailers, and flagship brand locations catering to diverse consumer preferences.

The region benefits from superior logistics networks enabling efficient distribution and rapid inventory replenishment to meet consumer demand consistently throughout the year. Major retailers prioritize Central Mexico for flagship store openings, premium brand launches, and pilot programs testing new retail concepts, recognizing the market's commercial significance and trendsetting influence. International fast-fashion giants maintain substantial store concentration in the central region, demonstrating global brands' strategic focus on this high-potential market area characterized by sophisticated consumer preferences and strong purchasing power.

Market Dynamics:

Growth Drivers:

Why is the Mexico Kidswear Market Growing?

Rising Disposable Income and Middle-Class Expansion

The expansion of Mexico's middle class has substantially increased household purchasing power, enabling greater expenditure on quality children's clothing that meets both functional and aesthetic requirements. Economic stability and sustained employment growth have created favorable conditions for discretionary spending on apparel across income segments. The fashion sector has demonstrated consistent performance as families allocate increasing portions of their budgets toward children's wardrobes, reflecting the growing importance of kidswear within household expenditure priorities. Parents demonstrate willingness to invest in durable, stylish clothing that offers value beyond basic functionality, driving premiumization trends within the market. Dual-income households particularly contribute to elevated spending patterns as both parents actively participate in purchasing decisions for children's wardrobes, seeking quality garments that reflect family values and social aspirations.

E-Commerce and Digital Retail Transformation

Digital commerce platforms have revolutionized how Mexican families shop for children's clothing, offering unprecedented convenience and product variety that traditional retail channels cannot match. The proliferation of smartphones and improving internet connectivity have accelerated online shopping adoption across demographic segments throughout the country. Internet penetration reached 83.2% of residents aged six or older in 2024, while 107.3 Million internet users access online shopping platforms through smartphones and computers. Expanding digital payment acceptance among retail merchants has facilitated seamless online transactions, removing friction from the purchasing journey and encouraging first-time digital buyers. E-commerce enables parents to browse extensive catalogs, compare prices across multiple retailers, read customer reviews, and access exclusive online promotions from the comfort of their homes. Major retailers have responded by developing sophisticated mobile applications and integrated omnichannel experiences that blur distinctions between physical and digital shopping environments, meeting evolving consumer expectations.

Organized Retail Sector Expansion

The systematic expansion of organized retail infrastructure has transformed product accessibility and consumer expectations within Mexico's kidswear market significantly. Department stores, specialty retailers, and shopping centers continue investing in new locations across urban and suburban areas to capture growing consumer demand. Major retail association members have demonstrated strong commitment to market development through consistent store launches, with particular emphasis on specialty retail locations serving family-oriented consumers. This expansion brings branded children's apparel to previously underserved markets while elevating shopping experiences through modern store designs, professionally trained staff, and comprehensive product assortments. International brand entry through organized retail partnerships introduces global fashion trends to Mexican consumers, raising quality standards and design expectations across the broader market landscape.

Market Restraints:

What Challenges the Mexico Kidswear Market is Facing?

Declining Birth Rate and Demographic Shifts

Mexico's declining birth rate presents a structural challenge for the kidswear market as the target consumer population gradually shrinks. Changing family planning preferences and urbanization have contributed to smaller household sizes, reducing the overall addressable market for children's apparel. Retailers must adapt strategies to extract greater value from a contracting consumer base.

Intense Competition from Fast Fashion and Unorganized Retailers

Price-sensitive consumers increasingly gravitate toward affordable options offered by fast-fashion chains and unorganized market vendors selling budget-friendly alternatives. This competitive pressure compresses margins for established retailers and limits pricing power across market segments. The proliferation of imported low-cost apparel from Asian manufacturing hubs challenges domestic manufacturers and premium-positioned brands seeking market differentiation.

Inflationary Pressures on Consumer Spending

Rising prices across consumer goods categories have significantly affected household budgets, prompting prioritization of essential expenditures over discretionary purchases like apparel. Families increasingly seek value-oriented options, discount sales, and promotional opportunities when purchasing children's clothing to maximize limited resources. Economic uncertainty and currency fluctuations drive cautious spending behaviors that negatively impact premium segment growth.

Competitive Landscape:

The Mexico kidswear market exhibits a competitive structure characterized by the presence of international fast-fashion retailers, domestic department stores, and specialty children's clothing brands. Major players compete through product differentiation, pricing strategies, and omnichannel distribution capabilities. Market participants invest in digital transformation, sustainable product development, and customer loyalty programs to strengthen competitive positions. Partnerships between Mexican retailers and global brands introduce diverse product offerings while localized merchandising strategies address regional preferences. Private label development enables retailers to offer exclusive options at competitive price points, while character licensing agreements with entertainment properties drive consumer engagement.

Mexico Kidswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Genders Covered | Female, Male |

| Categories Covered | Uniforms, T-Shirts/Shirts, Bottom Wear, Ethnic Wear, Dresses, Denims, Others |

| Seasons Covered | Summer Wear, Winter Wear, All Season Wear |

| Sectors Covered | Organized Sector, Unorganized Sector |

| Sales Channel Covered | Supermarkets/Hypermarkets, Exclusive Stores, Multi-Branded Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico kidswear market size was valued at USD 5,114.50 Million in 2025.

The Mexico kidswear market is expected to grow at a compound annual growth rate of 4.93% from 2026-2034 to reach USD 7,889.8 Million by 2034.

Female dominates the market with a share of 52%, driven by extensive fashion variety, greater emphasis on stylish designs for girls, and strong demand for dresses, skirts, and coordinated outfits.

Key factors driving the Mexico kidswear market include rising disposable incomes, expanding middle-class population, e-commerce growth, organized retail sector expansion, and increasing consumer preference for quality branded children's apparel.

Major challenges include declining birth rates affecting target consumer population, intense competition from fast-fashion and unorganized retailers, inflationary pressures on consumer spending, and economic uncertainties impacting discretionary purchases.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)