Mexico Luxury Footwear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

Mexico Luxury Footwear Market Overview:

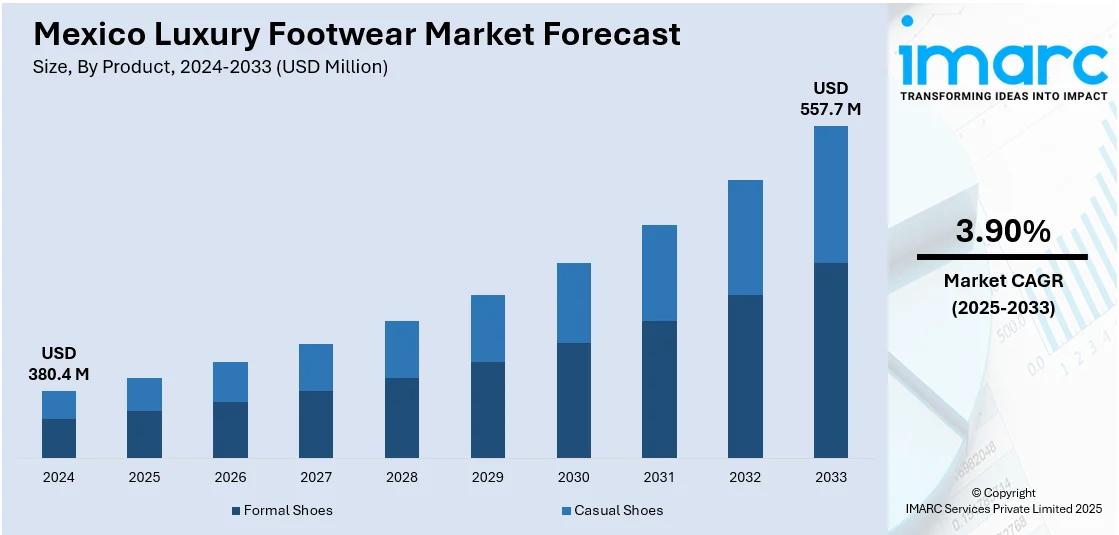

The Mexico luxury footwear market size reached USD 380.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 557.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is witnessing steady growth, driven by rising disposable incomes, brand consciousness, and urban fashion trends. Moreover, increased online retail penetration and demand for premium quality are further supporting market expansion across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 380.4 Million |

| Market Forecast in 2033 | USD 557.7 Million |

| Market Growth Rate 2025-2033 | 3.90% |

Mexico Luxury Footwear Market Trends:

Preference for Limited Editions and Custom Designs

In Mexico’s luxury footwear segment, consumer interest in exclusive and personalized designs is gaining significant traction. Affluent buyers are increasingly drawn to limited-edition releases and bespoke options that reflect individuality and rarity are key factors contributing to Mexico luxury footwear market growth. High-end brands are responding with capsule collections, artisanal craftsmanship, and customization services that allow clients to select materials, finishes, and monograms. This trend is also fueled by the influence of celebrity culture and social media, where showcasing rare or made-to-order footwear drives prestige. For instance, in October 2024, Jordan Brand launched the Air Jordan V El Grito, which is its first shoe celebrating Mexican culture. This shoe features vibrant design elements and details inspired by traditional artisan crafts. It reflects a deep pride in Latin American heritage. The campaign is led by rapper El Malilla, highlighting the importance of cultural connectivity. Collectibility has become a strong purchase motivator, especially among younger luxury consumers. Retailers and designers are capitalizing on this by offering invitation-only drops and exclusive online sales. As brand loyalty shifts toward uniqueness and personalization, this segment is expected to remain a dynamic driver in the Mexico luxury footwear market outlook.

Rising Brand Consciousness

In Mexico, the growing interest in high-end footwear is largely driven by consumers’ desire for status symbols and expressions of personal style. With rising disposable incomes and a growing middle-to-upper-class demographic, luxury footwear brands are becoming a key part of consumer identity. Prestigious names like Gucci, Louis Vuitton, and Balenciaga are increasingly seen as markers of wealth and sophistication. Social media, particularly Instagram, plays a significant role in shaping this trend, as influencers and celebrities often showcase high-end footwear. As consumers seek to distinguish themselves through luxury products, the demand for iconic, recognizable brands continues to rise. This growing brand consciousness is evident not only in major urban centers but also in smaller cities as affluent buyers look to invest in luxury goods. Consequently, this trend is significantly impacting Mexico luxury footwear market share, with luxury brands gaining a more substantial foothold in the retail sector.

Growth in Online and Omni-Channel Retailing

The growth of online and omni-channel retailing has significantly transformed the luxury footwear market, particularly in Mexico. As digital platforms become a primary shopping channel, luxury footwear brands are capitalizing on the convenience of e-commerce while maintaining an exclusive appeal. Many brands are offering exclusive online collections, limited-edition releases, and special promotions that drive consumer interest and urgency. Additionally, the rise of virtual try-ons and augmented reality (AR) technologies allows customers to experience a more personalized and interactive shopping experience from the comfort of their homes. Luxury brands are blending physical stores with online platforms to create seamless experiences, offering services like in-store pickup for online purchases, home delivery, and easy returns. This shift not only expands their customer reach but also strengthens brand loyalty. The growth in online and omni-channel retailing is expected to play a pivotal role in shaping the future of Mexico’s luxury footwear market.

Mexico Luxury Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Formal Shoes

- Casual Shoes

The report has provided a detailed breakup and analysis of the market based on the product. This includes formal shoes and casual shoes.

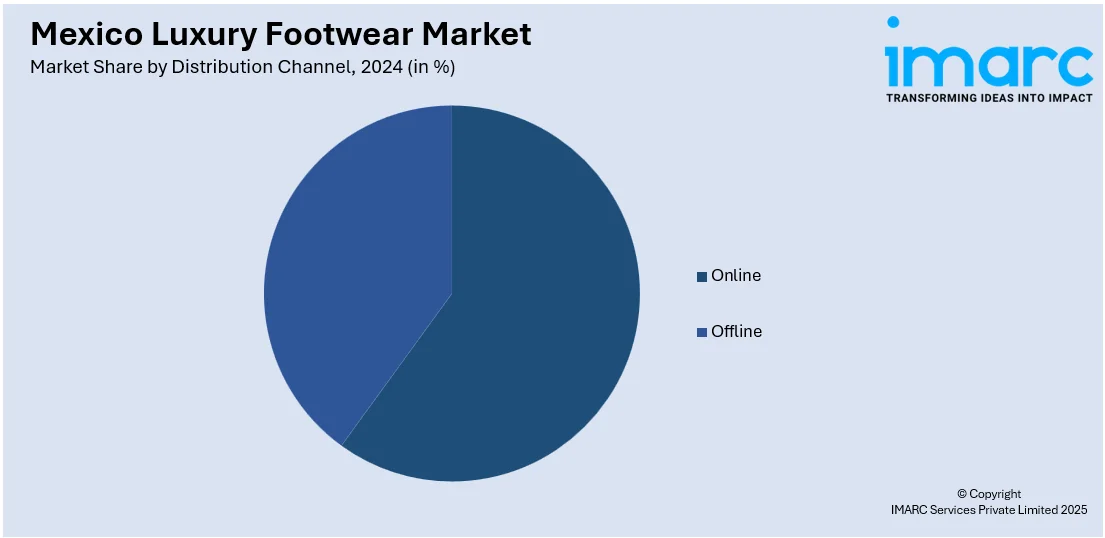

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Men

- Women

- Children

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and children.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Luxury Footwear Market News:

- In October 2023, U.K.-based luxury brand Kurt Geiger announced its plans to open its first stores in Mexico, expanding its presence in Latin America. With locations in Mexico City and Monterrey, the brand aims to capitalize on the growing demand for stylish shoes and accessories in the region.

Mexico Luxury Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Formal Shoes, Casual Shoes |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Men, Women, Children |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico luxury footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico luxury footwear market on the basis of product?

- What is the breakup of the Mexico luxury footwear market on the basis of distribution channel?

- What is the breakup of the Mexico luxury footwear market on the basis of end user?

- What is the breakup of the Mexico luxury footwear market on the basis of region?

- What are the various stages in the value chain of the Mexico luxury footwear market?

- What are the key driving factors and challenges in the Mexico luxury footwear market?

- What is the structure of the Mexico luxury footwear market and who are the key players?

- What is the degree of competition in the Mexico luxury footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico luxury footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico luxury footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico luxury footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)