Mexico LED Bulb Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Mexico LED Bulb Market Overview:

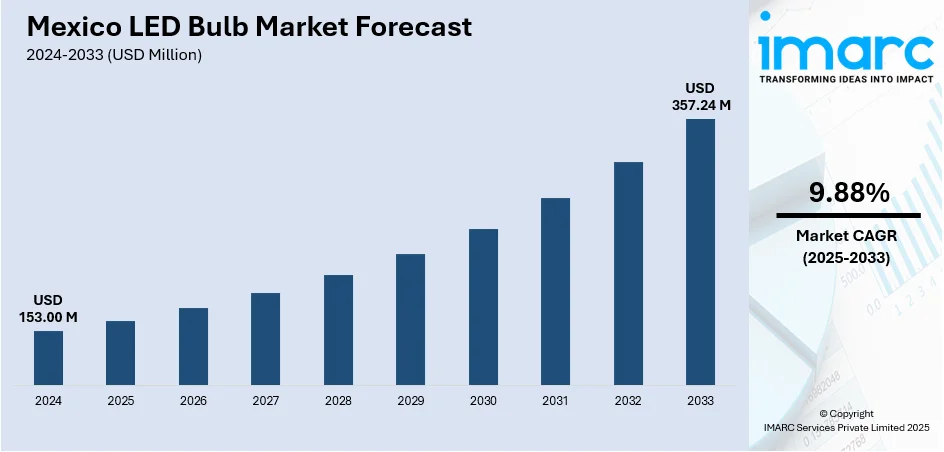

The Mexico LED bulb market size reached USD 153.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 357.24 Million by 2033, exhibiting a growth rate (CAGR) of 9.88% during 2025-2033. The market is driven by federal energy efficiency mandates and government-backed distribution programs that expand access to certified LED lighting. Commercial real estate and retail modernization drive demand for reliable, aesthetic, and cost-effective lighting solutions, thereby fueling the market. Improved domestic production capacity and nationwide availability through retail and e-commerce channels are supporting adoption at scale, further augmenting the Mexico LED bulb market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 153.00 Million |

| Market Forecast in 2033 | USD 357.24 Million |

| Market Growth Rate 2025-2033 | 9.88% |

Mexico LED Bulb Market Analysis:

- Major Market Drivers: Federal energy efficiency mandates and government-backed distribution programs significantly drive the market demand. Rising electricity costs, environmental consciousness, and urbanization fuel adoption across residential and commercial segments. Infrastructure modernization initiatives and public lighting retrofits create sustained procurement cycles, supporting long-term growth in energy-efficient lighting solutions throughout Mexico.

- Key Market Trends: Smart lighting integration, improved domestic manufacturing capabilities, and expanded distribution networks characterize current Mexico LED bulb market outlook trends. E-commerce penetration enhances accessibility while consumer education campaigns dispel cost misconceptions. Product innovations in form factors and multi-wattage compatibility attract diverse customer segments, reinforcing adoption across socio-economic brackets.

- Competitive Landscape: The competitive environment features established international manufacturers alongside growing domestic players leveraging proximity to North American supply chains. Market participants focus on price competitiveness, customization capabilities, and distribution network expansion. Strategic partnerships with retailers and e-commerce platforms strengthen market positioning while product certification compliance ensures consumer confidence.

- Challenges and Opportunities: Market challenges include informal retail segment penetration and rural accessibility limitations. However, opportunities exist in smart lighting technology adoption, municipal infrastructure projects, and commercial real estate modernization. Government subsidy programs and energy labeling requirements create favorable conditions for certified Mexico LED bulb products across diverse applications.

Mexico LED Bulb Market Trends:

Government Efficiency Mandates and Lighting Subsidy Programs

Mexico’s national energy policies have emphasized efficient lighting technologies as part of broader sustainability and emission reduction goals. Through regulatory initiatives such as the “Programa de Eficiencia Energética,” inefficient lighting products have been progressively phased out in favor of LED-based alternatives. The Mexico LED bulb market forecast indicates continued growth supported by these regulatory frameworks. On October 8, 2024, Cree LED, in collaboration with IDC Componentes and Ilumiled, completed a major public lighting upgrade in Santiago de Querétaro, Mexico, replacing 1,600 sodium lamps with high-efficiency LED fixtures using 2200K JR5050C E Class technology. The retrofit project, authorized by local government, preserves the historic ambiance of the downtown area while improving light uniformity and achieving a projected 58% reduction in power consumption, equating to annual energy savings of approximately USD 80,000. Federal agencies and utility companies have partnered to offer direct subsidies and financing for residential and municipal LED adoption, particularly in lower-income and rural regions. Programs such as “Luz Sustentable” enabled the mass distribution of efficient bulbs, laying the groundwork for LED acceptance. Public sector investments in street lighting retrofits and institutional facilities have also stimulated domestic demand. Additionally, lighting efficiency standards set by CONUEE (Comisión Nacional para el Uso Eficiente de la Energía) encourage widespread compliance and benchmarking. These frameworks require performance testing, energy labeling, and product registration, giving consumers and contractors confidence in certified products. Local governments in key urban centers, including Mexico City, Guadalajara, and Monterrey, are enforcing energy codes that mandate LED usage in public works. As urbanization accelerates and public lighting grids expand, such policies create sustained procurement cycles. These coordinated actions are instrumental in reinforcing long-term Mexico LED bulb market analysis, particularly in cost-sensitive and infrastructure-driven segments.

To get more information on this market, Request Sample

Domestic Manufacturing, Distribution Networks, and Market Accessibility

Mexico’s growing manufacturing base and expanding logistics infrastructure have significantly improved the accessibility and affordability of LED lighting products. With increased domestic assembly and packaging of LED bulbs, local players are able to compete on price and customization, supplying both urban and semi-urban regions. Proximity to North American supply chains enables quick integration of components and access to high-efficiency chips and drivers. This has reduced reliance on imports for certain SKUs while supporting just-in-time distribution strategies for wholesalers and retailers. Moreover, e-commerce platforms and traditional hardware store networks now offer a wide range of LED options, making the technology accessible to individual consumers and small businesses alike. Consumer education campaigns have also helped dispel misconceptions about LED cost and compatibility, increasing product turnover in informal and rural retail segments. The revenue in Mexico’s Comfort and Lighting market, primarily comprising smart LED lighting solutions, is projected to reach USD 129.0 Million in 2025. The sector is expected to grow at a 12.63% CAGR from 2025 to 2029, with market volume forecasted to reach USD 207.6 Million by 2029. Household penetration of smart lighting technologies is anticipated to increase from 14.8% in 2025 to 40.4% by 2029.Product innovations in terms of bulb form factors, fixture integration, and multi-wattage compatibility has created a favorable environment for first-time buyers and upgrade customers. Retailers are emphasizing LED options in promotional pricing strategies, bundling, and extended warranties to strengthen consumer trust. As a result, the market is witnessing steady adoption across diverse socio-economic brackets, reinforcing broader demand trends in residential and light commercial sectors.

Mexico LED Bulb Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

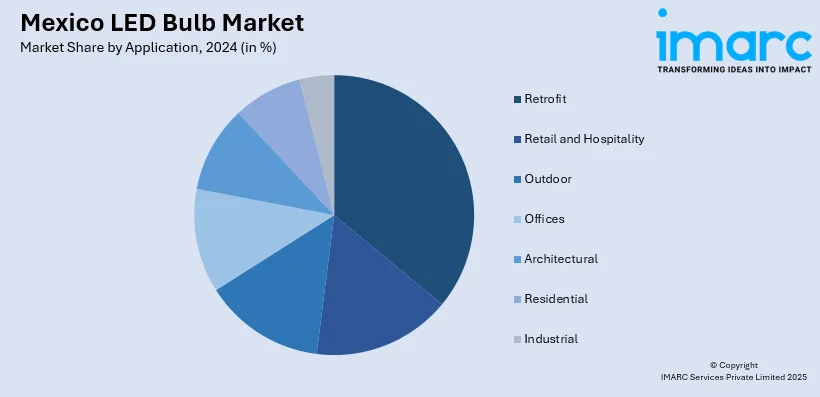

Application Insights:

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Residential

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes retrofit, retail and hospitality, outdoor, offices, architectural, residential, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico LED Bulb Market News:

- On July 6, 2023, Estadio BBVA in Monterrey, Mexico, unveiled a state-of-the-art LED sports lighting system from Musco Lighting ahead of the 2026 FIFA World Cup, replacing its previous infrastructure to meet FIFA Lighting Standard A. The upgrade reduces energy consumption by over 40% while enhancing the fan experience through dimming capabilities and synchronized color-changing light shows using Show-Light® Pro Venue effects.

Mexico LED Bulb Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Residential, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico LED bulb market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico LED bulb market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico LED bulb industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The LED bulb market in Mexico was valued at USD 153.00 Million in 2024.

The Mexico LED bulb market is projected to exhibit a CAGR of 9.88% during 2025-2033, reaching a value of USD 357.24 Million by 2033.

Federal energy efficiency mandates, government-backed distribution programs, rising electricity costs, commercial real estate modernization, improved domestic manufacturing capabilities, expanded retail networks, consumer education initiatives, and municipal infrastructure upgrade projects drive sustained growth across residential, commercial, and public sector applications in Mexico.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)