Mexico Kitchenware Market Size, Share, Trends, and Forecast by Product, Material, Distribution Channel, End User, and Region, 2025-2033

Mexico Kitchenware Market Size and Share:

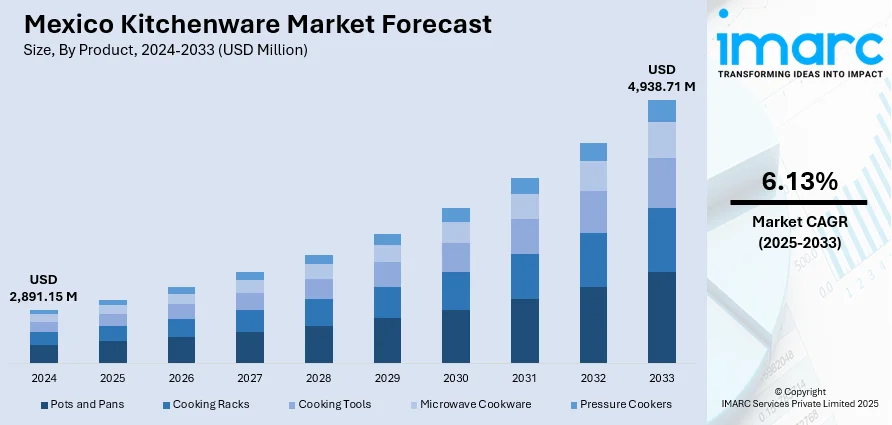

The Mexico kitchenware market size was valued at USD 2,891.15 Million in 2024. Looking forward, the market is expected to reach USD 4,938.71 Million by 2033, exhibiting a CAGR of 6.13% during 2025-2033. The market is witnessing steady growth driven by increasing consumer interest in cooking and home improvement. Rising disposable incomes, along with the growing trend for modern kitchen designs, are boosting demand for innovative and high-quality kitchen products. E-commerce platforms are enhancing accessibility, resulting in significant growth in the Mexico kitchenware market share across both urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,891.15 Million |

| Market Forecast in 2033 | USD 4,938.71 Million |

| Market Growth Rate 2025-2033 | 6.13% |

The market is experiencing a stable growth, owing to a conglomeration of demographic, economic, and lifestyle factors. The increasing disposable income and urbanization trends are pushing households to purchase new and upscale kitchenware products, which are modern and durable and have more functions. With the trend towards home cooking that has been driven by culinary programs, social media, and the health-conscious movement, there has been an explosion in the demand for high-quality cookware, utensils, and kitchen tools among Mexican consumers. The tendency is also justified by the increase in awareness of nutritious food and the need to have a personalized cooking experience, and therefore, consumers are keen on stocking their kitchens with multitasking and effective products.

The expansion of the foodservice sector, including restaurants, hotels, and catering businesses, is another key driver driving the Mexico kitchenware market trends. Commercial kitchens require specialized, high-durability kitchenware to meet the demands of professional cooking, food safety, and efficiency. This has helped boost sales of high-quality and specialty products in the urban and semi-urban areas. Also, more types of kitchenware have become accessible to Mexican consumers due to the emergence of e-commerce and online retailers. Through online channels, it is easy to compare and review, and access domestic and international brands, which increases the rate of market penetration. The distribution of retail stores via hypermarkets, supermarkets, and specialty shops also achieves mass distribution to the various consumer markets. Market growth is further supported by consumer preference for the quality of materials used, like stainless steel, aluminum, and glass, and the need to have multifunctional and aesthetically appealing designs.

Mexico Kitchenware Market Trends:

Rising Interest in Cooking

Increased interest in cooking at home in Mexico is being driven by social media food trends and a wider cultural shift toward culinary exploration. Social media platforms such as Instagram and YouTube have provided a new generation of home cooks with access to new recipes and techniques, leading them to spend money on good kitchenware. According to the World Population Review, the number of individuals using Instagram in Mexico reached 48.9 Million in 2024. Of these, women accounted for 54.9% while men accounted for 45.1%. As home cooking becomes increasingly popular as both a hobby and lifestyle preference among consumers, sales of kitchen tools, gadgets, and cookware have increased. This also stems from a need to prepare healthier meals and discover new culinary traditions, fueling overall growth in sales of kitchenware. Consequently, the Mexico kitchenware market continues to expand, demonstrating a trend towards more home-based dining experiences.

To get more information on this market, Request Sample

Increasing Focus on Sustainability

In Mexico, the consumer trend is toward environmentalism in the kitchenware sector. Customers are now shopping for products made from sustainable materials like bamboo, stainless steel, and recycled plastics. As per industry reports, 54% of consumers in Mexico prioritize sustainability while making purchases. This is motivated by increased awareness about the environment and the need to avoid waste, with most consumers preferring items that last long, can be reused, and have no chemicals that are harmful to humans and the environment. Brands are answering back by innovating with sustainable solutions that not only resonate with the increasing environmentally aware consumer base but also with international sustainability trends. The demand for greener alternatives is boosting the Mexico kitchenware market growth, as consumers make more environmentally responsible purchasing decisions. This trend is likely to shape the future of the market as sustainability becomes a central value in product design and marketing.

Growing Demand for Premium and Aesthetic Designs

In Mexico, there is a growing demand for premium kitchenware that combines both high-quality performance and stylish designs. Consumers are no longer just looking for functionality; they want kitchen tools and appliances that enhance the overall aesthetic of their kitchen spaces. This trend is particularly prevalent among urban dwellers who seek to create a modern, sophisticated kitchen environment. Brands are responding by offering sleek, well-designed cookware, utensils, and appliances made from durable materials such as stainless steel, copper, and high-grade ceramics. For instance, in May 2023, Tramontina, a renowned manufacturer of kitchenware headquartered in Brazil, announced plans to establish a production facility in Mexico to better meet consumer demand for high-quality kitchenware. These products not only promise superior performance but also contribute to the kitchen's visual appeal. As the demand for premium and aesthetically pleasing kitchenware grows, it is driving innovation and higher-end offerings in the market.

Mexico Kitchenware Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Mexico kitchenware market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product, material, distribution channel, and end user.

Analysis by Product:

- Pots and Pans

- Cooking Racks

- Cooking Tools

- Microwave Cookware

- Pressure Cookers

Pots and pans are expected to hold a significant share in the market as they form the core of everyday cooking. Consumers prioritize durability, heat distribution, and ease of cleaning, making these products essential in both residential and commercial kitchens. Rising interest in home cooking, diverse culinary practices, and international cuisines further drive demand for versatile cookware. Premium materials such as stainless steel, aluminum, and non-stick coatings enhance performance and longevity, appealing to both budget-conscious and premium buyers. The continual innovation in design, size, and functionality ensures that pots and pans remain the most sought-after kitchenware segment in Mexico.

Cooking racks are anticipated to maintain a strong share in the market due to their essential role in baking, roasting, and cooling processes. Consumers value these racks for improving airflow, ensuring even cooking, and preserving the quality of baked or roasted foods. The growing trend of home baking, along with increased interest in health-conscious cooking methods such as grilling and steaming, has boosted demand. Durable materials like stainless steel enhance usability and longevity, while various sizes and designs cater to diverse culinary needs. These factors make cooking racks a vital component of modern kitchens in Mexico.

Cooking tools, including spatulas, ladles, whisks, and tongs, are expected to hold a significant share in the market because of their indispensable role in meal preparation. Rising culinary interest, home cooking trends, and social media-driven food content encourage consumers to invest in high-quality, ergonomic, and durable tools. Multifunctional and heat-resistant designs appeal to modern kitchens, while aesthetic finishes attract style-conscious buyers. Professional chefs and restaurants also contribute to the demand for specialized tools, which is creating a positive Mexico kitchenware market outlook. The combination of practicality, convenience, and innovation ensures that cooking tools remain a core segment, supporting consistent growth in Mexico’s kitchenware market.

Analysis by Material:

- Stainless Steel

- Aluminum

- Glass

- Others

Stainless steel is expected to hold a significant share in the market due to its durability, corrosion resistance, and ease of maintenance. Consumers prefer stainless steel cookware and utensils for their long lifespan, hygienic properties, and ability to retain heat evenly during cooking. Its modern appearance and compatibility with various cooking surfaces, including induction, further enhance its appeal. Additionally, stainless steel products are perceived as premium, offering value for money, which drives consumer preference in both residential and commercial segments. These factors collectively ensure stainless steel remains a dominant material choice in the Mexican kitchenware market.

Aluminum kitchenware is anticipated to maintain a strong market share in Mexico because of its lightweight nature, excellent heat conductivity, and affordability. Consumers value aluminum cookware for quick and even cooking, making it suitable for everyday home use. Its cost-effectiveness compared to premium materials appeals to budget-conscious buyers, while its versatility accommodates a wide range of cooking techniques. Modern anodized aluminum products also offer durability and resistance to scratches and corrosion, enhancing consumer confidence. According to the Mexico kitchenware market forecast, aluminum’s widespread availability, combined with its practical benefits, positions it as a preferred material in both residential kitchens and professional foodservice settings.

Glass kitchenware is expected to hold a notable share in the Mexico market due to its transparency, non-reactive nature, and aesthetic appeal. Consumers prefer glass cookware and storage products for monitoring cooking progress, food presentation, and maintaining hygiene without chemical reactions with ingredients. Glass is also ideal for baking, microwaving, and storing leftovers, making it highly versatile for modern households. Additionally, eco-conscious consumers are drawn to glass for its recyclability and sustainability. The combination of visual appeal, functionality, and health safety considerations ensures glass remains a popular material choice in residential kitchens and specialty food preparation settings across Mexico.

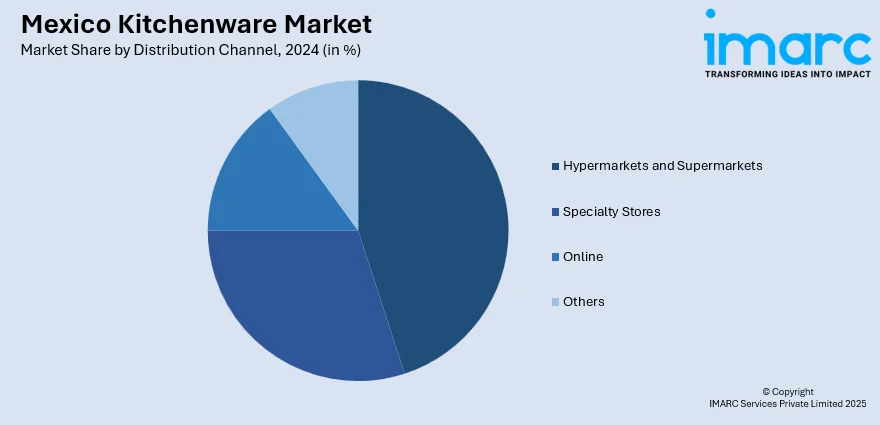

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

- Others

Hypermarkets and supermarkets are expected to hold a significant share in the market due to their wide product range, competitive pricing, and convenience. These retail formats cater to diverse consumer needs by offering kitchenware for various budgets and preferences under one roof. Frequent promotions, bundled offers, and loyalty programs further attract shoppers. Additionally, the presence of well-known domestic and international brands in these stores enhances consumer trust. Urban consumers, seeking convenience and accessibility, often prefer hypermarkets and supermarkets for their kitchenware purchases. This strong reach and ability to meet evolving customer expectations ensure their continued prominence in the market.

Specialty stores are anticipated to maintain a substantial share in the market as they provide curated, high-quality, and premium kitchenware products. These stores focus on specific categories such as cookware, bakeware, or utensils, appealing to consumers seeking expertise and product variety. Personalized customer service, expert advice, and in-store demonstrations enhance the shopping experience and influence purchasing decisions. Affluent and culinary-focused consumers prefer specialty stores for premium or unique items that are often unavailable in general retail. The emphasis on product differentiation, quality assurance, and niche offerings ensures specialty stores remain a preferred channel in the Mexican kitchenware market.

Online channels are expected to hold a growing share in the Mexico kitchenware market due to the convenience, wider selection, and competitive pricing they offer. E-commerce platforms allow consumers to compare products, read reviews, and access domestic and international brands from the comfort of their homes. Increasing internet penetration, smartphone adoption, and digital payment options further fuel online sales. Promotions, discounts, and fast delivery services attract both urban and semi-urban shoppers. Additionally, the rise of social media and influencer marketing drives awareness and demand for innovative kitchenware products online. These factors position e-commerce as a key distribution channel in Mexico’s market.

Analysis by End User:

- Residential

- Commercial

The residential segment is expected to hold a significant share in the market due to growing consumer interest in home cooking and culinary experimentation. Increasing disposable incomes, urbanization, and rising health consciousness are encouraging households to invest in modern, durable, and multifunctional kitchenware. Social media influence, cooking shows, and online tutorials are further inspiring consumers to upgrade their kitchen tools. E-commerce platforms and retail expansion make a wide variety of products easily accessible, driving adoption across households. As lifestyle changes continue and home-based cooking remains popular, the residential segment is poised to maintain a leading market share.

The commercial segment is anticipated to hold a substantial share in the market due to the expansion of the foodservice industry, including restaurants, hotels, and catering businesses. Increasing tourism, evolving culinary trends, and demand for high-quality, durable kitchenware are driving commercial investments. Professional chefs and commercial kitchens require specialized tools and equipment to ensure efficiency, safety, and consistent food quality. Additionally, the growth of institutional facilities such as hospitals, schools, and corporate canteens further boosts demand. This steady need for reliable, large-scale kitchenware solutions ensures the commercial segment maintains a strong presence in the market.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico's kitchenware market is propelled by its proximity to the United States, facilitating access to a diverse range of products and international brands. The region's robust manufacturing sector and cross-border trade enhance product availability and affordability. Urban centers like Monterrey exhibit a growing preference for modern and durable kitchenware, influenced by international trends. Additionally, the increasing adoption of e-commerce platforms has expanded consumer access to a variety of kitchenware options, further stimulating market growth.

Central Mexico, encompassing major cities such as Mexico City and Guadalajara, is experiencing a surge in demand for kitchenware driven by urbanization and rising disposable incomes. The region's rich culinary heritage fosters a strong market for both traditional and contemporary kitchen tools. Consumers are increasingly inclined towards high-quality, durable, and aesthetically pleasing kitchenware, reflecting a shift towards premium products. E-commerce platforms and local retail outlets are expanding their offerings to meet this growing demand, contributing to the market's expansion.

In Southern Mexico, the Mexico kitchenware market demand is influenced by a blend of traditional cooking practices and modern influences. Regions like Oaxaca and Chiapas maintain a strong preference for handcrafted, artisanal kitchen tools, which are integral to local culinary traditions. However, urbanization and exposure to global culinary trends are gradually introducing consumers to contemporary kitchenware options. The market is witnessing a fusion of traditional and modern products, catering to diverse consumer preferences and contributing to the sector's growth.

Competitive Landscape:

The Mexico kitchenware market is characterized by a dynamic and competitive landscape, featuring a mix of established international brands and strong domestic players. Global companies such as LG Electronics, Panasonic, Electrolux, Samsung, and Whirlpool lead in the kitchen appliances segment, offering a wide range of products from refrigerators to small cooking appliances. In the cookware sector, brands like Cuisinart, Tramontina, and Groupe SEB dominate, providing high-quality cookware options. Domestic manufacturers like CINSA and Magefesa also play a significant role, catering to local preferences and price points. The market is further influenced by the growing e-commerce sector, with platforms like Amazon and MercadoLibre facilitating access to a broad array of kitchenware products. This competitive environment drives continuous innovation and product diversification to meet the evolving demands of Mexican consumers.

The report provides a comprehensive analysis of the competitive landscape in the Mexico kitchenware market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Tramontina Mexico, in partnership with Chef Alfredo Oropeza, officially launched the novel Chef Oropeza by Tramontina range of kitchenware in Mexico. This partnership is a part of the company's goal of producing cooking tools that are practical and long-lasting, and also genuinely a part of the everyday lives of Mexican families.

- June 2024: Tupperware, a manufacturer of various kitchenware and home products, announced plans to transfer all its production operations from the United States to Mexico. As a part of this transition, Tupperware will close its factory in South Carolina, United States.

- March 2024: Lifetime Brand, a prominent manufacturer of various kitchenware and home solutions, announced plans to expand its manufacturing capabilities at its factory in Mexico. With this expansion, the company intends to improve operational resilience, reduce interruptions, and guarantee steady availability of goods for its global clientele.

Mexico Kitchenware Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Pots and Pan, Cooking Racks, Cooking Tools, Microwave Cookware, Pressure Cookers |

| Materials Covered | Stainless Steel, Aluminum, Glass, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Store, Online, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico kitchenware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico kitchenware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico kitchenware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kitchenware market in Mexico was valued at USD 2,891.15 Million in 2024.

The Mexico kitchenware market is projected to exhibit a CAGR of 6.13% during 2025-2033, reaching a value of USD 4,938.71 Million by 2033.

The Mexico kitchenware market is driven by rising consumer spending, growing interest in home cooking, and increasing demand for modern, durable, and multifunctional products. Urbanization, e-commerce expansion, and the influence of culinary trends and social media further stimulate market growth and product innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)