Mexico Load Break Switch Market Size, Share, Trends and Forecast by Type, Voltage, Installation, End Use, and Region, 2025-2033

Mexico Load Break Switch Market Overview:

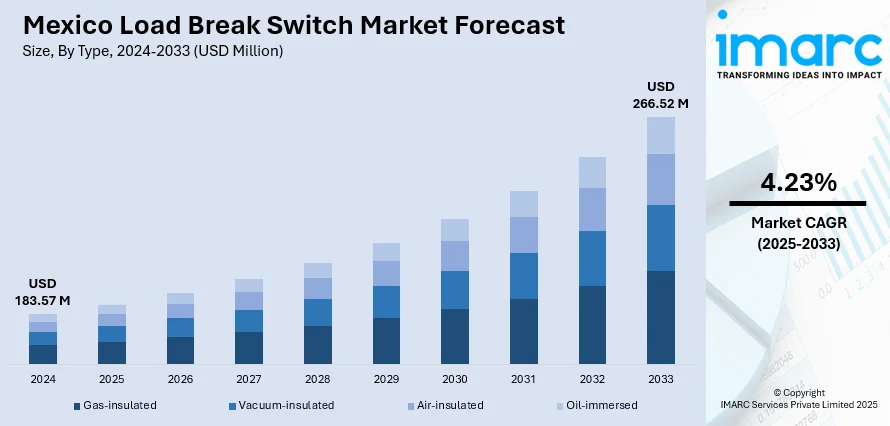

The Mexico load break switch market size reached USD 183.57 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 266.52 Million by 2033, exhibiting a growth rate (CAGR) of 4.23% during 2025-2033. The market is driven by the country’s push to modernize its aging electrical infrastructure to meet rising urban and industrial power demands. The growing integration of renewable energy sources requires advanced switching solutions to manage grid stability amid fluctuating power inputs. Additionally, the adoption of smart grid technologies, featuring automation and remote monitoring, is enhancing network efficiency and reliability. Together, these factors are fueling increased Mexico load break switch market share for reliable, efficient load break switches across Mexico’s power distribution systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 183.57 Million |

| Market Forecast in 2033 | USD 266.52 Million |

| Market Growth Rate 2025-2033 | 4.23% |

Mexico Load Break Switch Market Trends:

Integration of Renewable Energy Sources

Mexico's increasing use of renewable energy sources such as wind and solar is changing its power grid by adding variability and complexity in the generation of electricity. The intermittency of these alternative energy sources makes it difficult to safely and reliably manage the flow of electricity. Load break switches are essential in this new development since they allow the grid to disconnect faults and transfer power flows securely during changes brought about by renewables. These switches support stability, safeguard electrical equipment, and lower outages. With Mexico racing towards cleaner energy, load break switches capable of dealing with these new requirements are becoming a necessity. Their capacity to facilitate seamless integration of intermittent renewables supports a stable and reliable power supply. Thus, Mexico load break switch market trends reveal a growing demand for advanced switching solutions, highlighting the critical role these devices play in the country’s energy transition.

To get more information on this market, Request Sample

Infrastructure Modernization and Urbanization

Mexico is undergoing major infrastructure upgrades to meet rising electricity demands, with an estimated annual investment need of USD 10 billion. Much of the country’s power grid relies on outdated electrical systems that require urgent replacement to ensure safety and reliability. Rapid urbanization and expanding industrial activities are increasing the pressure on energy distribution networks. Load break switches play a crucial role in this modernization by enabling safe current interruption during faults or maintenance, improving grid stability and reducing outages. These switches are vital for managing growing power loads, ensuring uninterrupted service across residential, commercial, and industrial sectors. As Mexico intensifies efforts to build a more resilient and efficient electrical infrastructure, the demand for load break switches is expected to grow significantly. Their role is pivotal in supporting the country's shift toward a more modern, robust, and future-ready power distribution system.

Adoption of Smart Grid Technologies

Mexico's energy industry is rapidly embracing smart grid technologies to improve the efficiency and reliability of its power systems. Smart grids employ digital communication and automation to manage and control electricity flow in real-time. Load break switches are being transformed to facilitate these innovations by providing remote operation, fault detection, and real-time monitoring features. These smart switches provide quicker response to electrical faults, reducing downtime and allowing for predictive maintenance. Through the implementation of high-tech load break switches, Mexico is upgrading its electrical grid to be more reliable and responsive to future power needs. The transition elevates the need for high-tech switching devices that enhance grid control and power delivery, facilitating the nation's vision of a technologically advanced, efficient, and reliable future power infrastructure.

Mexico Load Break Switch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, voltage, installation, and end use.

Type Insights:

- Gas-insulated

- Vacuum-insulated

- Air-insulated

- Oil-immersed

The report has provided a detailed breakup and analysis of the market based on the type. This includes gas-insulated, vacuum-insulated, air-insulated, and oil-immersed.

Voltage Insights:

- Below 11 kV

- 11-33 kV

- 33-60 kV

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes below 11 kV, 11-33 kV, and 33-60 kV.

Installation Insights:

- Outdoor

- Indoor

The report has provided a detailed breakup and analysis of the market based on the installation. This includes outdoor and indoor.

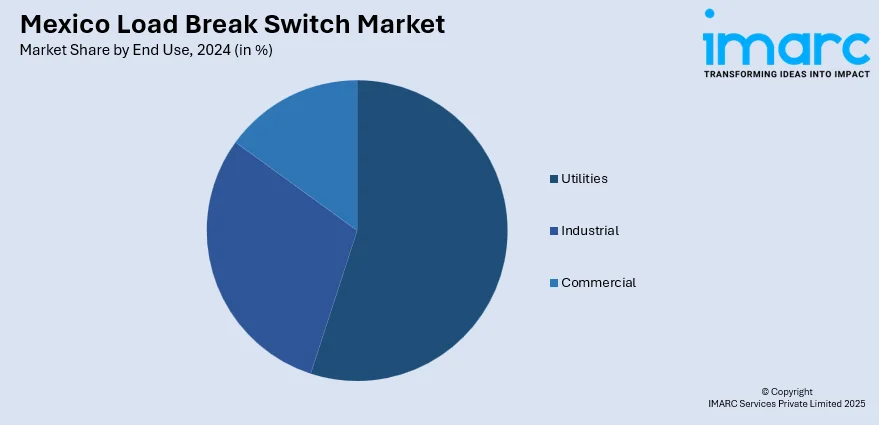

End Use Insights:

- Utilities

- Industrial

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes utilities, industrial, and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also detailed profiles of all major companies have been provided.

Mexico Load Break Switch Market News:

- In March 2025, SpaceX’s ninth Starship test flight launched successfully but ended in failure due to fuel leaks in the upper-stage vehicle, causing it to spin uncontrollably and break apart during re-entry. The first-stage Super Heavy booster also exploded before splashdown. Despite setbacks, the mission marked progress. Elon Musk is set to address the future of Starship and humanity’s multiplanetary ambitions in an upcoming presentation from Texas.

Mexico Load Break Switch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gas-insulated, Vacuum-insulated, Air-insulated, Oil-immersed |

| Voltages Covered | Below 11 kV, 11-33 kV, 33-60 kV |

| Installations Covered | Outdoor, Indoor |

| End Uses Covered | Utilities, Industrial, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico load break switch market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico load break switch market on the basis of type?

- What is the breakup of the Mexico load break switch market on the basis of voltage?

- What is the breakup of the Mexico load break switch market on the basis of installation?

- What is the breakup of the Mexico load break switch market on the basis of end use?

- What is the breakup of the Mexico load break switch market on the basis of region?

- What are the various stages in the value chain of the Mexico load break switch market?

- What are the key driving factors and challenges in the Mexico load break switch market?

- What is the structure of the Mexico load break switch market and who are the key players?

- What is the degree of competition in the Mexico load break switch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico load break switch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico load break switch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico load break switch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)