Mexico Managed Services Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprise Size, End Use, and Region, 2026-2034

Mexico Managed Services Market Summary:

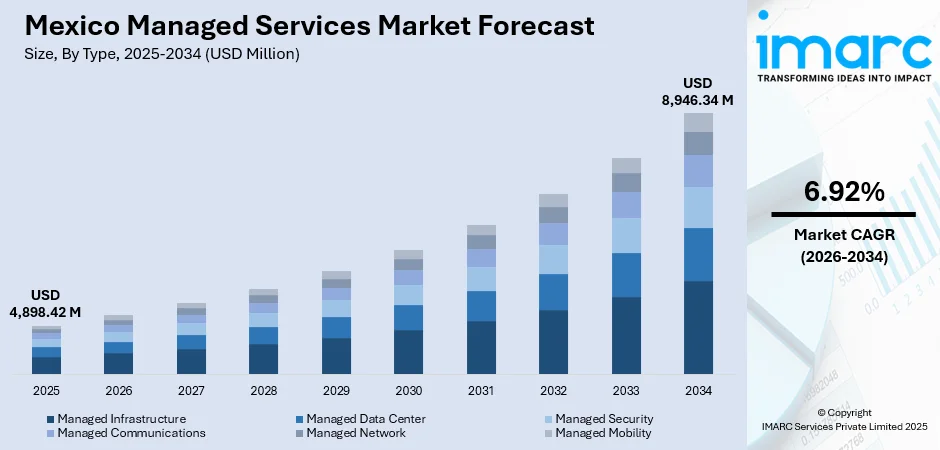

The Mexico managed services market size was valued at USD 4,898.42 Million in 2025 and is projected to reach USD 8,946.34 Million by 2034, growing at a compound annual growth rate of 6.92% from 2026-2034.

The market is driven by the increasing demand for IT infrastructure management, cloud computing adoption, and cybersecurity solutions as Mexican enterprises seek to optimize operations and reduce costs. Organizations are prioritizing digital transformation initiatives, enhancing data protection capabilities, and adapting to remote work requirements. The growing emphasis on leveraging expert service providers to maintain competitiveness in an evolving technological landscape continues to strengthen the Mexico managed services market share.

Key Takeaways and Insights:

- By Type: Managed infrastructure dominates the market with a share of 22% in 2025, driven by the growing need for comprehensive IT infrastructure management, network optimization, and data center operations as enterprises seek scalable solutions to support their digital transformation initiatives and maintain operational efficiency.

- By Deployment Mode: On-premises leads the market with a share of 55% in 2025, owing to data sovereignty requirements, regulatory compliance mandates in regulated industries, and organizational preferences for maintaining direct control over sensitive information within their own physical infrastructure environments.

- By Enterprise Size: Small and medium-sized enterprises represent the largest segment with a market share of 58% in 2025, driven by SMEs increasingly adopting cost-effective managed service solutions to access enterprise-grade IT capabilities without substantial capital investments, enabling competitive technology positioning.

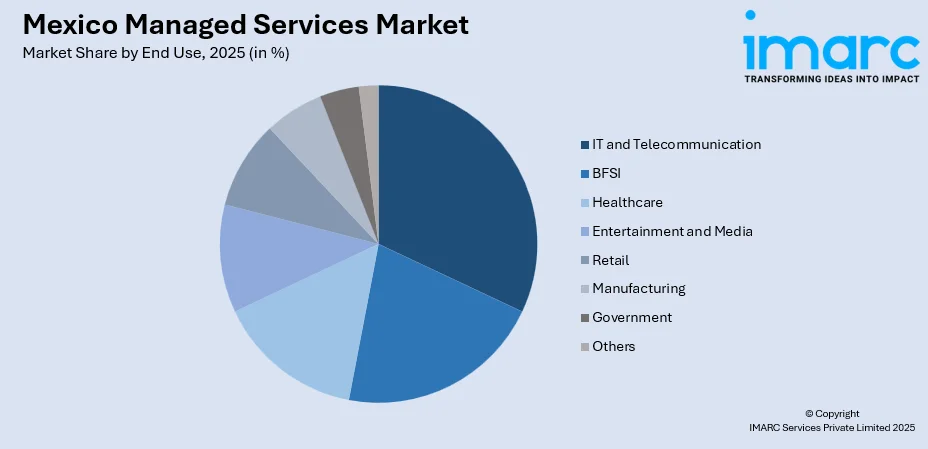

- By End Use: IT and telecommunication lead the market with a share of 24% in 2025, owing to the sector's inherent need for advanced network management, cybersecurity services, and continuous technology infrastructure optimization to support expanding digital service delivery requirements.

- Key Players: The market exhibits moderate competitive intensity, with multinational technology corporations competing alongside regional service providers across diverse price segments and service offerings. Market participants are focusing on strategic partnerships, service portfolio expansion, and localized expertise to strengthen market positioning.

To get more information on this market Request Sample

The Mexico managed services market is experiencing significant expansion driven by accelerating digital transformation initiatives across enterprises of all sizes. Organizations are increasingly recognizing the strategic value of outsourcing IT management functions to specialized service providers, enabling them to focus on core business operations while benefiting from expert technical capabilities. The growing complexity of IT infrastructure, coupled with the rapid adoption of cloud technologies and hybrid computing environments, has created substantial demand for comprehensive managed service solutions. In October 2025, AWS launched three local availability zones in Mexico, supporting enterprise cloud modernization, GenAI adoption, and compliance strategies, accelerating innovation and improving operational performance across multiple industries. Moreover, Mexican enterprises are prioritizing operational efficiency, cost optimization, and access to advanced technological expertise, making managed services an integral component of their business strategies. The convergence of cybersecurity requirements, regulatory compliance mandates, and the ongoing evolution toward remote and hybrid work models continues to reinforce market expansion prospects.

Mexico Managed Services Market Trends:

Accelerated Cloud Migration and Hybrid Infrastructure Adoption

Mexican enterprises are increasingly transitioning from conventional on-premises infrastructure to flexible hybrid cloud environments, driving substantial demand for managed service providers with cloud expertise. Organizations are seeking partners capable of delivering end-to-end integration between existing legacy systems and modern cloud platforms, ensuring seamless data flow and operational continuity. In July 2025, Mexican enterprises extensively adopted cloud computing, with usage increasing over 25 percent annually, driven by Microsoft Azure and partners advancing AI and digital transformation. Moreover, this transition is particularly pronounced among mid-sized companies and multinational subsidiaries seeking scalability, cost-effectiveness, and operational agility. Managed service providers are responding by expanding their cloud integration capabilities, offering specialized migration roadmaps, DevSecOps implementation, and ongoing hybrid infrastructure management to support evolving enterprise requirements.

Rising Emphasis on Cybersecurity and Compliance Services

The escalating frequency and advancement of cyber threats targeting Mexican organizations has created unprecedented demand for comprehensive managed security services. As per sources, in 2025, cyberattacks targeting Mexican government agencies were projected to surge by 260 percent, highlighting urgent demand for managed security services and advanced cybersecurity solutions. Furthermore, enterprises across all sectors are prioritizing security operations center capabilities, threat detection and response services, and compliance management solutions. The evolving regulatory landscape, including data protection requirements and industry-specific compliance mandates, is compelling organizations to seek specialized managed security expertise. Service providers are expanding their security portfolios to include advanced threat intelligence, vulnerability management, and regulatory compliance frameworks tailored to Mexican market requirements.

Integration of Artificial Intelligence and Automation Technologies

The integration of artificial intelligence (AI) and machine learning (ML) capabilities into managed service offerings is transforming service delivery models across the Mexican market. Organizations are increasingly seeking managed service providers capable of leveraging predictive analytics, intelligent automation, and AI-driven insights to optimize IT operations and enhance business decision-making. As per sources, in December 2025, AWS reported that nearly 40 percent of Mexican businesses, are now using AI, with 88 percent noting productivity and revenue improvements. Moreover, this trend is particularly evident in network management, infrastructure monitoring, and customer experience optimization applications. Managed service providers are investing in advanced analytics platforms and automation frameworks to deliver proactive service management, reduce operational costs, and provide enhanced value propositions to enterprise clients.

Market Outlook 2026-2034:

The Mexico managed services market demonstrates robust growth potential throughout the forecast period, with revenue projected to expand significantly driven by accelerating digital transformation initiatives and increasing enterprise technology adoption. The market is expected to benefit from sustained demand across IT infrastructure management, cybersecurity solutions, and cloud services as organizations continue prioritizing operational optimization and cost reduction strategies. Strategic investments in data center expansion, hyperscale infrastructure development, and advanced service capabilities are anticipated to further strengthen market revenue prospects through the forecast period. The market generated a revenue of USD 4,898.42 Million in 2025 and is projected to reach a revenue of USD 8,946.34 Million by 2034, growing at a compound annual growth rate of 6.92% from 2026-2034.

Mexico Managed Services Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Managed Infrastructure | 22% |

| Deployment Mode | On-premises | 55% |

| Enterprise Size | Small and Medium-sized Enterprises | 58% |

| End Use | IT and Telecommunication | 24% |

Type Insights:

- Managed Infrastructure

- Managed Data Center

- Managed Security

- Managed Communications

- Managed Network

- Managed Mobility

The managed infrastructure dominates with a market share of 22% of the total Mexico managed services market in 2025.

Managed infrastructure have emerged as the leading segment within the Mexico managed services market. This segment encompasses comprehensive outsourced management of enterprise IT infrastructure components including servers, storage systems, networking equipment, and data center facilities. According to sources, in 2025, AWS launched a new server region in Mexico with a $5B investment, enhancing local enterprise IT infrastructure and boosting demand for managed infrastructure services. Further, organizations across diverse industry verticals are increasingly recognizing the strategic value of delegating infrastructure management responsibilities to specialized service providers, enabling them to access advanced technical expertise while maintaining focus on core business operations.

The dominance of managed infrastructure services reflects the growing complexity of modern enterprise technology environments and the corresponding need for specialized management capabilities. Mexican enterprises are leveraging these services to optimize infrastructure performance, ensure high availability, and implement proactive maintenance strategies that minimize operational disruptions. Service providers deliver continuous monitoring, capacity planning, and infrastructure optimization that enables organizations to scale their technology capabilities efficiently while managing costs and mitigating operational risks associated with maintaining sophisticated IT environments internally.

Deployment Mode Insights:

- On-premises

- Cloud-based

The on-premises lead with a share of 55% of the total Mexico managed services market in 2025.

On-premises maintains dominant market positioning, reflecting strong organizational preferences for infrastructure control and data sovereignty within the Mexican market. Enterprises in regulated industries including financial services, healthcare, and government sectors demonstrate particular preference for on-premises managed services due to stringent compliance requirements and data residency mandates. As per sources, in March 2025, Mexico enacted new data protection and transparency laws, reinforcing data residency and compliance requirements, prompting many enterprises in regulated sectors to retain on‑premises managed services. Moreover, this deployment model enables organizations to maintain physical control over sensitive information while still benefiting from expert management services provided by specialized technology partners.

The sustained preference for on-premises deployment reflects organizational concerns regarding data security, regulatory compliance, and integration with existing legacy systems that may not readily support cloud migration. Many Mexican enterprises are adopting hybrid approaches that combine on-premises infrastructure with selective cloud services, creating demand for managed service providers capable of delivering integrated management across both environments. This deployment model continues attracting organizations requiring customized infrastructure configurations, low-latency processing capabilities, and comprehensive control over technology assets within their physical facilities.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The small and medium-sized enterprises exhibits a clear dominance with a 58% share of the total Mexico managed services market in 2025.

Small and medium-sized enterprises represent the largest customer segment. According to sources, in May 2025, sixty four percent of Mexican SMEs integrated AI into operations, highlighting their growing adoption of managed IT services while cybersecurity implementation remains limited. Further, this substantial representation reflects the compelling value proposition that managed services offer to organizations with limited internal IT resources and constrained technology budgets. SMEs increasingly recognize that outsourcing IT management functions provides access to enterprise-grade capabilities, specialized expertise, and advanced technologies that would otherwise require prohibitive capital investments to develop and maintain internally.

The dominance of SMEs within the managed services market demonstrates the democratizing effect of outsourced IT management, enabling smaller organizations to compete effectively with larger enterprises in technology-enabled business capabilities. Managed service providers offer scalable solutions that grow alongside business requirements, predictable operational expenditure models that enhance financial planning, and continuous access to technical expertise spanning cybersecurity, cloud computing, and infrastructure management. This segment benefits particularly from pay-as-you-use pricing structures and flexible service agreements that accommodate evolving business requirements without substantial upfront commitments.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecommunication

- BFSI

- Healthcare

- Entertainment and Media

- Retail

- Manufacturing

- Government

- Others

The IT and telecommunication lead with a share of 24% of the total Mexico managed services market in 2025.

The IT and telecommunication sector commands the leading position, reflecting the sector's inherent technology intensity and sophisticated infrastructure management requirements. In October 2025, Equinix launched its MO2 data center in Monterrey, Mexico, with a $250 million investment, expanding colocation space and strengthening local digital infrastructure. Moreover, organizations within this sector operate complex network environments, manage substantial data volumes, and require continuous service availability that necessitates specialized managed service partnerships. Telecommunications providers and technology companies leverage managed services to optimize network performance, enhance cybersecurity postures, and maintain competitive service delivery capabilities.

This sector's leadership position reflects the symbiotic relationship between IT and telecommunications enterprises and managed service providers, with both requiring advanced technical capabilities and continuous operational excellence. Organizations in this segment demand sophisticated service level agreements, rapid incident response capabilities, and proactive infrastructure optimization that ensures uninterrupted service delivery to their customers. Managed service providers serving this sector invest substantially in advanced monitoring tools, automation capabilities, and specialized expertise to meet the exacting performance and reliability standards that IT and telecommunications enterprises require.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for managed services, anchored by major industrial cities including Monterrey and Tijuana that serve as technology and manufacturing hubs. The region benefits from proximity to the United States border, facilitating cross-border connectivity and nearshoring activities that drive demand for IT infrastructure management, industrial automation solutions, and digital services. Strong private enterprise investment and government-supported industrial development initiatives continue to accelerate managed services adoption across manufacturing, logistics, and technology sectors in this economically dynamic region.

Central Mexico dominates the national managed services landscape, encompassing Mexico City, Querétaro, and Puebla as primary technology and business centers. The Querétaro-Mexico City corridor hosts major hyperscale data centers and a dense ecosystem of cloud integrators, cybersecurity firms, and managed service providers. This region benefits from robust digital infrastructure, substantial corporate presence across financial services, IT, telecommunications, and manufacturing sectors, and strong government support for technology initiatives, making it the leading hub for enterprise managed services adoption and innovation.

Southern Mexico presents emerging opportunities for managed services expansion, though adoption rates currently lag behind northern and central regions due to infrastructure development constraints. Growing investments in tourism, healthcare, logistics, and emerging technology sectors are gradually increasing demand for IT management solutions. Government initiatives focused on developing the southern region, including industrial park development and digital infrastructure investments, are expected to accelerate managed services adoption. Cities like Mérida are developing nascent technology ecosystems and smart city initiatives that will drive future growth.

Other regions across Mexico contribute to managed services market growth through diverse industrial and commercial activities spanning agricultural technology, energy sector operations, and regional business enterprises. These areas are experiencing gradual digital transformation as connectivity improves and awareness of managed service benefits increases among local enterprises. Secondary technology hubs in states like Jalisco, particularly Guadalajara, continue contributing substantially to software development and IT services capabilities, supporting broader national managed services ecosystem development and specialized service delivery.

Market Dynamics:

Growth Drivers:

Why is the Mexico Managed Services Market Growing?

Accelerating Digital Transformation Across Enterprise Sectors

Mexican enterprises across all industry verticals are intensifying their digital transformation initiatives, creating substantial demand for comprehensive managed service solutions. As per sources, in November 2025, Banco Santander México completed the full migration of its technology infrastructure to the cloud with Gravity, becoming the first systemic bank in Mexico to operate entirely on a cloud-based platform. Furthermore, organizations are recognizing the strategic imperative of modernizing legacy IT infrastructure, adopting cloud-first strategies, and implementing advanced analytics capabilities to maintain competitive positioning. This transformation extends beyond technology modernization to encompass fundamental business process optimization, customer experience enhancement, and operational efficiency improvements. Managed service providers are positioned as essential partners in enabling this transformation, offering specialized expertise, scalable infrastructure, and continuous innovation support that enables organizations to accelerate their digital journeys without diverting internal resources from core business priorities.

Escalating Cybersecurity Threats and Regulatory Compliance Requirements

The dramatic increase in cyber threats targeting Mexican organizations has elevated cybersecurity from a technical concern to a strategic business priority, driving substantial demand for managed security services. According to sources, in 2025, Mexico’s health sector faced 40.6 Million cyberattack attempts across industries, making the country the second most-targeted in Latin America. Additionally, enterprises face increasingly sophisticated attack vectors including ransomware, advanced persistent threats, and targeted intrusion attempts that require specialized expertise to detect and mitigate effectively. Simultaneously, evolving regulatory frameworks and industry-specific compliance mandates are compelling organizations to implement robust security governance structures. Managed security service providers offer comprehensive solutions including continuous threat monitoring, incident response capabilities, vulnerability management, and compliance reporting that address these multifaceted security and regulatory requirements more effectively than most organizations can achieve independently.

Cost Optimization and Operational Efficiency Imperatives

Mexican enterprises are increasingly adopting managed services to transition from capital-intensive technology investments to predictable operational expenditure models that enhance financial flexibility and resource allocation efficiency. Organizations recognize that outsourcing IT management functions to specialized providers enables access to enterprise-grade capabilities, advanced technologies, and expert talent without the substantial investments required to develop these capabilities internally. This approach is particularly compelling for small and medium-sized enterprises seeking to compete effectively with larger organizations while managing technology costs prudently. For example, in March 2025, Mexican companies adopting a managed service model achieved significant operational efficiency, reducing OPEX costs while outsourcing IT processes without increasing internal resource burdens. Managed service providers deliver economies of scale, process optimization, and continuous service improvements that generate measurable operational efficiencies and cost reductions for their clients.

Market Restraints:

What Challenges the Mexico Managed Services Market is Facing?

Skilled Talent Scarcity and Rising Labor Costs

The Mexican managed services market faces significant challenges related to chronic shortages of qualified cybersecurity professionals, cloud architects, and specialized IT talent. This scarcity is driving substantial wage inflation for skilled technical roles, eroding the labor-cost advantages that have traditionally supported competitive service pricing models. Managed service providers must invest heavily in talent development, training programs, and retention strategies while managing client expectations regarding service delivery capabilities and pricing.

Data Sovereignty and Security Concerns

Enterprises in regulated industries and those handling sensitive information continue to express concerns regarding data sovereignty, security, and control when considering managed service adoption. Organizations must navigate complex decisions regarding data location, access controls, and third-party risk management. These concerns are particularly acute in financial services, healthcare, and government sectors where regulatory requirements and stakeholder expectations regarding data protection are stringent.

Infrastructure Development Gaps in Emerging Regions

Uneven digital infrastructure development across Mexican regions creates barriers to managed services adoption in certain geographic areas. Limited broadband connectivity, sparse backbone coverage, and inconsistent power infrastructure in rural and developing regions constrain the ability of enterprises in these areas to fully leverage cloud-based managed services. Addressing these infrastructure gaps requires sustained investment and targeted government initiatives to enable broader market participation.

Competitive Landscape:

The Mexico managed services market demonstrates a fragmented competitive structure characterized by the presence of multinational technology corporations, regional service providers, and specialized niche players competing across diverse service segments and customer categories. Market participants are differentiating through service portfolio expansion, technology partnerships, vertical industry expertise, and localized service delivery capabilities. Strategic acquisitions, partnership formations, and organic capability development are primary competitive strategies employed by leading providers to strengthen market positioning. The competitive environment emphasizes service quality, technical expertise, customer relationship management, and the ability to deliver integrated solutions addressing enterprise digital transformation requirements. Innovation in service delivery models, pricing structures, and customer engagement approaches continues to intensify as providers seek sustainable competitive advantages.

Recent Developments:

- In February 2025, Alibaba Cloud officially launched its first cloud region in Mexico, enhancing digital transformation across Latin America. The infrastructure offers scalable, resilient cloud services for businesses, startups, and developers, supporting sectors like fintech, e-commerce, and telecom while fostering innovation, local partnerships, and talent development.

Mexico Managed Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed Infrastructure, Managed Data Center, Managed Security, Managed Communications, Managed Network, Managed Mobility |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Uses Covered | IT and Telecommunication, BFSI, Healthcare, Entertainment and Media, Retail, Manufacturing, Government, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico managed services market size was valued at USD 4,898.42 Million in 2025.

The Mexico managed services market is expected to grow at a compound annual growth rate of 6.92% from 2026-2034 to reach USD 8,946.34 Million by 2034.

Managed infrastructure held the largest share of the Mexico managed services market, driven by widespread adoption of cloud computing, data center outsourcing, and IT system modernization across enterprises. Organizations increasingly rely on providers for scalable, secure, and cost-efficient infrastructure management solutions.

Key factors driving the Mexico managed services market include accelerating digital transformation initiatives, increasing cybersecurity threats requiring specialized expertise, cloud migration and hybrid infrastructure adoption, cost optimization imperatives, and regulatory compliance requirements.

Major challenges include skilled talent scarcity driving labor cost inflation, data sovereignty and security concerns among regulated industries, infrastructure development gaps in emerging regions, and evolving regulatory complexity requiring continuous adaptation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)