Mexico Leather Chemicals Market Size, Share, Trends and Forecast by Product, Process, Application, and Region, 2025-2033

Mexico Leather Chemicals Market Overview:

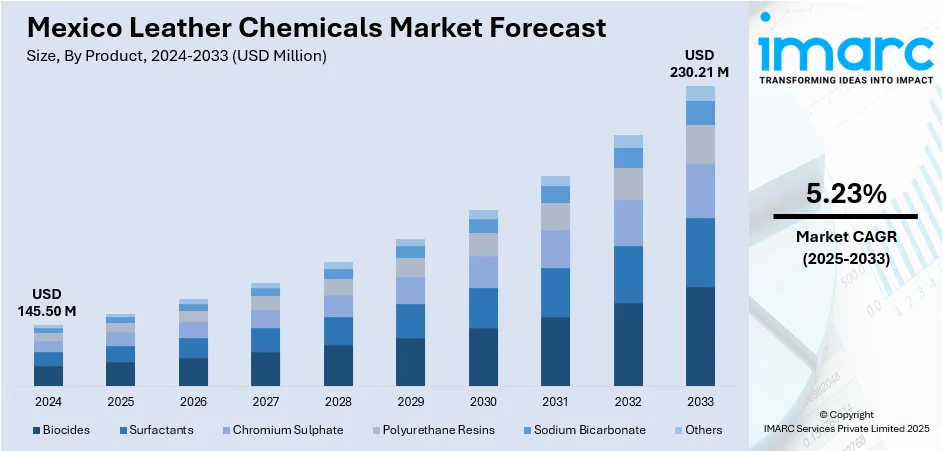

The Mexico leather chemicals market size reached USD 145.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 230.21 Million by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The market is fueled by rising demand for premium leather goods across industries like fashion, automotive, and furniture. There is also greater awareness of environmentally friendly practices and the increasing desire for green leather treatments, which have contributed significantly to the market growth. Furthermore, the growing automotive industry and the subsequent increase in demand for heavy-duty and aesthetic appealing leather materials further expand the Mexico leather chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 145.50 Million |

| Market Forecast in 2033 | USD 230.21 Million |

| Market Growth Rate 2025-2033 | 5.23% |

Mexico Leather Chemicals Market Trends:

Growing Demand for Sustainable Leather Chemicals

The demand for sustainable leather chemicals in Mexico is witnessing a notable increase due to global environmental concerns and local regulatory pressures. As consumers become more environmentally conscious, leather manufacturers are turning toward more eco-friendly tanning, dyeing, and finishing chemicals. These chemicals assist in lessening the environmental footprint of leather manufacturing by reducing the utilization of dangerous chemicals and increasing the biodegradability of the leather. In Mexico, where the leather market has a significant role to play in both domestic production and exports, international environmental practices, like REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), are encouraged. Companies are, in turn, investing in green technologies like water-based dyes and chromium-free tanning chemicals to address these needs. A recent study examines the environmental impact of traditional and new methods of leather production, highlighting significant reductions in chromium and water consumption. The innovative processes, which include alternative tanning methods such as spray nozzles and aerosol rooms, show reductions in environmental impacts like Human toxicity-cancer and Ecotoxicity freshwater by up to 57% and 29%, respectively. The growing adoption of such sustainable practices is reshaping the market landscape, aligning the industry with both consumer preferences and stringent environmental regulations, which is positively impacting the Mexico leather chemicals market growth.

To get more information on this market, Request Sample

Rise of High-Performance Leather in Automotive and Fashion Industries

The industry is witnessing a boom in demand fuelled by the growing utilization of high-performance leather, especially in the automotive and fashion industries. Mexico plays a major role in the automotive industry, with several global brands opening manufacturing units within the country. Leather is an essential material in automotive interiors, including seats, steering wheels, and dashboards, where quality, beauty, and comfort are top priorities. Companies now seek more advanced leather finishes that not only satisfy functional needs but also enhance performance aspects like heat, water resistance, and durability. This has stimulated an increase in demand for sophisticated leather chemicals, including high-end resins, polymer coatings, and anti-microbial additives. In the fashion sector, increasing demand for luxury and premium leather products continues to fuel demand for advanced leather chemicals that provide texture, color hold, and softness. The trend is specifically noticeable in Mexico, where there has been a high rise in the production of leather products from MXN 67.99 Billion in 2013 to MXN 92.8 Billion in 2023. The growth of the leather market in the country is motivating innovation in the leather chemicals industry as producers demand expert solutions that can address the increased demands of both fashion and automotive sectors. Consequently, Mexican suppliers are turning their attention to creating specially designed chemical products that meet the changing needs for improved quality, long-lasting, and visually attractive leather.

Mexico Leather Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, process, and application.

Product Insights:

- Biocides

- Surfactants

- Chromium Sulphate

- Polyurethane Resins

- Sodium Bicarbonate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biocides, surfactants, chromium sulphate, polyurethane resins, sodium bicarbonate, and others.

Process Insights:

- Tanning and Dyeing

- Beamhouse Chemicals

- Finishing Chemicals

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes tanning and dyeing, beamhouse chemicals, and finishing chemicals.

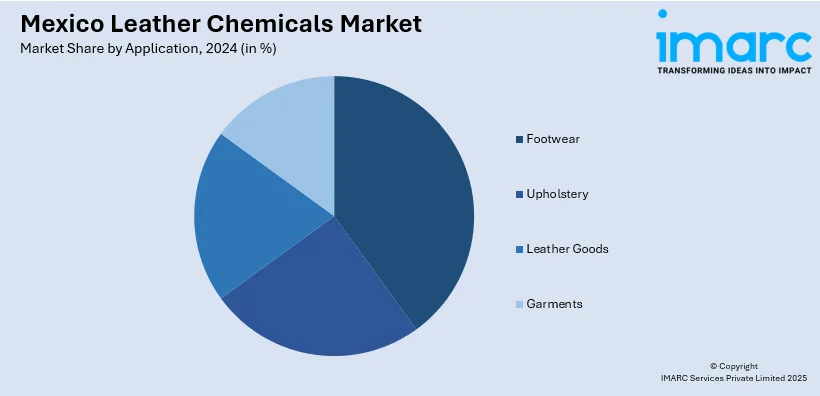

Application Insights:

- Footwear

- Upholstery

- Leather Goods

- Garments

The report has provided a detailed breakup and analysis of the market based on the application. This includes footwear, upholstery, leather goods, and garments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Leather Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Biocides, Surfactants, Chromium Sulphate, Polyurethane Resins, Sodium Bicarbonate, Others |

| Processes Covered | Tanning and Dyeing, Beamhouse Chemicals, Finishing Chemicals |

| Applications Covered | Footwear, Upholstery, Leather Goods, Garments |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico leather chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico leather chemicals market on the basis of product?

- What is the breakup of the Mexico leather chemicals market on the basis of process?

- What is the breakup of the Mexico leather chemicals market on the basis of application?

- What is the breakup of the Mexico leather chemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico leather chemicals market?

- What are the key driving factors and challenges in the Mexico leather chemicals market?

- What is the structure of the Mexico leather chemicals market and who are the key players?

- What is the degree of competition in the Mexico leather chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico leather chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico leather chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico leather chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)