Mexico Machine Vision Market Size, Share, Trends and Forecast by Component, Product, Application, End Use Industry, and Region, 2025-2033

Mexico Machine Vision Market Overview:

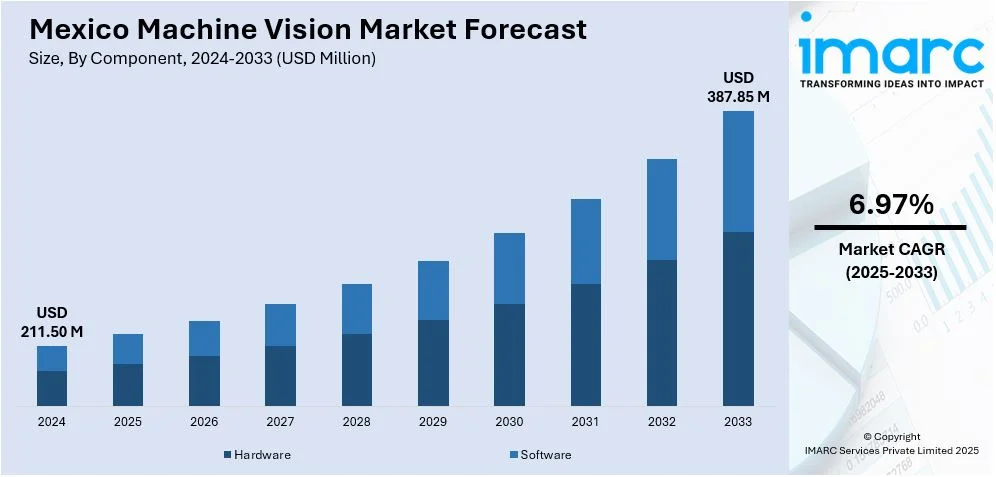

The Mexico machine vision market size reached USD 211.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 387.85 Million by 2033, exhibiting a growth rate (CAGR) of 6.97% during 2025-2033. Automated inspection in manufacturing, robotic guidance systems, and industrial digitization are increasing adoption. Semiconductor production, PCB inspection, and electronics quality control are expanding vision-based applications. Food processing checks, packaging verification, pharmaceutical inspection, logistics automation, AI-powered algorithms, and cloud-integrated systems are some of the factors positively impacting the Mexico machine vision market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 211.50 Million |

| Market Forecast in 2033 | USD 387.85 Million |

| Market Growth Rate 2025-2033 | 6.97% |

Mexico Machine Vision Market Trends:

Manufacturing Automation and Industrial Quality Control Initiatives

The increasing integration of automated inspection and process optimization technologies across Mexico’s manufacturing sector is a central factor advancing the adoption of machine vision systems. Automotive, electronics, aerospace, and consumer goods manufacturers are deploying high-resolution vision sensors and smart cameras on production lines to conduct defect detection, alignment verification, and assembly inspection. These systems enable real-time analysis of visual data to improve product quality, reduce error rates, and minimize waste without halting production. With Mexico serving as a strategic nearshoring destination, multinational firms are investing in advanced automation to remain competitive under global standards. Machine vision solutions are also being used in robotic guidance systems to enhance precision and operational speed in repetitive or hazardous tasks. As manufacturers move toward Industry 4.0 frameworks, integration of machine vision with PLCs, MES systems, and AI-driven analytics platforms is becoming increasingly common. This industrial shift toward digitized and autonomous inspection processes is aligning with productivity goals and lean manufacturing principles. At this stage of technological adoption, Mexico machine vision market growth reflects the country’s deeper move toward intelligent automation in high-output industries.

Expansion of Electronics and Semiconductor Production

Growth in electronics manufacturing, particularly in semiconductor assembly and printed circuit board (PCB) production, is further contributing to demand for vision-based inspection systems. As these sectors operate within narrow tolerances and complex fabrication workflows, precision and repeatability in inspection processes are essential. Machine vision technology enables micro-level surface inspection, pattern recognition, and component verification, reducing reliance on manual checking and improving consistency. The establishment of electronics clusters in states such as Jalisco and Baja California has attracted foreign direct investment into SMT (surface-mount technology) lines and cleanroom environments where automated optical inspection (AOI) and 3D vision systems are integral. As global supply chains increasingly diversify, Mexico’s role in high-tech manufacturing has prompted companies to adopt advanced quality control methods to meet international compliance requirements. Machine vision also enhances traceability and yield analysis, allowing manufacturers to identify process inefficiencies and implement corrective action rapidly. This growing sophistication in electronics production is creating a robust demand for machine vision as a strategic enabler of defect-free, high-throughput manufacturing environments.

Rising Demand in Packaging, Food Processing, and Logistics

Outside of heavy industry, sectors such as food and beverage, pharmaceuticals, and e-commerce logistics are adopting machine vision systems to address traceability, labeling accuracy, and packaging integrity. In food processing, vision-based systems are used to monitor product appearance, detect contaminants, and ensure proper sealing and labeling. These functions are critical for both consumer safety and regulatory compliance. In logistics and warehousing, machine vision is being applied to barcode reading, dimensioning, and automated sorting in fulfillment centers experiencing growth due to rising domestic and cross-border e-commerce activity. Pharmaceutical manufacturers are leveraging the technology to verify batch codes, inspect blister packs, and confirm dosing consistency on high-speed production lines. The shift toward automation in these sectors is being reinforced by consumer expectations for speed, accuracy, and safety. Cloud integration and AI-enhanced vision algorithms are also making it possible to conduct predictive analysis and remote diagnostics, further improving supply chain visibility and operational agility. As automation requirements grow across multiple verticals, the versatility of machine vision is becoming a key asset in maintaining efficiency and compliance.

Mexico Machine Vision Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, product, application, and end use industry.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Product Insights:

- Vision Systems

- Cameras

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes vision systems, cameras, and others.

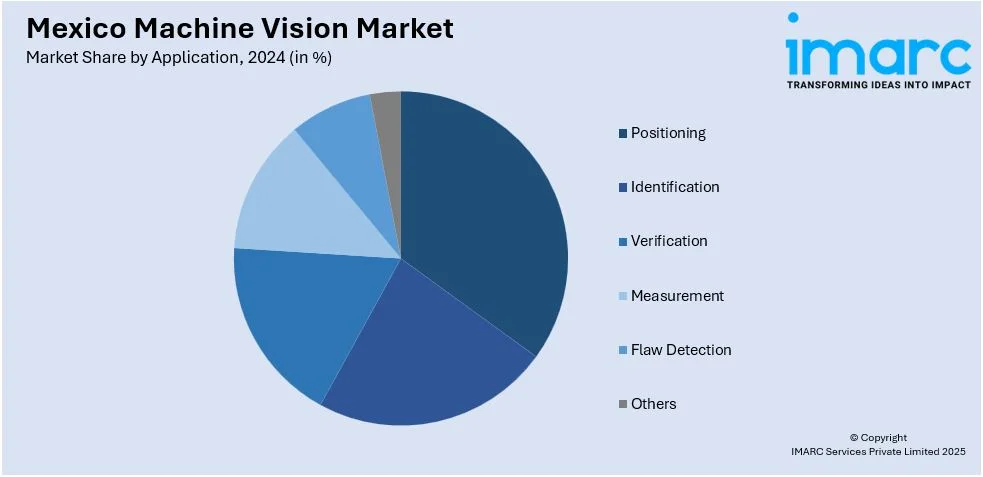

Application Insights:

- Positioning

- Identification

- Verification

- Measurement

- Flaw Detection

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes positioning, identification, verification, measurement, flaw detection, and others.

End Use Industry Insights:

- Electronics and Semiconductor

- Automotive

- Medical and Pharmaceutical

- Food, Packaging and Printing

- Security and Surveillance

- Intelligent Traffic System

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes electronics and semiconductor, automotive, medical and pharmaceutical, food, packaging and printing, security and surveillance, intelligent traffic system, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Machine Vision Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Products Covered | Vision Systems, Cameras, Others |

| Applications Covered | Positioning, Identification, Verification, Measurement, Flaw Detection, Others |

| End Use Industries Covered | Electronics and Semiconductor, Automotive, Medical and Pharmaceutical, Food, Packaging and Printing, Security and Surveillance, Intelligent Traffic System, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico machine vision market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico machine vision market on the basis of component?

- What is the breakup of the Mexico machine vision market on the basis of product?

- What is the breakup of the Mexico machine vision market on the basis of application?

- What is the breakup of the Mexico machine vision market on the basis of end use industry?

- What is the breakup of the Mexico machine vision market on the basis of region?

- What are the various stages in the value chain of the Mexico machine vision market?

- What are the key driving factors and challenges in the Mexico machine vision market?

- What is the structure of the Mexico machine vision market and who are the key players?

- What is the degree of competition in the Mexico machine vision market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico machine vision market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico machine vision market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico machine vision industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)