Mexico Leisure Travel Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Expenditure Type, Sales Channel, and Region, 2025-2033

Mexico Leisure Travel Market Overview:

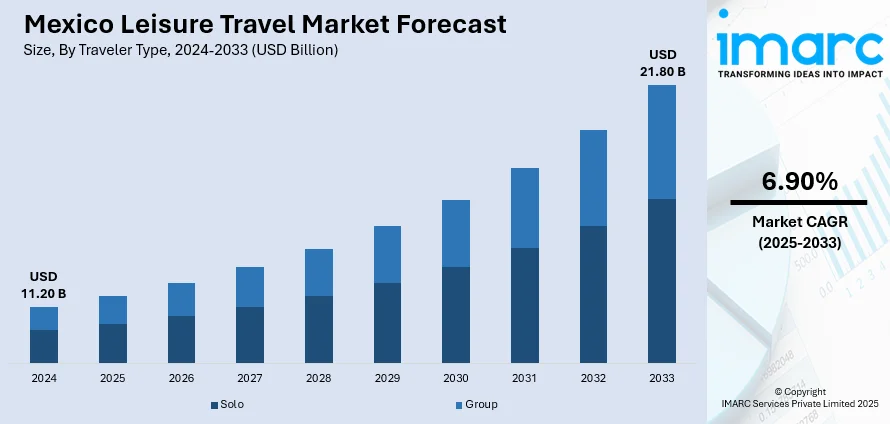

The Mexico leisure travel market size reached USD 11.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.80 Billion by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. Growing disposable incomes, government-led cultural tourism initiatives, improved air connectivity with international destinations, digital adoption among travelers, and the rising popularity of domestic travel experiences are collectively driving the Mexico leisure travel market, transforming it into a dynamic and accessible sector for both local and international tourists seeking diverse experiences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.20 Billion |

| Market Forecast in 2033 | USD 21.80 Billion |

| Market Growth Rate 2025-2033 | 6.90% |

Mexico Leisure Travel Market Trends:

Rising Disposable Incomes and Middle-Class Expansion

Among the leading factors driving Mexico's tourism travel market is the consistent rise in disposable incomes and the expanding middle class. In recent years, Mexico has seen sustained economic growth, leading to higher financial stability and purchasing power among an increasing proportion of its citizens. With more individuals now having sufficient income to meet basic requirements and save discretionary income, leisure travel is now a viable and affordable activity for a broader population. This change is most noticeable in urban areas, such as Mexico City, Guadalajara, and Monterrey, where increased employment opportunities, particularly in the services and manufacturing industries, have created lifestyle changes that involve placing importance on recreational experiences. Households, working-class professionals, and even retired people are investing extensively larger portions of their budgets into vacations, quick weekend escapes, and cultural tourism, both abroad and domestically. Competitive fares offered by airlines, as well as the growing presence of cheap and alternate lodgings, such as hostels, boutique hotels, and Airbnb rooms, contribute to the democratization of tourism as well.

Cultural and Heritage Tourism Initiatives by the Government

Another driver of Mexico's leisure travel market is the government's strategic promotion of cultural and heritage tourism. With a rich pool of UNESCO World Heritage Sites, archaeological areas, colonial cities, indigenous culture, and lively festivals, Mexico's cultural attractions are extensive and varied. As such, both state and federal governments have initiated widespread campaigns and policies to promote cultural tourism. One such project is the Pueblos Mágicos (Magical Towns) program, which identifies small, historic, cultural, or natural towns as focal points for targeted development and marketing. This has resulted in improvements to infrastructure, greater investment in local artisans, and the development of community-driven tourist experiences. San Miguel de Allende, Valle de Bravo, and Tequila are just a few such towns that have become weekend getaways for both domestic tourists and cultural pilgrims. These efforts are aimed at spreading tourist revenues more broadly throughout the nation, promoting visits beyond the standard beach destinations of Cancún and Los Cabos.

Mexico Leisure Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on traveler type, age group, expenditure type, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Baby Boomers

- Generation X

- Millennial

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes baby boomers, generation X, millennial, and generation Z.

Expenditure Type Insights:

- Lodging

- Transportation

- Food and Beverages

- Events and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the expenditure type. This includes lodging, transportation, food and beverages, events and entertainment, and others.

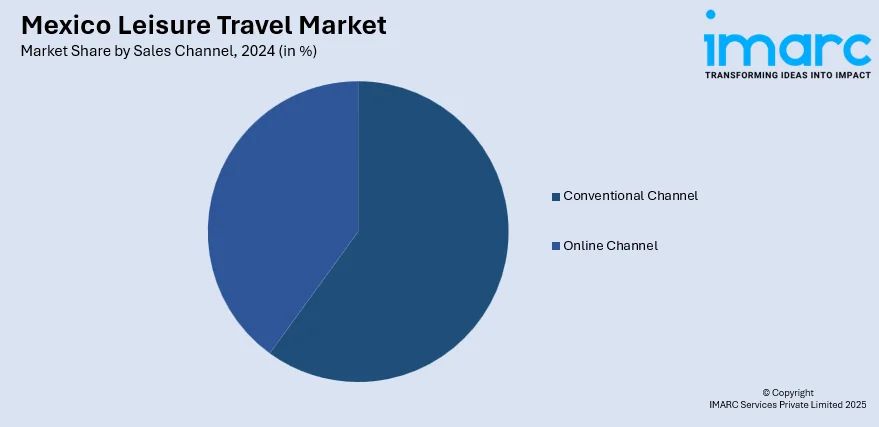

Sales Channel Insights:

- Conventional Channel

- Online Channel

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes conventional channel and online channel.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Leisure Travel Market News:

- April 2025: Delta Air Lines expanded its winter schedule by increasing services to the Caribbean, Mexico, and Central America. This expansion improved connectivity, making these destinations more accessible to travelers, including for leisure travel.

- January 2025: Volaris announced the addition of new routes from Monterrey to Leon/Guanajuato and Tuxtla Gutierrez. This expansion enhanced connectivity between Monterrey and key business and tourism hubs.

Mexico Leisure Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Baby Boomers, Generation X, Millennial, Generation Z |

| Expenditure Types Covered | Lodging, Transportation, Food and Beverages, Events and Entertainment, Others |

| Sales Channels Covered | Conventional Channel, Online Channel |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico leisure travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico leisure travel market on the basis of traveler type?

- What is the breakup of the Mexico leisure travel market on the basis of age group?

- What is the breakup of the Mexico leisure travel market on the basis of expenditure type?

- What is the breakup of the Mexico leisure travel market on the basis of sales channel?

- What are the various stages in the value chain of the Mexico leisure travel market?

- What are the key driving factors and challenges in the Mexico leisure travel?

- What is the structure of the Mexico leisure travel market and who are the key players?

- What is the degree of competition in the Mexico leisure travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico leisure travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico leisure travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico leisure travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)