Mexico Maintenance Repair and Operations Market Size, Share, Trends and Forecast by Provider, MRO Type, and Region, 2026-2034

Mexico Maintenance Repair and Operations Market Summary:

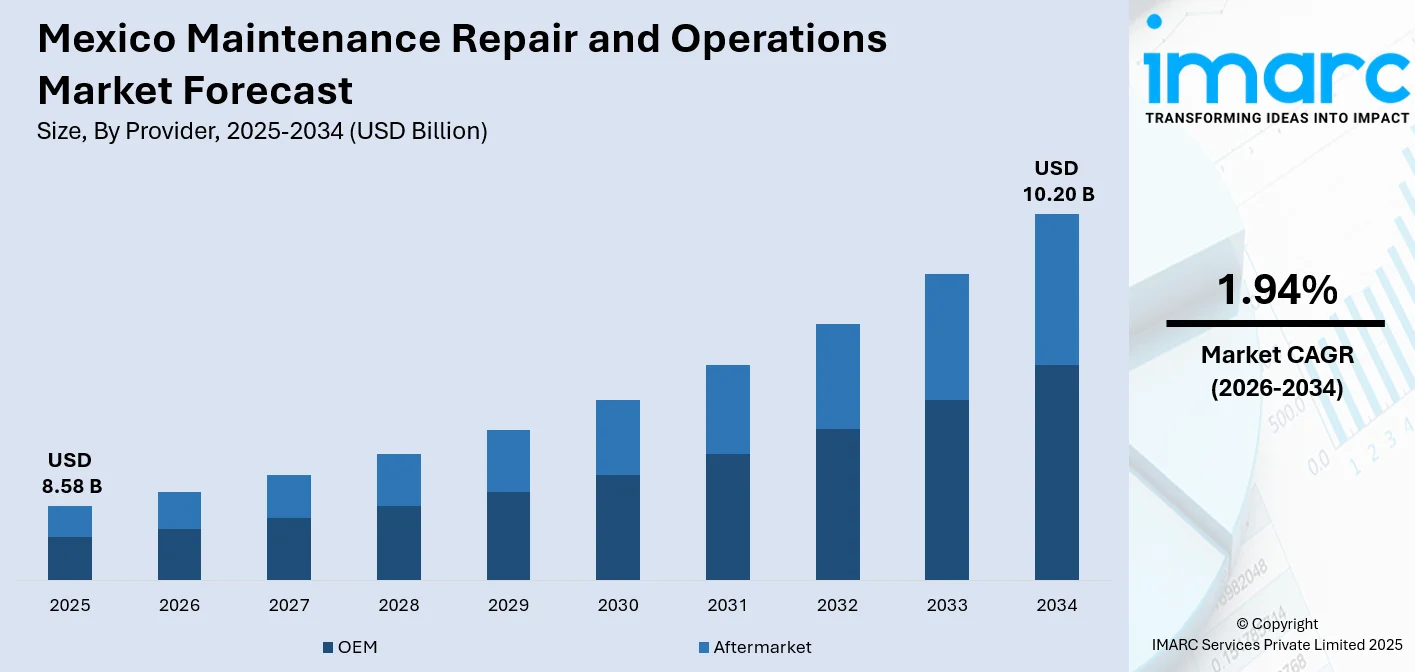

The Mexico maintenance repair and operations market size was valued at USD 8.58 Billion in 2025 and is projected to reach USD 10.20 Billion by 2034, growing at a compound annual growth rate of 1.94% from 2026-2034.

Mexico's maintenance repair and operations market is experiencing steady expansion driven by the country's robust manufacturing sector and industrial modernization initiatives. The integration of predictive maintenance technologies, growth of nearshoring activities, and expansion of facility management services are propelling market advancement. Original equipment manufacturers dominate service provision, while industrial MRO remains the primary application segment, supporting the Mexico maintenance repair and operations market share.

Key Takeaways and Insights:

- By Provider: OEM dominates the market with a share of 58% in 2025, owing to manufacturer expertise in equipment specifications, access to genuine replacement parts, and technical knowledge for complex machinery. Direct partnerships between OEMs and industrial facilities ensure optimal equipment performance and longevity.

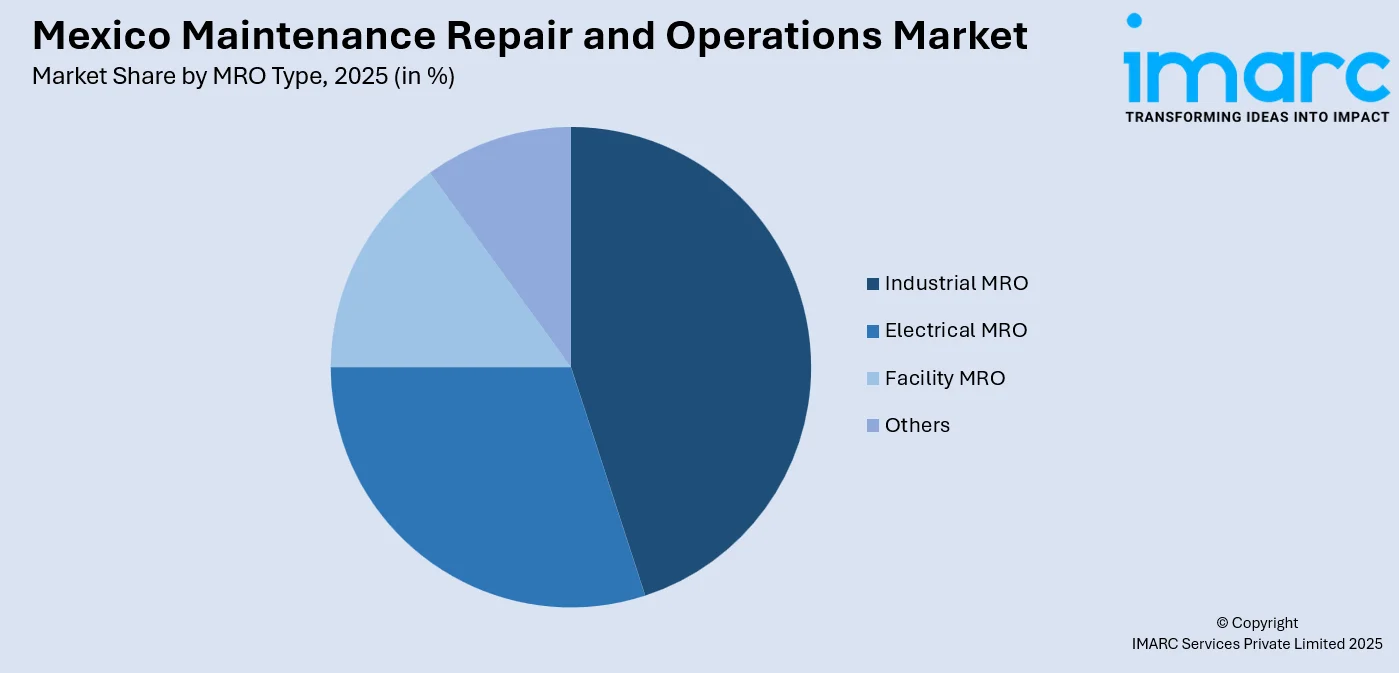

- By MRO Type: Industrial MRO leads the market with a share of 40% in 2025, reflecting Mexico's strong manufacturing base across automotive, aerospace, and electronics sectors. Continuous production requirements and emphasis on minimizing operational downtime drive substantial investments in industrial maintenance services.

- By Region: Northern Mexico represents the largest region with 36% share in 2025, driven by concentrated industrial clusters in Monterrey, Chihuahua, and border cities. Proximity to United States markets, established supply chain networks, and advanced manufacturing infrastructure support regional dominance.

- Key Players: Key players drive the Mexico maintenance repair and operations market by expanding service capabilities, integrating digital technologies, and strengthening distribution networks. Their investments in predictive maintenance solutions, workforce training programs, and strategic partnerships with manufacturing facilities boost service quality and market penetration.

To get more information on this market Request Sample

The Mexico maintenance repair and operations market is experiencing significant transformation propelled by the country's emergence as a premier nearshoring destination and ongoing industrial modernization. Manufacturing sector expansion, particularly in automotive and aerospace industries, is generating substantial demand for comprehensive maintenance services. The adoption of Industry 4.0 technologies, including IoT sensors and artificial intelligence-driven predictive maintenance systems, is reshaping traditional MRO practices toward proactive equipment management. Facility management services are witnessing notable growth as organizations seek integrated solutions for operational efficiency. Government incentives supporting foreign direct investment and workforce development programs further strengthen the market foundation for sustained growth. In December 2024, Tractian secured USD 120 Million in Series C funding to expand predictive maintenance technologies, demonstrating strong investor confidence in manufacturing AI solutions.

Mexico Maintenance Repair and Operations Market Trends:

Digital Transformation and Predictive Maintenance Adoption

Mexican industries are increasingly embracing digital transformation within maintenance operations, shifting from reactive to predictive maintenance strategies. The integration of IoT sensors, machine learning algorithms, and real-time data analytics enables manufacturers to forecast equipment failures and optimize maintenance scheduling. In September 2024, BCB showcased autonomous inspection innovations at Mexico's Maintenance and Reliability Congress in Monterrey, featuring thermographic cameras capable of detecting electrical faults through temperature monitoring, enhancing system reliability and proactive maintenance capabilities.

Expansion of Integrated Facility Management Services

The facility management services sector in Mexico is undergoing notable expansion, with organizations increasingly engaging single-service providers for comprehensive solutions. Consolidating maintenance tasks under unified contracts enhances operational efficiency, improves service quality, and enables businesses to focus on core activities. Commercial real estate growth driven by urbanization and economic development is further bolstering demand for integrated facility management, presenting opportunities for service providers to establish themselves as comprehensive solutions partners in the evolving Mexican industrial landscape.

Nearshoring-Driven Industrial Infrastructure Growth

Mexico's emergence as a leading nearshoring destination is driving substantial industrial infrastructure development, directly influencing MRO service demand. Manufacturing facilities are upgrading machinery and implementing advanced maintenance protocols to meet competitive industry requirements. In July 2024, Safran Aircraft Engines announced an USD 80 Million investment in Querétaro for a new MRO shop and plant expansion dedicated to CFM LEAP engines which is to be commenced by 2026, creating approximately 500 jobs and positioning Mexico among nations capable of covering complete engine lifecycles from manufacturing to maintenance.

Market Outlook 2026-2034:

The Mexico maintenance repair and operations market outlook remains positive through the forecast period, supported by sustained manufacturing expansion and technological advancement. Industrial modernization initiatives across automotive, aerospace, and electronics sectors will continue generating robust demand for specialized maintenance services. Government incentives supporting nearshoring activities, workforce development programs, and infrastructure investments will further strengthen market fundamentals and service provider opportunities. The integration of predictive maintenance technologies and expansion of facility management services will create additional growth avenues for market participants seeking competitive positioning. The market generated a revenue of USD 8.58 Billion in 2025 and is projected to reach a revenue of USD 10.20 Billion by 2034, growing at a compound annual growth rate of 1.94% from 2026-2034.

Mexico Maintenance Repair and Operations Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

| Provider | OEM |

58% |

| MRO Type | Industrial MRO |

40% |

| Region | Northern Mexico |

36% |

Provider Insights:

- OEM

- Aftermarket

OEM dominates with a market share of 58% of the total Mexico maintenance repair and operations market in 2025.

Original equipment manufacturers maintain dominant market positioning through comprehensive technical expertise, proprietary diagnostic tools, and direct access to genuine replacement components. OEM service providers leverage manufacturer-specific knowledge to deliver precise maintenance interventions, ensuring optimal equipment performance and extended asset lifecycles. Mexico received a record USD 31 Billion in foreign direct investment in the first half of 2024, with manufacturing receiving the majority share, driving substantial OEM maintenance service requirements.

Industrial facilities increasingly prefer original equipment manufacturers partnerships (OEMs) for critical equipment maintenance, recognizing value in manufacturer warranties, certified technician expertise, and access to latest technological updates. Apart from this, automotive and aerospace sectors particularly rely on OEM services for complex machinery requiring specialized knowledge. The growing sophistication of manufacturing equipment, including automation systems and precision instruments, further reinforces OEM dominance as facilities prioritize reliability and compliance with manufacturer specifications.

MRO Type Insights:

Access the comprehensive market breakdown Request Sample

- Industrial MRO

- Electrical MRO

- Facility MRO

- Others

Industrial MRO leads with a share of 40% of the total Mexico maintenance repair and operations market in 2025.

Industrial MRO services maintain leading market position driven by Mexico's extensive manufacturing sector spanning automotive, aerospace, electronics, and consumer goods industries. The segment encompasses maintenance activities for production machinery, conveyor systems, pneumatic equipment, and material handling infrastructure essential for continuous manufacturing operations. The need for specialist industrial maintenance services that can handle complex robotics, CNC machines, and integrated production systems requiring significant technical competence is growing as automation levels in Mexican manufacturers rise.

Manufacturing facilities prioritize industrial MRO investments to minimize production disruptions, optimize equipment utilization, and maintain quality standards. The adoption of predictive maintenance technologies within industrial applications enables early fault detection and proactive interventions, reducing costly unplanned downtime. Rising automation levels across Mexican factories are intensifying demand for specialized industrial maintenance services capable of supporting sophisticated robotics, CNC machinery, and integrated production systems.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits a clear dominance with a 36% share of the total Mexico maintenance repair and operations market in 2025.

Northern Mexico commands market leadership through concentrated industrial clusters in Nuevo León, Chihuahua, Baja California, and Tamaulipas. The region benefits from strategic proximity to United States markets, well-established cross-border logistics networks, and mature manufacturing ecosystems supporting automotive, aerospace, and electronics industries. Cities like Monterrey, Ciudad Juárez, and Tijuana serve as major industrial hubs attracting significant foreign direct investment. Enhanced transportation infrastructure, customs facilities, and access to skilled technical workforce further strengthen the region's competitive advantages.

Nearshoring activities have particularly benefited northern states, with numerous industrial facilities constructed or under development across the region. Monterrey's industrial sector contributes significantly to Nuevo León's GDP and state exports, generating substantial MRO service requirements. The region's strategic industrial clusters, including recent additions in renewable energy and digital technology sectors, continue attracting global manufacturers seeking efficient supply chain integration and access to skilled technical workforce. Well-developed transportation networks and customs infrastructure further enhance the region's competitive positioning.

Market Dynamics:

Growth Drivers:

Why is the Mexico Maintenance Repair and Operations Market Growing?

Nearshoring and Foreign Direct Investment Surge

Mexico's emergence as a premier nearshoring destination is fundamentally reshaping the maintenance repair and operations landscape, driving unprecedented demand for comprehensive MRO services. Global companies seeking supply chain resilience and proximity to North American markets are establishing manufacturing operations across Mexican industrial corridors. As per the industry report, total foreign direct investment into Mexico reached USD 21.4 Billion in the first quarter of 2025. The manufacturing sector captured the majority of these investments, particularly in transportation equipment, electronics, and aerospace industries. This capital influx translates directly into expanded industrial capacity requiring professional maintenance infrastructure, skilled technical workforce, and sophisticated service provider networks capable of supporting advanced manufacturing operations.

Integration of Predictive Maintenance Technologies

The accelerating adoption of predictive maintenance technologies represents a transformative driver for Mexico's MRO market, enabling manufacturers to shift from reactive to proactive maintenance strategies. Advanced data analytics, machine learning algorithms, and IoT sensor networks allow facilities to forecast equipment failures before occurrence, optimizing maintenance scheduling and minimizing costly unplanned downtime. Mexico's predictive maintenance market reached USD 190.5 Million in 2024, with projections indicating substantial growth potential. The Mexican government's proposed national digital industry plan extending to 2040 further supports technology adoption across industrial sectors. Manufacturing facilities recognize that predictive maintenance investments deliver measurable returns through extended equipment lifecycles, reduced emergency repair costs, and improved operational efficiency across production environments.

Manufacturing Sector Expansion and Industrial Modernization

Mexico's manufacturing sector continues experiencing robust expansion, directly driving MRO market growth through increased equipment maintenance requirements and facility management needs. The country maintains its position as a leading vehicle producer, with automotive exports representing a substantial portion of total Mexican exports. Aerospace manufacturing reached record export levels, with maintenance repair and overhaul services recording the fastest growth segment. Industrial modernization initiatives are prompting manufacturers to adopt Industry 4.0 technologies, automation systems, and advanced production equipment requiring specialized maintenance expertise. As per the industry reports, the Mexican Business Council for Foreign Trade expects export growth of 6% in 2025 and 6.5% in 2026, indicating sustained manufacturing activity and corresponding MRO service demand.

Market Restraints:

What Challenges the Mexico Maintenance Repair and Operations Market is Facing?

Skilled Workforce Shortage and Training Gaps

The MRO industry faces growing shortage of skilled technicians, engineers, and maintenance professionals, particularly in advanced sectors requiring specialized competencies. Evolving technologies including predictive maintenance systems, AI diagnostics, and automated equipment demand technical capabilities that traditional maintenance training may not adequately address. Knowledge gaps compound challenges as experienced workers retire without sufficient younger talent entering the field.

Infrastructure Disparities Across Regions

Significant infrastructure disparities exist between Mexico's industrialized northern region and less developed southern areas, creating uneven MRO market development. Energy reliability, water availability, logistics performance, and industrial capacity vary considerably across states and municipalities. These regional differences affect maintenance service delivery capabilities and operational consistency for manufacturing facilities requiring dependable infrastructure support.

Trade Policy Uncertainty and Tariff Implications

Evolving trade policies and tariff uncertainties create planning challenges for MRO service providers and their manufacturing clients. Changes in cross-border trade regulations may affect equipment sourcing, replacement part availability, and supply chain logistics. Manufacturers adjusting operations in response to policy shifts may delay maintenance investments or alter service requirements, introducing market volatility.

Competitive Landscape:

The Mexico maintenance repair and operations market exhibits a competitive structure characterized by diverse participants including global industrial service providers, regional specialists, and OEM service divisions. Market players differentiate through technological capabilities, geographic coverage, and sector-specific expertise. Leading companies invest substantially in predictive maintenance technologies, workforce development programs, and strategic partnerships with manufacturing facilities. Service providers expanding digital platforms for maintenance management and asset monitoring gain competitive advantages. The market structure encourages innovation as participants seek to address evolving customer requirements for integrated facility management, specialized industrial maintenance, and technology-enabled service delivery solutions.

Mexico Maintenance Repair and Operations Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | OEM, Aftermarket |

| MRO Types Covered | Industrial MRO, Electrical MRO, Facility MRO, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico maintenance repair and operations market size was valued at USD 8.58 Billion in 2025.

The Mexico maintenance repair and operations market is expected to grow at a compound annual growth rate of 1.94% from 2026-2034 to reach USD 10.20 Billion by 2034.

OEM dominated the market with a share of 58%, driven by manufacturer expertise, access to genuine replacement components, and technical knowledge for specialized equipment maintenance requirements.

Key factors driving the Mexico maintenance repair and operations market include nearshoring momentum attracting manufacturing investments, adoption of predictive maintenance technologies, industrial modernization across automotive and aerospace sectors, and expanding facility management services.

Major challenges include skilled workforce shortages and training gaps, infrastructure disparities between northern and southern regions, trade policy uncertainties affecting equipment sourcing, energy supply constraints in some areas, and evolving technological requirements demanding continuous upskilling.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)