Mexico Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Luxury Fashion Market Overview:

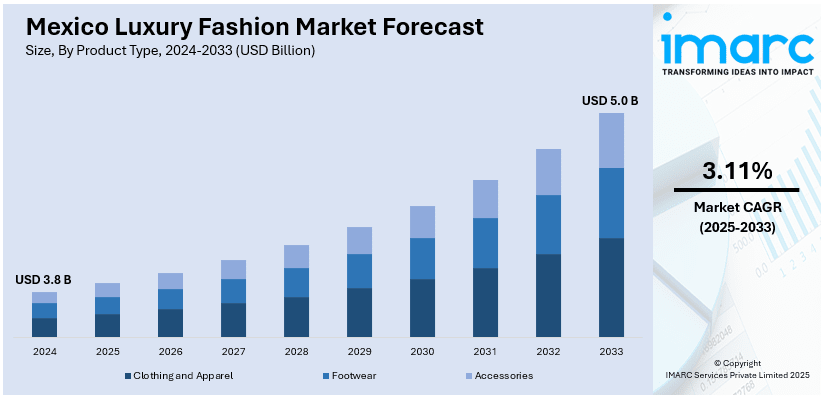

The Mexico luxury fashion market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.11% during 2025-2033. The market is experiencing significant growth, driven by rising affluence, tourism, e-commerce expansion, and international brand presence. Moreover, urban retail development, consumer demand for exclusivity, and digital adoption continue to shape Mexico’s premium fashion landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Market Growth Rate 2025-2033 | 3.11% |

Mexico Luxury Fashion Market Trends:

Expansion of Luxury Retail Spaces

Expansion of luxury retail spaces is a major driver behind the rise of Mexico’s high-end fashion scene. Mexico luxury fashion market growth is closely tied to the development of premium shopping destinations in cities like Mexico City, Monterrey, and Guadalajara. These urban hubs are witnessing a surge in upscale malls, standalone boutiques, and curated concept stores, making them key targets for global luxury brands seeking new markets. Flagship stores from names like Louis Vuitton, Chanel, and Bottega Veneta are increasingly common, often designed to offer immersive brand experiences. These physical spaces are not just points of sale, they serve as cultural touchpoints where exclusivity and service drive loyalty. For instance, in June 2024, Bottega Veneta announced the launch of its first store in Cancun, Mexico, designed by Matthieu Blazy. The 349-square-meter space features Mediterranean coastal architecture, blending Venetian marmorino plaster, teak wood, and Palladiano terrazzo. It showcases the Summer 2024 collection, including an exclusive, handcrafted Sardine bag. The combination of a growing affluent class and rising international interest positions Mexico as a strategic luxury hotspot. The Mexico luxury market outlook remains strong, fueled by retail infrastructure, tourism, and brand localization.

Strong Growth in E-commerce

Strong growth in e-commerce is reshaping how luxury fashion is consumed in Mexico. The post-pandemic shift toward digital shopping accelerated online sales, as consumers sought convenience without compromising on exclusivity. Brands have responded by enhancing their digital storefronts, integrating features like virtual try-on tools, personalized styling, and live shopping events. According to the industry reports, e-commerce in Mexico reached 15% of retail sales, growing from 1% in the last decade, with online sales hitting $74 billion in 2023 and projected to reach $100 billion in 2024 and $176.8 billion by 2026. Investments in premium logistics and faster delivery options have further encouraged high-end buyers to embrace e-commerce platforms. Additionally, luxury multi-brand retailers and marketplaces are expanding their reach, offering a wider selection of global and local labels online. Social media platforms and influencer marketing have also played a role in driving online engagement and conversion. Younger, tech-savvy consumers especially in urban centers are driving this trend, pushing brands to maintain a strong digital presence alongside their physical stores. E-commerce is now a vital contributor to the Mexico luxury fashion market share.

Mexico Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and t-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

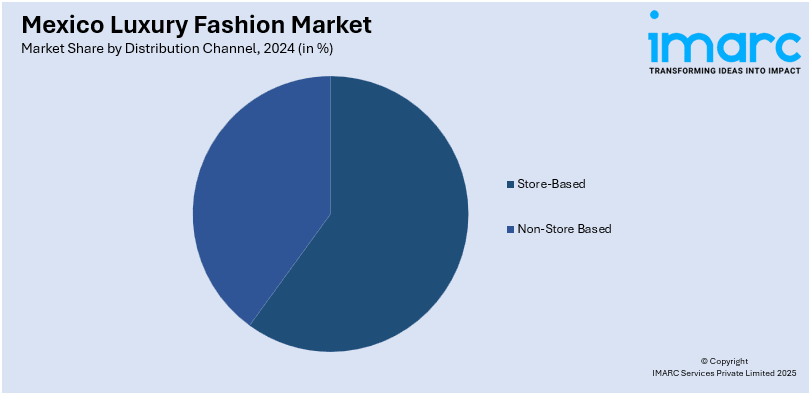

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Luxury Fashion Market News:

- In June 2024, Balenciaga opened its first store in Cancún, Mexico, at La Isla Shopping Village, covering 580 square meters. The store features the latest men’s and women’s ready-to-wear collections, along with shoes, bags, accessories, eyewear, and jewelry, marking a significant expansion into the Mexican market for the luxury brand.

- In October 2023, the 17th edition of the Salon Internacional Alta Relojería (SIAR) successfully concluded in Mexico City. The event featured over 20 new timepieces and special editions and attracted 3,964 attendees. This turnout underscored Mexico's increasing prominence in the luxury watchmaking industry, as brands celebrated their unique contributions to the market, given more opportunities.

Mexico Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico luxury fashion market on the basis of product type?

- What is the breakup of the Mexico luxury fashion market on the basis of distribution channel?

- What is the breakup of the Mexico luxury fashion market on the basis of end user?

- What is the breakup of the Mexico luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Mexico luxury fashion market?

- What are the key driving factors and challenges in the Mexico luxury fashion market?

- What is the structure of the Mexico luxury fashion market and who are the key players?

- What is the degree of competition in the Mexico luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)