Mexico Laboratory Centrifuge Market Size, Share, Trends and Forecast by Product Type, Model Type, Rotor Design, Intended Use, Application, End-User, and Region, 2026-2034

Mexico Laboratory Centrifuge Market Summary:

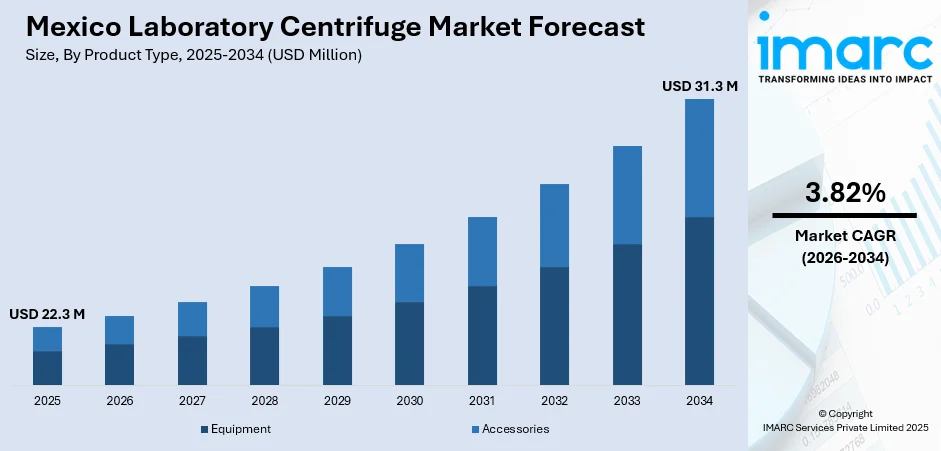

The Mexico laboratory centrifuge market size was valued at USD 22.3 Million in 2025 and is projected to reach USD 31.3 Million by 2034, growing at a compound annual growth rate of 3.82% from 2026-2034.

The Mexico laboratory centrifuge market is experiencing steady expansion, driven by the country's growing healthcare infrastructure, rising pharmaceutical manufacturing investments, and increasing demand for advanced diagnostic capabilities. Government initiatives to enhance medical research facilities and strengthen domestic drug production are creating favorable conditions for laboratory equipment adoption. The expanding biotechnology sector, coupled with rising prevalence of chronic diseases requiring sophisticated diagnostic solutions, is accelerating the need for high-performance centrifugation technologies across hospitals, research institutions, and pharmaceutical companies.

Key Takeaways and Insights:

-

By Product Type: Equipment dominates the market with a share of 57.62% in 2025, driven by the essential role of centrifuge machinery in clinical diagnostics, pharmaceutical research, and biomanufacturing applications. Rising investments in healthcare infrastructure and laboratory modernization are sustaining equipment procurement across Mexican facilities.

-

By Model Type: Benchtop centrifuges lead the market with a share of 71.24% in 2025, owing to their compact design, affordability, and versatility for routine laboratory procedures. These units offer space-efficient solutions ideal for clinical laboratories and research facilities operating within constrained physical environments.

-

By Rotor Design: Fixed-angle rotors represent the largest segment with a market share of 36.56% in 2025, reflecting their efficiency in high-throughput sample processing and faster sedimentation times. Laboratories favor these rotors for routine separations requiring quick turnaround without compromising resolution.

-

By Intended Use: General purpose centrifuges prevail the market with a share of 46.63% in 2025, driven by their flexibility to accommodate diverse applications, ranging from blood separation to cellular research. Their adaptability makes them indispensable across multiple laboratory settings throughout Mexico.

-

Key Players: Leading manufacturers drive the Mexico laboratory centrifuge market through continuous product innovations, strategic distribution partnerships, and after-sales service networks. Companies focus on developing energy-efficient models with advanced automation features while expanding accessibility across urban and regional healthcare facilities.

To get more information on this market Request Sample

The Mexico laboratory centrifuge market is advancing, as healthcare institutions and research organizations prioritize modernization of diagnostic capabilities. Increasing investments in pharmaceutical manufacturing and clinical research infrastructure are creating sustained demand for reliable centrifugation equipment. The country's position as a nearshoring hub for medical device assembly and biopharmaceutical production further strengthens market prospects. Mexico's pharmaceutical sector received significant foreign direct investment (FDI) totaling USD 784 Million during January 2024 to September 2024, reinforcing manufacturing capacity and research capabilities across the nation. Technological innovations, including automated sample processing, Internet of Things (IoT)-enabled monitoring systems, and energy-efficient designs, are reshaping laboratory workflows. The convergence of government healthcare initiatives, private sector investments, and growing chronic disease prevalence positions the market for continued growth, with academic institutions and biotechnology companies driving the adoption of advanced centrifuge platforms.

Mexico Laboratory Centrifuge Market Trends:

Integration of Automation and Digital Technologies

The adoption of automated centrifuge systems with digital interfaces and the IoT is transforming laboratory operations throughout Mexico. As per IMARC Group, the Mexico IoT market size reached USD 15,339.0 Million in 2024. Modern centrifuge platforms incorporate smart sensors, enabling real-time monitoring, predictive maintenance alerts, and seamless integration with laboratory information management systems. These technological enhancements are improving workflow efficiency, reducing operator dependency, and ensuring consistent reproducibility across diagnostic and research applications.

Rising Demand for Sustainable Laboratory Equipment

Rising demand for sustainable laboratory equipment is driving the market expansion in Mexico, as healthcare and research facilities prioritize energy efficiency, reduced environmental impact, and long product lifecycles. Laboratories are increasingly selecting centrifuges with low power consumption, quiet operation, and recyclable materials to align with institutional sustainability goals. Manufacturers are responding by offering durable designs, longer maintenance intervals, and eco-friendly production practices. This shift also supports cost savings over time, encouraging wider adoption of modern, environmentally responsible centrifuge systems.

Expansion of Point-of-Care (POC) and Decentralized Testing

The expansion of POC and decentralized testing is fueling the market growth in Mexico by increasing the demand for compact, efficient, and easy-to-operate centrifuges across clinics, diagnostic centers, and smaller laboratories. These settings require rapid sample preparation to support faster clinical decision-making, especially in emergency care and routine diagnostics. Portable and low-maintenance centrifuges enable on-site processing of blood and urine samples, reducing reliance on centralized labs. This shift strongly supports the growing adoption of POC diagnostics for timely, accessible healthcare delivery. As per IMARC Group, the Mexico POC diagnostics market is set to attain USD 1,363.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.9% during 2025-2033.

Market Outlook 2026-2034:

The Mexico laboratory centrifuge market outlook remains positive, as healthcare modernization initiatives and pharmaceutical industry expansion continue to drive equipment demand. Growing emphasis on precision diagnostics, personalized medicine, and biopharmaceutical research will sustain adoption of advanced centrifugation technologies. The market generated a revenue of USD 22.3 Million in 2025 and is projected to reach a revenue of USD 31.3 Million by 2034, growing at a compound annual growth rate of 3.82% from 2026-2034. Strategic investments in laboratory infrastructure, expanding clinical research activities, and technological innovations in automation will shape competitive dynamics throughout the forecast period.

Mexico Laboratory Centrifuge Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Equipment |

57.62% |

|

Model Type |

Benchtop Centrifuges |

71.24% |

|

Rotor Design |

Fixed-Angle Rotors |

36.56% |

|

Intended Use |

General Purpose Centrifuges |

46.63% |

Product Type Insights:

- Equipment

- Multipurpose Centrifuges

- Microcentrifuges

- Ultracentrifuges

- Minicentrifuges

- Others

- Accessories

- Rotors

- Tubes

- Centrifuge Bottles

- Buckets

- Plates

- Others

Equipment dominates with a market share of 57.62% of the total Mexico laboratory centrifuge market in 2025.

The equipment segment maintains leadership in the Mexico laboratory centrifuge market, owing to the fundamental requirement for centrifugation platforms across clinical diagnostics, pharmaceutical manufacturing, and academic research. Hospitals, diagnostic laboratories, and biotechnology companies continuously invest in centrifuge equipment to support sample processing workflows essential for disease diagnosis and drug development. The segment benefits from technological advancements incorporating digital interfaces, programmable protocols, and enhanced safety features.

Rising demand for specialized centrifugation capabilities is driving diversification within the equipment category throughout Mexican laboratories. Ultracentrifuges supporting protein purification and viral vector separation are gaining traction among biopharmaceutical manufacturers, while microcentrifuges remain essential for molecular biology applications requiring rapid processing of small sample volumes. Government initiatives promoting domestic pharmaceutical production and healthcare infrastructure development are creating sustained procurement opportunities. In April 2025, the Mexican administration revealed plans to allocate 25 Billion pesos (USD 1.23 Billion) for the establishment of seven new hospitals in seven states, greatly increasing healthcare availability for almost 3 Million individuals.

Model Type Insights:

- Benchtop Centrifuges

- Floor-Standing Centrifuges

Benchtop centrifuges lead with a share of 71.24% of the total Mexico laboratory centrifuge market in 2025.

Benchtop centrifuges dominate the Mexico laboratory centrifuge market due to their compact footprint, operational simplicity, and cost-effectiveness for routine laboratory procedures. These units offer ideal solutions for facilities operating within space constraints while delivering performance suitable for clinical diagnostics, blood separation, and basic research applications. Their accessibility makes them particularly attractive for small and medium-sized laboratories expanding throughout Mexico.

The versatility of benchtop centrifuges across multiple application areas reinforces their market leadership position in Mexico. Healthcare facilities utilize these units for routine blood component separation, urinalysis preparation, and microbiological sample processing without requiring dedicated floor space or specialized installation. Academic institutions favor benchtop models for student training and research projects, given their user-friendly interfaces and safety features. Ongoing technological improvements, including touch-screen controls, programmable rotor recognition, and quiet operation modes, are enhancing adoption across diverse laboratory environments throughout Mexican healthcare and research ecosystems.

Rotor Design Insights:

- Fixed-Angle Rotors

- Swinging-Bucket Rotors

- Vertical Rotors

- Others

Fixed-angle rotors exhibit a clear dominance with a 36.56% share of the total Mexico laboratory centrifuge market in 2025.

Fixed-angle rotors maintain market leadership in Mexico, owing to their efficiency in high-throughput sample processing and faster sedimentation characteristics compared to alternative designs. These rotors position samples at predetermined angles relative to the rotational axis, creating shorter sedimentation paths that accelerate separation times critical for time-sensitive diagnostic workflows. Clinical laboratories processing large sample volumes particularly benefit from the productivity advantages offered by fixed-angle configurations.

The ergonomic advantages and resolution capabilities of fixed-angle rotors support their widespread adoption across Mexican laboratory facilities. Researchers conducting protein precipitation, nucleic acid isolation, and cellular pelleting procedures favor these rotors for delivering consistent results with minimal operator variability. Manufacturing improvements, including carbon-fiber construction and enhanced aerodynamic profiles, are reducing rotor weight while improving durability and energy efficiency. These innovations align with institutional sustainability goals while maintaining the performance standards required for quality-controlled laboratory operations throughout Mexico's expanding healthcare and research infrastructure.

Intended Use Insights:

- General Purpose Centrifuges

- Clinical Centrifuges

- Preclinical Centrifuges

General purpose centrifuges represent the leading segment with a 46.63% share of the total Mexico laboratory centrifuge market in 2025.

General purpose centrifuges command the largest market share in Mexico due to their adaptability across diverse laboratory applications and cost-effectiveness for multi-functional facilities. These versatile units accommodate various rotor configurations, enabling laboratories to perform blood separation, microbiological processing, and basic research procedures using single equipment platform. Healthcare institutions and diagnostic centers particularly value this flexibility when managing diverse sample types within budgetary constraints.

The operational versatility of general purpose centrifuges positions them as foundational equipment for Mexican laboratories establishing or expanding their capabilities. Academic institutions training future laboratory professionals rely on these units to demonstrate fundamental centrifugation principles across multiple scientific disciplines. Regional healthcare facilities serving varied patient populations benefit from equipment capable of addressing different diagnostic requirements without specialized instrumentation for each application. Manufacturers continue to develop general purpose models with enhanced programmability, improved safety interlocks, and quieter operation to meet evolving laboratory expectations throughout Mexico's healthcare ecosystem.

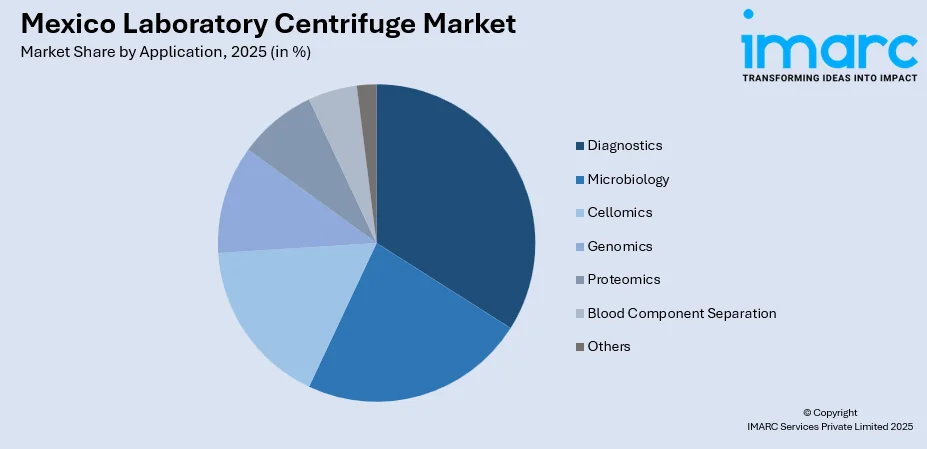

Application Insights:

Access the comprehensive market breakdown Request Sample

- Diagnostics

- Microbiology

- Cellomics

- Genomics

- Proteomics

- Blood Component Separation

- Others

The diagnostics segment holds a significant share in the Mexico laboratory centrifuge market due to the high volume of routine clinical testing performed in hospitals, diagnostic centers, and private laboratories. Centrifuges are essential for separating blood, serum, plasma, and urine samples to support biochemical and immunological tests. Rising disease screening, preventive healthcare practices, and demand for faster test turnaround times continue to drive adoption across centralized and decentralized diagnostic facilities nationwide.

Microbiology applications drive steady demand for laboratory centrifuges in Mexico for isolating microorganisms, concentrating samples, and preparing cultures for analysis. Centrifuges support testing related to infectious diseases, food safety, and environmental monitoring. Growing awareness about microbial contamination, along with increased testing in healthcare and industrial laboratories, encourages consistent equipment usage.

The cellomics segment is expanding as cell-based research and clinical studies grow across Mexico’s research institutions and biotechnology labs. Laboratory centrifuges are widely used for cell harvesting, washing, and separation processes critical to cell biology experiments. Increasing interest in regenerative medicine, immunology, and cancer research supports demand for precise, low-shear centrifugation systems.

Genomics represents a growing application area in the Mexico laboratory centrifuge market, driven by expanding genetic testing, research programs, and personalized medicine initiatives. Centrifuges play a key role in (deoxyribonucleic acid) DNA and (ribonucleic acid) RNA extraction, purification, and sample preparation processes. The increasing use of molecular diagnostics and academic research projects fuels demand for reliable, high-speed centrifuges.

Proteomics applications rely on laboratory centrifuges for protein extraction, clarification, and sample concentration. In Mexico, growth in pharmaceutical research, academic studies, and clinical research supports this segment. Centrifuges help ensure clean separation of proteins from complex biological samples, improving downstream analysis accuracy.

Blood component separation is a critical application in the Mexico laboratory centrifuge market, particularly within hospitals, blood banks, and transfusion centers. Centrifuges are essential for separating whole blood into plasma, platelets, and red blood cells. Growing demand for blood transfusions, surgical procedures, and emergency care increases equipment usage. Reliable, high-capacity centrifuges support efficient processing, storage, and safe distribution of blood components across healthcare facilities.

End User Insights:

- Hospitals

- Biotechnology and Pharmaceutical Companies

- Academic and Research Institutions

Hospitals hold prominence in the market due to the high volume of diagnostic and clinical testing performed daily. Centrifuges are essential for blood separation, routine pathology tests, and emergency diagnostics. Growing patient inflow, expansion of hospital laboratories, and increasing focus on faster diagnosis drive demand for reliable, easy-to-operate centrifuges. Adoption is further supported by decentralized testing and continuous healthcare infrastructure upgrades.

Biotechnology and pharmaceutical companies drive the demand for advanced laboratory centrifuges to support drug development, quality control, and bioprocessing activities. Centrifuges are used in cell culture processing, protein purification, and formulation testing. Growth in clinical research, biosimilars, and local pharmaceutical manufacturing encourages adoption of high-speed and temperature-controlled models. These companies prioritize precision, scalability, and compliance, boosting the demand for technologically advanced centrifuge systems.

Academic and research institutions form a significant end-user segment as centrifuges are widely used in life science research, molecular biology, and biomedical studies. Universities and research labs rely on centrifuges for genomics, proteomics, and cell-based experiments. Increasing government and private funding for research, along with growing collaboration with industry, supports steady demand.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico holds a prominent share of the laboratory centrifuge market due to its developed industrial base, cross-border healthcare services, and concentration of private hospitals and diagnostic laboratories. The region benefits from proximity to the United States, encouraging technology transfer and adoption of advanced laboratory equipment. Growing pharmaceutical manufacturing and medical research activities further drive demand for efficient centrifuges in clinical and industrial laboratories.

Central Mexico hosts the country’s largest concentration of hospitals, academic institutions, and diagnostic centers. Major metropolitan areas generate high testing volumes, increasing demand for reliable laboratory equipment. Strong government healthcare infrastructure, expanding private diagnostics, and active biomedical research support consistent adoption of centrifuges across clinical, research, and educational laboratories in the region.

Southern Mexico shows steady growth in the laboratory centrifuge market, driven by expanding healthcare access and improving diagnostic capabilities. Public hospitals and regional laboratories are increasing investments in basic and mid-range centrifuges to support routine testing. Rising focus on infectious disease monitoring, maternal healthcare, and community diagnostics is strengthening equipment adoption. Continued healthcare development and decentralization efforts are expected to gradually enhance regional market demand.

Market Dynamics:

Growth Drivers:

Why is the Mexico Laboratory Centrifuge Market Growing?

Expansion of Pharmaceutical Manufacturing and Investments

Mexico's pharmaceutical industry is experiencing significant investment growth as domestic and international companies expand manufacturing capabilities within the country. Government initiatives aimed at promoting pharmaceutical sovereignty and reduced dependence on foreign drug supplies are attracting substantial capital commitments from industry players. These investments encompass new production facilities, capacity expansions, and technology upgrades requiring advanced laboratory equipment, including centrifuges for quality control and research applications. In July 2025, four Mexican pharmaceutical companies, Kener, Genbio, Neolpharma, and Neolsym, announced investment plans totaling over 13 Billion pesos to broaden drug development and manufacturing capabilities in the country. These investments directly translate into increased demand for laboratory centrifuge equipment supporting pharmaceutical manufacturing operations throughout Mexico.

Growing Healthcare Infrastructure and Diagnostic Capabilities

Mexico is investing substantially in healthcare infrastructure modernization to address growing population healthcare demands and improve access to diagnostic services. The expansion of hospitals, clinical laboratories, and diagnostic centers across urban and regional areas is creating sustained demand for laboratory equipment essential to healthcare delivery. Government programs targeting preventive healthcare and early disease detection are driving diagnostic testing volumes requiring reliable centrifugation capabilities. In March 2025, IMSS Bienestar introduced La Muestra Viaja, an initiative aimed at offering laboratory tests to those without social security, eliminating the need for extensive travel. The initiative sought to lower diagnostic expenses and waiting periods by forwarding samples to expert laboratories. Infrastructure expansion directly supports laboratory centrifuge adoption across new and existing healthcare facilities throughout the nation.

Rising Prevalence of Chronic Ailemnts and Diagnostic Testing Demand

The increasing burden of chronic diseases across Mexico's population is generating sustained demand for diagnostic testing services and associated laboratory equipment. Conditions, including diabetes, cardiovascular diseases, and cancer, require ongoing monitoring through blood tests and other diagnostic procedures utilizing centrifugation for sample preparation. Mexico's demographic profile with an aging population further amplifies healthcare service requirements and diagnostic testing volumes. In Mexico, the population affected by diabetes stood at 85,855,300 in 2024, creating substantial demand for continuous glucose monitoring and related diagnostic services. Healthcare facilities nationwide are expanding laboratory capabilities to address these chronic disease management needs, driving procurement of centrifuge equipment capable of supporting high-volume sample processing. The convergence of chronic disease prevalence, preventive healthcare awareness, and improved insurance coverage is sustainably fueling laboratory equipment investments across Mexican healthcare institutions.

Market Restraints:

What Challenges the Mexico Laboratory Centrifuge Market is Facing?

High Cost of Imported Laboratory Equipment

The reliance on imported laboratory equipment presents cost challenges for Mexican healthcare facilities and research institutions. Currency fluctuations, import duties, and logistics expenses elevate acquisition costs for advanced centrifuge systems beyond the reach of budget-constrained facilities. Smaller laboratories and regional healthcare providers face particular difficulties affording modern equipment necessary for competitive diagnostic services.

Shortage of Skilled Laboratory Personnel

Mexico faces challenges in maintaining adequate numbers of trained laboratory technicians and specialists capable of operating sophisticated centrifuge equipment. This workforce shortage limits diagnostic capacity and can extend turnaround times at facilities lacking sufficient skilled personnel. Training programs and educational initiatives are working to address these gaps but require sustained investment and time to produce qualified professionals.

Regulatory Complexities and Approval Delays

Regulatory requirements and approval processes for laboratory equipment can create procurement delays impacting facility operations. Documentation requirements, certification procedures, and interagency coordination challenges may extend timelines for acquiring and deploying new centrifuge systems. These regulatory considerations require manufacturers and distributors to navigate compliance frameworks while healthcare facilities manage equipment procurement planning accordingly.

Competitive Landscape:

The Mexico laboratory centrifuge market features competition among established international manufacturers and specialized equipment suppliers serving diverse healthcare and research segments. Companies differentiate through product innovations, service network coverage, and technical support capabilities addressing customer requirements. Market participants invest in developing energy-efficient models, automation features, and digital connectivity enhancing laboratory workflow integration. Strategic partnerships with distributors and healthcare institutions strengthen market positioning while after-sales service quality influences customer retention. Manufacturers focus on expanding product portfolios spanning entry-level benchtop units through specialized ultracentrifuge platforms to address varying facility requirements and budget considerations across Mexican laboratories.

Mexico Laboratory Centrifuge Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Model Types Covered | Benchtop Centrifuges, Floor-Standing Centrifuges |

| Rotor Designs Covered | Fixed-Angle Rotors, Swinging-Bucket Rotors, Vertical Rotors, Others |

| Intended Uses Covered | General Purpose Centrifuges, Clinical Centrifuges, Preclinical Centrifuges |

| Applications Covered | Diagnostics, Microbiology, Cellomics, Genomics, Proteomics, Blood Component Separation, Others |

| End-Users Covered | Hospitals, Biotechnology and Pharmaceutical Companies, Academic and Research Institutions |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico laboratory centrifuge market size was valued at USD 22.3 Million in 2025.

The Mexico laboratory centrifuge market is expected to grow at a compound annual growth rate of 3.82% from 2026-2034 to reach USD 31.3 Million by 2034.

Equipment dominated the market with a share of 57.62%, driven by essential requirements for centrifugation platforms across clinical diagnostics, pharmaceutical manufacturing, and research applications throughout Mexican laboratories.

Key factors driving the Mexico laboratory centrifuge market include expanding pharmaceutical manufacturing investments, growing healthcare infrastructure development, rising incidence of chronic diseases, increasing diagnostic testing demand, and technological advancements in automation and energy efficiency.

Major challenges include high costs of imported laboratory equipment, shortage of skilled laboratory personnel, regulatory complexities affecting procurement timelines, and infrastructure limitations in regional healthcare facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)