Mexico Luxury Bath Fixtures Market Size, Share, Trends and Forecast by Product Type, Material, Distribution Channel, End User, and Region, 2026-2034

Mexico Luxury Bath Fixtures Market Summary:

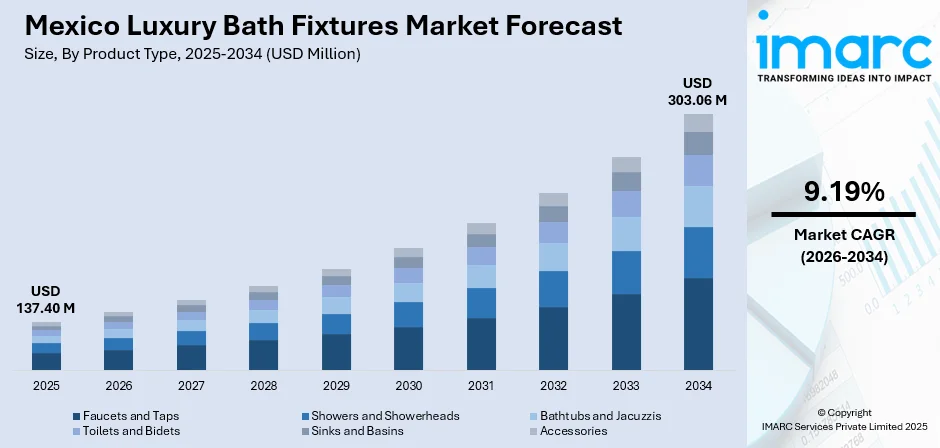

The Mexico luxury bath fixtures market size reached USD 137.40 Million in 2025 and is projected to reach USD 303.06 Million by 2034, growing at a compound annual growth rate of 9.19% from 2026-2034.

The Mexico luxury bath fixtures market is experiencing robust expansion driven by the country's thriving residential real estate sector, rising middle-class purchasing power, and growing consumer preference for premium bathroom aesthetics. Mexican homeowners are increasingly investing in high-end bathroom renovations that blend cultural authenticity with contemporary design sensibilities. The convergence of urbanization trends, government-backed housing initiatives, and heightened awareness of sustainable living practices is reshaping consumer expectations toward sophisticated yet eco-conscious bathroom solutions across both metropolitan and emerging urban centers.

Key Takeaways and Insights:

-

By Product Type: Faucets and taps dominate the market with a share of 28% in 2025, driven by widespread adoption in both residential renovations and new construction projects, with consumers prioritizing technologically advanced and aesthetically refined water control solutions that complement modern bathroom designs.

-

By Material: Metal leads the market with a share of 42% in 2025, attributed to the enduring popularity of brass, stainless steel, and copper finishes that offer superior durability, corrosion resistance, and premium visual appeal aligned with Mexican consumers' preference for long-lasting quality craftsmanship.

-

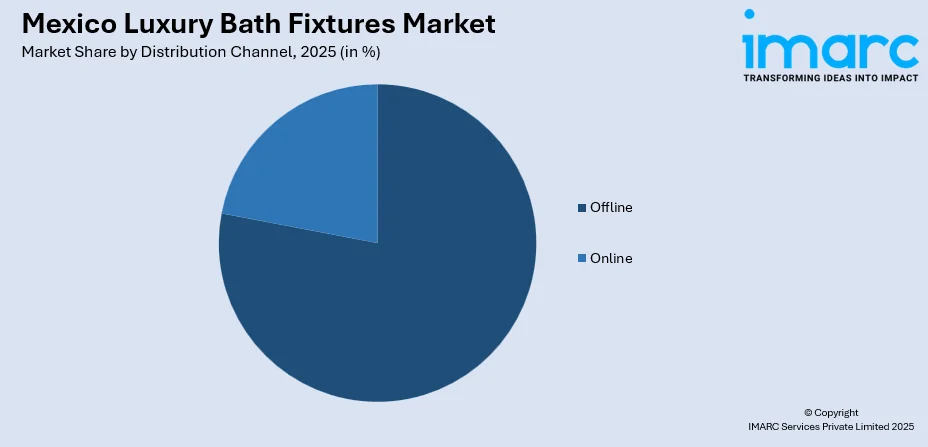

By Distribution Channel: Offline represents the largest segment with a market share of 78% in 2025, reflecting Mexican consumers' strong preference for experiential purchasing, enabling tactile product evaluation, professional consultation, and immediate verification of quality before committing to high-value bathroom investments.

-

By End User: Residential exhibits clear dominance with a 65% share of the total market in 2025, fueled by the expanding middle-class population, government housing programs facilitating homeownership, and growing household renovation expenditures prioritizing bathroom upgrades as value-adding home improvements.

-

Key Players: The Mexico luxury bath fixtures market exhibits a moderately competitive landscape characterized by the presence of established international manufacturers alongside prominent domestic producers. Market participants are differentiating through product innovation, sustainable manufacturing practices, design collaborations, and strategic distribution partnerships to capture evolving consumer preferences across premium bathroom segments.

To get more information on this market Request Sample

Mexico's luxury bath fixtures industry is fundamentally transforming as the nation's residential real estate sector continues its upward trajectory, with the house price index registering sustained appreciation and construction activity reaching record levels. The market's evolution reflects broader socioeconomic shifts, including urbanization patterns concentrating populations in metropolitan corridors spanning Mexico City, Monterrey, and Guadalajara, where demand for sophisticated living spaces drives premium bathroom investments. Government initiatives through INFONAVIT and private banking channels are expanding mortgage accessibility, enabling first-time homeowners and upgraders to incorporate luxury fixtures into their residential projects. The tourism-driven hospitality sector, particularly in coastal destinations like Cancun and Riviera Maya, contributes substantially to commercial demand for high-end bathroom installations that deliver memorable guest experiences. Furthermore, nearshoring-induced industrial expansion in northern states is generating employment growth and income elevation, creating new consumer segments with discretionary spending capacity for luxury home improvements.

Mexico Luxury Bath Fixtures Market Trends:

Cultural Heritage Integration in Contemporary Bathroom Design

Mexican consumers are increasingly embracing bathroom fixtures that celebrate the nation's rich artistic heritage while meeting contemporary functionality requirements. This trend manifests through hand-painted ceramic sinks featuring traditional talavera motifs, sculptural copper faucets reflecting pre-Columbian artistry, and stone-carved basins incorporating indigenous design elements. Luxury fixture manufacturers are partnering with artisanal studios in Puebla and Oaxaca to create exclusive, limited-edition lines that appeal to high-end homeowners looking for genuine representations of Mexican cultural identity. The movement represents a broader cultural reclamation where luxury transcends imported aesthetics to embrace locally rooted craftsmanship traditions.

Smart Technology Adoption in Premium Bathroom Solutions

The integration of intelligent technologies into luxury bathroom fixtures is gaining momentum among tech-savvy Mexican consumers prioritizing convenience, hygiene, and personalized experiences. Touchless faucets equipped with motion sensors, digitally controlled shower systems offering temperature memory functions, and smart toilets featuring automated cleaning and bidet capabilities are becoming aspirational purchases for upper-income households. Voice-activated fixtures compatible with home automation ecosystems enable seamless bathroom control, while app-connected devices allow real-time water consumption monitoring. This technological evolution addresses contemporary lifestyle expectations where bathroom spaces serve as personal wellness sanctuaries enhanced by digital sophistication.

Minimalist Space-Efficient Luxury for Urban Dwellings

Urbanization pressures and evolving architectural preferences in Mexico's major cities are driving demand for minimalist luxury fixtures that maximize functionality within compact spaces. Wall-mounted vanities, floating sinks, and frameless glass shower enclosures represent design solutions addressing spatial constraints without compromising aesthetic refinement. Clean geometric lines, neutral color palettes, and integrated storage systems characterize this movement, appealing particularly to young urban professionals establishing residences in vertical housing developments. The trend reflects international modernist influences adapted to Mexican metropolitan contexts, where premium bathroom design must harmonize visual sophistication with practical space optimization requirements.

Market Outlook 2026-2034:

The Mexico luxury bath fixtures market demonstrates compelling growth prospects supported by sustained residential construction activity, expanding middle-class prosperity, and evolving consumer sophistication regarding bathroom aesthetics. Infrastructure investments enhancing urban connectivity, coupled with nearshoring-driven employment expansion in industrial corridors, are establishing favorable conditions for premium home improvement expenditures. The hospitality sector's continued investment in upgraded guest accommodations further reinforces commercial demand trajectories. Sustainability considerations are transitioning from peripheral preferences to central purchasing criteria, positioning water-efficient luxury fixtures for accelerated adoption. The market generated a revenue of USD 137.40 Million in 2025 and is projected to reach a revenue of USD 303.06 Million by 2034, growing at a compound annual growth rate of 9.19% from 2026-2034.

Mexico Luxury Bath Fixtures Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Faucets and Taps | 28% |

| Material | Metal | 42% |

| Distribution Channel | Offline | 78% |

| End User | Residential | 65% |

Product Type Insights:

- Faucets and Taps

- Showers and Showerheads

- Bathtubs and Jacuzzis

- Toilets and Bidets

- Sinks and Basins

- Accessories

The faucets and taps segment dominates with a market share of 28% of the total Mexico luxury bath fixtures market in 2025.

Faucets and taps represent the cornerstone of bathroom fixture purchases in Mexico, commanding market leadership through their fundamental role in daily hygiene routines and their significant visual impact on bathroom aesthetics. Mexican consumers demonstrate strong preferences for designer faucet collections featuring premium finishes, including brushed nickel, matte black, and rose gold, that complement contemporary interior design trends. The segment benefits from relatively accessible price points compared to larger fixtures, enabling consumers to achieve noticeable bathroom upgrades without comprehensive renovation investments. For instance, in March 2024, MAC Faucets, a prominent developer of plumbing solutions, unveiled a strategic plan to broaden its global presence after successfully entering the markets in Mexico and Canada. Backed by a strong reputation for premium products and outstanding customer support, the company is now preparing to expand into additional regions, including Europe and the Middle East.

Technological advancement within the faucets category drives premium positioning, with touchless sensor-activated models gaining traction among hygiene-conscious consumers and thermostatic mixing valves appealing to families prioritizing safety and consistency. Water-efficient aerator technologies enable luxury faucet manufacturers to address sustainability concerns without compromising the powerful water flow expectations associated with premium products. The replacement cycle dynamics favor this segment, as faucets typically require updating more frequently than structural fixtures, sustaining consistent demand across both new construction and renovation channels.

Material Insights:

- Metal

- Ceramic

- Glass

- Stone

- Others

The metal segment leads with a share of 42% of the total Mexico luxury bath fixtures market in 2025.

Metal fixtures command dominant market positioning through their unparalleled combination of durability, aesthetic versatility, and perceived value among Mexican consumers seeking long-term bathroom investments. Brass remains the foundational material for premium faucets and accessories, offering excellent corrosion resistance and accommodating diverse finishing treatments that satisfy varied design preferences. Stainless steel fixtures appeal to consumers prioritizing modern industrial aesthetics and antimicrobial surface properties, while copper elements resonate with those embracing traditional Mexican craftsmanship heritage.

The material segment's leadership reflects consumer confidence in metal fixtures' lifecycle value proposition, where higher initial investments yield extended service life compared to alternative materials. Surface finishing innovations including physical vapor deposition coatings provide enhanced scratch resistance and color retention, addressing previous consumer concerns about maintaining pristine appearance over time. Premium metal fixtures increasingly incorporate recycled content, enabling environmentally conscious consumers to select sustainable options without compromising the material's inherent quality advantages.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The offline distribution channel exhibits clear dominance with a 78% share of the total Mexico luxury bath fixtures market in 2025.

Physical retail channels maintain commanding market presence reflecting Mexican consumers' strong preference for experiential purchasing when selecting high-value bathroom fixtures. Specialized showrooms operated by premium fixture brands and comprehensive building materials retailers provide environments where consumers can evaluate product quality, finish appearance, and functional performance before committing to significant purchases. The tactile nature of luxury bath fixtures, where surface texture, weight, and operational smoothness communicate quality, reinforces offline channel relevance despite broader e-commerce expansion trends.

Professional consultation services available through offline channels add substantial value for consumers navigating complex product selections involving compatibility considerations, installation requirements, and design coordination. Architect and interior designer partnerships with showroom networks create specification channels influencing high-end residential and commercial projects. The offline segment also benefits from immediacy advantages where consumers can acquire fixtures for urgent replacement needs without shipping delays, and from established trust relationships between retailers and installation service providers ensuring seamless project completion.

End User Insights:

- Residential

- Commercial

The residential segment represents the largest category with a 65% share of the total Mexico luxury bath fixtures market in 2025.

Residential applications drive market demand through the convergence of Mexico's expanding homeownership rates, robust renovation activity, and evolving household expectations regarding bathroom sophistication. Government housing programs through INFONAVIT have expanded mortgage accessibility, enabling millions of Mexican families to establish homeownership and subsequently invest in interior improvements including premium bathroom fixtures. The cultural significance of home presentation in Mexican society motivates substantial spending on visible quality upgrades that communicate success and refined taste to family and social visitors.

Market dynamics within residential applications reflect demographic diversification, with young urban professionals seeking contemporary minimalist designs, established families prioritizing durable family-friendly configurations, and affluent empty-nesters pursuing spa-like bathroom transformations. The segment benefits from property value considerations where bathroom upgrades deliver recognized return on investment, incentivizing expenditures that combine immediate enjoyment with future resale advantages. Regional variation in residential demand patterns shows particular strength in metropolitan areas experiencing population growth and in coastal tourism zones where vacation home development incorporates luxury specifications.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The demand in Northern Mexico is fueled by strong residential development, high-income households in border cities, and growth in premium apartments aimed at cross-border executives. The region’s thriving hospitality and short-term rental sectors encourage the installation of high-end faucets, smart showers, and designer sanitaryware. Increased renovation spending and US design influences also promote adoption of luxury finishes, water-efficient fixtures, and contemporary bathroom upgrades.

Central Mexico’s market is driven by dense urban populations, expanding upscale housing projects, and premium hotel development across Mexico City, Querétaro, and surrounding states. Affluent consumers prioritize modern aesthetics, wellness-oriented features, and smart bathroom technologies. Rising investment in office-to-residential conversions and boutique hospitality further boosts demand for luxury bathtubs, digital mixers, spa-inspired shower systems, and sustainable, high-quality materials that elevate interior design standards.

In Southern Mexico, growth is supported by tourism-driven construction, especially luxury resorts, boutique hotels, and vacation properties in coastal states like Oaxaca, Chiapas, and Yucatán. Rising interest in eco-luxury design encourages the use of premium, water-saving fixtures and natural-material aesthetics. Increasing second-home development and refurbishment of high-end tourist accommodations generate demand for elegant vanities, designer faucets, and advanced shower systems that enhance guest experience.

Market Dynamics:

Growth Drivers:

Why is the Mexico Luxury Bath Fixtures Market Growing?

Sustained Residential Construction and Renovation Activity

Mexico's residential real estate sector demonstrates sustained momentum, providing foundational demand support for luxury bath fixtures across new construction and renovation channels. Edna Vega, Minister of Agrarian, Territorial, and Urban Development (SEDATU), stated that the government has secured land reserves sufficient for 900,000 housing units on strategically located sites with necessary services. For 2025, the target is to build 400,000 homes, 302,000 through INFONAVIT, 86,000 via CONAVI, and 9,000 under FOVISSSTE, representing 70% progress toward the yearly goal. The construction industry has registered record output levels, with government housing initiatives targeting substantial dwelling production increases over the coming years. Metropolitan areas, including Mexico City, Monterrey, and Guadalajara, continue experiencing population influx requiring expanded housing stock, while secondary cities benefit from decentralization initiatives promoting balanced regional development. The renovation segment shows vitality as existing homeowners undertake bathroom modernization projects, with bathroom upgrades ranking among the most popular home improvement categories due to their combination of lifestyle enhancement and property value impact. Rising median home renovation expenditures reflect consumer willingness to invest significantly in quality improvements, with bathroom fixtures commanding substantial project budget allocations.

Expanding Middle-Class Prosperity and Discretionary Spending

Mexico's middle-class expansion generates growing consumer segments with purchasing capacity for premium bathroom fixtures previously accessible only to upper-income households. Economic growth sustained by manufacturing sector strength, nearshoring investments, and services sector expansion has elevated household incomes across diverse metropolitan and regional markets. Remittance inflows from Mexican workers abroad contribute substantially to household budgets, with recipients frequently directing funds toward home improvement investments including bathroom upgrades. The aspiration toward elevated living standards manifests through deliberate fixture selections that communicate achievement and refined taste within Mexican social contexts where home presentation carries cultural significance. Financial services expansion including improved mortgage accessibility and consumer credit availability, enables purchase financing arrangements that democratize luxury fixture access across broader income segments.

Growing Environmental Consciousness and Sustainability Preferences

Heightened environmental awareness among Mexican consumers is driving preference shifts toward luxury bath fixtures incorporating water conservation and sustainable manufacturing characteristics. Water scarcity concerns affecting various Mexican regions have sensitized consumers to fixture efficiency considerations, positioning low-flow technologies and dual-flush systems as responsible luxury choices. Green building certification requirements for premium residential and commercial developments mandate water-efficient fixture specifications, creating institutional demand for sustainable luxury products. Manufacturers responding to these preferences are developing fixture lines utilizing recycled materials, implementing responsible production processes, and achieving environmental certifications that resonate with eco-conscious consumers. The sustainability trend particularly influences younger demographic segments establishing households with strong environmental values, representing emerging luxury fixture consumers who prioritize ecological responsibility alongside aesthetic refinement.

Market Restraints:

What Challenges the Mexico Luxury Bath Fixtures Market is Facing?

Economic Volatility and Consumer Spending Uncertainty

Macroeconomic fluctuations affecting inflation rates, interest levels, and employment stability influence consumer confidence regarding discretionary expenditures, including luxury home improvements. Currency exchange variations impact imported fixture pricing, while broader economic uncertainty may prompt households to defer non-essential renovation projects. These factors create demand volatility that complicates market planning and inventory management for fixture suppliers.

Counterfeit Products and Quality Inconsistency Concerns

The presence of counterfeit and substandard fixtures misrepresenting premium quality creates consumer confusion and erodes brand trust within the luxury segment. Sophisticated counterfeiting operations produce convincing imitations that disappoint consumers with inferior performance and durability, potentially dampening overall market enthusiasm for premium-priced products. Establishing authentication mechanisms and consumer education represents an ongoing challenge requiring industry coordination.

Skilled Installation Labor Availability Constraints

Luxury bath fixture installation demands specialized technical competencies that exceed general plumbing skills, creating service availability constraints that may discourage complex fixture purchases. Shortages of qualified installers capable of properly handling premium products and achieving manufacturer-specified results can extend project timelines and increase total installation costs. This labor market limitation particularly affects regions outside major metropolitan areas where professional installer networks remain underdeveloped.

Competitive Landscape:

The Mexico luxury bath fixtures market presents a moderately consolidated competitive environment where established international manufacturers compete alongside reputable domestic producers for premium consumer segments. Market leaders leverage brand heritage, design innovation capabilities, and comprehensive distribution networks to maintain positioning, while challengers pursue differentiation through specialized product categories, sustainability leadership, or heritage craftsmanship authenticity. Strategic partnerships between fixture manufacturers and real estate developers create specification opportunities for large-scale projects, while showroom investments enhance brand visibility and consumer engagement. Digital marketing initiatives are expanding as competitors seek to influence consideration phases preceding showroom visits, although physical retail presence remains critical for the luxury segment conversion. Industry participants are increasingly emphasizing after-sales service excellence, warranty protection, and installation support as competitive differentiators beyond product attributes alone.

Mexico Luxury Bath Fixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Faucets and Taps, Showers and Showerheads, Bathtubs and Jacuzzis, Toilets and Bidets, Sinks and Basins, Accessories |

| Materials Covered | Metal, Ceramic, Glass, Stone, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico luxury bath fixtures market size was valued at USD 137.40 Million in 2025.

The Mexico luxury bath fixtures market is expected to grow at a compound annual growth rate of 9.19% from 2026-2034 to reach USD 303.06 Million by 2034.

Faucets and taps dominated the market with approximately 28% share in 2025, driven by their essential functionality in daily use, significant aesthetic impact on bathroom design, and the availability of technologically advanced options, including touchless and thermostatic models that appeal to premium consumers.

Key factors driving the Mexico luxury bath fixtures market include sustained residential construction and renovation activity, expanding middle-class prosperity enabling discretionary spending on premium home improvements, and growing environmental consciousness driving preference for water-efficient sustainable fixtures.

Major challenges include economic volatility affecting consumer spending confidence on discretionary purchases, presence of counterfeit products creating quality perception concerns, skilled installation labor availability constraints particularly outside metropolitan areas, and import cost fluctuations impacting premium fixture pricing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)