Mexico Loaders Market Size, Share, Trends and Forecast by Type, Engine, Fuel, and Region, 2025-2033

Mexico Loaders Market Overview:

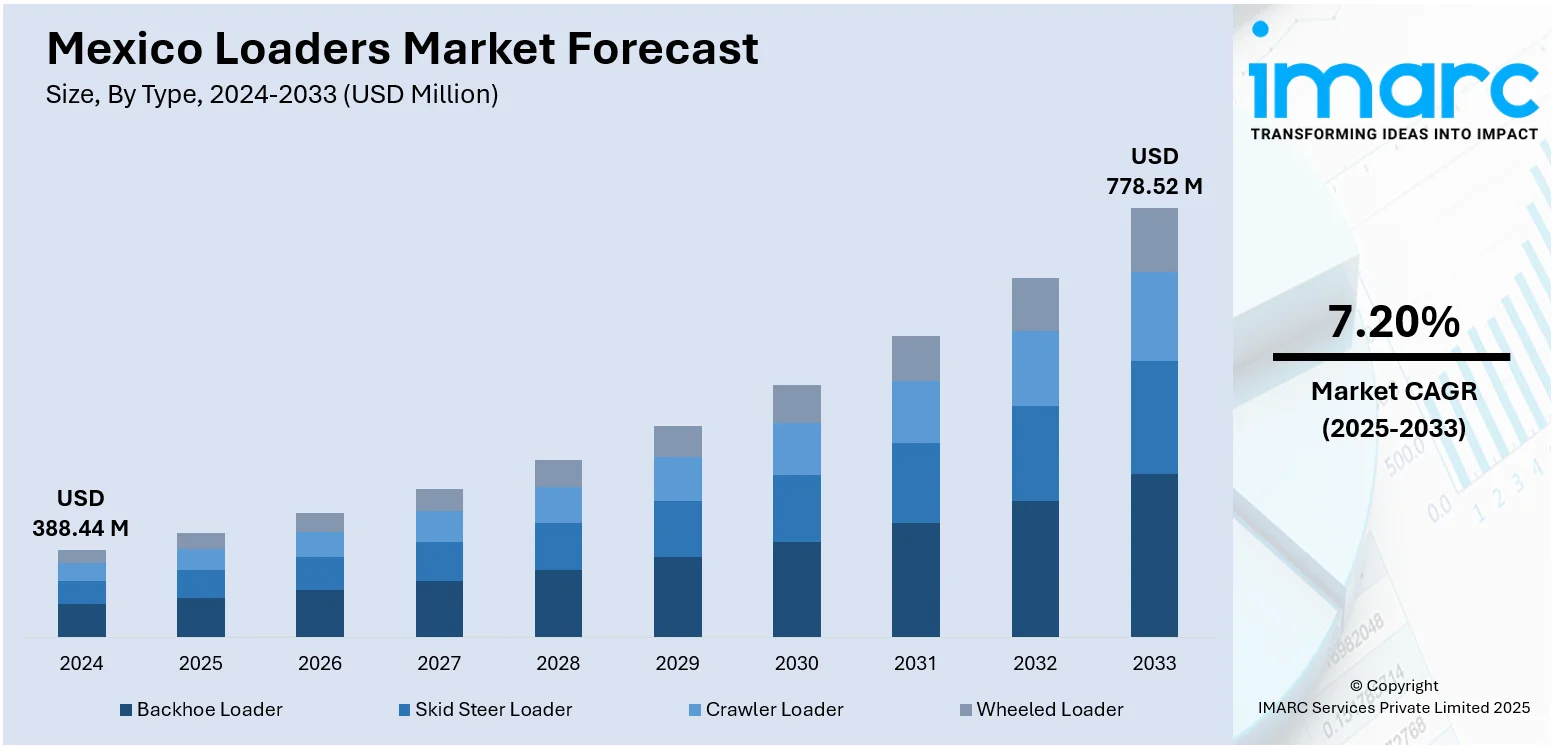

The Mexico loaders market size reached USD 388.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 778.52 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. Rising infrastructure development, urbanization, and government investments in construction projects are some of the factors contributing to Mexico loaders market share. Increased demand for efficient material handling, mining activities, and technological advancements in equipment also fuel growth. Additionally, growing industrialization boosts the need for versatile and powerful loader machinery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 388.44 Million |

| Market Forecast in 2033 | USD 778.52 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Loaders Market Trends:

Growing Shift toward Regional Manufacturing

There is a noticeable increase in relocating manufacturing operations to Mexico, particularly for construction and agricultural equipment like mid-frame skid steer loaders and compact track loaders. Companies are focusing on expanding regional capacity by establishing new production facilities in strategic locations such as Ramos. This shift allows for improved operational efficiency, cost savings, and better access to the growing Latin American market. Moving production closer to key markets helps reduce logistics expenses and lead times, enabling faster response to customer demands. Additionally, Mexico’s skilled labor force and favorable trade agreements make it an attractive hub for manufacturing activities. This approach reflects a broader movement within the industry to optimize supply chains and enhance competitiveness by leveraging the benefits of regional production centers. These factors are intensifying the Mexico loaders market growth. For example, in June 2024, Deere & Company announced plans to build a new manufacturing facility in Ramos, Mexico, to produce mid-frame skid steer loaders and compact track loaders. The production would be relocated from its Dubuque, Iowa, plant. This move aims to boost regional capacity and efficiency.

To get more information on this market, Request Sample

Rising Demand for Specialized Mining Equipment

The mining sector in northern Mexico is experiencing increased investment in advanced underground machinery, including loaders, mine trucks, and drilling rigs. This surge is driven by growing activity in precious metal extraction, particularly silver mining, requiring equipment that enhances efficiency in face drilling, production drilling, and rock reinforcement. Large-scale contractors are securing substantial orders to support expanding mining operations, reflecting confidence in the region’s resource potential. Strengthening equipment availability in this market helps mining companies optimize productivity and safety while addressing the challenges of underground mining environments. The focus on upgrading machinery signals a commitment to modernizing mining infrastructure, which supports sustained growth and competitiveness in the mining industry across Mexico. This development highlights the region’s importance as a hub for mining investments and operational advancements. For instance, in March 2024, Epiroc secured a USD 19.5 Million order from Dumas Contracting Ltd for underground mining equipment in northern Mexico. The order includes loaders, mine trucks, and rigs for face drilling, production drilling, and rock reinforcement at a silver mine. Dumas, a subsidiary of STRACON Group, is a leading mining contractor in the Americas. This deal, booked in Q1 2024, strengthens equipment availability for Mexico’s mining sector.

Mexico Loaders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, engine, and fuel.

Type Insights:

- Backhoe Loader

- Skid Steer Loader

- Crawler Loader

- Wheeled Loader

The report has provided a detailed breakup and analysis of the market based on the type. This includes backhoe loader, skid steer loader, crawler loader, and wheeled loader.

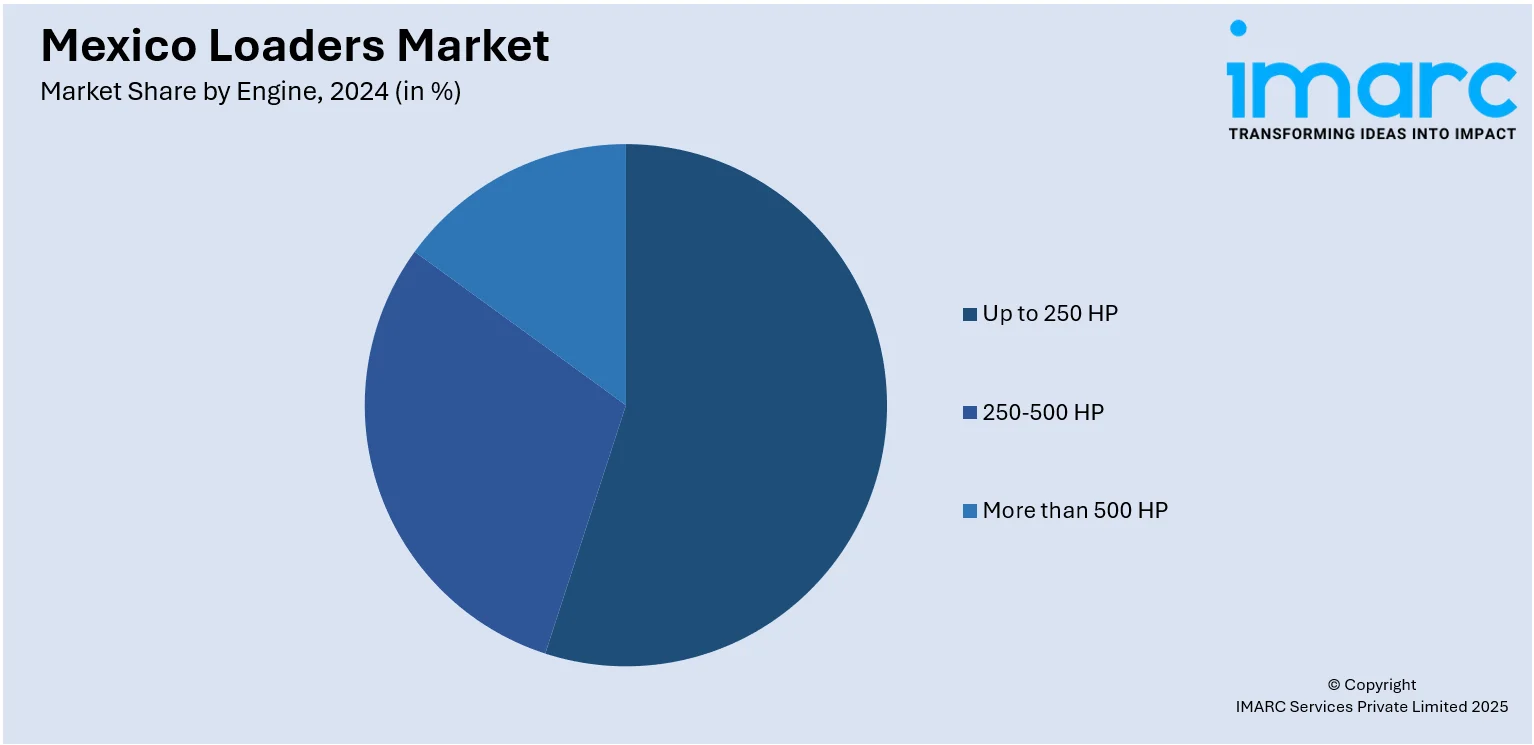

Engine Insights:

- Up to 250 HP

- 250-500 HP

- More than 500 HP

A detailed breakup and analysis of the market based on the engine have also been provided in the report. This includes up to 250 HP, 250-500 HP, and more than 500 HP.

Fuel Insights:

- Electric

- ICE

A detailed breakup and analysis of the market based on the fuel have also been provided in the report. This includes electric and ICE.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Loaders Market News:

- In June 2024, Bobcat Company broke ground on a USD 300 Million manufacturing facility in Salinas Victoria, near Monterrey, Nuevo León, Mexico. The 700,000-square-foot plant is set to expand production capacity for compact track and skid-steer loaders. Scheduled to be operational in 2026, the facility will support rising regional demand.

Mexico Loaders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Backhoe Loader, Skid Steer Loader, Crawler Loader, Wheeled Loader |

| Engines Covered | Up to 250 HP, 250-500 HP, More than 500 HP |

| Fuels Covered | Electric, ICE |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico loaders market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico loaders market on the basis of type?

- What is the breakup of the Mexico loaders market on the basis of engine?

- What is the breakup of the Mexico loaders market on the basis of fuel?

- What is the breakup of the Mexico loaders market on the basis of region?

- What are the various stages in the value chain of the Mexico loaders market?

- What are the key driving factors and challenges in the Mexico loaders market?

- What is the structure of the Mexico loaders market and who are the key players?

- What is the degree of competition in the Mexico loaders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico loaders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico loaders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico loaders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)