Mexico Lightweight Building Materials Market Size, Share, Trends and Forecast by Type of Material, Density, Application, End User, and Region, 2025-2033

Mexico Lightweight Building Materials Market Overview:

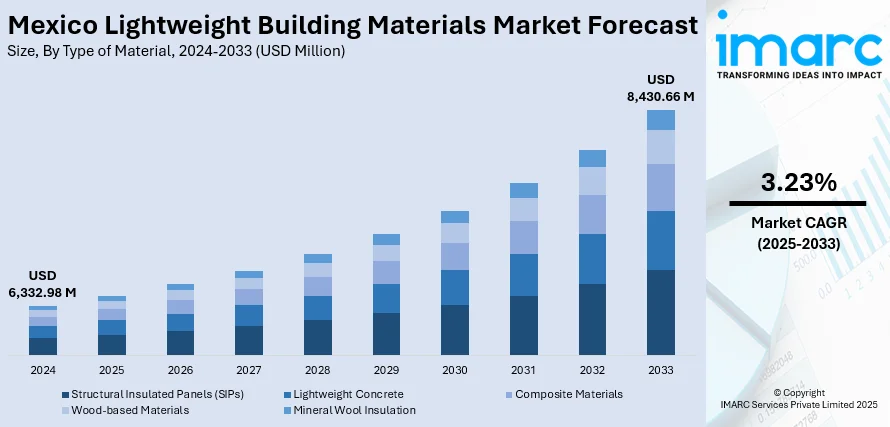

The Mexico lightweight building materials market size reached USD 6,332.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,430.66 Million by 2033, exhibiting a growth rate (CAGR) of 3.23% during 2025-2033. The market is driven by tightening environmental regulations and rising demand for green construction, compelling builders to adopt sustainable lightweight materials such as AAC and CLT. Government-backed affordable housing programs and rapid urbanization further propel demand, as developers seek cost-effective, energy-efficient solutions. Additionally, the expansion of industrial and logistics infrastructure enhances the need for high-performance insulation materials, further augmenting the Mexico lightweight building materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,332.98 Million |

| Market Forecast in 2033 | USD 8,430.66 Million |

| Market Growth Rate 2025-2033 | 3.23% |

Mexico Lightweight Building Materials Market Trends:

Growing Demand for Sustainable and Eco-Friendly Materials

The market is experiencing a rise in demand for sustainable and eco-friendly solutions, driven by increasing environmental awareness and stricter government regulations. Builders and developers are focusing on materials like recycled steel, cross-laminated timber (CLT), and autoclaved aerated concrete (AAC) because of their reduced carbon footprint and energy-efficient characteristics. These materials reduce construction waste and enhance energy efficiency in buildings, aligning with Mexico’s push toward green building certifications, including LEED and EDGE. Mexico seeks to have 66% fewer emissions from commercial and residential buildings by 2030, according to worldwide efforts where the building sector accounts for 34% of CO₂ emissions, of which 18% come from materials such as concrete and steel. While there has been some progress, international green investments in buildings dropped 7% in 2023 to USD 270 Billion, and only 4% was invested in sustainable projects, highlighting strong prospects for Mexico's lightweight building materials sector. Recycling construction materials rose to 18% in specific regions, indicating an increasing demand for low-carbon building materials and circular construction practices. Additionally, the rising popularity of modular and prefabricated construction methods is further improving the adoption of lightweight, sustainable materials, as they enable faster project completion and minimize resource consumption. With urbanization and infrastructure development accelerating, manufacturers are investing in innovative, eco-conscious products to meet the changing needs of the Mexican construction sector.

To get more information on this market, Request Sample

Increasing Adoption of Lightweight Insulation Materials

The growing use of advanced insulation materials to improve thermal efficiency and reduce energy costs is propelling the Mexico lightweight building materials market growth. Expanded polystyrene (EPS), polyurethane foam, and mineral wool are gaining traction due to their lightweight properties and superior insulation capabilities. As energy prices rise and building codes become more stringent, contractors are incorporating these materials into residential, commercial, and industrial projects to enhance climate control and sustainability. The trend is further supported by the increasing construction of affordable housing under government initiatives, where lightweight insulation offers cost-effective and durable solutions. In 2023, only 131,050 housing units were built, a sharp decline from the 301,820 units built in 2015. This deficit, considering that 57% of the 37 million housing units are self-constructed (usually not up to building standards) and need to be replaced, provides a massive opportunity for Mexico's lightweight building materials sector to offer solutions for more dense, affordable, and standards-conforming construction. It is necessary to reverse the shrinkage of mortgage loans (455,300 in 2023) and the 3.1% decline in residential building investments recorded in 2022 in a bid to satisfy demand and seize this material opportunity. Additionally, the expansion of the manufacturing and logistics sectors is driving demand for insulated lightweight panels in warehouses and factories. This shift toward energy-efficient construction is expected to sustain market growth, with manufacturers focusing on high-performance, fire-resistant, and moisture-proof insulation materials.

Mexico Lightweight Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of material, density, application, and end user.

Type of Material Insights:

- Structural Insulated Panels (SIPs)

- Lightweight Concrete

- Composite Materials

- Wood-based Materials

- Mineral Wool Insulation

The report has provided a detailed breakup and analysis of the market based on the type of material. This includes structural insulated panels (SIPs), lightweight concrete, composite materials, wood-based materials, and mineral wool insulation.

Density Insights:

- Low Density

- Medium Density

- High Density

- Ultra Lightweight

A detailed breakup and analysis of the market based on the density have also been provided in the report. This includes low density, medium density, high density, and ultra lightweight.

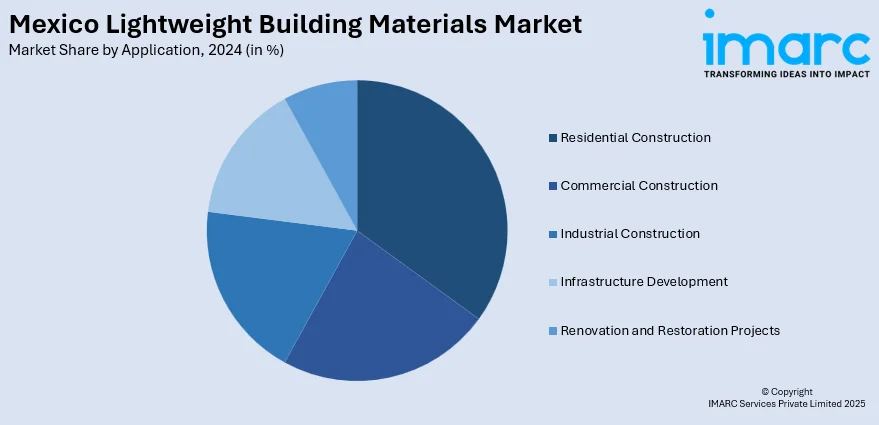

Application Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Development

- Renovation and Restoration Projects

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential construction, commercial construction, industrial construction, infrastructure development, and renovation and restoration projects.

End User Insights:

- Contractors

- Construction Companies

- Architects and Designers

- Homeowners

- Real Estate Developers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes contractors, construction companies, architects and designers, homeowners, and real estate developers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Lightweight Building Materials Market News:

- June 20, 2024: Holcim Mexico has introduced ECOCycle®, an innovative technology that transforms demolition and construction waste into low-carbon cement, road aggregates, and ready-mix concrete. This technology is currently implemented at facilities in Arvide, Naucalpan, Xalostoc, and Iztapalapa, positioning Holcim as the leader in Mexico and Latin America in the provision of ready-mix concrete utilizing recycled aggregates. ECOCycle is in line with Holcim's dedication to minimizing environmental impacts and promoting circular building practices within the aggregates sector.

Mexico Lightweight Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Material Covered | Structural Insulated Panels (SIPs), Lightweight Concrete, Composite Materials, Wood-based Materials, Mineral Wool Insulation |

| Densities Covered | Low Density, Medium Density, High Density, Ultra Lightweight |

| Applications Covered | Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development, Renovation and Restoration Projects |

| End Users Covered | Contractors, Construction Companies, Architects and Designers, Homeowners, Real Estate Developers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico lightweight building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico lightweight building materials market on the basis of type of material?

- What is the breakup of the Mexico lightweight building materials market on the basis of density?

- What is the breakup of the Mexico lightweight building materials market on the basis of application?

- What is the breakup of the Mexico lightweight building materials market on the basis of end user?

- What is the breakup of the Mexico lightweight building materials market on the basis of region?

- What are the various stages in the value chain of the Mexico lightweight building materials market?

- What are the key driving factors and challenges in the Mexico lightweight building materials market?

- What is the structure of the Mexico lightweight building materials market and who are the key players?

- What is the degree of competition in the Mexico lightweight building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico lightweight building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico lightweight building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico lightweight building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)