Mexico Managed Security Services Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprises Size, Vertical, and Region, 2025-2033

Mexico Managed Security Services Market Overview:

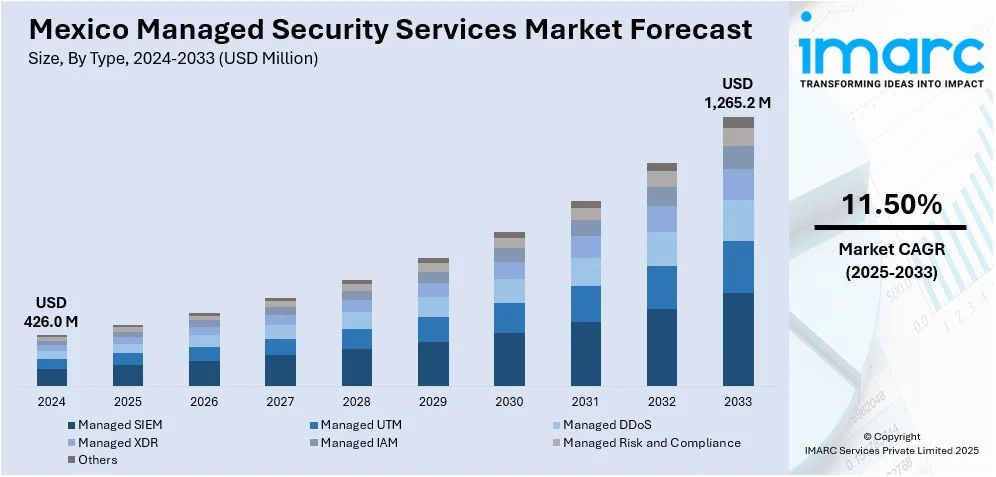

The Mexico managed security services market size reached USD 426.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,265.2 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The industry is propelled by increasing cyber threats, regulatory needs, and limited availability of proficient cybersecurity experts. Additionally, the expansion of cloud usage, IoT devices, and the need for low-cost security solutions fuel the industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 426.0 Million |

| Market Forecast in 2033 | USD 1,265.2 Million |

| Market Growth Rate 2025-2033 | 11.50% |

Mexico Managed Security Services Market Trends:

Rise of Cloud-Based Managed Security Services

The increasing use of cloud computing by Mexican companies is transforming the managed security services industry. Cloud security offerings offer scalability, flexibility, and cost-effectiveness, making them appealing to organizations of various sizes. MSSPs are transforming to match the trend by delivering specialized cloud security services, including cloud access security brokers (CASBs), cloud workload protection, and security posture management. This shift enables businesses to reap the advantages of the cloud without compromising security stance, solving data security and compliance concerns in the cloud. For instance, in February 2025, Alibaba Cloud launched its first cloud region in Mexico to boost Latin America's digital transformation. The new infrastructure provides secure, resilient, and scalable cloud services for businesses, startups, and developers. Alibaba Cloud aims to foster innovation, collaboration, and sustainable growth in the region. The Mexico region offers a suite of cloud products and includes plans for talent development and SME support programs.

Growing Demand for Threat Detection and Response Capabilities

Mexican organizations are experiencing increasingly sophisticated cyberattacks, and these attacks need a proactive security approach. This has resulted in high demand for managed detection and response (MDR) services that go beyond traditional security solutions through continuous monitoring, threat hunting, and incident response. The MDR services employ innovative technologies like artificial intelligence and machine learning to identify and disable attacks before they can cause much damage. This shift from reactive to proactive security where enterprises are seeking MSSPs that provide 24/7 monitoring and instant response capability are favoring market expansion. For instance, in March 2024, Eviden launched a new Security Operations Center (SOC) in Monterrey, Mexico, its 17th globally. The center will provide organizations with advanced cybersecurity services, including Managed Detection and Response (MDR) solutions. Eviden's MDR is powered by its AI platform AIsaac Cyber Mesh and offers threat intelligence, hunting, and response capabilities. The SOC aims to address the increasing sophistication of cyberattacks.

Mexico Managed Security Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, deployment mode, enterprises size, and vertical.

Type Insights:

- Managed SIEM

- Managed UTM

- Managed DDoS

- Managed XDR

- Managed IAM

- Managed Risk and Compliance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes, managed SIEM, managed UTM, managed DDOS, managed XDR, managed IAM, managed risk and compliance, and others.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprises Size Insights:

- Small and Medium-Sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprises size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

Vertical Insights:

.webp)

- BFSI

- Healthcare

- Manufacturing

- IT and Telecom

- Retail

- Defense/Government

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes, BFSI, healthcare, manufacturing, IT and telecom, retail, defense/government, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Managed Security Services Market News:

- In February 2025, Atos launched a Google Cloud Managed Security Services Provider (MSSP) portfolio. This partnership combines Atos's cybersecurity expertise with Google Cloud's technology, offering solutions like the Google CloudSecOps Protection Platform and 24/7 Security Operations Center (SOC) powered by Google SecOps. Atos aims to enhance organizations' security posture and operational resilience.

- In May 2024, Motive, an AI-powered operations platform, announced its expansion into Mexico, offering safety, security, and fleet management solutions. Motive is tailoring its products to the Mexican market, including a new Security Suite with engine immobilizer, door sensors, and a panic button. Motive is also updating its AI Dashcam for Mexican roads.

Mexico Managed Security Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed SIEM, Managed UTM, Managed DDoS, Managed XDR, Managed IAM, Managed Risk and Compliance, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprises Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Healthcare, Manufacturing, IT and Telecom, Retail, Defense/Government, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico managed security services market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico managed security services market on the basis of type?

- What is the breakup of the Mexico managed security services market on the basis of deployment mode?

- What is the breakup of the Mexico managed security services market on the basis of enterprises size?

- What is the breakup of the Mexico managed security services market on the basis of vertical?

- What is the breakup of the Mexico managed security services market on the basis of region?

- What are the various stages in the value chain of the Mexico managed security services market?

- What are the key driving factors and challenges in the Mexico managed security services market?

- What is the structure of the Mexico managed security services market and who are the key players?

- What is the degree of competition in the Mexico managed security services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico managed security services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico managed security services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico managed security services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)