Mexico Kitchen Fittings Market Size, Share, Trends and Forecast by Product Type, Material, Distribution Channel, End User, and Region, 2025-2033

Mexico Kitchen Fittings Market Overview:

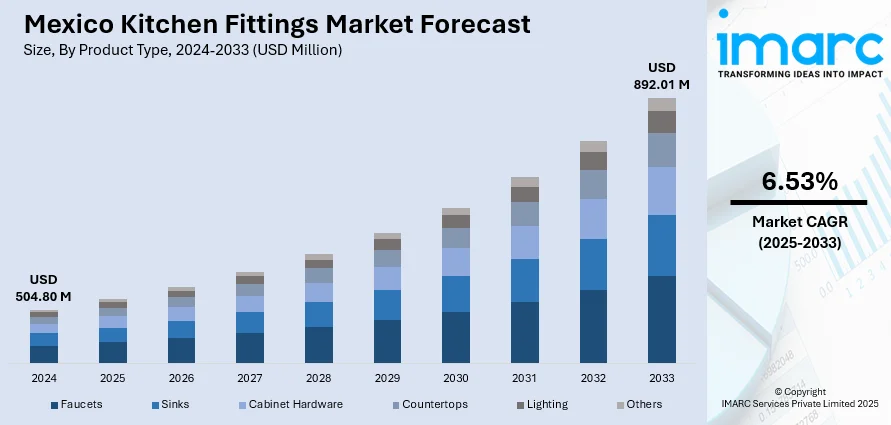

The Mexico kitchen fittings market size reached USD 504.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 892.01 Million by 2033, exhibiting a growth rate (CAGR) of 6.53% during 2025-2033. The market is fueled by urbanization and lifestyle changes which have generated higher demand for space-saving, modern kitchen solutions. Increased demand in home cooking, driven by culinary trends and cultural food traditions on a global scale, has also driven the demand for premium kitchen fittings that aim to improve culinary experiences. Economic considerations, including increased disposable incomes and emerging middle class, have enabled consumers to invest in premium kitchen fittings that balance functionality, durability, and aesthetics, which collectively contributes to the Mexico kitchen fittings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 504.80 Million |

| Market Forecast in 2033 | USD 892.01 Million |

| Market Growth Rate 2025-2033 | 6.53% |

Mexico Kitchen Fittings Market Trends:

Embracing Modular Kitchen Designs

Mexico's market for kitchen fittings is witnessing a major transformation toward embracing modular kitchen designs. This is influenced by the rising need for space-saving and customizable solutions, especially in urban environments where space is scarce. According to the IMARC Group, the Mexico modular kitchens market size reached USD 468.48 Million in 2024, and is further expected to reach USD 720.60 Million by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. Modular kitchens provide flexibility, enabling homeowners to customize their kitchen designs in accordance with their individual needs and desires. The fact that one can combine and interchange elements like cabinets, countertops, and storage units makes it possible to have a customized kitchen design. Moreover, modular kitchens are typically intended with contemporary looks in mind, and this makes them appealing to consumers who want modern and fashionable interior spaces. Additionally supporting the trend is Mexico's growing middle class, which has a greater capacity to spend on home renovations. Consequently, the Mexican modular kitchen market is set for further growth as part of a wider trend toward custom and convenient home solutions.

To get more information on this market, Request Sample

Sustainability and Eco-Friendly Materials

Sustainability is becoming an important factor in the Mexican kitchen fittings market. Shoppers today are environmentally conscious and looking for products that match their values. This has prompted an increase in demand for kitchen fittings produced from environmentally friendly materials like recycled wood, bamboo, and other renewable resources. Manufacturers have been quick to respond by integrating these materials into their products, allowing consumers to make green choices without trading off quality or design. Besides the use of sustainable materials, focus on energy-efficient appliances and low-flow water fixtures is also gaining attention, reinforcing the overall green design of kitchens. This trend is compelled not only by consumer behavior but also by regulatory efforts encouraging green practices. With sustainability becoming ever more important to most consumers, the kitchen fittings industry in Mexico is accommodating these demands to become a more sustainable and environmentally friendly industry, which further contributes to the Mexico kitchen fittings market growth.

Adoption of Smart Technology

One notable trend in Mexico is the integration of smart technology into kitchen fixtures. Customers are searching for kitchen solutions that offer convenience, effectiveness, and connectivity as smart homes gain popularity. Touchless faucets, sensor-operated lighting, and appliances managed by smartphone apps are examples of intelligent kitchen fixtures that are growing in popularity. In addition to making the kitchen more functional, these technological developments also contribute to energy conservation and increased user convenience. The proliferation of smart devices in Mexican homes and the wider availability of high-speed internet are additional factors contributing to the rise in popularity of smart technology. The demand for smart kitchen appliances is expected to rise as people get more accustomed to connected living, which will push manufacturers to produce and deliver increasingly complex and cohesive solutions. It represents a shift in Mexico toward more technologically advanced and user-friendly kitchen areas.

Mexico Kitchen Fittings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material, distribution channel, and end user.

Product Type Insights:

- Faucets

- Sinks

- Cabinet Hardware

- Countertops

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes faucets, sinks, cabinet hardware, countertops, lighting, and others.

Material Insights:

- Stainless Steel

- Brass

- Ceramic

- Glass

- Wood

- Others

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes stainless steel, brass, ceramic, glass, wood, and others.

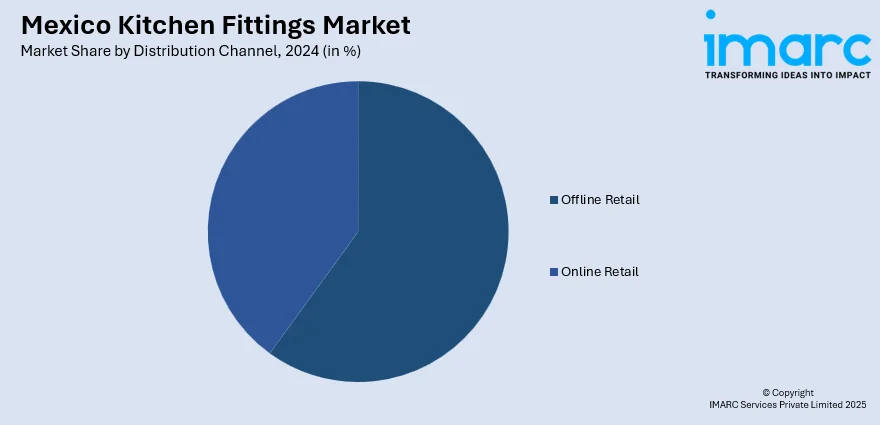

Distribution Channel Insights:

- Offline Retail

- Online Retail

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes offline retail and online retail.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Kitchen Fittings Market News:

- In August 2024, the top home appliance manufacturer in Europe, BSH Hausgeräte GmbH, declared that it will begin its manufacturing in Mexico as part of its global production network expansion. Large double-door refrigerators known as French Door Bottom Mount refrigerators are now being produced in Monterrey, Nuevo Leon. The appliances manufactured under the Bosch and Thermador brands are specifically designed to meet the demands of North American consumers. BSH is marking a significant turning point in its strategic growth objectives on the continent of North America with the opening of its first factory in Mexico.

Mexico Kitchen Fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Faucets, Sinks, Cabinet Hardware, Countertops, Lighting, Others |

| Materials Covered | Stainless Steel, Brass, Ceramic, Glass, Wood, Others |

| Distribution Channels Covered | Offline Retail, Online Retail |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico kitchen fittings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico kitchen fittings market on the basis of product type?

- What is the breakup of the Mexico kitchen fittings market on the basis of material?

- What is the breakup of the Mexico kitchen fittings market on the basis of distribution channel?

- What is the breakup of the Mexico kitchen fittings market on the basis of end user?

- What is the breakup of the Mexico kitchen fittings market on the basis of region?

- What are the various stages in the value chain of the Mexico kitchen fittings market?

- What are the key driving factors and challenges in the Mexico kitchen fittings market?

- What is the structure of the Mexico kitchen fittings market and who are the key players?

- What is the degree of competition in the Mexico kitchen fittings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico kitchen fittings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico kitchen fittings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico kitchen fittings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)