Mexico Laminated Flooring Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Laminated Flooring Market Overview:

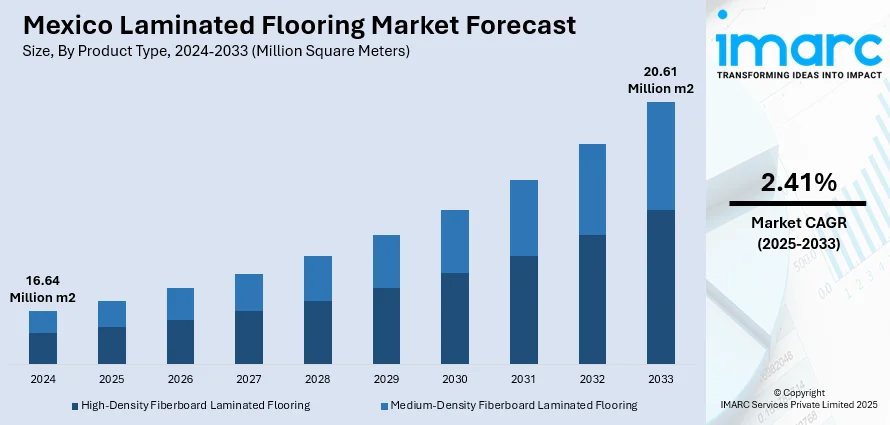

The Mexico laminated flooring market size reached 16.64 Million Sq. Metres in 2024. Looking forward, IMARC Group expects the market to reach 20.61 Million Sq. Metres by 2033, exhibiting a growth rate (CAGR) of 2.41% during 2025-2033. The market is driven by rising urban housing demand and consumer preference for stylish, affordable floor solutions in residential projects. Commercial real estate development favors laminated flooring for its durability, design consistency, and maintenance efficiency, thereby fueling the market. Localized manufacturing and product innovations in finishes and sustainability features further augment the Mexico laminated flooring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 16.64 Million Sq. Metres |

| Market Forecast in 2033 | 20.61 Million Sq. Metres |

| Market Growth Rate 2025-2033 | 2.41% |

Mexico Laminated Flooring Market Trends:

Urban Housing Growth and Middle-Class Consumption

Urbanization and middle-class expansion in cities such as Mexico City, Monterrey, and Guadalajara are key contributors to the rising demand for laminated flooring. As residential developers cater to growing housing needs, laminated options are preferred for their affordability, visual appeal, and ease of installation. Middle-income consumers seek low-maintenance alternatives to hardwood that still offer contemporary aesthetics and durability. Laminated flooring also aligns with compact apartment layouts and urban dwellings that require resilient surfaces under frequent use. The popularity of Western-style interiors further drives adoption, with laminated flooring mimicking high-end materials without the associated costs. Retail home improvement chains and online platforms have improved access to a wide variety of laminate products, allowing consumers to compare finishes, warranties, and pricing. In addition, government incentives and mortgage programs aimed at affordable housing indirectly support flooring material demand. These residential and retail dynamics play a pivotal role in shaping Mexico laminated flooring market growth.

To get more information on this market, Request Sample

Commercial Real Estate and Retail Infrastructure

The expansion of commercial real estate and organized retail in Mexico plays an integral role in sustaining laminate flooring consumption. Shopping malls, office parks, hospitality venues, and healthcare facilities increasingly prefer laminated surfaces for their resistance to wear, stains, and scratches. These qualities reduce maintenance costs and enable fast refurbishment cycles, essential in dynamic retail environments. Chain retailers and franchises often mandate cohesive interior designs, and laminated flooring provides consistent textures and colors across multiple locations. Additionally, developers favor laminate for its compliance with hygiene, slip resistance, and fire retardancy standards, especially in public-facing commercial spaces. Government investment in infrastructure, including airport terminals and transport hubs, further supports demand for hard-surface flooring. The commercial segment values speed of installation, durability under heavy footfall, and aesthetic flexibility, making laminate a strategic choice. As Mexico continues to modernize its urban commercial infrastructure, these priorities reinforce the need for functional, cost-efficient flooring solutions.

Supply Chain Localization and Product Innovation

Mexico’s market benefits from both domestic manufacturing capacity and proximity to global suppliers. The presence of regional production facilities shortens delivery timelines, reduces import costs, and allows for customization to local design preferences. Additionally, laminate producers are introducing water-resistant technologies, anti-bacterial coatings, and click-lock systems that appeal to diverse applications: from homes to clinics. Innovations in digital imaging now enable realistic wood and stone textures, making laminate a credible alternative to luxury flooring finishes. Furthermore, the country’s growing awareness of sustainable building materials has led manufacturers to emphasize recycled content and low-emission adhesives. The incorporation of environmentally responsible practices improves brand positioning among eco-conscious consumers and developers. These technological and logistical advantages allow the market to evolve in tandem with changing design trends and regulatory expectations. With rising standards for construction quality and consumer expectations, innovation and supply chain efficiency are driving new demand channels across Mexico.

Mexico Laminated Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- High-Density Fiberboard Laminated Flooring

- Medium-Density Fiberboard Laminated Flooring

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high-density fiberboard laminated flooring and medium-density fiberboard laminated flooring.

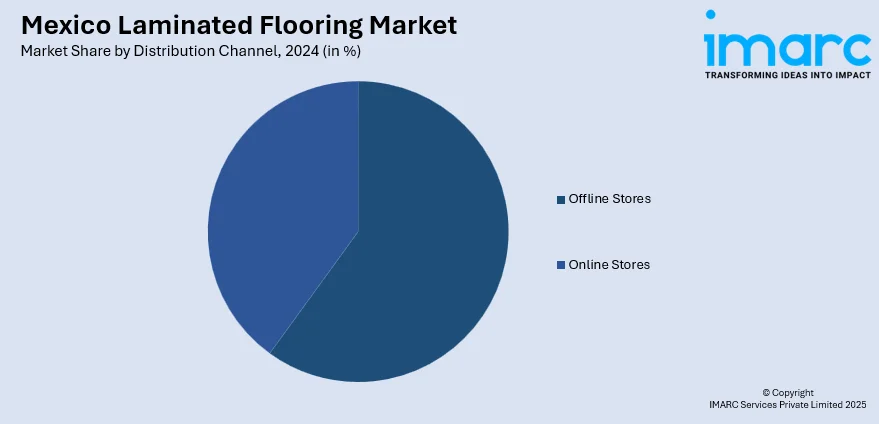

Distribution Channel Insights:

- Offline Stores

- Online Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline stores and online stores.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Laminated Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Sq. Metres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High-Density Fiberboard Laminated Flooring, Medium-Density Fiberboard Laminated Flooring |

| Distribution Channels Covered | Offline Stores, Online Stores |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico laminated flooring market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico laminated flooring market on the basis of product type?

- What is the breakup of the Mexico laminated flooring market on the basis of distribution channel?

- What is the breakup of the Mexico laminated flooring market on the basis of end user?

- What is the breakup of the Mexico laminated flooring market on the basis of region?

- What are the various stages in the value chain of the Mexico laminated flooring market?

- What are the key driving factors and challenges in the Mexico laminated flooring market?

- What is the structure of the Mexico laminated flooring market and who are the key players?

- What is the degree of competition in the Mexico laminated flooring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico laminated flooring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico laminated flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico laminated flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)