Mexico Machine Tool Accessories Market Size, Share, Trends and Forecast by Product, Machine Type, End-User Industry, and Region, 2025-2033

Mexico Machine Tool Accessories Market Overview:

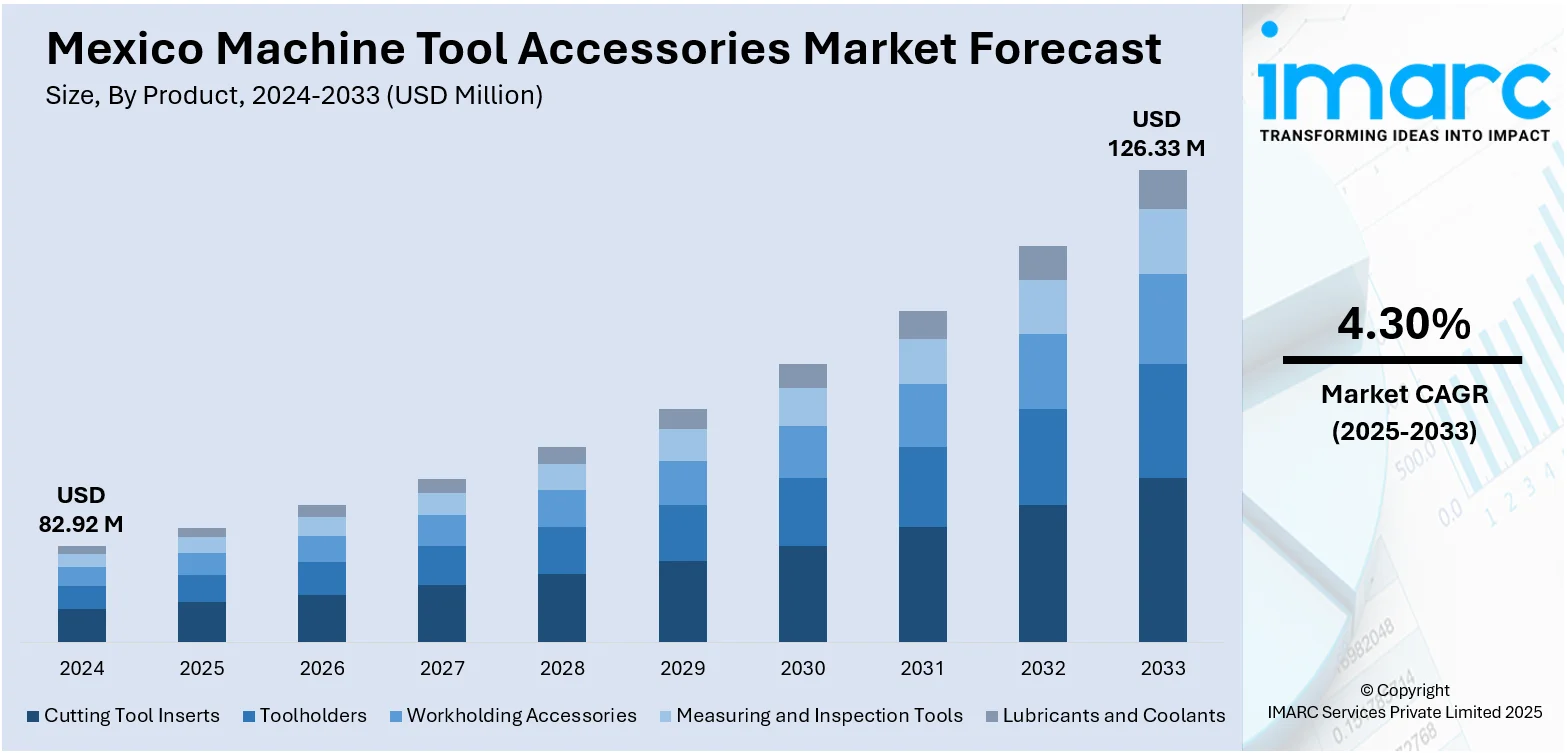

The Mexico machine tool accessories market size reached USD 82.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 126.33 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The market is experiencing steady growth, supported by rising industrial automation, expansion in automotive and aerospace manufacturing, and increasing investments in precision engineering. Demand for enhanced productivity and customization in machining processes continues to drive adoption across sectors, contributing to a more competitive landscape for the Mexico machine tool accessories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 82.92 Million |

| Market Forecast in 2033 | USD 126.33 Million |

| Market Growth Rate 2025-2033 | 4.30% |

Mexico Machine Tool Accessories Market Trends:

Expansion of Automotive and Aerospace Manufacturing

Mexico’s automotive and aerospace sectors are rapidly expanding, attracting global manufacturers due to strategic location, competitive labor costs, and favorable trade agreements. These sectors need highly precise machining, which depends a lot on tool holders, vises and cutting inserts. Engine parts, transmission systems and aircraft structures must meet stringent requirements for performance, safety and durability and so do other essential suppliers. With increasing foreign investment and new production plants being built, there continues to be strong demand for top-quality machine tool accessories. Moreover, suppliers are making special solutions that address the special requirements of advanced industries. This industrial growth cements Mexico’s role as a North American manufacturing hub and drives the machine tool accessories market forward across related supply chains.

To get more information on this market, Request Sample

Rising Industrial Automation and Technological Advancements

Mexican industries are increasingly adopting automation and smart manufacturing technologies to boost productivity and efficiency, which is further driving the Mexico machine tool accessories market growth. The shift from manual to automated machining involves CNC machines, robotics, and real-time monitoring systems, all of which depend on high-performance accessories for accurate, uninterrupted operation. Machine tool accessories such as tool changers, sensors, precision holders, and adaptive fixturing systems are essential to ensure seamless integration and operation. Additionally, advancements in data analytics and IoT are driving demand for smarter accessories that can interface with intelligent control systems. These accessories not only improve machine uptime but also reduce energy use and operational errors. As Mexico’s industrial landscape evolves technologically, the demand for innovative, integrated, and reliable machine tool accessories continues to grow, supporting industry 4.0 goals across multiple sectors.

Government Initiatives and Foreign Direct Investment

The Mexican government actively promotes industrial development through tax incentives, improved infrastructure, and business-friendly policies that attract foreign direct investment (FDI). These initiatives have led to a surge in new manufacturing facilities and technology parks, especially near the US border and major cities. International companies entering Mexico bring advanced manufacturing needs, increasing the demand for specialized machine tool accessories. The United States-Mexico-Canada Agreement (USMCA) has further solidified Mexico’s status as a competitive manufacturing base. These macroeconomic drivers create a stable environment for machine tool suppliers to invest in local operations and expand product offerings. As companies localize production to reduce costs and mitigate global supply chain risks, the need for high-quality, efficient, and adaptable machine tool accessories across multiple industries continues to grow significantly.

Mexico Machine Tool Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, machine type, and end-user industry.

Product Insights:

- Cutting Tool Inserts

- Toolholders

- Workholding Accessories

- Measuring and Inspection Tools

- Lubricants and Coolants

The report has provided a detailed breakup and analysis of the market based on the product. This includes cutting tool inserts, toolholders, workholding accessories, measuring and inspection tools, and lubricants and coolants.

Machine Type Insights:

- CNC Milling Machines

- CNC Lathes

- EDM Machines

- Grinding Machines

- Others

A detailed breakup and analysis of the market based on the machine type have also been provided in the report. This includes CNC milling machines, CNC lathes, EDM machines, grinding machines, and others.

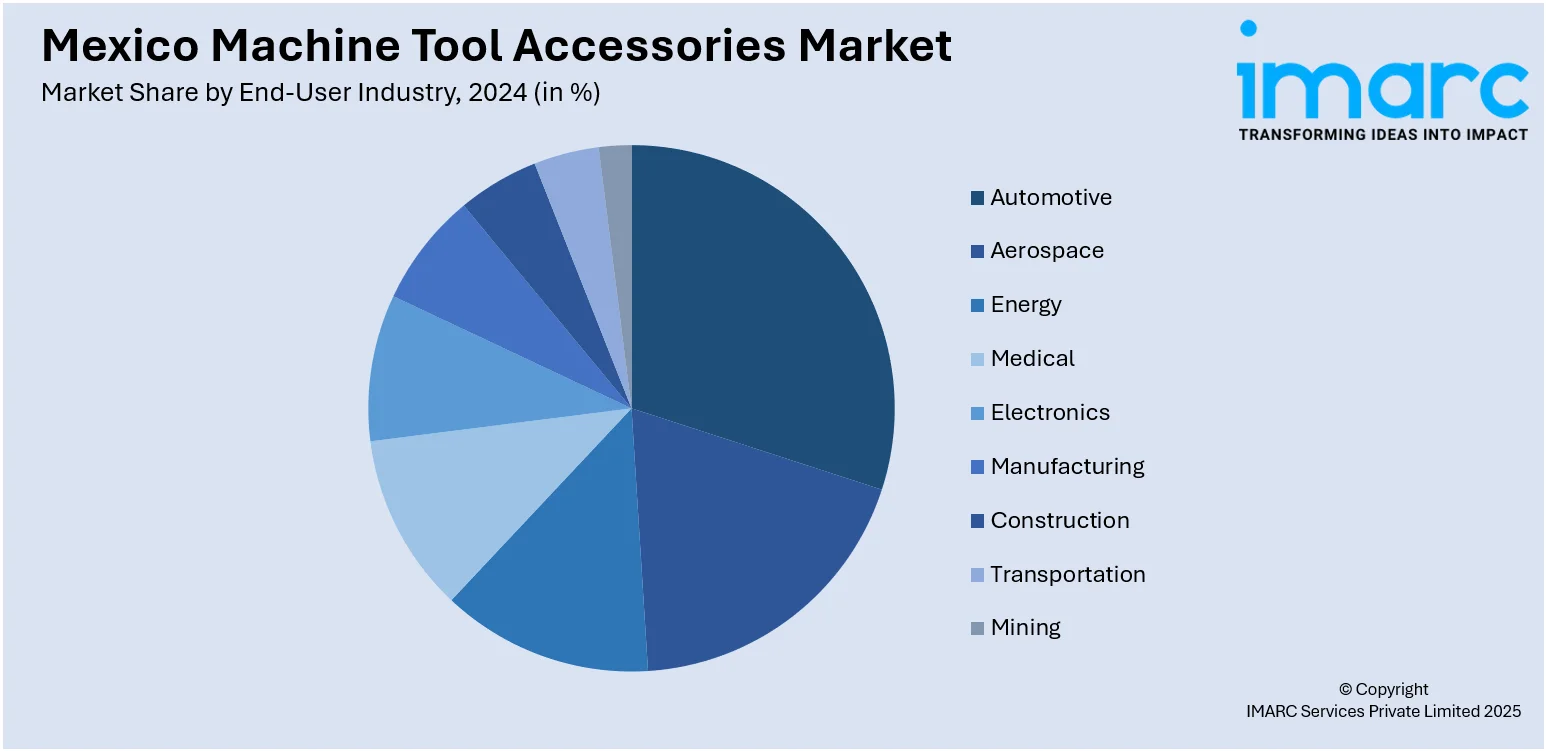

End-User Industry Insights:

- Automotive

- Aerospace

- Energy

- Medical

- Electronics

- Manufacturing

- Construction

- Transportation

- Mining

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes automotive, aerospace, energy, medical, electronics, manufacturing, construction, transportation, and mining.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also detailed profiles of all major companies have been provided.

Mexico Machine Tool Accessories Market News:

- In April 2025, Cincinnati Incorporated, a seasoned leader in the production of machine tools, announced the growth of its Mexican distribution network. Under Alex Sabido's direction, Samat has successfully and devotedly represented Cincinnati Incorporated (CI) in Mexico for more than 57 years. In addition to reaching outstanding sales and service benchmarks, this collaboration has significantly strengthened CI's reputation in the area.

- In March 2024, Hi-Tec CNC was appointed as Kitamura Machinery's sole dealer in Mexico. Through this collaboration, Kitamura will be able to provide cutting-edge machining technology to the Mexican market and increase its market share. According to reports, Hi Tec CNC is in a good position to market Kitamura's goods and offer customized solutions to satisfy the various demands of clients in Mexico.

Mexico Machine Tool Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cutting Tool Inserts, Toolholders, Workholding Accessories, Measuring and Inspection Tools, Lubricants and Coolants |

| Machine Types Covered | CNC Milling Machines, CNC Lathes, EDM Machines, Grinding Machines, Others |

| End-User Industries Covered | Automotive, Aerospace, Energy, Medical, Electronics, Manufacturing, Construction, Transportation, Mining |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico machine tool accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico machine tool accessories market on the basis of product?

- What is the breakup of the Mexico machine tool accessories market on the basis of machine type?

- What is the breakup of the Mexico machine tool accessories market on the basis of end-user industry?

- What is the breakup of the Mexico machine tool accessories market on the basis of region?

- What are the various stages in the value chain of the Mexico machine tool accessories market?

- What are the key driving factors and challenges in the Mexico machine tool accessories market?

- What is the structure of the Mexico machine tool accessories market and who are the key players?

- What is the degree of competition in the Mexico machine tool accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico machine tool accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico machine tool accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico machine tool accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)