Mexico Lubricants Market Size, Share, Trends and Forecast by Product Type, Base Oil, End Use Industry, and Region, 2025-2033

Mexico Lubricants Market Overview:

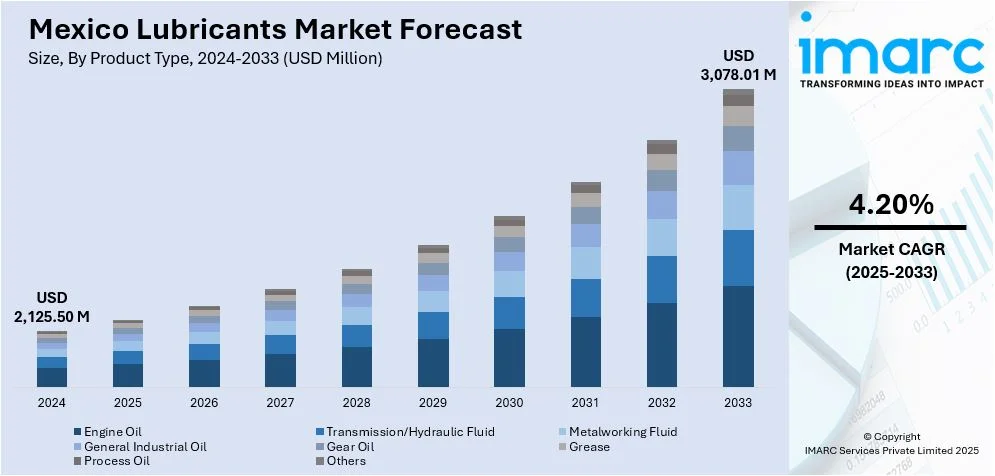

The Mexico lubricants market size reached USD 2,125.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,078.01 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The growing establishment of service centers across urban and semi-urban areas, along with the rising demand for heavy-duty lubricants in mining machinery and equipment, is contributing to the Mexico lubricants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,125.50 Million |

| Market Forecast in 2033 | USD 3,078.01 Million |

| Market Growth Rate 2025-2033 | 4.20% |

Mexico Lubricants Market Trends:

Growing vehicle ownership

Increasing vehicle ownership is fueling the Mexico lubricants market growth. As per the National Institute of Geography and Statistics (INEGI), the Mexican automotive market experienced a 9.8% rise in vehicle sales in 2024, totaling 1,496,806 units. As more individuals and businesses are purchasing vehicles for personal and commercial use, the need for engine oils, transmission fluids, brake fluids, and other lubricants is increasing steadily. The country is experiencing a consistent rise in car sales, supported by a growing middle-class population and easier access to financing options. High vehicle usage requires routine oil changes and maintenance, which enhances lubricant utilization. Urban expansion and the development of road infrastructure are encouraging more people to invest in vehicles, further impelling the market growth. With increasing disposable incomes, people tend to prefer higher-quality synthetic and semi-synthetic lubricants that offer better performance and longer protection. Additionally, the commercial transportation and logistics sector is contributing significantly, as trucks, buses, and delivery vehicles need regular lubricant applications to ensure operational efficiency. Fleet operators and logistics companies regularly service their vehicles to avoid downtime, driving the demand for lubricants. Automotive workshops and service centers across urban and semi-urban areas also play a vital role in distributing and employing lubricants.

Increasing mining activities

Rising mining activities are offering a favorable Mexico lubricants market outlook. Based on INEGI’s Monthly Index of Industrial Activity (IMAI), the monthly production value of the mining sector grew by 1.4% in July 2024. As the country continues to explore and extract valuable minerals like silver, gold, and copper, the need for efficient and reliable machinery is becoming critical. Mining operations rely heavily on large-scale equipment, such as excavators, drills, loaders, and trucks, which require frequent lubrication to ensure smooth functioning and prevent wear and tear. The harsh conditions in mines, including dust, high pressure, and extreme temperatures, make it necessary to use high-performance lubricants that can withstand such environments. As mining companies aim to reduce downtime and maintain productivity, they are investing in quality lubricants for optimal equipment life and efficiency. The growing scale of mining projects in various regions of Mexico is leading to consistent lubricant utilization. Additionally, with the increasing focus on automation and advanced machinery in mining operations, the need for specialized lubricants is rising. As mining is contributing significantly to Mexico’s economy, the increasing activities in this sector are positively influencing the market.

Mexico Lubricants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, base oil, and end use industry.

Product Type Insights:

- Engine Oil

- Transmission/Hydraulic Fluid

- Metalworking Fluid

- General Industrial Oil

- Gear Oil

- Grease

- Process Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes engine oil, transmission/hydraulic fluid, metalworking fluid, general industrial oil, gear oil, grease, process oil, and others.

Base Oil Insights:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

A detailed breakup and analysis of the market based on the base oil have also been provided in the report. This includes mineral oil, synthetic oil, and bio-based oil.

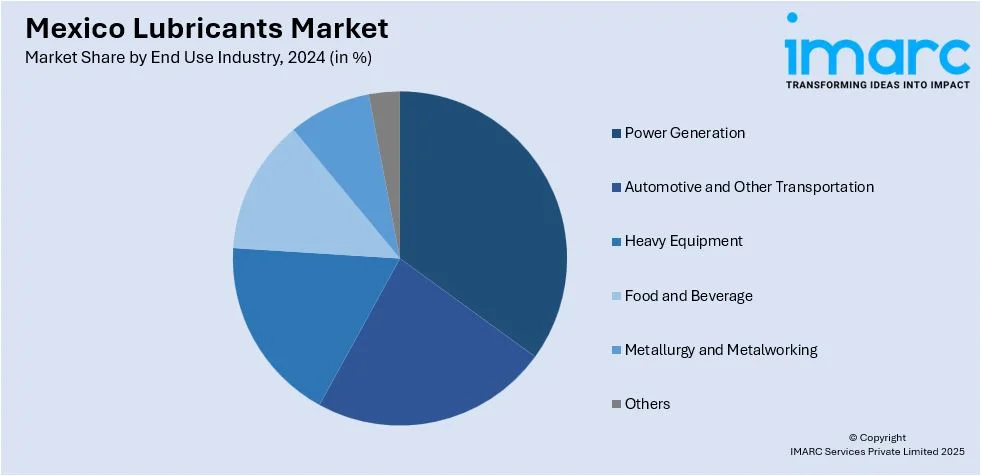

End Use Industry Insights:

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Food and Beverage

- Metallurgy and Metalworking

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes power generation, automotive and other transportation, heavy equipment, food and beverage, metallurgy and metalworking, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Lubricants Market News:

- In April 2025, Valvoline™ Global Operations teamed up with RIMSA, a top automotive distributor in Mexico, to enhance its footprint in six important states in the country. The partnership was intended to expand the accessibility of Valvoline’s complete selection of high-quality motor oils, featuring its acclaimed Restore & Protect Premium Full Synthetic, together with transmission fluids and gear oils.

- In April 2024, FUCHS, a German firm focused on the creation, manufacturing, and distribution of lubricants and specialty products, revealed the signing of a land deal for its second lubricant facility in Villa de Reyes, San Luis Potosi in Mexico. The new plant, which involved an investment of USD 15 Million, was set to cover 51,000m2 in Villa de Reyes. It symbolized the firms’ commitment to tackling new challenges and their dedication to advancing customers' operations by providing effective, innovative, and superior lubrication solutions.

Mexico Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Engine Oil, Transmission/Hydraulic Fluid, Metalworking Fluids, General Industry Oil. Gear Oil, Grease, Process Oil, Others |

| Base Oils Covered | Mineral Oil, Synthetic Oil, Bio-Based Oil |

| End Use Industries Covered | Power Generation, Automotive and Other Transportation, Heavy Equipment, Food and Beverages, Metallurgy and Metalworking, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico lubricants market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico lubricants market on the basis of product type?

- What is the breakup of the Mexico lubricants market on the basis of base oil?

- What is the breakup of the Mexico lubricants market on the basis of end use industry?

- What is the breakup of the Mexico lubricants market on the basis of region?

- What are the various stages in the value chain of the Mexico lubricants market?

- What are the key driving factors and challenges in the Mexico lubricants market?

- What is the structure of the Mexico lubricants market and who are the key players?

- What is the degree of competition in the Mexico lubricants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico lubricants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico lubricants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)